Trends in NRI Investment Portfolios

NRIs are increasingly adopting a blended approach to their investment portfolios, combining Indian and global assets. While India remains a core long-term investment destination, countries like the UAE and Singapore continue to attract NRI capital for diversification, real estate, and global exposure. This shift reflects a growing sophistication in wealth management and long-term planning among NRIs.

India's GDP is projected to grow at 6.5–7% over the next five years, making it one of the fastest-growing major economies. This, along with rising trust in India's governance, digital infrastructure, and regulatory frameworks, is driving NRIs to view India as a strategic long-term investment hub. Many NRIs are allocating funds into equities, real estate, REITs, AIFs, and startup ecosystems with a 10–15 year horizon.

GIFT City is emerging as a preferred investment vehicle for NRIs, with GIFT-domiciled funds gaining traction for inbound investments in India. Real estate in Dubai remains a favorite, with Indians being the top foreign investors in Dubai property in 2023. Singapore's fintech and REIT sectors are also appealing, particularly to younger NRIs.

Double Taxation Avoidance Agreements (DTAAs) with countries like the UAE, Singapore, and Mauritius prevent NRIs from being taxed twice on the same income. This, combined with the domestic tax policies of their resident countries, often results in zero tax on mutual fund gains in India. To avail these benefits, NRIs must meet certain criteria and submit necessary documents to Indian tax authorities.

NRIs are increasingly shifting from buying homes for nostalgia to making smarter, income-generating real estate investments in India. NRI investments in Indian real estate are expected to cross ₹1.2 lakh crore by 2025, with a growing portion moving into REITs and fractional ownership platforms. This approach offers rental income, professional management, and lower entry points.

Common mistakes NRIs should avoid include ignoring FEMA & RBI compliance rules, overexposing to real estate without rental yield focus, neglecting Double Taxation Agreements, lacking a financial advisor or estate planning, and chasing trendy asset classes without understanding risk. Compliance lapses have led to significant amounts of NRI investments being flagged by the RBI.

NRIs exhibit distinct financial behaviors, preferring globally diversified portfolios while maintaining a strong emotional connection to India. They invest with long-term goals, such as retirement in India or building a legacy, and value both digital platforms and relationship managers. Compliance and tax planning are also high priorities.

Popular investment options for NRIs include equity mutual funds and direct stocks, fixed deposits (NRE & FCNR), REITs & fractional real estate, sovereign gold bonds (SGBs) & digital gold, and alternative investments like PMS, AIFs, and startups. Sectors favored by NRIs include financial services & banking, technology & digital economy, real estate & REITs, and energy & infrastructure.

Luxury items like art, cars, and watches are also gaining traction as alternative investments. Watches have become mainstream among the younger generation, while art is increasingly viewed as a long-term appreciating asset. These sectors reflect the evolving wealth mindset of NRIs, where lifestyle, heritage, and financial return intersect.

You may also like...

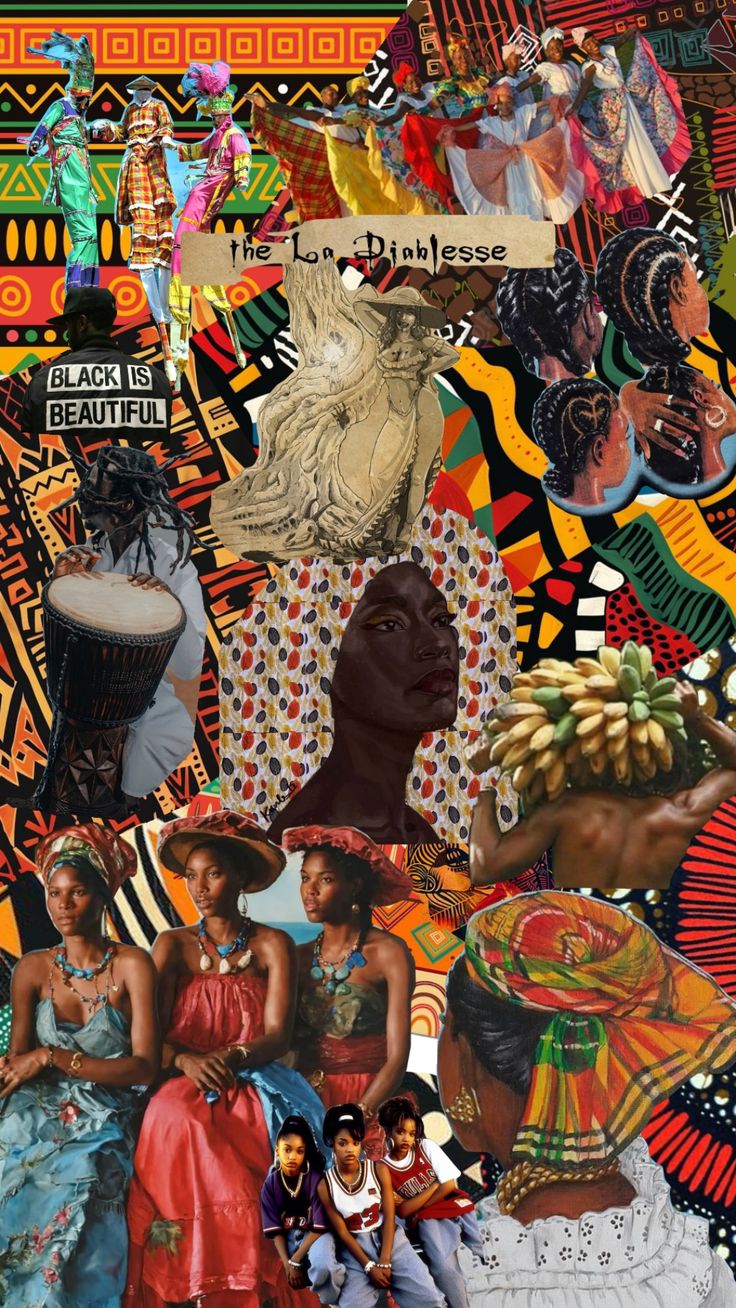

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

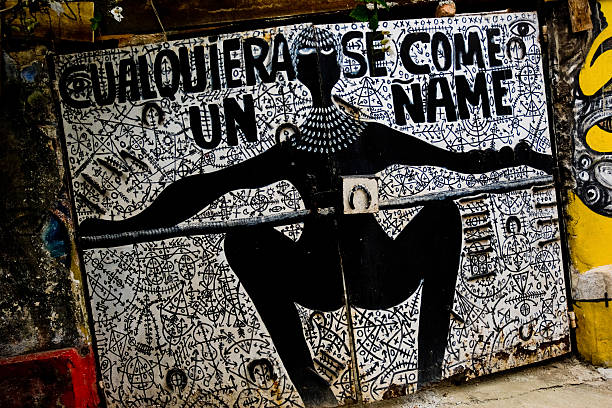

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

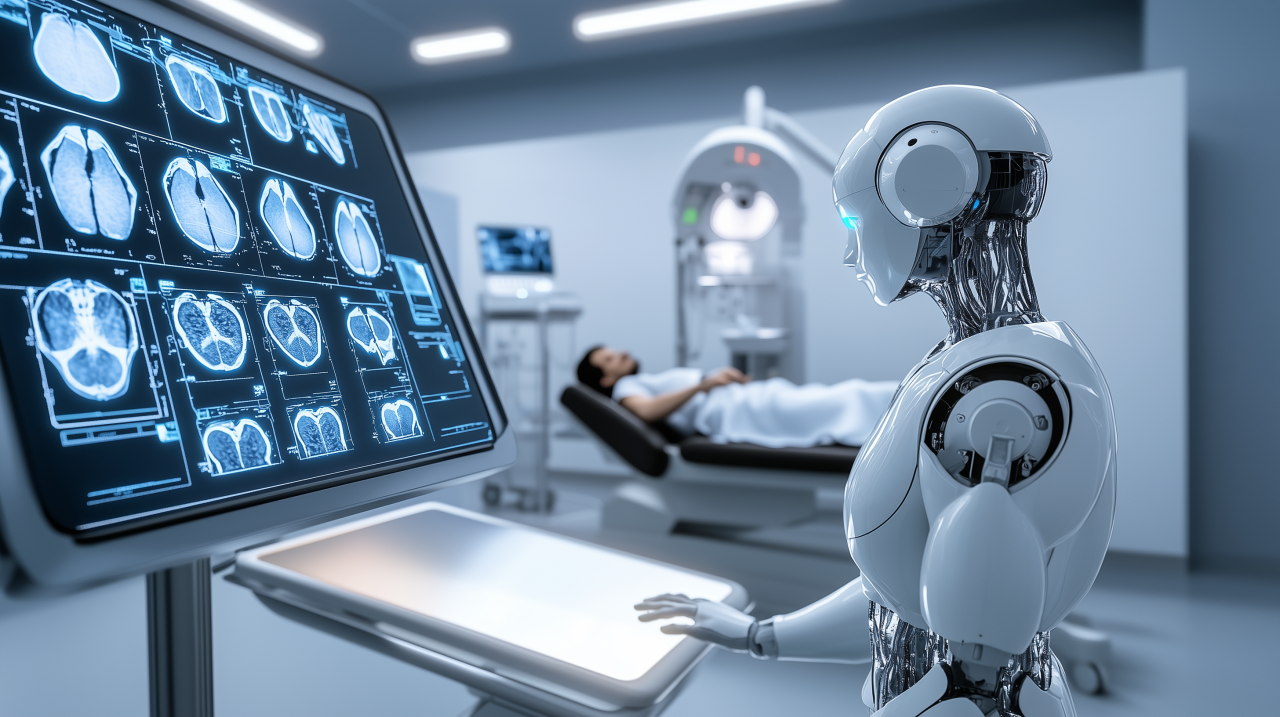

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

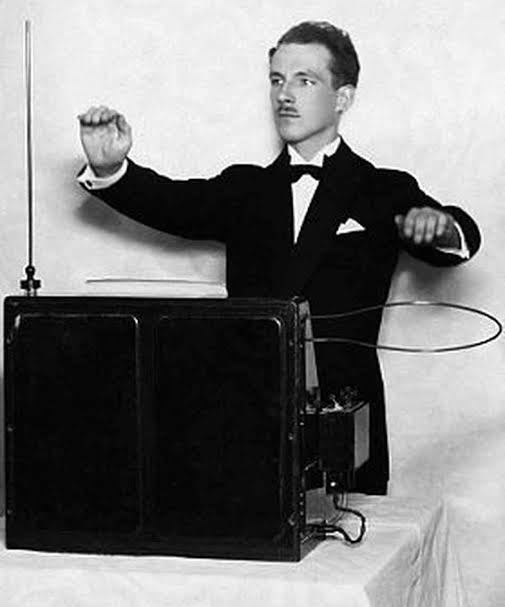

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...