TSX Penny Stocks Under CA$400M Market Cap in Focus

As the Canadian market navigates ongoing tariff uncertainties, investors are seeking opportunities amidst potential economic softening and inflationary pressures. In this climate, penny stocks, often associated with past trading eras, continue to be relevant for those looking for growth potential in smaller or newer companies. The focus is increasingly on entities that exhibit financial strength and the potential to offer hidden value beyond more established market names.

Several penny stocks on the TSX and TSXV exchanges stand out for their financial health and growth prospects. Examples include Westbridge Renewable Energy (TSXV:WEB) with a market cap of CA$73.84M and a strong financial health rating, PetroTal (TSX:TAL) at CA$576.47M, Orezone Gold (TSX:ORE) at CA$759.11M, and Fintech Select (TSXV:FTEC) with a market cap of CA$3.2M. Other notable mentions with generally positive financial health ratings include Findev (TSXV:FDI), Thor Explorations (TSXV:THX), NTG Clarity Networks (TSXV:NCI), Intermap Technologies (TSX:IMP), Pulse Seismic (TSX:PSD), and Hemisphere Energy (TSXV:HME). These companies represent a diverse range of sectors and market capitalizations, illustrating the varied opportunities within the penny stock landscape.

Among these, Questerre Energy Corporation (TSX:QEC) emerges as a noteworthy example for closer examination. Questerre Energy is an energy technology and innovation company with a market capitalization of CA$107.13 million. The company is primarily focused on the acquisition, exploration, and development of non-conventional oil and gas projects located in Canada.

Questerre Energy's operations generate revenue primarily from its Oil & Gas - Exploration & Production segment, which reported a total of CA$34.78 million. The company also boasts a strong Simply Wall St Financial Health Rating of six stars (★★★★★★), indicating a robust financial position.

In its recent financial reporting, Questerre Energy announced first-quarter revenue of CA$8.58 million. Significantly, the company achieved a net income turnaround, posting CA$0.004 million for the quarter compared to a loss in the same period last year. This positive shift highlights improving operational efficiency or market conditions benefiting the company.

Despite having been unprofitable on an overall basis in the past, Questerre Energy has made substantial progress in reducing its losses over the last five years. A key strength is its liquidity position, with short-term assets comfortably exceeding both its short-term and long-term liabilities. Furthermore, the company benefits from a highly experienced management team, which can be crucial for navigating the complexities and volatility inherent in the oil and gas sector. Adding to its financial stability, Questerre's debt levels have seen a significant decrease over time, which enhances its financial flexibility for future projects and operations.

The detailed examination of companies like Questerre Energy Corporation underscores the potential for uncovering valuable investment opportunities within the penny stock segment, particularly when due diligence is applied to assess financial health, management expertise, and strategic positioning in challenging economic environments.

You may also like...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

Beyond Fast Fashion: How Africa’s Designers Are Weaving a Sustainable and Culturally Rich Future for

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...

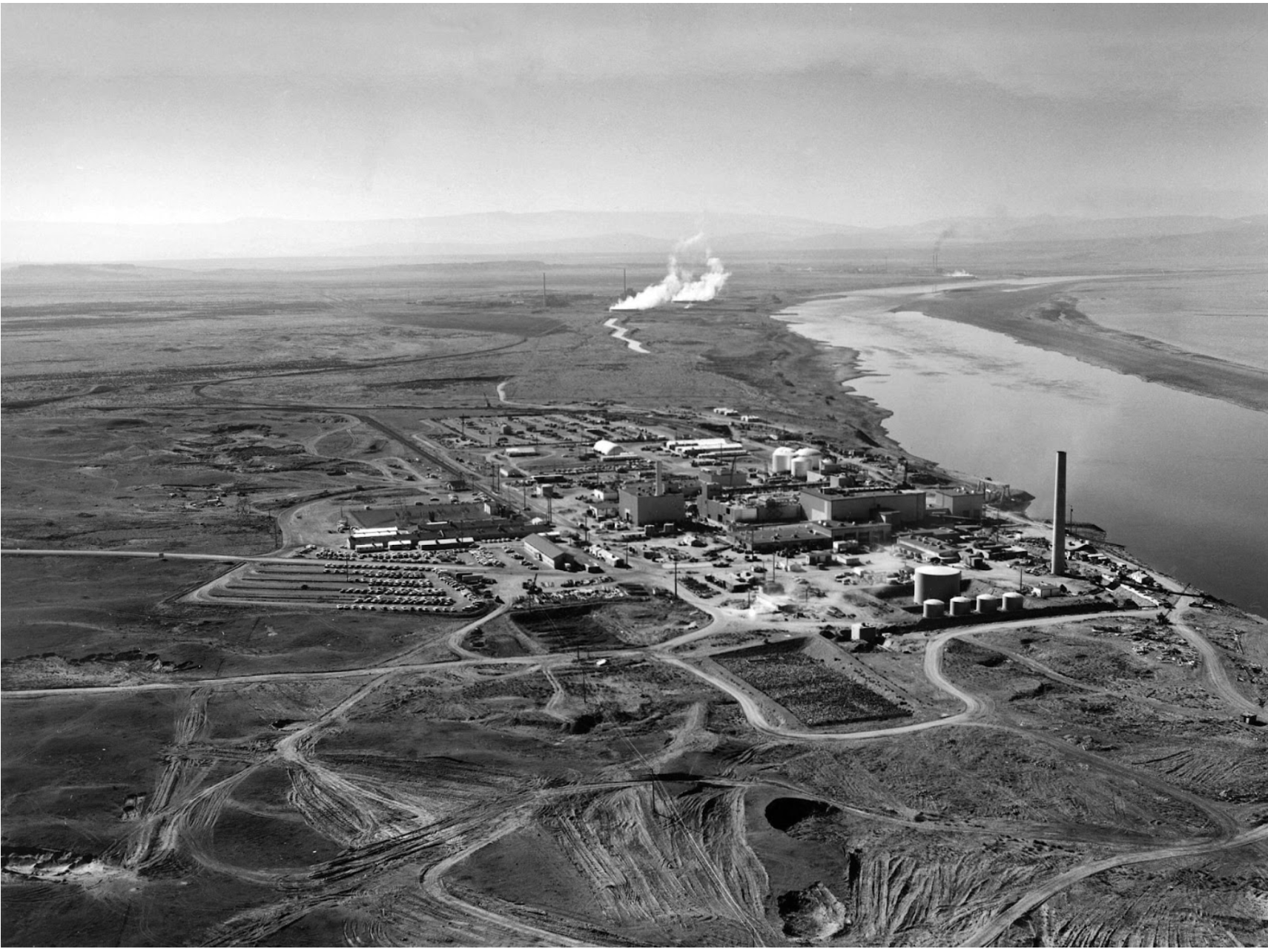

The Secret Congolese Mine That Shaped The Atomic Bomb

The Secret Congolese Mine That Shaped The Atomic Bomb.

TOURISM IS EXPLORING, NOT CELEBRATING, LOCAL CULTURE.

Tourism sells cultural connection, but too often delivers erasure, exploitation, and staged authenticity. From safari pa...

Crypto or Nothing: How African Youth Are Betting on Digital Coins to Escape Broken Systems

Amid inflation and broken systems, African youth are turning to crypto as survival, protest, and empowerment. Is it the ...

We Want Privacy, Yet We Overshare: The Social Media Dilemma

We claim to value privacy, yet we constantly overshare on social media for likes and validation. Learn about the contrad...

Is It Still Village People or Just Poor Planning?

In many African societies, failure is often blamed on “village people” and spiritual forces — but could poor planning, w...

The Digital Financial Panopticon: How Fintech's Convenience Is Hiding a Data Privacy Reckoning

Fintech promised convenience. But are we trading our financial privacy for it? Uncover how algorithms are watching and p...