Prediction Markets Signal Major Bitcoin Price Shift

Bitcoin price prediction markets are emerging as a valuable tool for assessing real-time sentiment and future price expectations within the cryptocurrency landscape. Platforms such as Polymarket and Kalshi allow traders to place wagers on Bitcoin's future price outcomes, generating aggregated odds that reflect the collective belief of market participants regarding BTC's trajectory. As these markets experience increased trading volumes and dynamic shifts in odds due to volatility, they are steadily gaining credibility as a forward-looking indicator of sentiment for the broader Bitcoin economy.

A key aspect of these markets is the ability to extract actionable insights, often referred to as 'Bitcoin Price Alpha.' For instance, in early October, Polymarket traders initially predicted BTC would close 2025 around $144,000. However, with increased volatility and a subsequent dip in BTC's price, this forecast adjusted downward to approximately $129,000. These real-time updates encapsulate the collective positioning and sentiment of thousands of participants, representing millions of dollars in capital. By continuously tracking the ratio between BTC’s spot price and the predicted year-end price, distinct sentiment trends become apparent. A significant spike in this ratio, indicating the spot price is considerably below the market's forecast, often signals periods of excessive fear or undervaluation. Conversely, when BTC trades close to the predicted price, it can suggest an overheated market nearing local peaks.

To refine this signal, normalizing the data to account for the natural narrowing of prediction volatility as the year progresses provides greater clarity. Historically, the highest percentile of days, characterized by the widest gap between predicted and spot prices, has correlated with market lows. Conversely, the lowest percentile of days, where the gap is narrowest, has aligned with local market highs, offering a contrarian signal for accumulation or reduction of exposure.

While Polymarket frequently cites an impressive 91% accuracy rate, a more in-depth analysis reveals this figure is often inflated by markets with extreme odds, such as highly improbable scenarios like "Bitcoin to hit $250,000 by year-end," which overwhelmingly resolve as 'no'. Excluding these outlier predictions yields a more realistic accuracy rate closer to 71% for BTC-related prediction markets. Although this figure remains notable, it highlights that these markets do not offer predictive certainty.

An interesting comparison arises when examining the standardized ratio of prediction-market expectations against BTC's actual price; this data moves inversely to the widely recognized Fear and Greed Index. When fear predominates the market, the prediction market ratio suggests that traders are undervaluing Bitcoin. Conversely, periods of extreme greed coincide with markets pricing BTC near or even above forecasted levels. This strong overlap indicates that prediction markets, much like other sentiment gauges, are effective in identifying instances where market emotions have swung too far in one direction.

In terms of trading implications, prediction markets alone may not consistently provide a trading edge, as their crowd-based probabilities are efficient but not infallible. However, when integrated with other sentiment indicators like the Fear and Greed Index or on-chain data, they can illuminate asymmetries in market perception. Historically, trading strategies that involve accumulating BTC during periods of extreme fear and reducing exposure during times of market euphoria have demonstrated superior performance compared to a simple buy-and-hold approach. When prediction markets corroborate these periods of widespread fear, the data further strengthens the argument for opportunistic accumulation.

In conclusion, Bitcoin price prediction markets are not infallible crystal balls but rather powerful reflections of the aggregated conviction of thousands of informed participants investing real money. While not perfectly accurate, their probabilities adeptly track human sentiment. When these odds significantly diverge from the spot price, particularly during moments of widespread fear, they can provide a data-driven contrarian signal that warrants careful attention for strategic investment decisions.

You may also like...

Bundesliga's New Nigerian Star Shines: Ogundu's Explosive Augsburg Debut!

Nigerian players experienced a weekend of mixed results in the German Bundesliga's 23rd match day. Uchenna Ogundu enjoye...

Capello Unleashes Juventus' Secret Weapon Against Osimhen in UCL Showdown!

Juventus faces an uphill battle against Galatasaray in the UEFA Champions League Round of 16 second leg, needing to over...

Berlinale Shocker: 'Yellow Letters' Takes Golden Bear, 'AnyMart' Director Debuts!

The Berlin Film Festival honored

Shocking Trend: Sudan's 'Lion Cubs' – Child Soldiers Going Viral on TikTok

A joint investigation reveals that child soldiers, dubbed 'lion cubs,' have become viral sensations on TikTok and other ...

Gregory Maqoma's 'Genesis': A Powerful Artistic Call for Healing in South Africa

Gregory Maqoma's new dance-opera, "Genesis: The Beginning and End of Time," has premiered in Cape Town, offering a capti...

Massive Rivian 2026.03 Update Boosts R1 Performance and Utility!

Rivian's latest software update, 2026.03, brings substantial enhancements to its R1S SUV and R1T pickup, broadening perf...

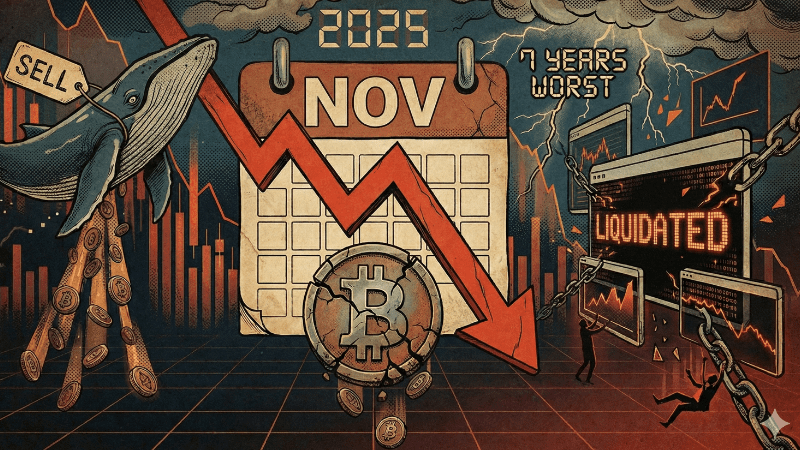

Bitcoin's Dire 29% Drop: VanEck Signals Seller Exhaustion Amid Market Carnage!

Bitcoin has suffered a sharp 29% price drop, but a VanEck report suggests seller exhaustion and a potential market botto...

Crypto Titans Shake-Up: Ripple & Deutsche Bank Partner, XRP Dips, CZ's UAE Bitcoin Mining Role Revealed!

Deutsche Bank is set to adopt Ripple's technology for faster, cheaper cross-border payments, marking a significant insti...