MicroStrategy's Bold Billion-Dollar Bitcoin Grab!

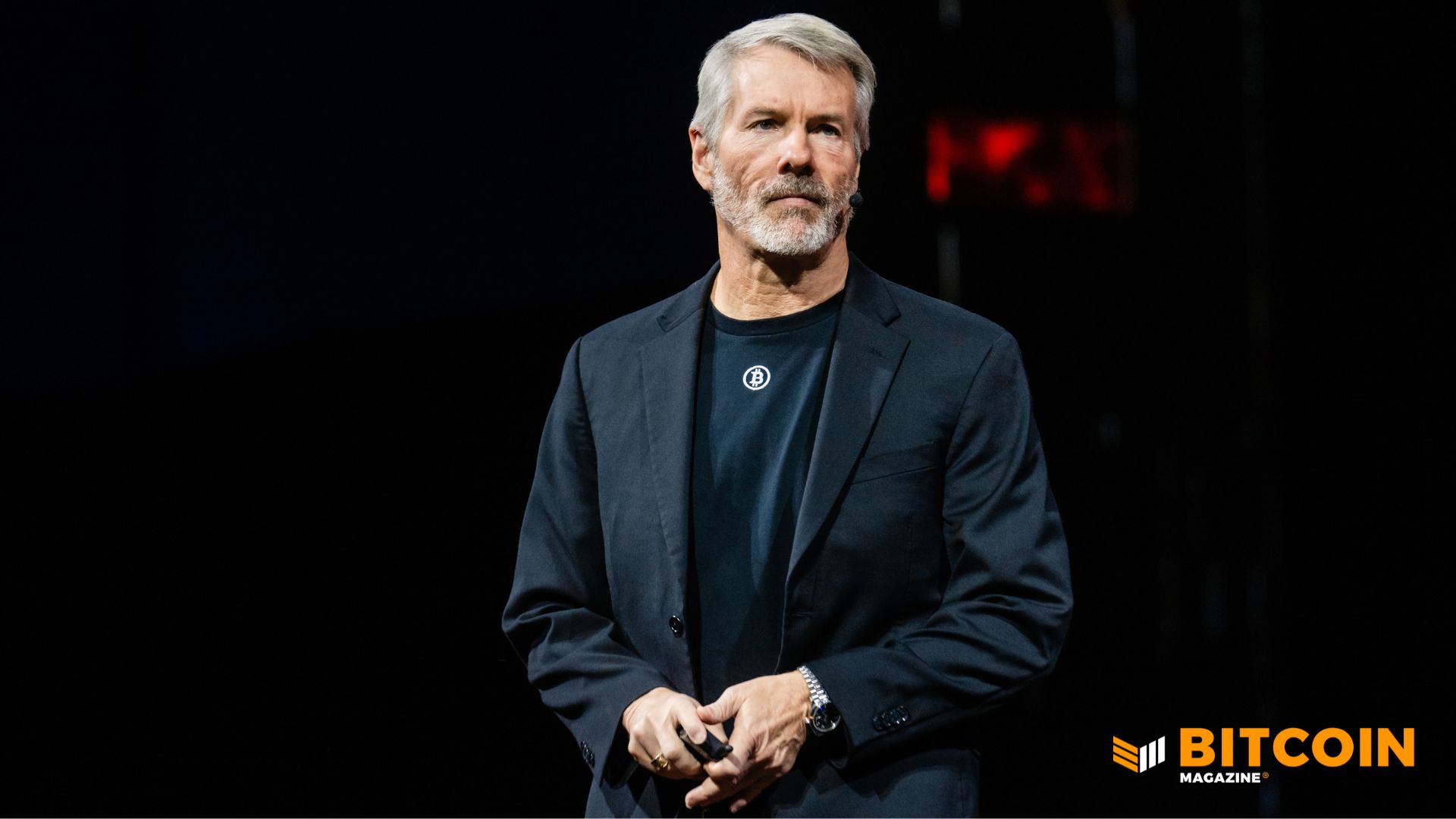

Strategy, the leading publicly traded holder of bitcoin, announced a significant acquisition last week, purchasing 10,624 BTC for approximately $962.7 million. This marked a return to large-scale purchases not seen since mid-year, coinciding with a period of steadied market volatility. The company paid an average price of $90,615 per bitcoin during the December 1–7 period, as detailed in a regulatory filing and a statement from Executive Chairman Michael Saylor.

This latest acquisition substantially increased Strategy’s total bitcoin holdings to 660,624 coins. These holdings were accumulated for roughly $49.35 billion, at an average cost of $74,696 per bitcoin. With bitcoin prices near $94,000 at the time of the announcement, Strategy’s bitcoin stash was valued at approximately $60.5 billion, resulting in an estimated $11 billion in unrealized gains for the firm.

The purchase, which represents Strategy’s largest weekly bitcoin acquisition since July, was primarily funded through its at-the-market equity sales program. The company successfully raised $928.1 million from the sale of 5.13 million shares of its MSTR common stock and an additional $34.9 million by selling 442,536 shares of its STRD preferred stock. The net proceeds from these sales totaled about $963 million, effectively covering the cost of the bitcoin acquisition. Strategy continues to hold substantial remaining issuance capacity, with approximately $13.45 billion in common stock and over $26 billion across various preferred and structured offerings, including STRK, STRF, STRC, and STRD.

In market trading, shares of Strategy (MSTR) showed a modest increase of about 2% in premarket trading on Monday, aligning with a small advance in bitcoin. The stock had previously rebounded from a low near $155 on December 1, following a sharp selloff across crypto-linked equities, though it remains down more than 50% over the past six months. Bitcoin itself saw a recovery, rising about 3% over 24 hours and roughly 1.5% on Monday morning, pulling back from recent weakness that pushed prices into the low $80,000s. Some analysts have attributed this bounce to expectations of a potential Federal Reserve interest rate cut this week, which could provide support for risk assets.

Executive Chairman Michael Saylor has been actively engaged in promoting bitcoin and Strategy’s unique position. While attending the BTC Conference in Abu Dhabi, Saylor spent the week meeting with sovereign wealth funds, banks, family offices, and hedge funds across the Middle East to discuss bitcoin and capital markets. He also highlighted the company’s "BTC Yield" metric, which reached 24.7% year-to-date in 2025. This metric is designed to reflect the growth in bitcoin held per diluted share, rather than changes in dollar value, and is central to Strategy’s investor messaging as it solidifies its identity as a bitcoin-focused treasury and structured finance business.

Despite its aggressive strategy, the backdrop for Strategy remains unsettled. Investors continue to scrutinize whether the company’s strategy of using extensive equity issuance to acquire bitcoin amplifies both potential upside and downside risks for shareholders. This comes after the firm raised nearly $2 billion just two weeks prior, largely to establish a cash buffer for preferred dividend obligations, before re-entering markets to fund its latest bitcoin purchases.

A significant challenge Strategy faces revolves around index inclusion, as MSCI is currently reviewing whether companies with substantial digital-asset holdings should remain within traditional equity benchmarks. JPMorgan analysts have cautioned that an exclusion could trigger billions of dollars in passive outflows from Strategy if index funds are compelled to divest. Saylor has consistently countered these concerns, asserting that Strategy operates as a legitimate software business with a growing Bitcoin-backed credit operation, rather than merely a fund or trust, and that such classification debates do not sway the firm's long-term strategic approach.

For the foreseeable future, Strategy is committed to its established approach. With over 660,000 bitcoin on its balance sheet and continuous access to capital markets, Strategy continues to serve as the most prominent corporate proxy for bitcoin exposure in public equities. This remains true even as both crypto prices and its own share price exhibit persistent volatility. The current bitcoin price is near $91,500.

You may also like...

If Gender Is a Social Construct, Who Built It And Why Are We Still Living Inside It?

If gender is a social construct, who built it—and why does it still shape our lives? This deep dive explores power, colo...

Be Honest: Are You Actually Funny or Just Loud? Find Your Humour Type

Are you actually funny or just loud? Discover your humour type—from sarcastic to accidental comedian—and learn how your ...

Ndidi's Besiktas Revelation: Why He Chose Turkey Over Man Utd Dreams

Super Eagles midfielder Wilfred Ndidi explained his decision to join Besiktas, citing the club's appealing project, stro...

Tom Hardy Returns! Venom Roars Back to the Big Screen in New Movie!

Two years after its last cinematic outing, Venom is set to return in an animated feature film from Sony Pictures Animati...

Marvel Shakes Up Spider-Verse with Nicolas Cage's Groundbreaking New Series!

Nicolas Cage is set to star as Ben Reilly in the upcoming live-action 'Spider-Noir' series on Prime Video, moving beyond...

Bad Bunny's 'DtMF' Dominates Hot 100 with Chart-Topping Power!

A recent 'Ask Billboard' mailbag delves into Hot 100 chart specifics, featuring Bad Bunny's "DtMF" and Ella Langley's "C...

Shakira Stuns Mexico City with Massive Free Concert Announcement!

Shakira is set to conclude her historic Mexican tour trek with a free concert at Mexico City's iconic Zócalo on March 1,...

Glen Powell Reveals His Unexpected Favorite Christopher Nolan Film

A24's dark comedy "How to Make a Killing" is hitting theaters, starring Glen Powell, Topher Grace, and Jessica Henwick. ...