Microsoft Soars: Tech Giant Beats Wall Street with Massive $81.3 Billion Revenue Haul

Microsoft announced robust financial results for its October-December quarter, reporting revenue of $81.3 billion, a significant 17% increase compared to the same period last year. This growth is largely attributed to the company's aggressive pursuit of global adoption for its artificial intelligence (AI) tools and technologies. The tech giant also surpassed Wall Street's expectations for net profit, achieving $30.9 billion, or $4.14 per share, during the quarter. These impressive figures, however, excluded the impact of Microsoft's substantial investments in OpenAI, the creator of ChatGPT.

When not factoring in its OpenAI investments, Microsoft's profit climbed even higher, reaching $38.5 billion, or $5.16 per share. This adjustment reflects a new accounting practice that the company plans to implement moving forward, which accounts for OpenAI's restructuring from a nonprofit into a for-profit public benefit corporation last year.

Microsoft holds a considerable stake in OpenAI, approximately 27% or $135 billion. Although Microsoft is no longer OpenAI's exclusive cloud provider – a relationship that was instrumental in bankrolling the AI company's early development – it retains crucial commercial rights to OpenAI products through 2032.

A key driver of Microsoft's financial success in the quarter was its AI-focused cloud computing business segment, which generated $32.9 billion in sales for the last three months of the year. This represents a strong 29% increase from the prior year's period and also exceeded the $32.4 billion analysts polled by FactSet had anticipated. Despite these overwhelmingly positive earnings and exceeding analyst forecasts, Microsoft's stock experienced an unexpected drop of nearly 5% in after-hours trading following the release of its earnings report.

Zacks Investment Research analyst Bryan Hayes suggested that this stock decline likely stemmed from "investor scrutiny" concerning Microsoft's substantial expenditures on the infrastructure required to power its AI initiatives. This includes significant investments in computer chips and data centers.

Microsoft CEO Satya Nadella addressed investors during an earnings call, emphasizing that the company is still in the "beginning stages" of AI diffusion, a term that describes the broad dissemination and application of AI across various sectors.

You may also like...

Fenerbahce Battles Atletico Madrid for Ademola Lookman as Transfer Saga Deepens

)

Ademola Lookman's transfer future is a hot topic as Fenerbahce intensifies direct talks with Atalanta, with a verbal €40...

Crystal Palace Star Jean-Philippe Mateta's Future Uncertain Amidst Exit Reports

Crystal Palace striker Jean-Philippe Mateta will miss the upcoming match against Nottingham Forest amid transfer specula...

Markiplier's 'Iron Lung' Horror Debut Shocks Audiences, Becomes Streaming Sensation

Markiplier, the celebrated YouTuber, makes his directorial debut with "Iron Lung," a self-financed and fan-supported hor...

Hollywood Mourns Legend Catherine O'Hara: Tributes Pour In After Her Passing at 71

Catherine O'Hara, the beloved two-time Emmy-winning actor known for her iconic roles in "Home Alone" and "Schitt's Creek...

Unpacking the Enduring Influence of Music Legend Fela Kuti

Decades after his death, Fela Anikulapo-Kuti's legacy of courage and resistance continues to inspire, with his Afrobeat ...

Fela Kuti Set for Posthumous Lifetime Grammy in 2026

Afrobeat legend Fela Anikulapo Kuti is slated to receive a posthumous Lifetime Achievement Award at the 2026 Grammy Awar...

HBO Series Star Reveals TikTok's Crucial Role in Genre-Defining Hit!

Shabana Azeez discusses her character Dr. Victoria Javadi in "The Pitt," revealing her secret life as a MedTok star. Aze...

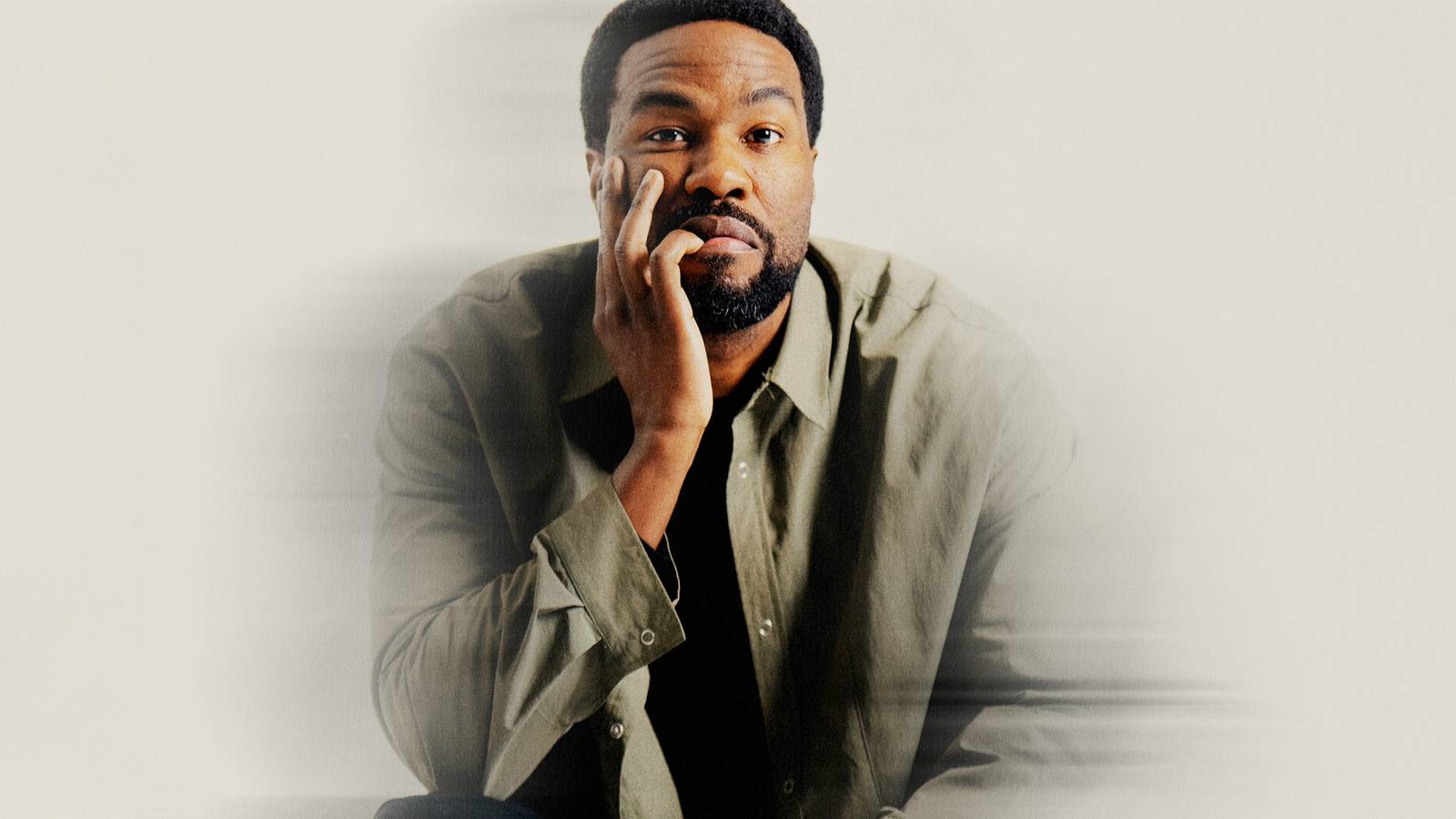

Yahya Abdul-Mateen II Redefines Marvel: 'Wonder Man' Becomes His Most Personal Work Yet!

Yahya Abdul-Mateen II stars in Marvel's <i>Wonder Man</i>, a Disney+ series that uniquely focuses on an actor's journey ...