How Ten Big AI Giants Lost $1.64 Trillion in Stock Market Value in Just 7 Days

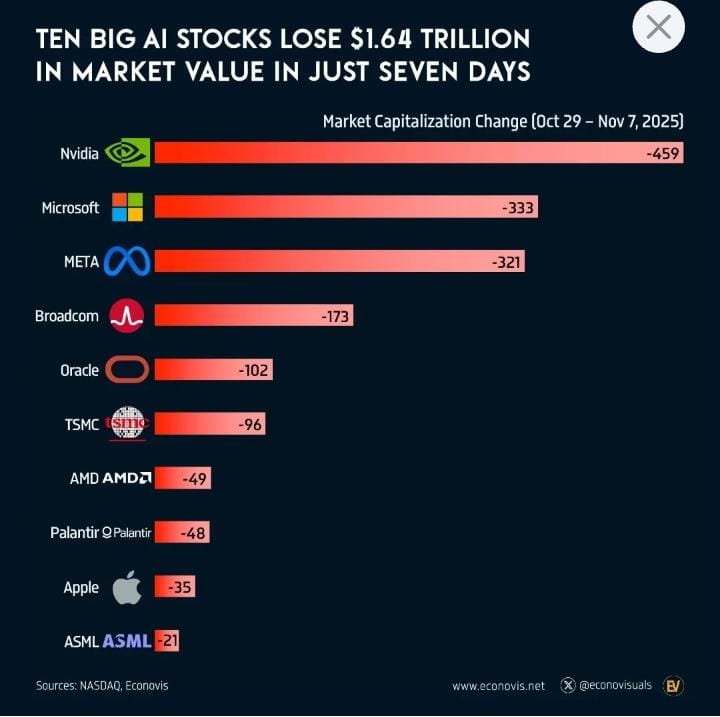

In the space of one week at the end of October and the beginning of November 2025, a group of ten companies at the heart of the artificial-intelligence boom saw roughly 1.64 trillion dollars sliced off their combined stock-market value. Those firms: Nvidia, Microsoft, Meta, Broadcom, Oracle, TSMC, AMD, Palantir, Apple and ASML, sit at the centre of today’s AI hardware and software ecosystem, so the sudden slide rattled investors far beyond the technology sector.

To get a sense of scale, 1.64 trillion dollars is close to the entire value of Spain’s equity market and almost half of Canada’s listed companies combined.

Watching that much wealth evaporate in a few trading sessions raises big questions: why did it happen, what does it tell us about the AI economy, and how should observers interpret this kind of violent move?

What Actually Happened During That Week?

The Voronoi’s Market Capitalization chart shared tracks the change in market capitalisation, the total value of a company’s outstanding shares, between 29 October and 7 November 2025. Over those seven trading days:

Nvidia lost about 459 billion dollars in value, the largest single drop in the group.

Microsoft fell roughly 333 billion dollars.

Meta shed around 321 billion dollars.

Broadcom dropped about 173 billion dollars.

Oracle declined by roughly 102 billion dollars.

TSMC saw a fall of 96 billion dollars.

AMD slipped by 49 billion dollars.

Palantir gave up 48 billion dollars.

Apple decreased by 35 billion dollars.

ASML rounded out the list with a 21-billion-dollar reduction.

These moves didn’t happen in isolation. During that same stretch, technology shares as a whole went through a sharp sell-off. One analysis pointed out that, on a single day in early November, AI-linked equities collectively erased more than 500 billion dollars as traders questioned whether the long rally in this theme had simply gone too far.

The point is not that these companies suddenly became tiny or irrelevant – even after the slump they remained some of the largest and most powerful businesses on the planet. Instead, the episode shows how quickly sentiment can reverse when enthusiasm, high valuations and a few negative catalysts collide.

How We Got Here: The AI Boom That Came Before The Drop

To understand why the setback was so dramatic, you have to look at the run-up.

From 2023 onward, AI became the main story driving global stock markets. Breakthroughs in large language models and image generators convinced investors that computing platforms were entering a new era.

Money flooded into chipmakers, cloud providers and software firms that were either building the infrastructure or promising to monetise AI in everyday products.

Nvidia turned into the poster child of this surge. Its graphics processing units (GPUs) became the standard engines for training and running large AI models. As demand exploded, the company’s share price soared, and its market capitalisation crossed the trillion-dollar mark, eventually making it the world’s most valuable listed firm by late 2025.

Microsoft gained because of its deep partnership with OpenAI and its strategy of weaving AI tools into Office, Windows and Azure.

Meta promised vast AI-driven improvements to advertising and content recommendation.

TSMC, AMD, ASML and Broadcom benefited as essential suppliers of advanced chips, manufacturing capacity and networking components.

Palantir marketed itself as a key player in AI-enabled data analysis for governments and corporations.

Apple and Oracle emphasised on-device intelligence and AI-enhanced cloud services.

Because these businesses were at the centre of the AI narrative, investors were willing to pay very high prices for their shares. By late 2025, a widely watched long-term valuation measure – the Shiller CAPE ratio for the U.S. market – climbed above 40, a zone last seen around the peak of the dot-com bubble in 2000.

That doesn’t automatically mean a crash is guaranteed, but it does signal that optimism has become extreme.

When prices stretch that far above historical norms, it takes surprisingly little to trigger a correction. In this case, several pressures arrived almost at once.

The Immediate Triggers: Why AI Shares Suddenly Stumbled

1. Competition in AI hardware

One of the most important catalysts was rising competition in the AI chip space. In early November 2025, news broke that Google’s parent company, Alphabet, was in talks to provide its home-grown tensor processing units (TPUs) directly to clients like Meta, not just through its cloud service.

Shortly afterwards, Google unveiled Gemini 3, a new AI model trained on its own hardware. Reports suggested that Google was encouraging other companies to adopt TPUs in their data centres rather than relying solely on Nvidia’s GPUs.

2. Export controls and geopolitics

At roughly the same time, Washington moved to tighten limits on advanced chip shipments to China, including further restrictions on the AI-focused processors Nvidia had designed specifically to comply with earlier rules.

China represents a crucial growth market for high-end data-centre chips, both for American firms and for manufacturing partners in Taiwan and Europe. Tougher export rules raise the risk that a meaningful slice of future demand could be delayed, diverted to domestic Chinese competitors, or blocked altogether.

That prospect weighed on Nvidia, AMD and TSMC in particular, but it also mattered to broad-based indices because these companies are now so large that their swings affect benchmarks.

3. Profit taking after huge gains

After nearly two years of steep appreciation, many traders were sitting on large unrealised profits. When the first negative headlines appeared, short-term investors decided to lock in gains.

That selling put pressure on prices, which in turn caused more investors using stop-loss strategies or leveraged positions to offload shares as well.

This kind of feedback loop is typical in momentum-driven markets: once the dominant trade stops working, everyone rushes to the exit at the same time. Because AI champions make up such a large portion of major U.S. indices, the ripple effects showed up across global portfolios.

4. Earnings worries and spending fatigue

Another underlying concern was whether all the massive spending on AI infrastructure would translate into equally massive profits. Data-centre owners, including Microsoft, Meta and other hyperscale cloud providers, have been pouring tens of billions of dollars into GPUs, networking equipment and new buildings.

Some analysts started to question whether enterprises would adopt AI tools quickly enough to justify that pace of investment. When a few high-profile AI software firms, including Palantir, reported results that hinted at slower-than-expected contract growth, investors used that as another excuse to reduce exposure.

Put together: emerging competition, regulatory risk, stretched valuations and questions about near-term earnings; the scene was set for a dramatic reset.

How Unusual Is A 1.64-trillion-dollar Wipeout?

Numbers in the trillions can feel abstract, so it helps to compare them with something concrete. Spain’s entire listed equity market is worth around 1.8 trillion dollars, according to recent estimates. Canada’s stock market has a capitalisation in the 3.5- to 4-trillion-dollar range.

That means the combined fall in these ten AI leaders over one week was roughly equivalent to erasing almost the whole Spanish market or nearly half of Canada’s.

However, it’s important to remember that market capitalisation is not the same as cash sitting in a bank account. It’s a snapshot of what investors are willing to pay for shares at a particular moment.

When prices change, wealth shifts between buyers and sellers: someone who sold near the top keeps their profits, while those who bought just before the decline see the market value of their holdings drop.

Crucially, even after the correction, the long-term story didn’t simply vanish. Within a couple of weeks, Nvidia reported strong quarterly results that reassured investors about continuing demand, and the stock jumped in after-hours trading, helping lift AI-related indices again. That rebound didn’t undo the entire previous loss, but it showed that markets can move both ways quickly.

What This Episode Reveals About the AI Economy?

1. AI is real, but so is hype

One temptation is to treat any large drop as proof that AI itself has been overblown. That’s too extreme. AI technologies are already widely deployed: they filter spam, improve language translation, optimise logistics and power recommendation systems.

Governments and companies are expanding their computing capacity rapidly; one study estimated that, by 2025, the combined AI computing power of the top nations reached levels many times above the fastest traditional supercomputers and required electricity on the scale of major countries’ entire grids.

2. Concentration risk in global markets

Another lesson is how concentrated modern equity markets have become. A small number of mega-capitalisation companies now account for a very large share of major indices such as the S&P 500 and Nasdaq 100. As of late 2025, just ten trillion-dollar-plus companies made up nearly half of the S&P 500’s total value.

When a theme – in this case AI – dominates that group, volatility in a few names can drag entire markets up or down. That’s exactly what happened during the week in question: selling pressure in Nvidia, Microsoft, Meta and their peers affected index funds, retirement portfolios and global exchange-traded products that hold large amounts of these shares.

3. Policy and regulation matter as much as engineering

The drop also illustrates how sensitive AI businesses are to policy decisions. Export rules limiting advanced chips to certain countries, data-protection regulations, antitrust scrutiny of big tech, and government procurement choices can all reshape demand.

The bigger picture

The seven-day, 1.64-trillion-dollar AI sell-off of 2025 will likely be remembered as one of the first major “reality checks” of the modern AI era. It didn’t mark the end of AI research, nor did it erase the strategic importance of computing power, data and algorithms. Instead, it highlighted how financial markets process new technologies: they overshoot, they reconsider, and they adjust.

You may also like...

WNBA Contract Crunch: Kelsey Plum Hails Offer Amid Ongoing CBA Negotiations

WNBPA Vice President Kelsey Plum views the WNBA's initial revenue-sharing offer as a "significant win" despite ongoing d...

Arsenal's Title Race Jitters: Jurriën Timber Exposes Growing Anxiety

Arsenal secured a tense 2-1 victory over Chelsea, re-establishing their five-point lead in the Premier League. Defender ...

Tom Hardy's Epic Western, a Career Changer, Becomes Instant Streaming Hit

Tom Hardy's critically acclaimed film "The Revenant" is experiencing renewed popularity, returning to streaming charts a...

Avatar Sequel 'Fire and Ash' Stumbles at Box Office, Fails to Ignite Expectations

James Cameron's 'Avatar: Fire and Ash' recently concluded its domestic top 10 run, falling short of its predecessors' bo...

Taylor Swift Unleashes Exclusive Vinyl for Record Store Day Fans

Taylor Swift is set to release an exclusive 7-inch single for her fan-favorite track "Elizabeth Taylor" on galactic purp...

Harry Styles Ensures Global Fan Access to Manchester Album Release Extravaganza

Harry Styles' "One Night in Manchester" album release concert will be available globally on Netflix, bringing the live d...

Industry's Miriam Petche Unveils Must-See Season 4 Finale Moment!

Miriam Petche delves into Sweetpea Golightly's pivotal Season 4 journey in HBO's "Industry," discussing the character's ...

Trailblazing Triumphs: Celebrating Women's Power This #BNSWomensMonth

BellaNaijaStyle celebrates its seventh Women's Month campaign, focusing on