How Opay Turns Customer Habits Into Smarter Payments

It starts with a small observation. Nigerians are clever. They hate unnecessary fees. They notice every little extra charge and work around it.

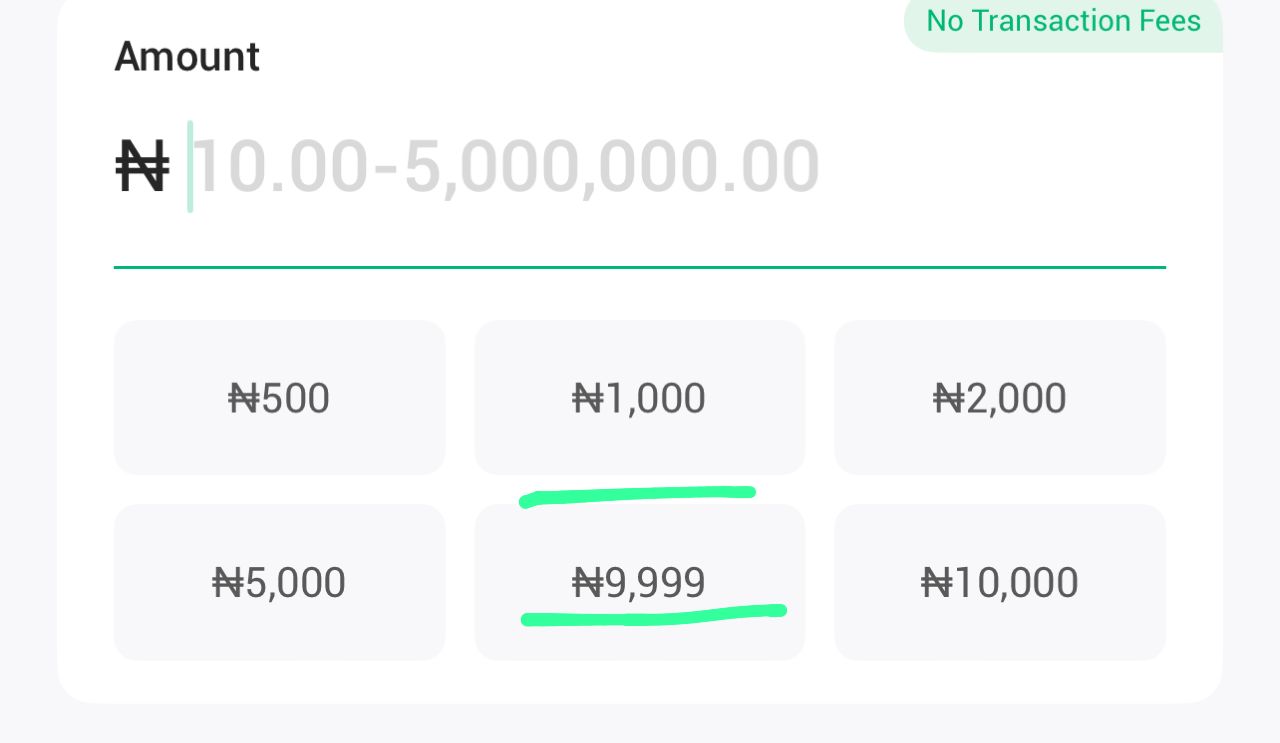

They noticed fifty naira was always deducted whenever they made a transfer of 10,000 naira or more so they started doing one thing: people started sending 9,999 naira instead of 10,000 to avoid a 50 naira transfer fee.

Some persons even went as far as sending 9999 naira four times or more whener they wanted to make a payment that was above 10 000 naira.

Most companies would have considered this a loophole to close. Opay did something else. They noticed, adapted, and made life easier.

Instead of punishing the customer or creating more rules, Opay added a 9999 naira option. It quietly added a ₦9,999 preset button alongside its existing ₦5,000 and ₦10,000 options.

The feature allows users to send amounts just below the chargeable threshold with a single tap, making a long-standing workaround easier and faster. The option aligns with OPay’s promise of zero transfer fees on transactions up to ₦5 million.

That small adjustment says a lot about the company: they study behavior and design systems that work with their users, not against them.

Listening Before Acting

Opay’s strategy isn’t about flashy marketing campaigns

or catchy app slogans. It’s about data-driven empathy. They watch, track, and analyze how customers interact with their platform.

Which buttons do people press first? Where do they hesitate? What little workarounds or “hacks” do they come up with?

Those observations inform product decisions. Every tweak, from payment amounts to interface design, is shaped by real-world customer behaviour, not assumptions. The 9999 naira example is just one visible proof of a philosophy that values understanding over enforcement.

Making Everyday Transactions Easier

Beyond fees, Opay simplifies other friction points that other payment apps ignore. Nigerians are familiar with clunky interfaces, hidden charges, or multi-step processes that waste time. Opay studies which parts of the experience frustrate users most, then removes them.

Examples include:

Quick bill payments: Instead of forcing users to navigate multiple screens to pay electricity or cable bills, Opay presents frequently used amounts upfront.

One-tap transfers: The app remembers the people you send money to most often and minimizes steps.

Integrated services: Beyond peer-to-peer transfers, users can pay bills, buy airtime, or even access microloans without leaving the app.

Every improvement is designed to reduce friction and increase convenience, not just to add features for the sake of it.

The Bigger Picture: Empowered Customers

When a company studies behavior deeply, it doesn’t just simplify payments; it empowers customers. People feel understood. They feel in control. Micro-adjustments like fee avoidance options or pre-set amounts make daily transactions faster and less stressful.

Opay’s approach also signals trust. They are willing to meet customers where they are, not force them into restrictive rules. In a market where financial friction often frustrates users, this philosophy differentiates them.

Why This Is Important For Fintech

Opay’s example offers a lesson for fintech companies everywhere: success comes from understanding the human, not just the transaction. Observing customer habits, studying pain points, and adapting services accordingly is more powerful than enforcing rigid policies.

In a market crowded with apps that boast flashy features, the real innovation is empathy turned into action. Small design decisions, informed by how people actually behave, build loyalty, trust, and consistent use.

For Nigerians, sending 9,999 naira instead of 10,000 is smart. For Opay, recognizing that and making it official is genius.

Opay isn’t just a payments platform. It’s a lesson in behavior-driven design. It proves that sometimes, the smartest way to innovate isn’t to create new rules, but to listen, adapt, and make life easier for the customer.

When fintech companies start treating users as real humans with habits, workarounds, and quirks, rather than numbers to optimize, that’s when real differentiation happens. And that is exactly what sets Opay apart.

More Articles from this Publisher

How Opay Turns Customer Habits Into Smarter Payments

Nigerians were sending 9,999 naira instead of 10,000 to dodge fees. Instead of punishing them, Opay made it official. Th...

Fashion Items That Were Once Considered Embarrassing

From corsets to second-hand clothing, sneakers to mini skirts, these fashion items were once sources of public shame. Re...

Music Genres That Were Once Criminalized or Considered Dangerous

From jazz clubs raided in Harlem to Afrobeat concerts attacked by soldiers, music has always been criminalized when it m...

Countries That Contribute the Least to Climate Change but Pay the Highest Price

They barely warm the planet, yet they bury their dead after floods, storms, and droughts. This justice-driven listicle e...

The Reason Why Adulthood Is Hard Is Because We Are All Gatekeepers

Adulthood feels exhausting, confusing, and unnecessarily hard. What if the real problem isn’t life itself, but the way w...

A Humanoid Robot Just Passed a Test Most Humans Would Fail

China’s Unitree G1 humanoid robot walked 130,000 steps in –47°C Arctic conditions while wearing a puffer jacket, setting...

You may also like...

Startups And Bureaucracy: The Shutdown of Kenya’s Bioethanol Pioneer

KOKO Networks, one of Kenya’s leading clean tech startups, has shut down. Its closure raises critical questions about cl...

How Opay Turns Customer Habits Into Smarter Payments

Nigerians were sending 9,999 naira instead of 10,000 to dodge fees. Instead of punishing them, Opay made it official. Th...

Sustainable Agriculture Practices That Protect African Lands

This article talks about how sustainable agriculture practices in Africa protect land, conserve water, and help communit...

Lassa Fever Is Back: 5 Simple Steps to Reduce Your Risk

Lassa fever cases are rising again in Nigeria, with over 1,000 confirmed infections and 200 deaths. Here are five simple...

Fashion Items That Were Once Considered Embarrassing

From corsets to second-hand clothing, sneakers to mini skirts, these fashion items were once sources of public shame. Re...

Music Genres That Were Once Criminalized or Considered Dangerous

From jazz clubs raided in Harlem to Afrobeat concerts attacked by soldiers, music has always been criminalized when it m...

Milner Makes History! Veteran Star Equals Premier League Appearance Record

James Milner has equaled Gareth Barry's Premier League appearance record of 653 games, a monumental achievement in his 2...

The Truth Is Out: Ryan Coogler's 'X-Files' Reboot Greenlit!

Ryan Coogler, fresh off the success of his award-winning film "Sinners," is deeply engrossed in writing the highly-antic...