Historic Acquisition Shakes Crypto: First Publicly Traded Bitcoin Firm Bought!

In a landmark event on January 13, history was made as Strive Enterprises (Nasdaq: ASST) officially secured shareholder approval for its acquisition of Semler Scientific (Nasdaq: SMLR). This monumental deal marks the financial world's first-ever acquisition of a publicly traded company holding Bitcoin as a primary treasury asset. The merger not only consolidates two significant Bitcoin stockpiles but also reshapes the landscape of corporate cryptocurrency holdings.

As a core component of the agreement, Strive Enterprises has acquired Semler Scientific’s entire Bitcoin treasury, which totaled an impressive 5,048.1 Bitcoin. Adding to this substantial acquisition, Strive also announced a recent strategic purchase of an additional 123 BTC for its own treasury, acquired at an average price of $91,561 per coin. Post-acquisition, the combined entity will command a formidable 12,797.9 Bitcoin, catapulting Strive past Tesla to become the 11th largest corporate holder of Bitcoin globally.

Strive Enterprises is swiftly moving to transform Semler Scientific into a pure-play Bitcoin asset. The company's immediate plans involve monetizing Semler's operating business, specifically its medical products division, within the next year. The proceeds generated from this strategic divestment are earmarked primarily for the retirement of Semler’s legacy debt, including a substantial $100 million convertible note and a $20 million loan from Coinbase. This move underscores Strive's clear intent to streamline Semler’s corporate structure and redirect its focus exclusively toward "Bitcoin operations with a simple preferred equity only amplification" model.

Matt Cole, CEO of Strive Enterprises, emphasized the significant financial efficiency and strategic benefits of this merger. He highlighted that the acquisition is projected to boost the combined company's first-quarter Bitcoin yield in 2026 to more than 15%. This strategic maneuver follows Semler Scientific's initial foray into Bitcoin, which began in May 2024 with the purchase of 581 Bitcoins for approximately $40 million, an action that led to the company being labeled a "Strategy copycat" at the time.

You may also like...

Goal Frenzy! Premier League Explodes with 19 Goals in Thrilling Afternoon

Saturday's Premier League 3 p.m. games delivered a thrilling spectacle of goals and drama, with high-scoring encounters ...

Haaland Sidelined! Man City Star Faces Injury Scare Ahead of Leeds Clash

Star striker Erling Haaland will miss Manchester City's crucial Premier League clash against Leeds United due to a "litt...

Potterheads Rejoice: The Unmade Harry Potter Movie Idea We're All Glad Never Saw the Light of Day

The Harry Potter stars Daniel Radcliffe, Emma Watson, and Rupert Grint once received a "bizarre" offer to reunite on scr...

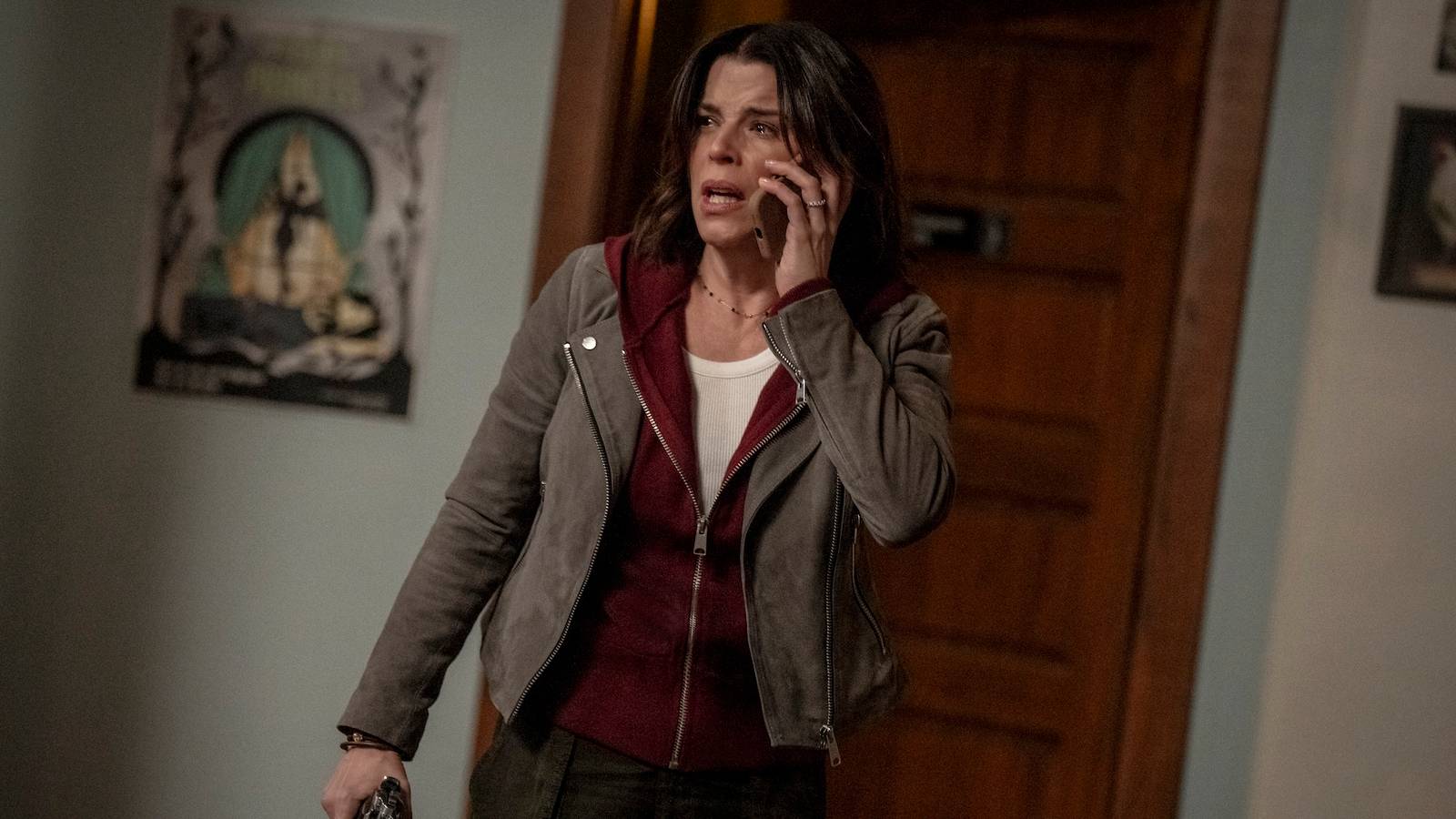

Scream 7 Slashes Opening Records Amidst Fan Furor and Backlash

Scream 7 is giving the domestic box office a much-needed boost, impressively exceeding projections with a projected $60 ...

Shakira's Historic Mexico Farewell: 13 Record-Breaking Dates Conclude!

Shakira has wrapped up a historic 13-concert series in Mexico City, setting a new record for performances at the GNP Seg...

Bruno Mars' Romantic Latin Fusion: Mariachi Opener Steals the Show!

This week in Latin music, Bruno Mars makes a grand return with a new album featuring a stunning mariachi bolero. Xavi's ...

Star Revealed: Jessica Chastain's Top Film Picks from Nolan to Kubrick

Jessica Chastain discusses her challenging role in Michel Franco's new erotic thriller "Dreams," exploring themes of pow...

Unraveling Zelda's Genre-Defining Legacy in Gaming History!

Celebrating its 40th anniversary, The Legend Of Zelda remains a genre-defining title, influencing video games and achiev...