Brazil Eyes Huge 1 Million BTC National Reserve Over Five Years

Brazilian lawmakers have reintroduced a significant bill proposing the creation of a national Strategic Sovereign Bitcoin Reserve, officially named RESBit. This ambitious proposal, put forth by Federal Deputy Luiz Gastão (PSD/CE), outlines a comprehensive framework for Brazil to integrate Bitcoin into its national financial strategy and diversify its existing national reserves. The core of the plan involves the gradual acquisition of a substantial one million bitcoins over a five-year period.

The proposed legislation for RESBit establishes several critical guidelines to ensure its successful implementation and transparency. A key component is the commitment to accumulate at least 1,000,000 BTC incrementally. Furthermore, the bill strictly prohibits the sale of any bitcoins seized by Brazilian judicial authorities, ensuring these assets remain under public control and contribute to the national reserve. The legislation also introduces provisions allowing for the collection of Brazil’s federal taxes in Bitcoin, thereby further integrating the digital asset into the national economy. To foster broader adoption and support, the bill offers incentives for public companies to engage in Bitcoin mining and secure storage activities.

Transparency and security are central tenets of the RESBit proposal. The bill mandates the public disclosure of RESBit’s bitcoin holdings through accessible internet-based platforms, enabling independent auditing and public oversight. Emphasizing robust security for these digital assets, the legislation requires the use of state-of-the-art technologies such as cold wallets, multisignature wallets, and other internationally recognized secure storage mechanisms. Additionally, it permits the temporary holding of spot Exchange Traded Funds (ETFs) backed by bitcoin within the reserve portfolio, specifically for urgent and limited circumstances.

If approved, Brazil would join a select group of countries actively holding Bitcoin at a national level. This move could potentially position Brazil as a major holder of Bitcoin, possibly surpassing even established economic powers like the United States and China in terms of declared national reserves.

Brazil's initiative is part of a growing global trend among nations exploring Bitcoin reserves, notably inspired by El Salvador. El Salvador famously holds the distinction of being the ‘world’s first country’ with a strategic Bitcoin reserve, reporting over 7,560 Bitcoin under President Nayib Bukele’s program. Despite having scaled back mandatory Bitcoin acceptance due to agreements with the International Monetary Fund (IMF), the Salvadoran government has consistently maintained regular purchases, citing long-term financial sovereignty and reserve diversification as key motivations. To enhance security and transparency, the National Bitcoin Office in El Salvador now meticulously splits its Bitcoin holdings across multiple addresses.

The pioneering approach taken by the Central American nation has inspired policymakers across the globe. In the United States, for instance, the BITCOIN Act of 2025 proposed the establishment of a federal strategic Bitcoin reserve, while several states, including New Hampshire and Arizona, have either passed or proposed laws allowing portions of public funds to be invested in digital assets. Further demonstrating interest, President Trump’s executive order in March 2025 directed federal agencies to explore the accumulation of Bitcoin from seized assets without incurring new taxpayer costs.

Beyond the Americas, European nations are also showing interest. The Czech National Bank already maintains a similar allocation in bitcoin, and in Switzerland, a citizen-led initiative is actively proposing a constitutional mandate for Bitcoin holdings. Countries such as Hong Kong, Ukraine, and Pakistan are also exploring various frameworks to integrate and hold Bitcoin at a national level, with Pakistan notably pledging a commitment never to sell its future Bitcoin reserves, underscoring a long-term strategic vision for the digital asset.

You may also like...

What Exactly Is an African Man’s Business with Valentine?

Every February 14, love becomes loud, red and expensive. But what exactly is an African man’s business with Valentine’s ...

9 Ways to Survive Valentine’s Day As A Singlet

Single on Valentine’s Day? Forget the roses and rom-coms; here’s your perfect survival guide to survive the day and cele...

Roses Are Red, Naira Is Not for Bouquets This Valentine

Money bouquets may look romantic, but the CBN has a warning. Here’s why using naira notes as Valentine decorations could...

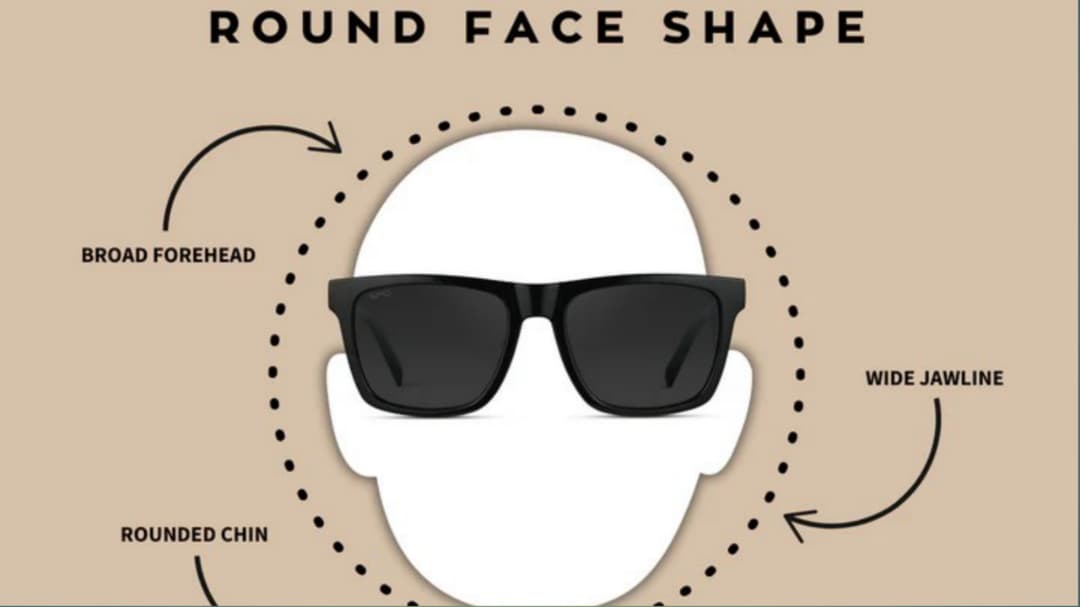

Have a Round Face? Avoid These 5 Sunglass Shapes

Have a round face? Avoid these 5 sunglass shapes that can make your face look wider and know the most flattering frame s...

Heavyweight Showdown! Wardley to Defend Title Against Dubois

The highly anticipated heavyweight title clash between Fabio Wardley and Daniel Dubois has been officially confirmed for...

WAFCON 2026 Host Revealed! CAF President Drops Major News

CAF President Patrice Motsepe has confirmed Morocco will host the 2026 Women's Africa Cup of Nations, dispelling recent ...

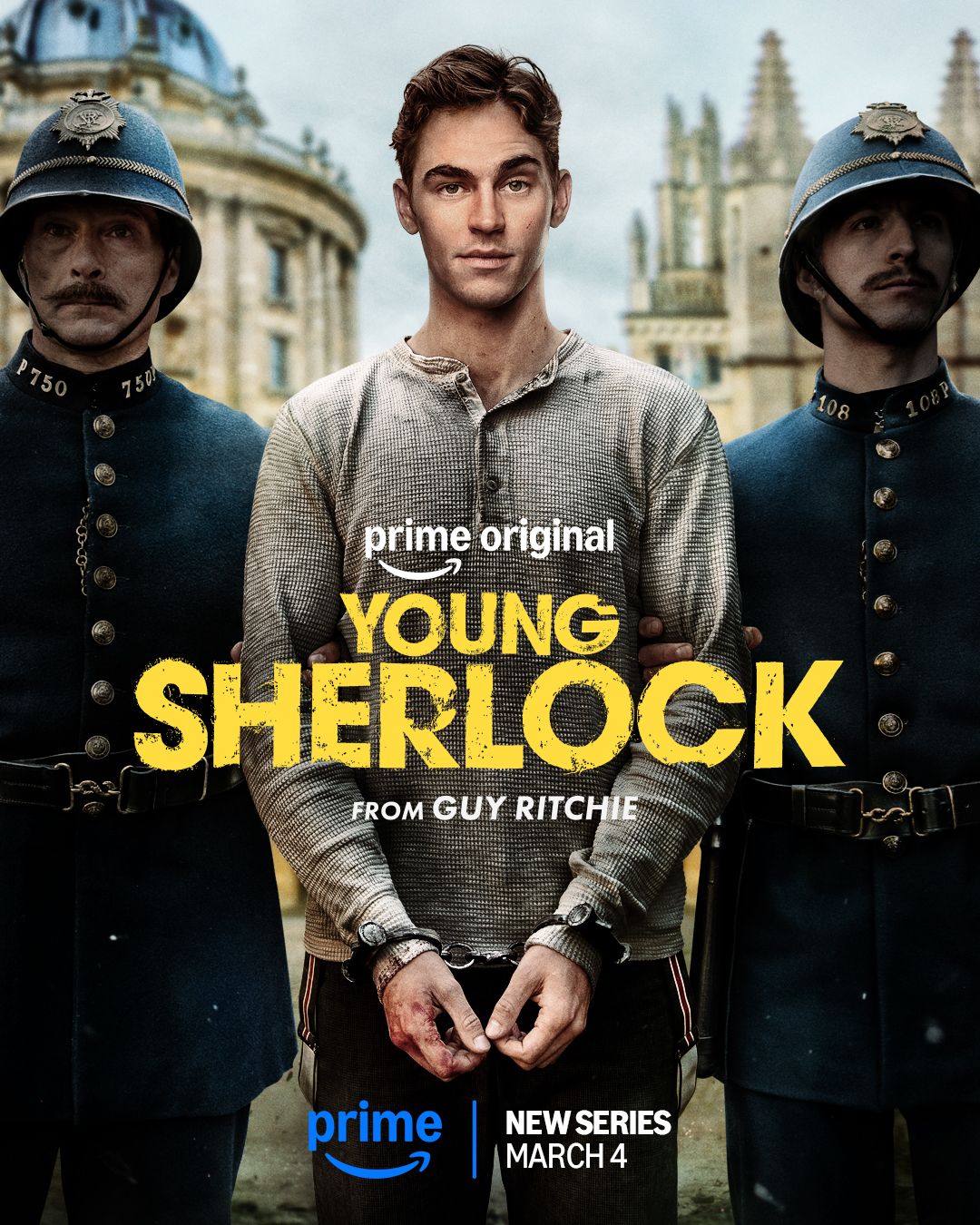

Guy Ritchie's Sherlock Holmes Revival Shatters Prime Video Records!

Guy Ritchie has been remarkably active in television with hits like 'The Gentlemen' and 'MobLand', but he's now returnin...

Unleash the Monster: 2026 Corvette ZR1 Debuts with Staggering 1,064-HP!

An ambitious journalist attempts to circumnavigate Los Angeles County in the 1,064-hp 2026 Chevrolet Corvette ZR1, inspi...