Ghana's Gold Under Scrutiny: President Backs GoldBod, Calls for Transparency Intensify Over GH¢2 Billion Guarantee

Ghana's national gold aggregation and trading arrangements, primarily through the initiative known as GoldBod, have become a focal point of both significant national pride and intense public scrutiny. Established in April 2025, GoldBod was introduced with the ambitious goal of giving Ghana greater control over its gold exports, particularly from the small-scale mining sector, and ensuring full repatriation of foreign exchange earnings.

However, amidst claims of success, the Institute of Economic Research and Public Policy (IERPP) has initiated a strong demand for full documentary disclosure concerning an alleged GH¢2 billion advance payment guarantee. This demand, articulated by IERPP Executive Director Prof. Isaac Boadi at a press conference on Tuesday, January 27, highlighted the matter as one of "national importance," warning against any attempt to diminish the transaction's significance. Prof. Boadi underscored that a GH¢2 billion figure is not trivial and raises fundamental questions regarding public financial exposure and sovereign risk for Ghana.

The IERPP's call for transparency was triggered by a public admission attributed to Mr. Sammy Gyamfi, an official associated with the GoldBod policy framework, indicating that Bawa Rock Company Limited provided this substantial advance payment guarantee for GoldBod’s operations. The Institute stressed that such an admission necessitated immediate clarification, transparency, and accountability, particularly given gold's strategic importance to Ghana's economy.

In its formal request, IERPP has sought certified true copies of documents across five critical areas: the contractual basis of the transaction, the precise nature of the guarantee, the source of the funds, the governance approvals obtained, and the financial treatment of the arrangement. Specific documents requested include principal contracts, Memoranda of Understanding (MOUs), or agreements between GoldBod and Bawa Rock Company Limited; any associated side letters, escrow agreements, or comfort letters; and legal opinions addressing the legality and compliance with public financial management laws. IERPP also sought clarity on whether the GH¢2 billion guarantee was bank-backed, corporate, cash-backed, or merely contingent, and whether the amount was "actually paid, placed in escrow, merely pledged on paper, or conditional on future performance."

Prof. Boadi further raised serious banking and fiscal red flags. He explained that under International Financial Reporting Standards (IFRS), guarantees are considered off-balance-sheet exposures that morph into financial liabilities once triggered, requiring the issuer to reimburse the holder. This led to a crucial unresolved question: "Which financial institution issued or backed the alleged GH¢2 billion advance payment guarantee?" Referencing Ghana's Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930), which mandates a minimum Capital Adequacy Ratio of 10 percent and a 25 percent single obligor limit, Prof. Boadi asserted that based on publicly available data, no individual Ghanaian bank could prudently issue such a guarantee without breaching regulatory thresholds or violating prudential exposure limits.

Grounding its demands in the Right to Information Act, 2019 (Act 989), IERPP emphasized that the matter directly involves the management of public resources and potential financial risk to the State. Prof. Boadi stressed that any refusal to disclose information must be legally justified, suggesting partial disclosure through severability where applicable. He firmly rejected any suggestions of political motivation, framing the intervention as a purely constitutional demand for openness, accountability, and the protection of the public purse, promising to keep the public informed of further developments.

Contrasting this demand for financial transparency, President John Mahama, speaking at the 2026 Africa Trade Summit in Accra, presented GoldBod as a resounding success. He affirmed that its establishment has empowered Ghana to exercise full control over the export of gold from the country, particularly from the small-scale sector. The President highlighted that since GoldBod's inception in April 2025, exports from the small-scale mining sector have surged to 104 tonnes, with a commendable 100% of the foreign exchange repatriated through the Bank of Ghana. This marks a significant improvement compared to 2024, when out of 63 tonnes exported from the same sector, only about 40 tonnes of foreign exchange were repatriated, leaving 23 tonnes unaccounted for.

President Mahama positioned GoldBod as a cornerstone of Ghana’s "resetting agenda for economic transformation," emphasizing the nation's commitment to adding value to its natural resources like gold, cocoa, and oil palm. He advocated for "resource sovereignty," urging African nations to break from colonial models where foreign entities extract value, leaving the continent in poverty. The President underscored Ghana's bold step in claiming a fairer share of its natural resource endowment through initiatives like GoldBod. The Africa Trade Summit, organized by the African Trade Chamber, convened key African business leaders and policymakers to foster trade integration and value addition for the continent’s raw materials, with discussions tailored to support industrial financing for the African Continental Free Trade Area.

Thus, while the Presidency champions GoldBod as a success story for Ghana's economic sovereignty and export control, the IERPP simultaneously insists on rigorous financial accountability for its operational underpinnings, particularly the significant GH¢2 billion advance payment guarantee. This dichotomy highlights the ongoing balance between achieving national economic objectives and ensuring robust governance and transparency in strategic national ventures.

You may also like...

Boxing World Awaits: Errol Spence Jr. Makes Blockbuster Return Against Tim Tszyu in June!

Former unified welterweight champion Errol Spence Jr. is reportedly ending his nearly three-year boxing hiatus for a Jun...

WBO Heavyweight Championship Shocker: Wardley vs. Dubois Clash Confirmed for May 9th!

An electrifying all-British heavyweight clash is confirmed for May 9 in Manchester, as Fabio Wardley prepares to defend ...

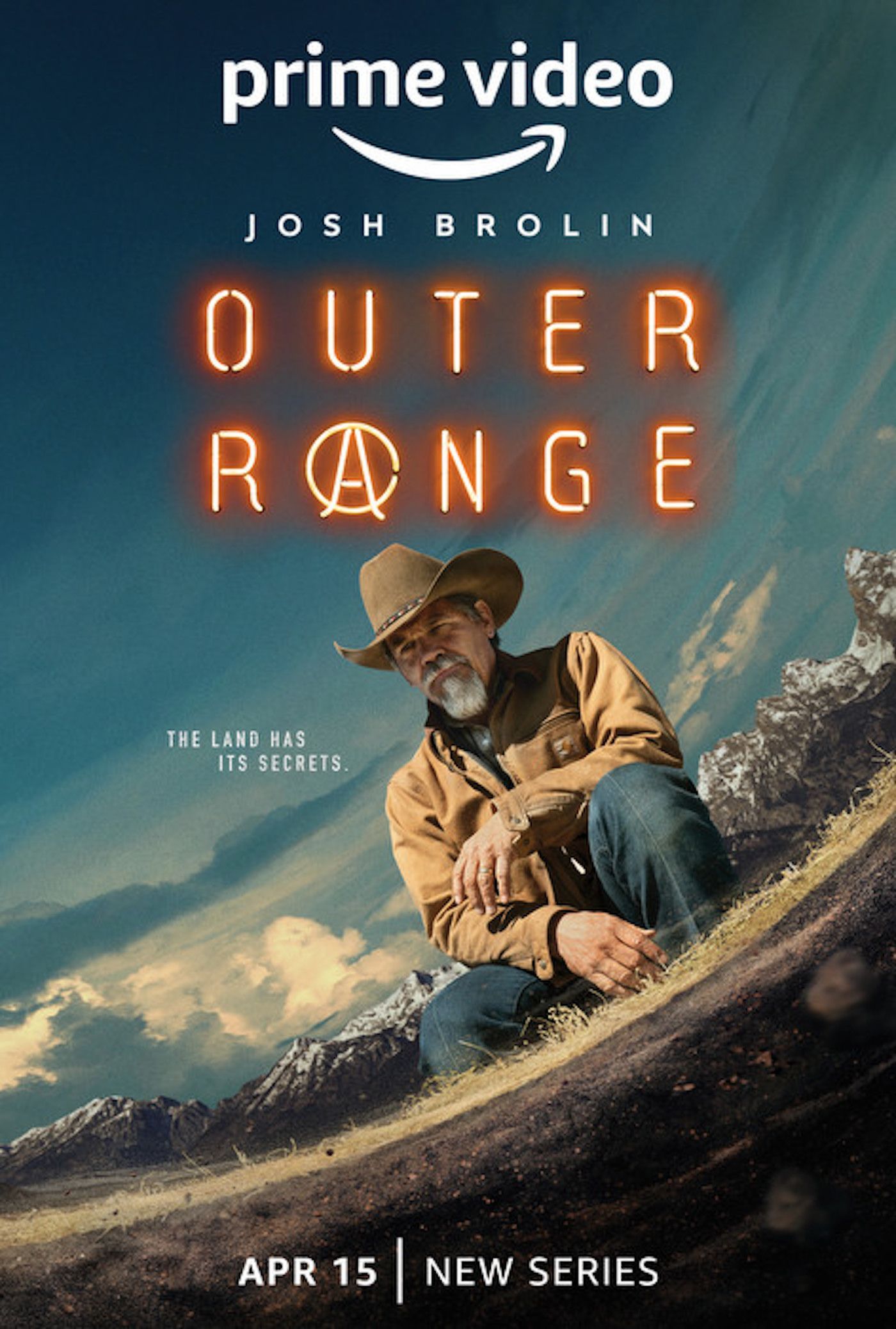

Prime Video's $6M Sci-Fi Western, Once a 'Yellowstone' Rival, Meets Abrupt End After Two Seasons

Prime Video's critically acclaimed sci-fi Western, "Outer Range," was canceled after its second season, reportedly due t...

Love Notes: RTG Delivers Valentine's Dinner Experiences Across Zimbabwe

Rainbow Tourism Group (RTG) is rolling out a nationwide Valentine's Day program across its hotels on February 14, featur...

Major Changes Ahead: Malawi to Implement New VAT, Foreign Currency Rules for Tourism in 2026

Malawi is introducing significant economic and policy changes for 2026, impacting travel budgets and payment methods. Th...

Urgent Travel Alert: Namibia Issues Malaria Outbreak Warning for Travelers

Namibia is experiencing a significant malaria outbreak in its northern and north-eastern regions in early 2026, with cas...

Beyond Milk: Discover 5 Superfoods for Superior Bone Strength

:max_bytes(150000):strip_icc()/Health-GettyImages-537628412-5fbbfa8e980845e9a55ee5453515838e.jpg)

For robust bone health, a diverse range of foods beyond milk offers essential calcium and vital nutrients. This guide de...

Unlock Health: The Optimal Dinner Hour for Peak Metabolism and Restful Sleep

:max_bytes(150000):strip_icc()/Health-GettyImages-2203057929-0af94670acbd4bd1b1a238a58fe28ae3.jpg)

New research highlights the critical role of meal timing in health, with experts advocating for earlier dinners to mitig...