Europe Plots "Divorce" From Trump: A New Transatlantic Order?

In an evolving international landscape, Europe is presented with a critical opportunity to initiate a financial separation from the United States, akin to a divorce from a controlling former partner like Donald Trump. While outwardly appearing unchanged, behind the scenes, the EU and the UK could strategically close joint financial accounts and cut credit cards, or at least set in motion a form of financial disengagement. This process will undoubtedly be challenging and protracted, but a necessary and achievable degree of separation is paramount.

The tumultuous week at Davos, marked by discussions of a post-Davos peace deal for Ukraine and the presence of the US president, might lead some to believe that appeasement or potential US midterm election outcomes could temper American political volatility. However, the breakdown of the post-Second World War order, with flashing red signs since the 2008 financial crisis, suggests that future US administrations are likely to remain belligerent when international rules seek to constrain them.

There's a growing recognition within the shifting tectonic plates of international finance that a separation from the 'White House wrecking ball' is a widespread concern. Despite the S&P 500's seemingly unstoppable rise, which attracts vast international capital, other financial markets tell a different story. Notably, China has spent the past year reducing its holdings of US government bonds, effectively cutting the amount it lends to the US government. Japanese pension funds have followed suit, partly driven by fears of an impending stock market crash, given current US share prices reminiscent of the dot-com bubble, and also by domestic economic challenges prompting repatriation or redirection of foreign investments.

This ongoing exodus of bond investors has already begun to incrementally increase the cost of US government borrowing. If Europe were to embark on its financial divorce, it too would begin divesting its US bond holdings. A recent move by AkademikerPension, the main retirement fund for Danish academics, offered a glimpse of this potential future. The fund announced its decision to sell all remaining $100 million (£73 million) in US government bonds by month's end, citing 'poor US government finances.' While not directly linked to the current US-Europe rift, the prevailing geopolitical climate certainly didn't impede the decision, serving as a significant beacon for others.

European regulators could facilitate this shift by easing the process for other pension funds to sell their US bond holdings. Experts suggest that pension funds have often slavishly adhered to credit rating agency verdicts, which, despite downgrading the US last year, still largely deem it a safe bet. It's crucial to remember the role credit rating agencies played in the 2008 financial crash, erroneously labeling financial products containing US sub-prime mortgages as safe. By re-evaluating US debt as higher risk, pension funds could justify reducing their exposure. While a reduction, or a comprehensive Danish-style clear-out, would inevitably reduce the value of remaining bonds in a portfolio, the long-term gain lies in a less risky portfolio once US bond holdings are minimized.

Furthermore, Europe could foster self-reliance by creating a market for bonds denominated in euros. Such a market would rival US Treasury bonds, offering an alternative safe haven and further diverting capital from the US market. This concept, initially proposed by the Bruegel thinktank in 2010 and recently updated, has gained renewed relevance. While the EU has previously issued one-off eurobonds, such as those underpinning the post-Covid €385 billion (£334 billion) NextGenerationEU recovery scheme, there is a recognized need, echoed by institutions like the Peterson Institute, for a permanent market to genuinely compete with the US.

The current global environment presents a ripe opportunity, with funds worldwide seeking stable havens, making Europe an attractive candidate. Brussels could initiate this by forming a 'coalition of the willing' rather than awaiting unanimous agreement from all 28 member countries. It might also need to acknowledge that a significant portion of the capital for such a market could originate from London's deeper and wider bond markets. This could, surprisingly, serve to pull the UK closer to the EU, with the allure of financial gain potentially overcoming existing political resistance on both sides of the Channel. Ultimately, establishing an independent European debt market in its own currency would provide valuable insulation from potential threats of financial punishment emanating from the US.

Recommended Articles

Crypto Titans Collide: Jamie Dimon Blasts Coinbase CEO Brian Armstrong at Davos

A tense encounter between Coinbase CEO Brian Armstrong and JPMorgan Chase CEO Jamie Dimon at Davos revealed deep divisio...

Davos Showdown: Tech CEOs Boast and Bicker Over AI Future

The World Economic Forum meeting in Davos transformed into a high-powered tech conference, dominated by AI discussions a...

Trump's 'Board of Peace' Debacle: Logo Scandal, Canada Withdrawal, and European Rejection

Donald Trump launched his controversial "Board of Peace" at the World Economic Forum, featuring a gold logo resembling t...

Davos Decoded: Binance's CZ Pinpoints Crypto's Next Major Frontiers

Crypto billionaire Changpeng Zhao (CZ), at the World Economic Forum in Davos, outlined three major future targets for th...

Ukraine Peace Talks Loom: Trump-Zelensky Meeting Signals War's Climax

Ukrainian President Volodymyr Zelensky is in Davos for crucial talks with US President Donald Trump, as Trump's envoy ex...

You may also like...

Startups And Bureaucracy: The Shutdown of Kenya’s Bioethanol Pioneer

KOKO Networks, one of Kenya’s leading clean tech startups, has shut down. Its closure raises critical questions about cl...

How Opay Turns Customer Habits Into Smarter Payments

Nigerians were sending 9,999 naira instead of 10,000 to dodge fees. Instead of punishing them, Opay made it official. Th...

Sustainable Agriculture Practices That Protect African Lands

This article talks about how sustainable agriculture practices in Africa protect land, conserve water, and help communit...

Lassa Fever Is Back: 5 Simple Steps to Reduce Your Risk

Lassa fever cases are rising again in Nigeria, with over 1,000 confirmed infections and 200 deaths. Here are five simple...

Fashion Items That Were Once Considered Embarrassing

From corsets to second-hand clothing, sneakers to mini skirts, these fashion items were once sources of public shame. Re...

Music Genres That Were Once Criminalized or Considered Dangerous

From jazz clubs raided in Harlem to Afrobeat concerts attacked by soldiers, music has always been criminalized when it m...

Milner Makes History! Veteran Star Equals Premier League Appearance Record

James Milner has equaled Gareth Barry's Premier League appearance record of 653 games, a monumental achievement in his 2...

The Truth Is Out: Ryan Coogler's 'X-Files' Reboot Greenlit!

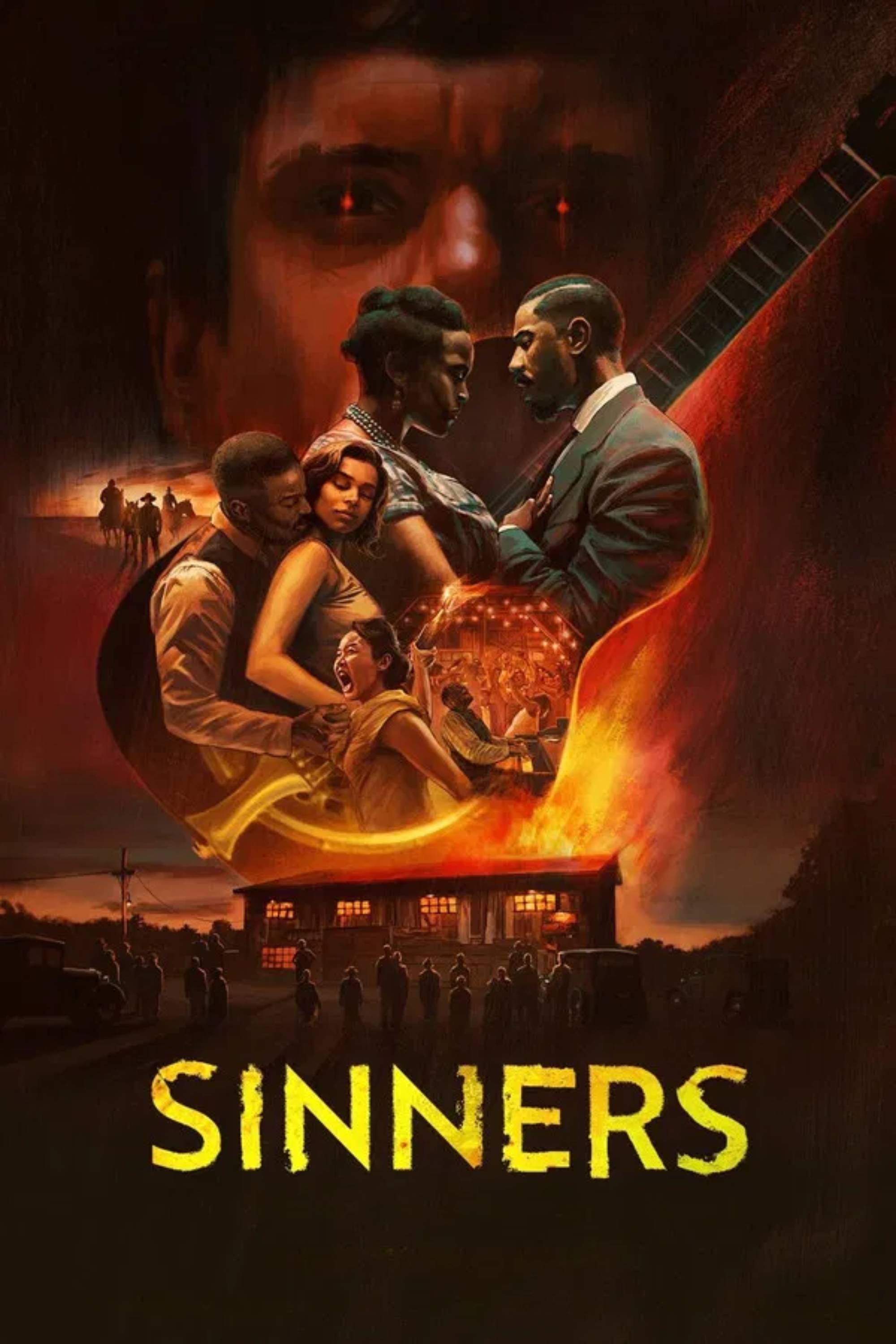

Ryan Coogler, fresh off the success of his award-winning film "Sinners," is deeply engrossed in writing the highly-antic...