Crypto Titans Collide: Jamie Dimon Blasts Coinbase CEO Brian Armstrong at Davos

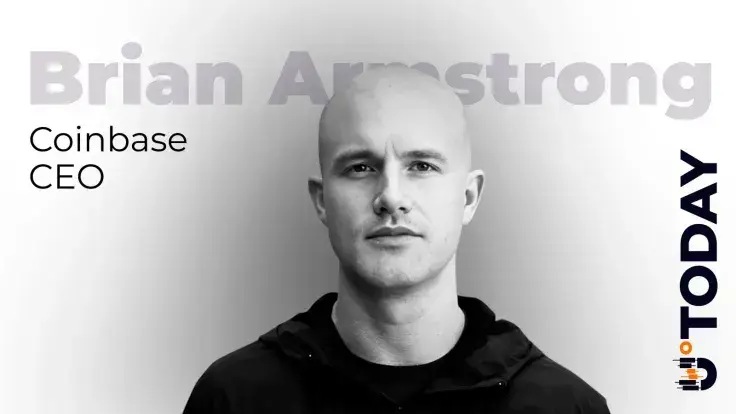

A heated exchange at the World Economic Forum in Davos last week cast a stark light on the growing chasm between traditional Wall Street finance and the burgeoning crypto industry. Brian Armstrong, CEO of Coinbase, found himself directly confronting JPMorgan Chase CEO Jamie Dimon during a chance encounter, where Dimon reportedly told Armstrong bluntly, “You are full of s—.” This personal outburst, which many attendees described as uncharacteristically intense for the annual gathering of global elites, served to underscore the raw tensions surrounding the future of U.S. financial regulation.

The confrontation followed a series of television appearances by Armstrong, in which he accused major banks of actively attempting to undermine crucial provisions of the Senate’s Clarity Act. This proposed crypto market-structure bill aims to redefine how digital assets are regulated and to clarify whether crypto exchanges can offer interest-like rewards on stablecoins. Armstrong asserted that banks are leveraging their legislative influence to suppress competition, rather than engaging fairly in a free market, particularly concerning the issue of yield on stablecoins.

At the core of the dispute is the practice of offering yields on stablecoins, which are digital tokens pegged to the U.S. dollar, returning approximately 3.5% to holders. This contrasts sharply with traditional banks, which typically offer near-zero interest on checking and savings accounts. Banking executives contend that allowing crypto platforms to provide such returns is economically equivalent to paying interest on bank deposits. They warn that this could trigger a significant shift of consumer funds out of the conventional banking system, potentially making it challenging for community banks to lend to businesses if their deposit base erodes.

Armstrong’s strong advocacy for the crypto industry comes amidst legislative gridlock for the Clarity Act. The Senate Banking Committee unexpectedly postponed a markup and vote on the bill after Coinbase retracted its support, citing the current draft as “materially worse than the status quo” due to its restrictions on stablecoin yields and other significant concerns. During the Davos forum, other prominent bank chiefs reportedly maintained a distance from Armstrong. Bank of America CEO Brian Moynihan suggested that if Coinbase desired to offer deposit-like products, it should “just be a bank,” emphasizing the extensive regulatory oversight faced by traditional deposit-takers. Citigroup’s Jane Fraser granted Armstrong only a brief audience, while Wells Fargo’s Charlie Scharf declined any engagement whatsoever.

This high-profile clash at Davos highlights a broader, ongoing struggle to shape the evolution of the U.S. financial system as cryptocurrencies increasingly gain mainstream acceptance. Recognizing the critical nature of these disagreements, the White House is scheduled to convene a meeting next week with both banking and crypto executives to discuss strategies for reviving stalled U.S. crypto legislation, aiming to find common ground and establish a clearer regulatory path forward.

Recommended Articles

Crypto War Heats Up: Coinbase CEO Alleges Banks Sabotage Trump's Digital Asset Plans

Coinbase CEO Brian Armstrong has accused major U.S. banks of attempting to sabotage President Trump’s pro-crypto agenda ...

Legislative Showdown: Senate's Crypto Bill Sparks Fierce Industry Debate

Ongoing legislative efforts to establish a digital asset market structure in the U.S. have faced significant hurdles, de...

CLARITY Act: Coinbase Rejects Restrictions as Senate Prepares Legislative Push

The Digital Asset Market CLARITY Act is advancing through Capitol Hill, aiming to establish a clear federal framework fo...

Coinbase CEO Unleashes Bold 'Crypto Is Here to Stay' Declaration!

Coinbase CEO Brian Armstrong reaffirms his belief in crypto's permanence, citing the U.S. government's Bitcoin reserve, ...

Larry Fink's Bitcoin Epiphany: BlackRock CEO Admits Past Mistakes, Signals Major Crypto Shift

BlackRock CEO Larry Fink has publicly reversed his critical stance on Bitcoin, now viewing it as an "asset of fear" and ...

You may also like...

Cole Palmer's Historic Treble: Chelsea Star Rewrites Record Books with Sensational Hat-Trick

)

Cole Palmer has cemented his place in Chelsea's history books, achieving a club-record fourth hat-trick in the Premier L...

Carrick's Manchester United Dominance: Red Devils Punish Spurs, Secure Fourth Consecutive Win

)

Michael Carrick's Manchester United continued their sensational run with a dominant 2-0 victory over Tottenham Hotspur a...

New in: 'Dhurandhar' Rises as Indian Spy Thriller Conquers Netflix Global Charts!

The Indian espionage thriller “Dhurandhar,” starring Ranveer Singh, has captivated audiences worldwide, topping Netflix'...

New in: Lincoln Lawyer Season 4 Teases Freedom Fight, Shocking Death, and Cliffhanger Drama!

Season 4 of "The Lincoln Lawyer" sees Mickey Haller facing his most intense challenge yet, defending himself against a m...

Rwanda's Hidden Gems: Bingeable Music Film Series for the Weekend

February offers a compelling array of short, bingeable series across streaming platforms, perfect for a weekend of viewi...

Expert Warns: AI Adoption Isn't Enough for Africa's Tech Future

Africa is rapidly adopting AI, but AI Transformations Coach David Adeoye Abodunrin highlights a critical gap: the absenc...

Bypass the Blackout: #EndSARS Protesters' Guide to Staying Online

Despite the dissolution of SARS, #EndSARS protests continue to grow in Nigeria, sparking fears of a government-imposed i...

Chaos in Italy: Railways Sabotaged as Winter Olympics Kick Off!

Suspected sabotage targeting northern Italy's railway network has caused widespread travel disruption during the initial...