Debit Card vs. Credit Card: Smart Choices for Your Money

In today’s digital economy, electronic payments are more than a convenience, they’re a necessity.

When it comes to everyday spending, deciding between a debit card and a credit card can feel confusing.

Both are convenient and widely accepted, but they function in different ways.

Your choice largely depends on how you manage money, your financial goals, and how comfortable you are with borrowing.

In this article, we’ll explain the main differences, benefits, and potential downsides of each to help you make a smart and confident decision

What Is a Debit Card?

A debit card is linked directly to your checking or savings account, and every purchase you make deducts money immediately from your available balance.

Because you are spending money you already have, debit cards make it easier to stay in control of your finances.

They help prevent debt accumulation and support simple, day-to-day budgeting.

Most debit cards also come with minimal or no annual fees when connected to your bank account.

However, debit cards have certain limitations.

Fraud protection may not be as strong as with credit cards, and if unauthorized transactions occur, recovering funds can sometimes take time.

In addition, debit card usage does not help build your credit history, which is important for future financial opportunities like loans or mortgages.

Rewards and perks are also typically limited.

What Is a Credit Card?

A credit card allows you to borrow money from a card issuer up to a pre-approved limit.

Instead of using your own funds immediately, you are using borrowed money that must be repaid.

You can pay off the balance in full each month to avoid interest, or carry a balance and pay interest on the remaining amount.

When managed responsibly, credit cards can be valuable financial tools.

One of the main benefits of a credit card is its ability to helpbuild your credit score through consistent, on-time payments.

Many credit cards alsooffer rewards and perks such as cashback, points, or travel benefits.

They generally provide stronger fraud protection and consumer safeguards, making them a safer option for online and large purchases.

Additionally, credit cards can serve as a financial backup during emergencies.

Despite these advantages, credit cards come with risks.

Carrying a balance can lead to high-interest debt, and easy access to credit may encourage overspending.

There may also be additional costs, including annual fees or late payment charges.

For this reason, credit cards require financial discipline and responsible usage.

How to Choose the Right Card

When deciding between debit and credit cards, consider these factors:

Your Spending Habits: Prefer to spend only what you have? Debit cards work well. Want to leverage rewards and build credit? Credit cards may be better.

Financial Goals: Credit cards help improve credit scores and earn rewards; debit cards help avoid debt.

Security Needs: Credit cards offer stronger protection for online and large purchases.

Emergency Preparedness: Credit cards can provide a financial buffer; debit cards are limited to your account balance.

Using Both Strategically

Many smart consumers use both cards: debit for daily expenses and credit for online shopping, larger purchases, and building credit history.

This approach maximizes convenience, security, and financial benefits.

More Articles from this Publisher

Debit Card vs. Credit Card: Smart Choices for Your Money

Not sure whether to use a debit card or credit card? This guide explains how each works, their advantages, risks, reward...

Snapchat Rolls Out Arrival Notifications to Let Others Know You’ve Reached Your Destination

Snapchat’s Arrival Notifications, officially released in February 2026, offer a perfect mix of convenience, safety, and ...

Click ‘Accept’: Why Does Every Website You Visit Beg You to Accept Cookies?

Every website asks you to accept cookies, but what are they really? Learn how cookies track your activity, their role in...

The Top 10 Most Indebted Countries in the World in 2026

Which countries owe the most in 2026? A data-driven look at the world’s top 10 most indebted nations and their debt-to-G...

Roses Are Red, Naira Is Not for Bouquets This Valentine

Money bouquets may look romantic, but the CBN has a warning. Here’s why using naira notes as Valentine decorations could...

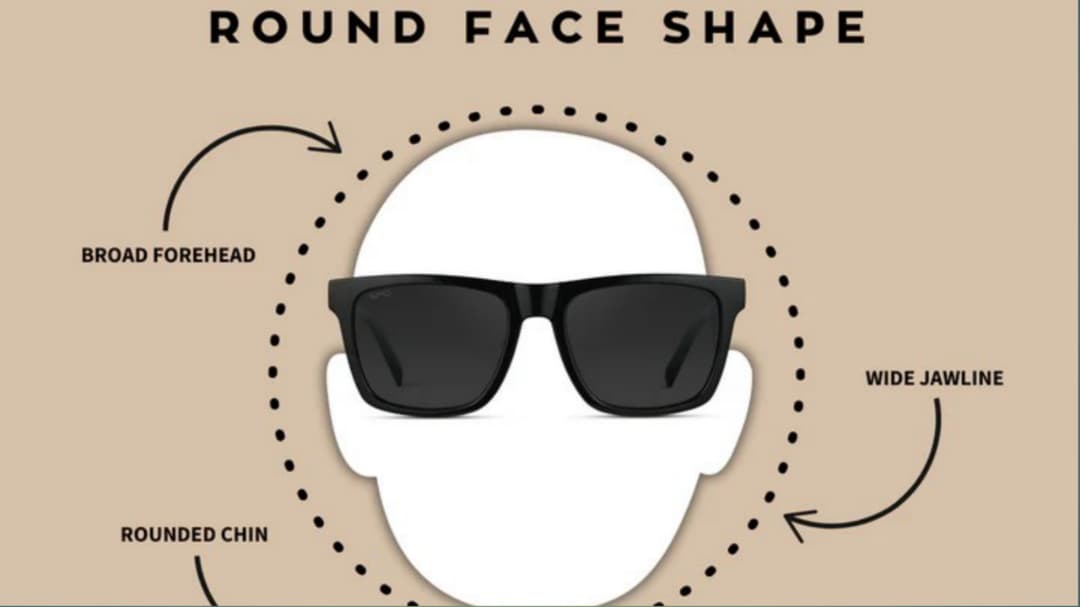

Have a Round Face? Avoid These 5 Sunglass Shapes

Have a round face? Avoid these 5 sunglass shapes that can make your face look wider and know the most flattering frame s...

You may also like...

Shockwave in Transfers: Manchester United Reportedly Eyeing Liverpool Midfield Maestro Mac Allister!

Football's summer transfer window is heating up with major European clubs eyeing key players. Manchester United is repor...

Klopp's Agent Drops Bombshell: Two Premier League Giants Vied for Jurgen Post-Liverpool Exit!

)

Jürgen Klopp's agent, Marc Kosicke, revealed that Chelsea and Manchester United pursued the German manager after his Liv...

Tom Hardy's Crime Saga Hits New Heights: Fans Rave Over Season 2 and Stellar Performance

Emmett J. Scanlan teases an "insane" Season 2 for Guy Ritchie's 'MobLand', promising heightened drama and the return of ...

Game of Thrones Spinoff 'A Knight of the Seven Kingdoms' Stirs Controversy and Celebration

<i>A Knight of the Seven Kingdoms</i> Episode 5, "In the Name of the Mother," earns accolades as the franchise's highest...

'The Rookie' Star Eric Winter on Why He Loves Chenford's Unpredictable Journey

The Rookie Season 8 sees Tim Bradford embrace his new watch commander role, facing managerial challenges while his roman...

Sarah Ferguson's Business Empire Collapses Amid New Epstein Scandal Revelations

Six businesses associated with Sarah Ferguson, the former Duchess of York, are being dissolved amid heightened scrutiny ...

Chaos at JKIA: Aviation Workers' Strike Grounds Flights, Stranding Thousands

Jomo Kenyatta International Airport in Nairobi faced widespread chaos, delays, and flight cancellations as aviation work...

Outrage Erupts After Tragic Kitengela Rally Shooting, Family Demands Justice

Tragedy struck an ODM 'Linda Mwananchi' rally in Kitengela as 28-year-old Vincent Ayomo Otieno was fatally shot, alleged...