Circle's Successful NYSE IPO Sparks Optimism for Crypto Public Listings

Circle Internet Group, a prominent issuer of the USDC stablecoin, experienced a highly successful debut on the New York Stock Exchange (NYSE) on a Thursday in early June 2025. After pricing its shares at $31 the previous day, the company, trading under the ticker "CRCL," saw its stock surge upon commencement of trading, marking a significant moment for the cryptocurrency industry and highlighting strong investor appetite for crypto-related assets.

Circle's shares opened significantly higher at $69. The stock soared throughout its first trading day, reaching highs reported variously above $96 and up to $103.75, before closing at $83.23 per share – a remarkable increase of approximately 168% from its IPO price. The upsized offering saw Circle sell 34 million shares, raising around $1.05 to $1.1 billion. This strong performance pushed Circle's market capitalization to a range of roughly $16.7 billion to $18.5 billion by the close of trading, a substantial increase from its initial IPO valuation of $6.1 billion and surpassing its last private market valuation of $7.7 billion from 2021.

Circle is known as one of the world's largest issuers of USDC, a stablecoin pegged 1-to-1 to the U.S. dollar, and also issues EURC, pegged to the euro. These stablecoins offer a less volatile alternative for transactions within the crypto ecosystem, being backed by cash, short-dated U.S. Treasuries, and overnight U.S. Treasury repurchase agreements. Since its launch in 2018, USDC has reportedly been used for over $25 trillion in on-chain transactions, and Circle has seen significant revenue growth, from $15 million in 2020 to $1.7 billion in 2024, primarily by earning interest on its reserves.

The success of Circle's IPO is viewed as a testament to public market investors' growing interest in cryptocurrencies, buoyed by a supportive stance on crypto assets from the Trump administration and ongoing legislative efforts to regulate stablecoins in the U.S. Analysts suggest this could encourage other major crypto players, such as Kraken and Gemini, to pursue public listings. Beyond the crypto sector, some experts, including NYSE Group President Lynn Martin, see Circle's debut as a positive bellwether for the broader IPO market. Circle CEO Jeremy Allaire described the IPO as a "significant and powerful" success, reflecting a market ready for internet-based financial systems.

This successful public offering came three years after Circle's previous attempt to go public via a SPAC merger in 2022, which was valued at $9 billion but ultimately did not materialize. The company's significant outside shareholders include General Catalyst and IDG Capital, with other notable venture investors like Accel, Breyer Capital, and Oak Investment Partners. Circle's journey to becoming a public company also involved raising substantial private funding, including a $400 million Series F in 2021 and another $440 million round.

The IPO process and Circle's operations involve significant legal oversight and expenditure. Davis Polk & Wardwell advised Circle on its IPO, with legal fees for the deal amounting to $7.3 million, while Skadden Arps Slate Meagher & Flom advised the underwriters. Circle's legal fees have risen considerably, and the company has engaged multiple top law firms like WilmerHale, Wilson Sonsini, and Goodwin Procter for corporate matters, acquisitions, and litigation. Notably, Circle is also embroiled in a significant dispute with its former investment bank, Financial Technology Partners LP (FT Partners), over allegedly owed transaction fees, potentially amounting to tens of millions. Circle, represented by Bartlit Beck, disputes these claims.

Circle's strong market entry occurred amidst a dynamic and sometimes volatile broader cryptocurrency market. While Bitcoin was reported to be consolidating in a range around $101,000-$107,000, and Ethereum's network activity showed signs of slowing with increased competition, Circle's IPO demonstrated sustained institutional interest in regulated crypto enterprises. Experts like Joe DiPasquale of BitBull Capital anticipate "choppy conditions" to persist in the near term, with investors likely remaining selective. However, the demand for Circle's shares, including reported interest from major players like BlackRock and ARK Investment, underscores the perceived long-term value in compliant digital asset companies, even as the market navigates trade tensions and economic uncertainties that have impacted other crypto assets like Dogecoin, Solana, and XRP.

In conclusion, Circle's triumphant IPO not only provides a significant capital infusion for the company and a validation of its business model but also sends a strong signal about the maturing crypto industry's increasing integration with traditional financial markets. The event may well encourage further listings and reflects growing confidence in the future of digital assets, particularly those with a focus on regulation and real-world utility, despite prevailing market headwinds.

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

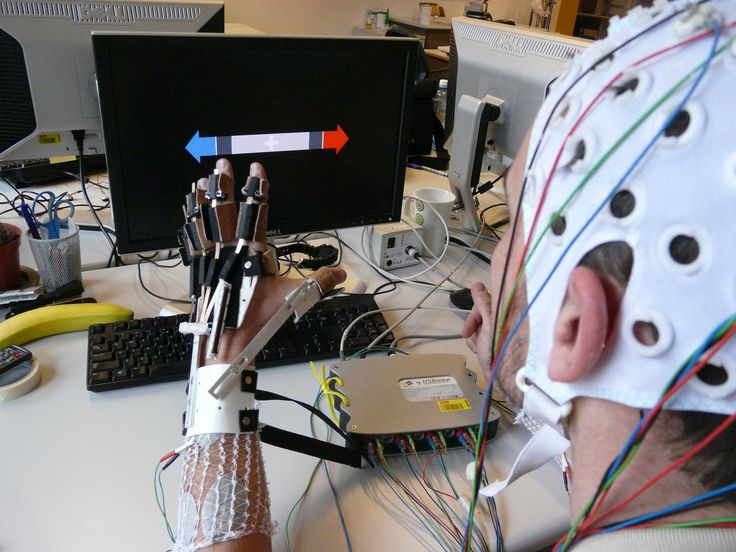

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...