Crypto Brokerage FalconX Reportedly Considers 2025 IPO

FalconX, a prominent cryptocurrency prime brokerage and digital assets services provider, is actively exploring the possibility of going public, with early-stage discussions suggesting a potential Initial Public Offering (IPO) filing as early as this year. This strategic move is largely driven by a surging institutional appetite for digital assets and the firm's ambition to bolster its public profile and secure fresh capital. While informal talks have been held with bankers and consultants regarding the IPO process, FalconX has not yet taken the formal step of hiring an investment bank. The firm last received an $8 billion valuation during a $150 million funding round in 2022.

FalconX's consideration of a public listing aligns with a broader and unprecedented IPO boom across the cryptocurrency industry in 2025. Notable examples include Bitcoin financial services firm Fold, crypto software wallet Exodus, and trading platform eToro, which have already gone public. A significant catalyst for this trend was stablecoin issuer Circle’s blockbuster $1.1 billion public listing on June 5, marking the largest crypto IPO in recent history. Following Circle's success, other major players like centralized cryptocurrency exchanges Bullish and Gemini have filed for IPOs, while digital assets trading platform Kraken and Justin Sun's Tron Group (via a reverse merger) also plan to tap public markets, further fueling the industry's public-listing craze.

Founded in 2018, FalconX initially debuted as a crypto-focused prime brokerage, enabling clients direct access to markets for trading on exchanges. It has since evolved into a full-fledged trading firm and comprehensive digital assets services provider. FalconX operates with three core verticals: a markets business, a custody and staking business, and a prime brokerage direct-market-access business. The firm operates akin to a principal trading business or dealer, committing capital for its clients and aiming to be "a financial services provider for the next generation of crypto."

Over the past year, FalconX has significantly ramped up its deal-making to support its expanding mandate and to serve a wider range of clients amidst booming investor interest in crypto. Key strategic initiatives include the early 2025 acquisition of crypto derivatives-focused trading firm Arbelos Markets, a move designed to deepen its foray into the highly profitable global derivatives market and enhance institutional trading expertise. Several months later, FalconX formed a strategic partnership with international banking group Standard Chartered, integrating its banking infrastructure and foreign exchange capabilities to strengthen its institutional services. More recently, in late May, the firm announced an agreement with Cantor Fitzgerald to access a substantial credit facility collateralized by Bitcoin. This facility is viewed as the initial phase in a broader credit framework designed to enable FalconX to cater to more traditional institutional investors, as highlighted by CEO Raghu Yarlagadda. Co-head of markets Joshua Lim emphasized the firm's strategy of acquiring or partnering with companies that can fill service gaps between their established business verticals, ensuring a comprehensive offering for clients.

Analysts view FalconX's potential IPO as a pivotal step in its growth strategy, which could provide access to a larger pool of investors, offer liquidity to existing shareholders, and accelerate expansion plans. Furthermore, it is expected to enhance the company's regulatory compliance and governance structures, thereby building greater trust with institutional investors and attracting more clients. The anticipated IPO draws parallels to Coinbase's 2021 listing, which significantly bolstered industry legitimacy, and could lead to further evolution in the regulatory landscape and impact cryptocurrency price dynamics as institutional adoption continues to amplify.

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

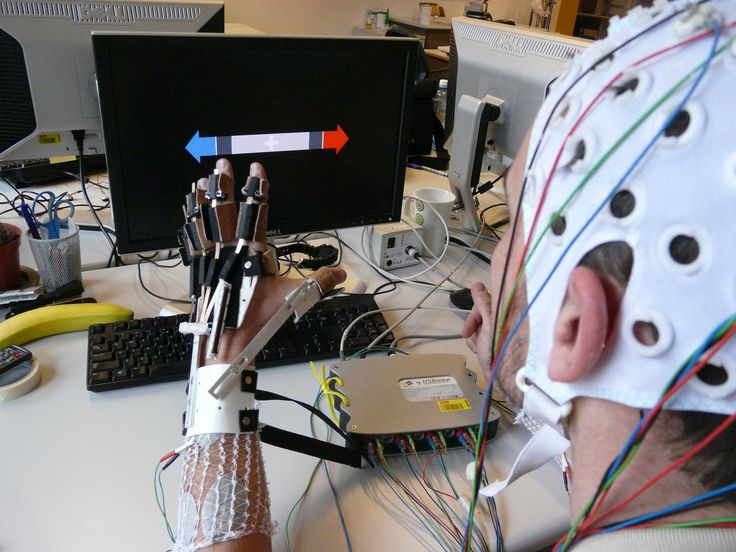

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...