Circle's IPO Signals Growing Interest in Crypto Public Offerings

Bybit, the world's second-largest cryptocurrency exchange by trading volume, has released its latest Crypto Insights Report, prominently featuring the successful initial public offering (IPO) of Circle (NYSE: CRCL), the issuer of the USDC stablecoin. The report analyzes how Wall Street significantly undervalued Circle pre-IPO, as evidenced by its stock surging from an IPO price of $31 to close at $107 in its first week of trading. Circle's triumphant debut not only demonstrated the market's strong appetite for crypto equities but also signaled growing mainstream acceptance of digital assets, establishing a new benchmark for the cryptocurrency industry and highlighting the compelling narratives crafted under the current crypto-positive climate in the U.S.

Investment bankers were notably humbled by Circle's actual market valuation, which far exceeded their expectations. The IPO was oversubscribed, and demand remained extraordinarily high after the company went public. This phenomenon underscores the game-changing nature of the crypto sector, suggesting that as more blockchain and crypto firms prepare to enter capital markets, they will likely rewrite the rulebooks of conventional valuation methods, models, and metrics. The Bybit report further delves into Circle's fundamentals and its competitive landscape to assess potential for further gains, while also drawing parallels to Coinbase's post-IPO experience during the 2022 market correction to highlight potential risks involved.

Circle's successful public offering is widely viewed as just the beginning of a larger trend. The Bybit Crypto Insights Report has identified six prominent candidates gearing up for IPOs, potentially in 2025, each possessing unique advantages in the crypto and blockchain space. Among these key players are companies like Fireblocks and Chainalysis, which specialize in areas ranging from DeFi to the security layer of blockchain technology, and are eyeing valuations in the billions. This anticipated wave signifies a maturing industry ready for public market scrutiny and investment.

The timing for this emerging IPO wave appears optimal. Industry experts note that a favorable regulatory environment, particularly under the new U.S. administration, has created conducive conditions for crypto companies to access public capital markets. The successful launch of Circle, attracting significant institutional investment, has further validated the market's confidence in the crypto sector. This anticipated surge of crypto IPOs is expected to play a crucial role in further legitimizing the cryptocurrency industry's position and influence within global finance, encouraging more companies to explore public offerings and driving the overall growth of the crypto space.

The excitement surrounding Circle's IPO also underscores the increasing integration of cryptocurrency into traditional financial systems, offering new avenues for mainstream finance to engage with this evolving digital asset class. Bybit itself, as a major exchange serving over 70 million users, continues to provide insights and infrastructure, positioning itself at the forefront of Web3 innovation and bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi), empowering builders and enthusiasts in the decentralized world.

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

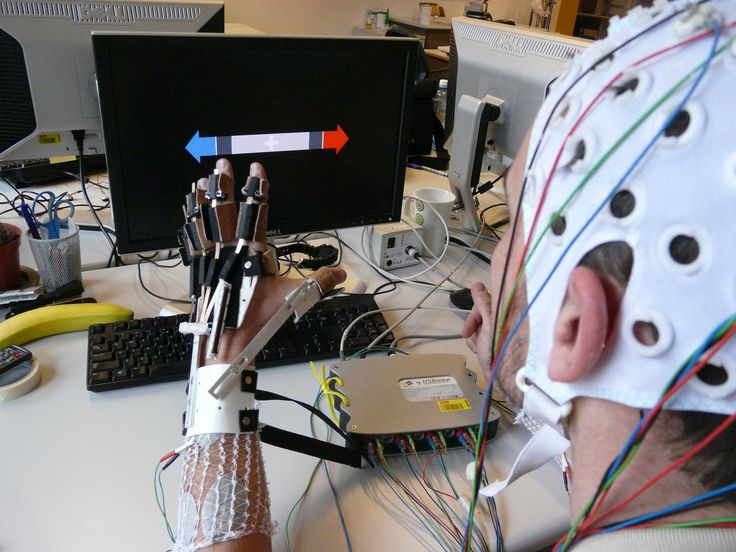

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...