Circle Internet Group Raises Over $1 Billion in Major Crypto IPO

Circle Internet Group, Inc., the prominent issuer of the USD Coin (USDC) stablecoin, has successfully concluded its highly anticipated Initial Public Offering (IPO), reportedly raising $1.1 billion. This achievement, announced around June 5, 2025, surpassed an initial fundraising target of $896 million and propelled Circle's valuation to an impressive $6.9 billion, according to updates attributed to Crypto Rover. The IPO was priced with 34 million shares at $31 each, an upsized deal initially valued at $1.05 billion, significantly exceeding previous market expectations and highlighting strong investor appetite.

The demand for Circle's IPO was extraordinary, with reports from sources like Walter Bloomberg indicating it was oversubscribed by more than 25 times. This overwhelming interest led to multiple upward revisions of the offering; initially planned to raise $624 million by selling 24 million shares, the share count was first increased to 32 million and then finalized at 34 million. The final pricing of $31 per share also surpassed the initially anticipated range of $27 to $28, underscoring robust market reception for the crypto-focused company.

Several factors are believed to have contributed to this immense investor interest. USDC's established dominance as the second-largest stablecoin by market capitalization plays a critical role, serving as a vital bridge between traditional finance and the digital asset ecosystem. Furthermore, the growing mainstream awareness and institutional adoption of cryptocurrencies are fueling interest in companies that provide essential infrastructure. Circle's strategic positioning at the intersection of blockchain technology and traditional financial technology (fintech) also appeals to a broader range of investors, including those seeking exposure to the digital asset space without direct cryptocurrency investment. Finally, hopes for increasing regulatory clarity surrounding stablecoins may have made a well-established and compliant entity like Circle an attractive prospect.

Circle, established in 2013, had previously attempted to go public via SPAC (Special Purpose Acquisition Company) deals in 2021 and again earlier in the current year, but these efforts were paused due to market uncertainties. For the current IPO, underwriters have been granted a 30-day option to purchase an additional 5.1 million shares, potentially increasing the total capital raised. The company has stated its intention to use the proceeds for potential acquisitions, international expansion, and further product development, emphasizing reinvestment in growth rather than issuing dividends at this time.

An IPO oversubscribed to such an extent typically implies high investor confidence, suggesting a belief that the company was undervalued at its initial offering price and possesses significant growth potential. It can also lead to the stock trading considerably above its IPO price upon listing and serves as a strong validation for the sector, in this case, the broader digital asset and blockchain industry in the eyes of mainstream finance.

The market reaction around June 5, 2025, was immediate and significant. Trading volume for USDC pairs spiked on major exchanges like Binance and Coinbase, with USDC/BTC volume reportedly increasing by 12% within the first hour of announcements. On-chain data from CoinGecko showed USDC’s 24-hour trading volume surged by 18% to $7.2 billion. The broader crypto market saw positive movements, with Bitcoin (BTC) climbing 1.3% to $72,500 and Ethereum (ETH) rising 1.5% to $3,850. Traditional stock markets also reflected positive sentiment, with the S&P 500 gaining 0.8%, the Nasdaq Composite up 1.2%, and the Dow Jones Industrial Average increasing by 0.6%. Crypto-related stocks like Coinbase Global (COIN) saw an uptick, rising 2.4% to $245.50. Concurrently, USDC's total supply reportedly increased by 1.2% to 33.5 billion tokens.

The success of Circle's IPO is viewed as a barometer for the evolving relationship between traditional finance and the cryptocurrency world. It signifies a growing comfort level among institutional and retail investors with companies operating in the digital asset space, particularly those focused on critical infrastructure like stablecoins. This event may pave the way for more crypto and blockchain companies to pursue traditional public listings, especially with expectations of potentially lighter crypto regulation. It marks a maturation of the industry, where underlying technology providers are gaining recognition and investment interest comparable to traditional tech or finance companies, and is expected to increase institutional trust and liquidity in USDC trading pairs.

In conclusion, the massively oversubscribed Circle IPO is a landmark development, highlighting robust investor confidence in the company and the essential infrastructure it provides through the USDC stablecoin. This event bridges a significant gap between traditional financial markets and the crypto industry. While the strong demand is a positive indicator, potential investors are typically advised to conduct their own due diligence, as IPOs can be volatile. Circle's performance post-listing will be closely watched as an indicator of future crypto investment trends and the continued convergence of digital assets with mainstream financial technology. Monitoring USDC liquidity, Circle's regulatory developments, and cross-market correlations will be key for observers and traders in the coming quarters.

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

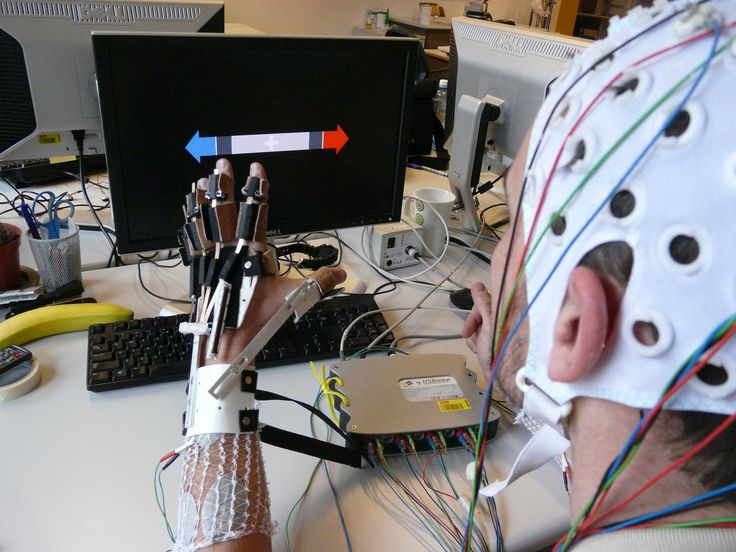

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...