CBN Upgrades Licenses for Microfinance banks including for OPay, PalmPay, Kuda.

Recently, the Central Bank of Nigeria (CBN) upgraded the operating licences of several major fintech companies and microfinance banks in Nigeria.

This move has raised questions among users about which companies are affected and most especially, what has changed.

This article explains the licence upgrade clearly and simply.

What Did the CBN Actually Do?

The CBN upgraded the operating licences of some fintech companies and microfinance banks to national licences.

A national licence allows a financial institution to legally operate across all 36 states and the Federal Capital Territory (FCT) under one regulatory approval.

Nigeria’s financial institutions are regulated under specific frameworks issued by the CBN, depending on the type of services they provide. These frameworks define what institutions can and cannot do.

Before this upgrade, some fintechs operated under:

state-level licences, or

restricted microfinance licences, or

partnerships with fully licensed banks

Despite these limitations, many of them already had users and agents nationwide.

The licence upgrade aligns their legal status with their actual operations.

Why Did the CBN Upgrade These Licences?

The CBN’s decision was driven by three main reasons:

Regulatory Control

Fintech usage has grown rapidly in Nigeria. Upgrading licences allows the CBN to regulate these platforms more effectively.Consumer Protection

National licences place fintechs under stronger oversight, improving accountability and dispute resolution for users.Alignment With Reality

Millions of Nigerians already rely on these platforms daily. The previous licence structure no longer reflected how widely they were used.

With National licences now issued, FinTechs are subject to stricter capital requirements and compliance standards.

Does This Turn Fintech Apps Into Banks?

No.

Although these fintechs now have national licences, they are still not commercial banks like traditional deposit money banks. Their services remain limited to what their specific licence category allows.

However, they are now treated as systemically important financial institutions, meaning they are more closely monitored.

What Changes for Users and Companies

For Users

Better protection: If money is lost, fraud occurs, or disputes arise, the CBN’s oversight is clearer and more enforceable.

Increased trust: Users can feel confident that these fintechs are legally recognized to operate nationwide.

Access to regulated services: More Nigerians, including those in rural areas, can safely use digital financial tools.

For Companies

Higher standards to meet: Companies must comply with stricter capital, reporting, and governance rules.

Enhanced credibility: National licences strengthen their brand and investor confidence.

Closer regulatory oversight: They are now accountable for consistent service quality and legal compliance across the country.

Conclusion

The upgrade of licences tells that the legal system is catching up with digital adoption, ensuring that fintech growth is safe, regulated, and inclusive.

For users, it’s a reassurance that digital financial services are becoming more reliable.

For companies, it’s an opportunity to expand responsibly.

And for the country, it’s a clear step toward a cashless, digitally empowered economy.

You may also like...

Tottenham's Champions League Success Contrasts With Troubled Premier League Form Under Thomas Frank

Tottenham's Premier League form poses problems for boss Thomas Frank despite their Champions League success. BBC Sport e...

The Pitt Unleashed: Exclusive Sneak Peeks, Star Secrets, and a Shocking 'Simpsons' Crossover!

The Indian SUV market sees compact SUVs leading sales in FY2025, with Tata Punch topping the charts. Maruti Brezza </div...

Neil Young Unleashes Fury: Slams Apple, Verizon, T-Mobile Over Trump Regime Support!

Neil Young has intensified his political activism, publicly condemning the Trump administration and companies like Veriz...

Grammy Gala Shakes Up 2026: Chappell Roan, Teyana Taylor, Karol G Join Presenter Ranks!

The 68th annual Grammy Awards are slated for February 1, 2026, with Trevor Noah hosting his final consecutive show. Chap...

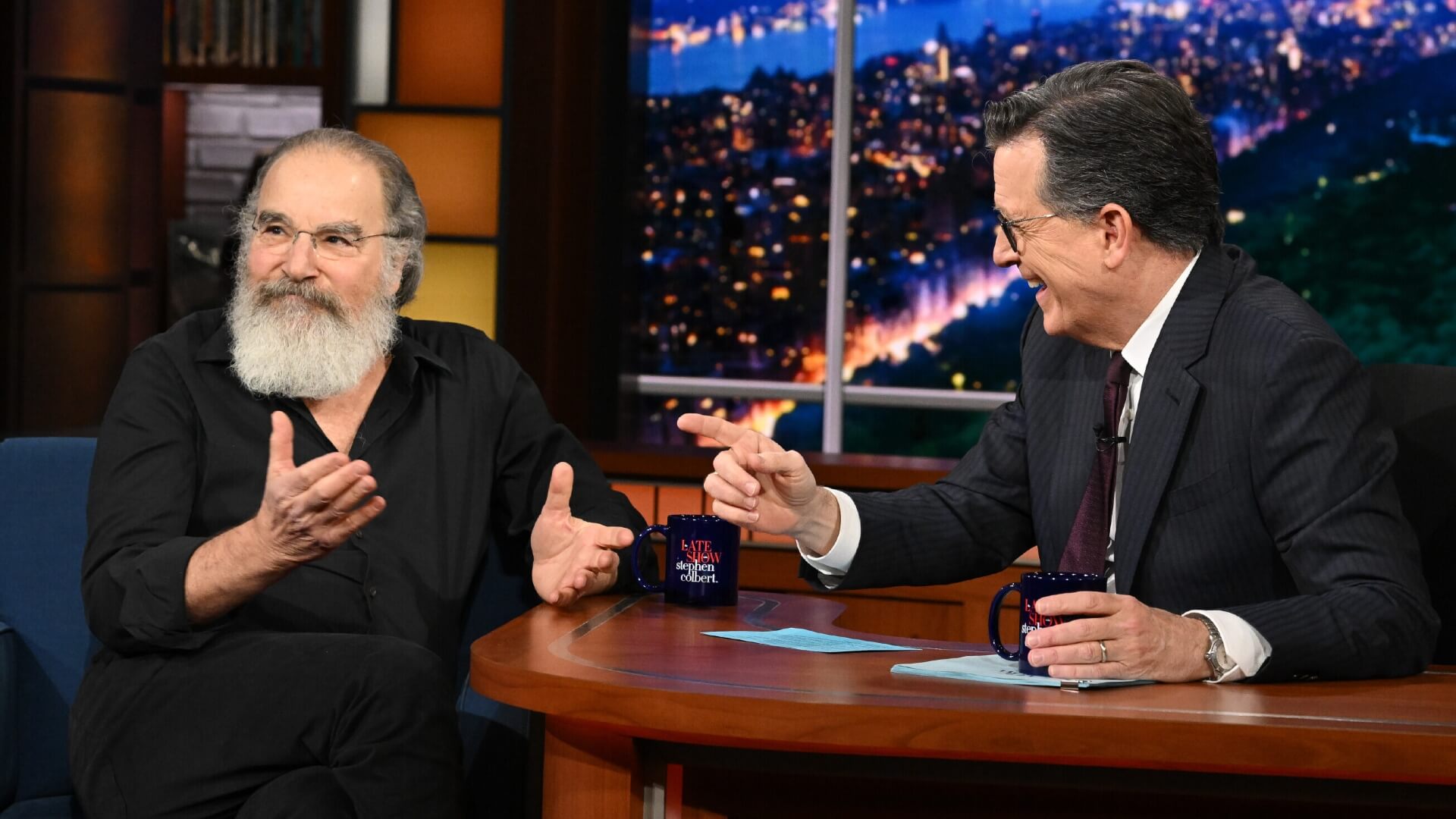

Divine Casting Revelation: Mandy Patinkin Ascends as Odin in Amazon's God Of War Series!

Mandy Patinkin has officially joined Amazon's live-action 'God of War' series, taking on the role of Odin, the Allfather...

Gaming Glory: Beth Mead, Cunha Dominate EA FC 26 Team of the Week 20!

Arsenal's Beth Mead earned a spot in the Team of the Week after a stellar performance against Chelsea, scoring and assis...

Crypto Bloodbath: Bitcoin Plummets to $84K, Triggering MicroStrategy Stock's 52-Week Low

Bitcoin's price plummeted sharply this morning, falling to the $84,000 range due to macro uncertainty and Federal Reserv...

Billion-Dollar Scandal: First Brands Founder Faces Charges for Massive Fraud

The founder and a former executive of First Brands Group, Patrick and Edward James, have been indicted in New York on ch...