AGM Alts Weekly | 6.1.25: Brand Equity - by Michael

👋 Hi, I’m Michael.

Welcome to .

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good afternoon from London. Tonight, I’m heading to Berlin for SuperReturn. On Monday, I will be chairing SuperReturn’s Private Wealth Summit, as well as moderating the panel, “The rise of semi-liquid fund structures: opportunities and risks for investors” with an experienced and thoughtful panel that includes Markus Egloff from KKR, Diana Celotto from UBS, Boris Maeder from Coller Capital, Jose Luis Gonzalez Pastor from Neuberger Berman.

While in Berlin, I’ll also be recording a podcast with one of Europe’s leading private equity firms, which I’m very excited about sharing with the AGM community. If you’re at SuperReturn, drop me a line so we can find a time to meet or catch up.

The private equity industry will be converging on Berlin for its annual pilgrimage to discuss the state of the industry as everyone charts a course for the next year.

The course to chart? Well, it will depend on the wave that the private equity industry catches.

As I wrote in the 3.9.25 AGM Alts Weekly, following the release of the Bain & Company 2025 Global Private Equity Report, private equity is going through a challenging wave. Exits have been hard to come by, making it hard for LPs to re-up into new funds, which has resulted in an environment defined by fundraising headwinds.

But has it all gone Pete Tong, as I wrote about in a recap of last year’s SuperReturn?

There are plenty of reasons why perhaps it hasn’t gone all Pete Tong.

Central amongst them is the rapid evolution of alternative asset managers as businesses and the increasingly important role they are playing in financial services as a whole.

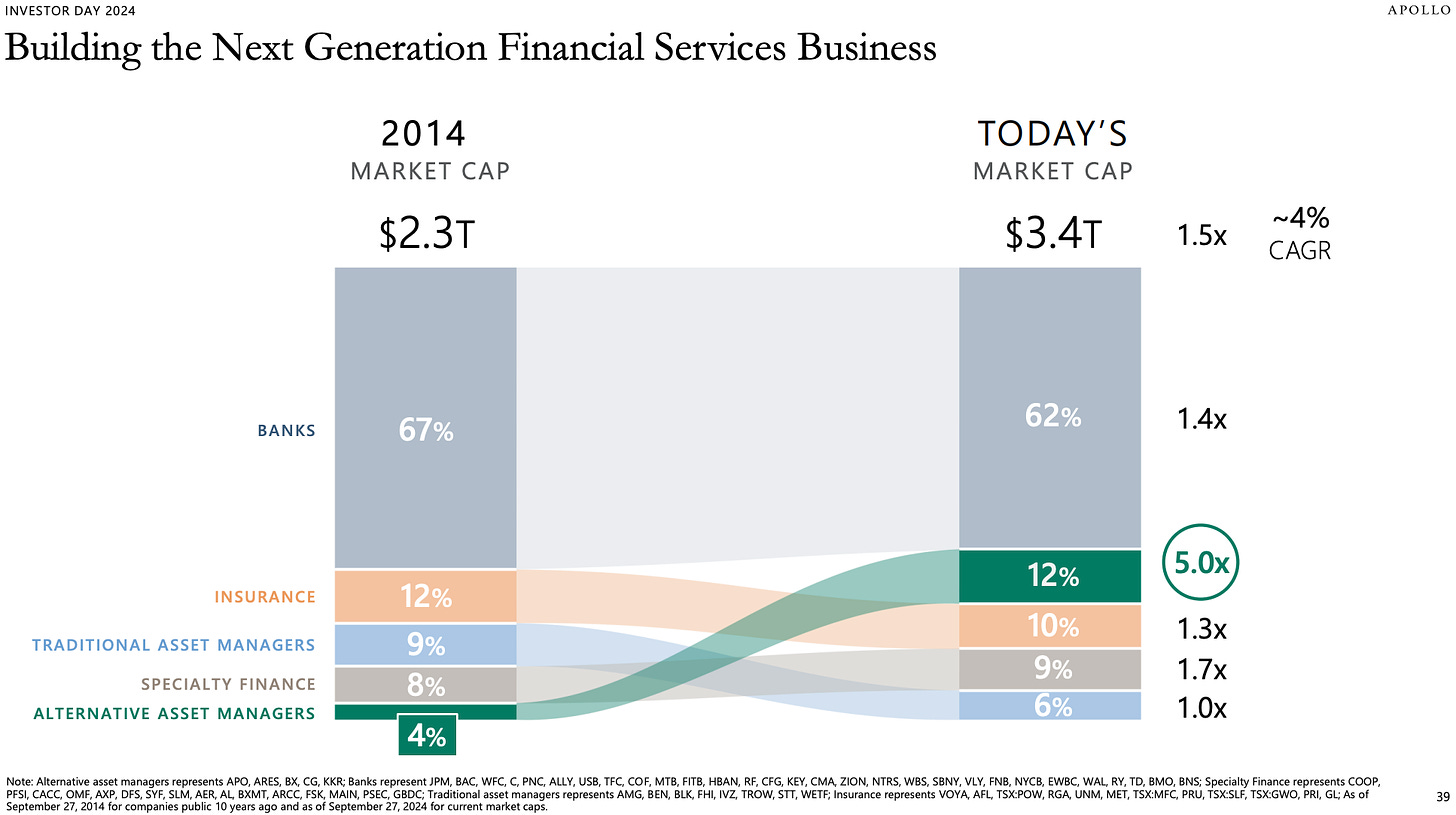

It’s impossible to ignore the rise to prominence of alternative asset managers reaching an ever-expanding set of dimensions in the financial services ecosystem, as the graphic below from Apollo’s recent Investor Day presentation illustrates.

Core to the question of the business evolution of alternative asset managers is who do they want to be as a business. As these firms look to work with the wealth channel that question has also become “what brand do they want to be?”

In this new era of private markets, many firms have taken a maniacal focus to their brand — and brand building — in this new era of private markets, as I discussed in the 8.25.24 AGM Alts Weekly on the topic of “build [brand] with Blackstone.”

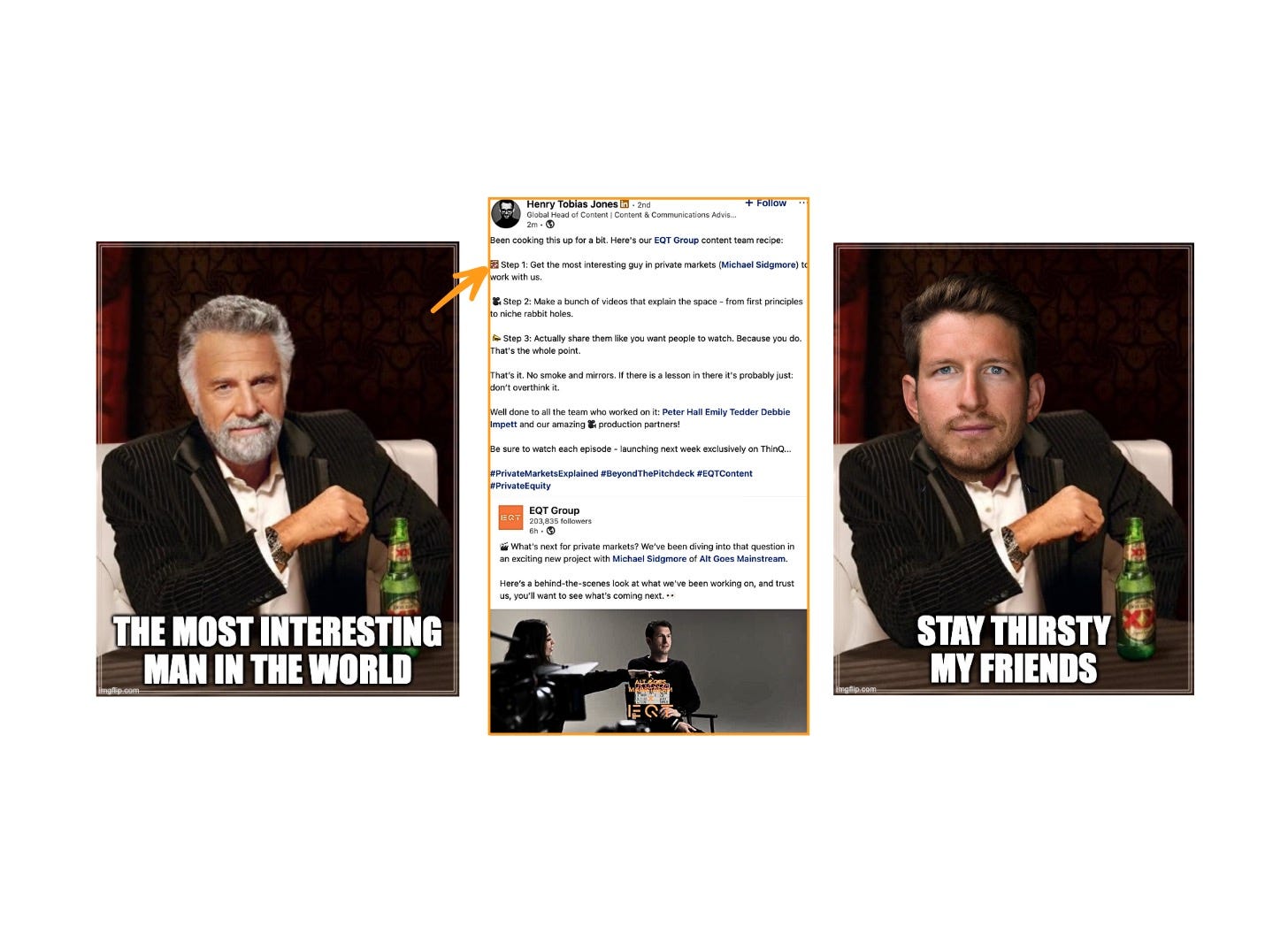

A project that I collaborated on recently with EQT made the gears in my mind turn about how to effectively build brand in an industry that — by deciding to work with the wealth channel — now has to balance on the tightrope of trying to build a brand that resonates with consumers in a way that meets them where they are, yet is constrained by very necessary and important guardrails.

Private markets is serious. Investing is a fiduciary responsibility.

Private markets and wealth management are regulated industries. Compliance is critical — and mandatory.

Dealing with people’s money is serious. That responsibility must be honored.

But in a world governed by dopamine hits and incendiary impressions, how does an asset manager break through the noise — and the LinkedIn algorithm?

How does an asset manager navigate the razor’s edge of being engaging and interesting yet responsible and serious?

If an alternative asset manager was a consumer brand, who would they be?

Consumer brands can capture culture.

Capturing culture results in brand equity that can be hard to replicate.

Perhaps no sports team has capitalized on capturing culture more than Paris Saint-Germain, the French soccer club.

Peter Rutzler of The Athletic dove into how Michael Jordan, perhaps the world’s most famous basketball icon, “helped make the PSG brand cool,” in a 2023 article.

The magic?

The brand icon of Michael Jordan’s Jumpman logo from the Nike Air Jordan commercial (and subsequent merch creations).

PSG’s marketing masterstroke was to transcend its own sport to associate MJ’s air of greatness with their own brand.

If Michael Jordan was widely considered to be the greatest basketball player of all time, then PSG’s vision was to make it the greatest sports franchise in the sports industry (they did win the Champions League last night, so they came one step closer to achieving that goal, not to mention had a lot to play for off the field, as I wrote in the 6.2.24 AGM Alts Weekly).

That’s what Fabien Allegre, Chief Brand Officer at PSG, told The Athletic:

“The vision of the chairman (Nasser Al-Khelaifi) in 2011 was clear — to make the greatest sports franchise in the sports industry. PSG is unique. It belongs to Paris. We believe football is part of culture, not apart from, and so creating a bridge between music, art, fashion and sport was a key element of our strategy.”

PSG entered into a collaboration with the Jordan Brand to include the signature Jordan Jumpman logo on its kit and merchandise.

Aligning its identity with one of the greatest athletes of all time has paid tremendous dividends.

PSG went global and went beyond soccer.

On social media, as of the time of the 2023 article from The Athletic, PSG’s social media followers skyrocketed from 500,000 in 2011 to over 200 million across a variety of social media platforms.

Collaborating with a brand that carries such equity around the world has been incredibly impactful and has taken the PSG brand global, as Rutzler shared in his article:

In its latest annual report, as detailed by Forbes, Nike reported $6.6 billion in annual wholesale revenue for Jordan Brand. The club say that their revenue has increased eightfold since 2012, and that their partnership with Jordan has increased sales outside France. Indeed, they suggest those sales rose by 50 per cent within the first six months of the agreement.

“It’s a significant proportion of the annual sales now and it’s got us to the position where, today, we think we’re the best-selling jersey in the world,” says Armstrong, who joined PSG just after the Jordan agreement was signed. “When you add in the lifestyle ranges and the whole collection, we think we’re out-selling everybody.

Brand equity matters. And it’s not easy to tap into.

The Jordan Brand carries a level of cultural appreciation and inspiration that few brands can rival.

That alone can supercharge a brand’s equity and reach in a world where social media and influence reign supreme.

The Jordan Brand tapped into a level of viral marketing that few marketing campaigns could achieve — and all in an organic, authentic way.

They have deliberately played into Paris’ high-end image. They have unashamedly expanded their VIP section at Parc des Princes to nearly 5,000, almost 10 per cent of the stadium’s capacity, and have welcomed an array of celebrities from Kim Kardashian to Pharrell Williams. Jordan himself has visited twice. Stars have worn their attire and the club claim they do not pay them to do so.

“We sent a friends and family pack to all kinds of celebrities around the world,” says Armstrong. “Will Smith received sneakers and unveiled them live on his Instagram channel. It’s organic. We are not paying these people to do this. They want this cool product. Every week you see different celebrities wearing the product.”

Sometimes, an image or a name becomes imprinted in the literal and figurative memories of society.

The Jumpman logo certainly did. That undoubtedly contributed to the success of PSG’s innovative — if unorthodox — marketing campaign.

More recently, these images or names have become what is known today as memes.

From a 2022 New York Times article by Alexis Benveniste, Webster’s New World College Dictionary defines a meme as “a concept, belief, or practice conceived as a unit of cultural information that may be passed on from person to person, subject to influences in a way analogous to natural selection.”

And memes have existed long before the internet.

From Benveniste:

The word “meme” has been used in the New York Times Crossword 60 times since the puzzle’s inception in the 1940s, according to XWordInfo. Although it’s difficult to identify the first meme ever, the British evolutionary biologist Richard Dawkins is credited with introducing the term in his 1976 book, “The Selfish Gene.” In Mr. Dawkins’s original conception, a “meme” was analogous to a “phoneme,” the smallest unit of sound in speech, or a “morpheme,” the smallest meaningful subunit of a word, Kirby Conrod, a professor of linguistics at Swarthmore College, said. “I would explain the concept of a meme — a self-replicating chunk of information — by asking someone about an inside joke they had with friends or an advertising jingle that’s been stuck in their head for 20 years,” Professor Conrod said. “That chunk of information, the joke or the jingle, self-replicates because we humans like to share and repeat stuff. When we repeat the joke, or sing the jingle, that’s an instance of the meme reproducing itself.” The word “meme” first appeared in the New York Times Crossword in 1953 with the clue “Same: French.” Its most recent appearance was on Dec. 24, 2021, with the clue “Something that gets passed around a lot.”

Private markets is a serious endeavor. And, working with the wealth channel is a serious endeavor.

But sometimes serious endeavors require memeified marketing to make it memorable.

Or, in the case of Dos Equis, make their brand interesting.

That’s what EQT’s Global Head of Content, Henry Jones, aimed to accomplish earlier this week as he announced a content collaboration between EQT and Alt Goes Mainstream.

EQT has tried to take a different tact with its marketing, particularly to the wealth channel, with Henry at the helm of content.

Henry’s background, which spans being a Features Editor at the Evening Standard and, most recently, as Head of Content for British retailer and department store chain John Lewis & Partners, brings a distinctly consumer focus to marketing a B2B brand in EQT.

Henry discussed how EQT is aiming to be different in a recent interview with Job Sanderman of The Private Equity Marketeer.

Discussing EQT’s content strategy, Henry shared a number of insightful perspectives on how EQT is approaching its community building efforts.

Today we are trying to build a brand with a much broader appeal. We may never be like the consumer brands I’ve worked with in the past, but the days of B2B content strategies that solely focus on the sales marketing audience are dying or dead. Today even B2B firms need resonant “pull” brands and content. So for firms like us, social media isn’t a nice to have, it’s essential.

Henry also discussed the importance of making content accessible and engaging:

It tells; it doesn’t talk. And when it does talk it speaks in a relatively uninclusive language – lots of jargon and industry speak. That might work for a narrow audience, but there’s a ceiling on how far it goes. It rarely sparks conversation and almost never earns attention outside of your base.

In part, the ability to create accessible content comes from the process of connecting the brand of an alternative asset manager to a brand that does an incredible job of selling a lifestyle or a feeling. After all, many private equity firms are investors in companies that themselves create these brands.

Henry compared EQT to Nike, trying to connect the how with the why:

If we could imagine EQT as Nike for a second, our portfolio companies are our athletes. Just like Nike backs talent to build its brand, we rely on our portfolio companies to show the value we bring. They are the lifeblood: future deal flow, proof of exits, evidence of value creation. And frankly, it’s what we’re best at.

But a brand has to be about more than what you do. For Nike, the trainers and the athletes are the “what” – but the “why” is bigger. It’s about grit and determination.

For EQT, what’s the why? More than capital. They aim “to future-proof companies by developing a good company and making it great,” as EQT’s Global Head of Private Wealth Management Peter Beske said in the aforementioned piece on EQT’s ThinQ platform about EQT’s 30 year history.

EQT wanted to do something different.

That was the challenge with the content project that EQT and Alt Goes Mainstream set out to produce together.

How could we show that private markets are about more than capital?

How could we balance being different with being compliant and uncomplicated?

When Henry, the EQT team, and production team shared their vision, I was excited to work with their team to come up with a way to educate in a compelling, differentiated, but responsible way.

We had to balance planning, scripting, and creating content that would be compliant but simultaneously feel authentic and different.

How did we make it feel real and sound authentic?

Well, while we mapped out a set of themes and topics and wrote a script, we didn’t use a script on set. The words? Came naturally. The tone? Conversational. The topics were themes and perspectives that I have been writing and thinking about for some time, so it was about fitting together the pieces of the puzzle that have defined the what, the how, the who, and the why of private markets over the past few years. That’s a story that I — and many others — have told, talked about, thought about, and worked on for years, so it should roll off the tongue.

Marketing needs to be authentic and human — so too does the production of content.

The result?

The finished product will be released next week, with EQT sharing the BTS this past Friday.

Social media has turned content into a 24/7 liquid marketplace of idea exchange.

There is post after post, video after video. Consumers scroll through social media sites as fast as tickers roll by on a stock exchange’s tape.

It’s also never been easier to create content.

In a world where Claude or ChatGPT are a click away, it’s never been easier to digest information, take that information, tweak that information, and repackage it as digestible and clickable content on social media.

But content risks becoming commoditized, as I discussed on the Capital Allocators podcast with Ted Seides.

The only way to stand out? Staying authentic and human.

Yes, short-form content is important. Certain firms and industry leaders have mastered this art with LinkedIn posts, X threads, or even short, engaging running videos.

But there also are times when long-form content is more appropriate. In certain cases, for certain firms and investment strategies, sharing long-form content that adds value to the consumer’s life or job could be more impactful than feeding them a 60-second clip that provides them with momentary memorable respite or a digestible nugget of information as they wait in line for coffee.

In fact, long-form content could be a differentiator in a world where AI commoditizes content.

Some firms will have a lot to say. And that’s ok. If they stay true to their brand and culture, then they can win with long-form content.

And, after all, in the world of investing, it might be more impactful to have 1,000 true fans.

Kevin Kelly’s seminal 2008 post, 1,000 True Fans, was ahead of its time. The internet has created niche and direct distribution channels that can enable creators to find and focus on their true fans. Organically and virally spreading across the nodes of the network can take care of the rest. That’s the beauty of the network effects of the internet. These viral effects don’t happen by accident and require effort, focus, community building, and a bit of luck that the right post hits at the right time.

Scale matters, but as Paul Graham wrote doing things that don’t scale can be, at times, just as effective.

An excerpt from Kelly’s post highlights the importance of finding and cultivating true fans.

To be a successful creator you don’t need millions. You don’t need millions of dollars or millions of customers, millions of clients or millions of fans. To make a living as a craftsperson, photographer, musician, designer, author, animator, app maker, entrepreneur, or inventor you need only thousands of true fans.

A true fan is defined as a fan that will buy anything you produce. These diehard fans will drive 200 miles to see you sing; they will buy the hardback and paperback and audible versions of your book; they will purchase your next figurine sight unseen; they will pay for the “best-of” DVD version of your free youtube channel; they will come to your chef’s table once a month. If you have roughly a thousand of true fans like this (also known as super fans), you can make a living — if you are content to make a living but not a fortune.

Another excerpt from Kelly’s post highlights the importance of having a direct relationship with fans.

Second, you must have a direct relationship with your fans. That is, they must pay you directly. You get to keep all of their support, unlike the small percent of their fees you might get from a music label, publisher, studio, retailer, or other intermediate. If you keep the full $100 of each true fan, then you need only 1,000 of them to earn $100,000 per year. That’s a living for most folks.

Now, successful distribution in private markets requires more than true fans. Performance must deliver, too. But the combination of providing what is promised with returns and creating a feeling of community can create engaged, long-term fans.

The network effects embedded in the internet and its social platforms enable for amplification and virality that was previously not possible. But building engaged relationships of trust and fandom can also be more fleeting with more competition for clicks and time — and being at the mercy of a LinkedIn algorithm.

That’s why going direct is critical for any brand. They need to find ways to have direct and differentiated relationships of trust — and fandom — with their fans.

Sports teams have found ways to go direct. Fans feel a visceral and unique relationship to a team and its brand, often whether the team wins or loses. Some fans have even gone so far as getting inked with the logo or colors of their team, in what I have called the “tattoo test.” It’s something that Angel City FC Co-Founder and CEO Julie Uhrman and I discussed on our Alt Goes Mainstream podcast (here).

In the business world, cutting through the clutter of social media by ending up in the email inbox is a form of going direct.

I wrote about the magic of owning the email in the 2.2.25 AGM Alts Weekly:

Social media can provide a low cost and leveraged way for firms to amplify their brand and work to consumers in the wealth channel.

However, anyone posting on LinkedIn or any social platform has to live and die by the algorithm: they have no choice but to rely on the algorithm to reach their audience.

There’s a solution: own the email.

Firms are increasingly coming up with ways to deliver insights directly into consumers’ inboxes.

Apollo’s The Daily Spark with their Chief Economist Dr. Torsten Slok is an example of this brilliance. The Daily Spark provides short, digestible, useful content via email to subscribers.

This also achieves another goal: this steady drumbeat of educational content provides a daily subliminal reminder about Apollo to subscribers and amplifies their brand as a thought leader that shares useful, actionable content.

Content matters, but distribution matters even more.

That’s why having a direct relationship with fans is so critical.

But how to create distribution?

To create distribution, it’s imperative to create community.

Sports teams have figured out how to create community and loyal, engaged fanbases. Is there something for asset managers to learn from sports teams? Perhaps so.

Short of creating rabid and diehard fandom, asset managers can create community by providing value to its fans.

To create community, brands have to be interesting and different.

But firms can’t just be interesting and different. They have to be authentic.

Authenticity is unique to each brand and culture. While every asset manager needs to educate the wealth channel on private markets, they don’t need to do it in the same way. The way in which they educate and build brand should be grounded in what makes their firm and their culture unique and different.

After all, sameness is boringness.

To be authentic, firms have to be true to their brand and their culture. To do that? Firms have to understand who they are and who they want to be.

Not every firm needs to work with the wealth channel. That’s ok. Firms need to make a conscious decision to invest in the resources required to win in wealth. That may be different for different firms. And that’s ok too.

But it doesn’t mean that firms can’t punch above their weight with marketing.

In 2006, Dos Equis was toiling as a relatively obscure Mexican beer brand licensed to Heineken as it attempted to make inroads in the US market. Dos Equis commissioned Havas to uncover insights for how to market to the US consumer.

The Havas and Dos Equis study uncovered a major insight: consumers’ deepest fear was that of being boring.

Their study found that consumers wanted to be seen as intriguing and charismatic. Apparently, “they’d rather be dead than dull.” And so the moniker was created: “The Most Interesting Man in the World.”

And that’s where memes come in.

How can firms make themselves memorable? How can they make themselves meme-able? But importantly, particularly in this industry, do so in a thoughtful, intelligent, and responsible way.

“I don’t always invest in private equity, but when I do …”

Stay thirsty, my friends.

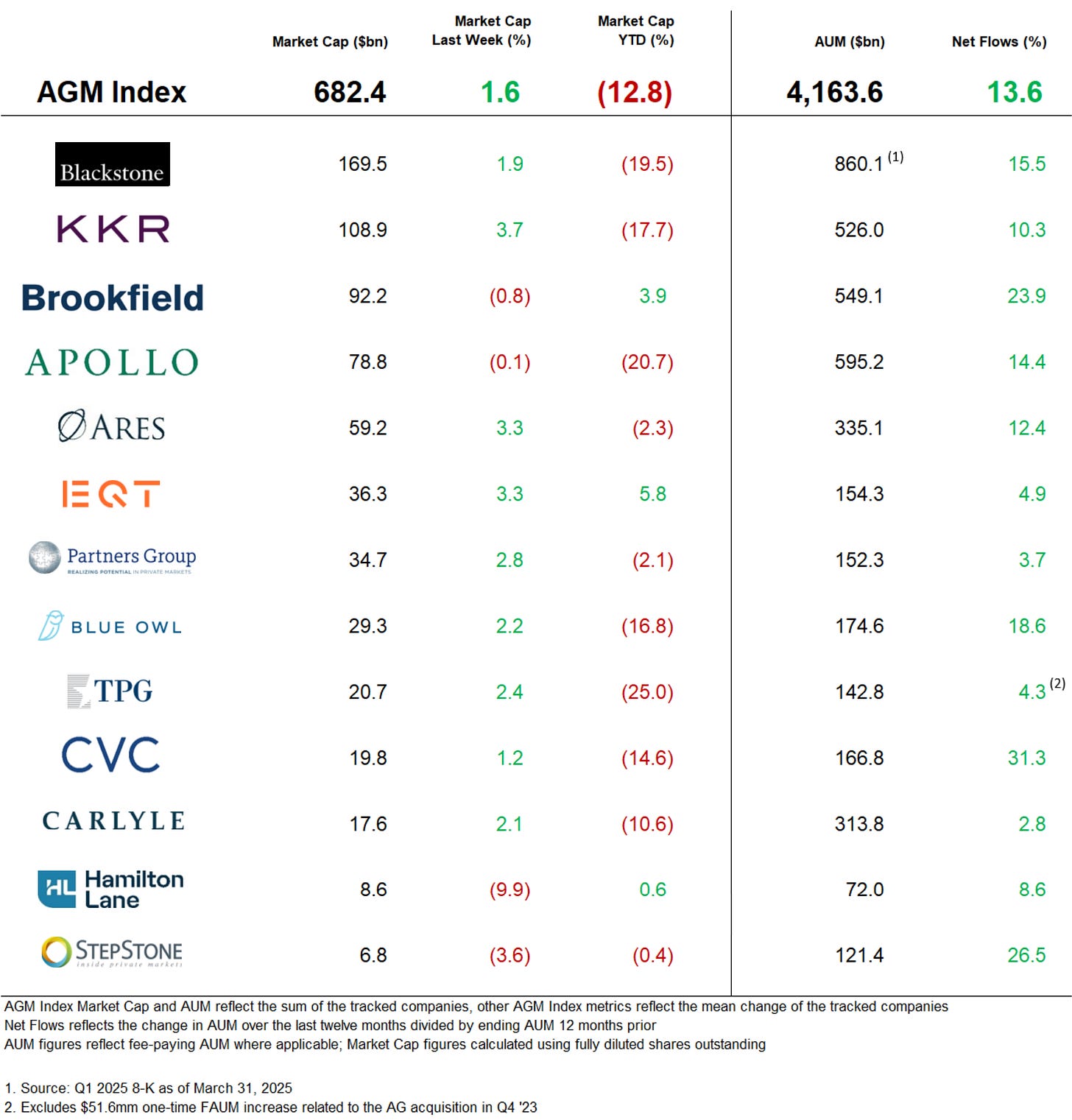

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

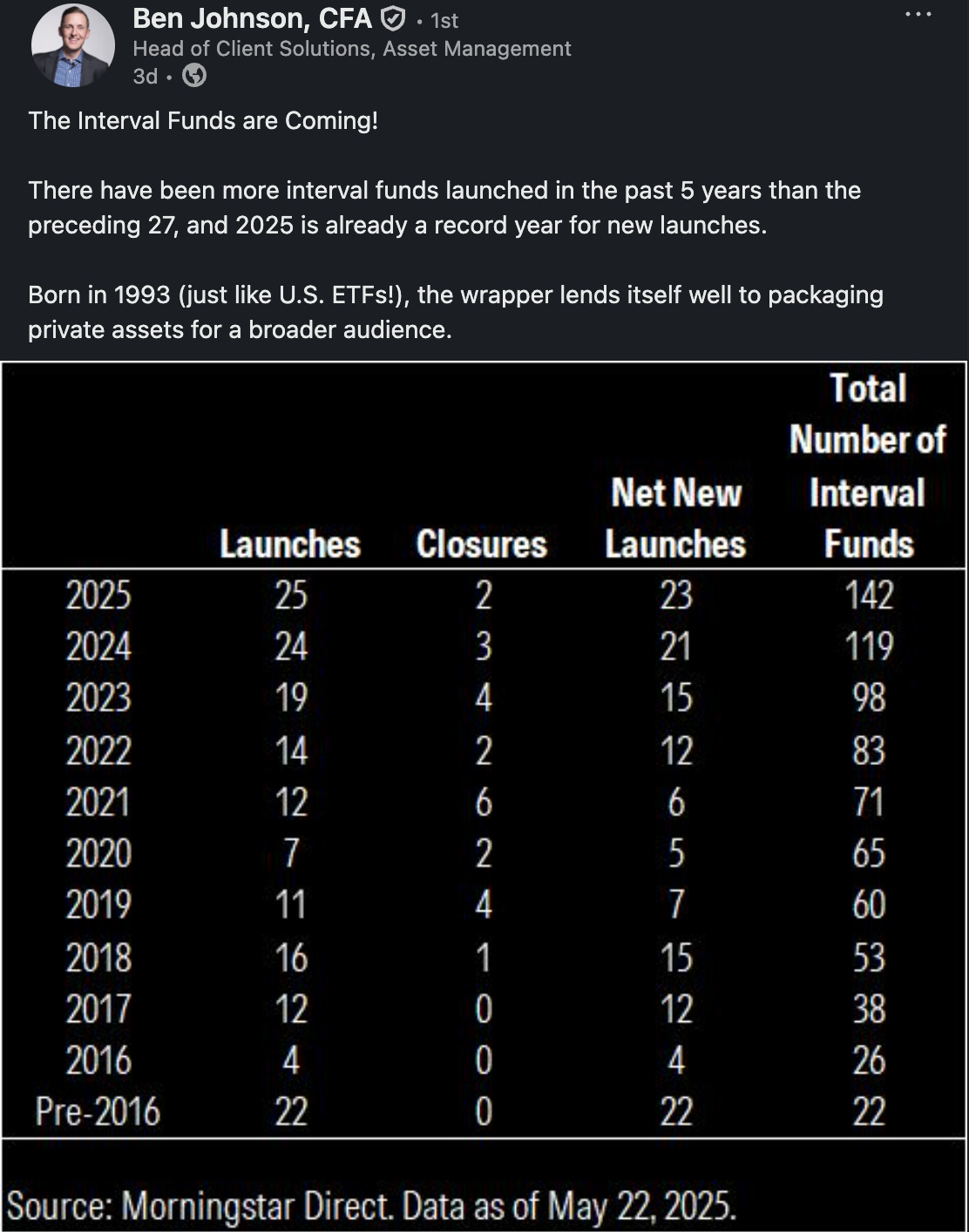

Morningstar’s Head of Client Solutions, Asset Management Ben Johnson shared data from Morningstar on the rise in new interval fund launches.

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

- Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

- Global Wealth Solutions - Investor Relations - Principal. Click here to learn more.

- Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

- Strategy & Corporate Development Associate. Click here to learn more.

- Head of Marketing - France, Benelux, and the Nordics. Click here to learn more.

Global Head of Product Strategy, Private Market Solutions - Managing Director. Click here to learn more.

SVP - GCG Head of Content Strategy. Click here to learn more.

- Associate, Business Operations (Private Wealth). Click here to learn more.

- RIA, Family Office Business Development - Vice President. Click here to learn more.

- SVP Business Development, Private Markets. Click here to learn more.

Private Markets for Wealth - Executive Director - Frankfurt. Click here to learn more.

- SVP, Business Development. Click here to learn more.

- Alternative Investment Sales Specialist Account Executive. Click here to learn more.

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

Partner with Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch ’s Founder & Chief Executive Officer discuss how $55B AUM New Mountain has built a business that builds businesses. Watch here.

🎥 Watch ’s Private Markets Head discuss data silos and technology integrations in private markets. Watch here.

🎥 Watch President & COO and SVP, Partnerships discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch Managing Director, Global Head of Alternatives, Third Party Wealth discuss how they are “standing on the shoulders of Goldman Sachs to be a complete partner” for the wealth channel. Watch here.

🎥 Watch Managing Director & Co-Head of Private Wealth Solutions discuss how Fortress has built a wealth solutions business from a whiteboard, leaning on the firm’s pioneering history of innovation. Watch here.

🎥 Watch President & Managing Partner on why there will be a $1T independent wealth management firm. Watch here.

🎙 Listen to , Founder of , and I discuss the convergence of the institutional world and the wealth world as we dive into the intersection of private markets and private wealth to kick off a mini-series on Private Wealth. Listen here.

🎥 Watch Managing Director, Co-Head of US Wealth Business, Senior Sponsor for Retirement Business and Chairman & CEO discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch Partner & Head of Private Wealth Americas discuss how the firm is bringing EQT’s success to the US wealth market. Watch here.

🎥 Watch Partner & Co-CEO of KKR Private Equity Conglomerate LLC (K-PEC) discuss how the firm has innovated in private markets, why KKR came up with the Conglomerate structure, and how evergreens can play a role in investors’ portfolios. Watch here.

🎥 Watch Co-Founder and Managing Partner in a live podcast from BTG Pactual’s NYC office share why GP stakes can be the best of all worlds. Watch here.

📝 Read The AGM Op-Ed with Private Markets Head on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch ’s Head of the Americas Client Business , Head of Product for US Wealth & Head of Alts to Wealth , and 's Co-Head of Private Wealth discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch the third episode of on Alt Goes Mainstream with Senior MD and Senior Research Analyst as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch CEO discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Partner & Chief Client Officerand Partner talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch , Co-CEO of , talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Co-CEO , where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to , Partner & Chief Client & Product Development Officer of , discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch , Founder & CEO of share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch , CEO of $72B AUM share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch , Global Head of Private Wealth Solutions at share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch , Senior Managing Director, Head of Global Wealth Advisory Services at live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch , Co-Founder of on building a single source of truth for private markets. Watch here.

🎥 Watch , Co-Founder & CEO of discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch , Chairman & CEO of on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Managing Director, Co-Head US Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Head of Americas, Global Wealth Solutions (GWS) and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Global Head of Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on in 2024. Read here.

📝 Read about the launch of the , a collaboration between and to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear General Partner and former Partner discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear ’s MD, Senior Investment Strategist & Co-Head of the Chicago Office discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch CEO discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM ’s Director of Institutional Asset Management bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Board Member and Senior Managing Director on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of and former and Partner discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear ’s President, Industries, and Co-Founder of DealCloud by Intapp discuss how data and automation are transforming private markets. Listen here.

🎙 Hear ’s CIO discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear discuss why and how alts are going mainstream on ’s Animal Spirits podcast with ’s and . Listen here.

🎙 Hear US Financial Intermediaries Leader and ’ MD and Head of Investments on following the fast river of alts. Listen here.

🎙 Hear Global Head of Private Markets share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch , Chairman & CEO at , on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend Chairman Emeritus and Former Managing General Partner discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Global Private Wealth President & CEOshare insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Managing Partner share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with and at , a mid-market GP stakes firm anchored by . Read here.

🎙 Hear how , Chairman, CEO, and Co-Founder of t has built a $29B credit investment firm and a winning NWSL soccer franchise, the . Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from , former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm . Listen here.

🎙 Hear , the CIO of $307B , discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear CTO discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Thank you for reading Alt Goes Mainstream by The AGM Collective. If you enjoyed this post, share it with anyone you know who is interested in private markets.