AGM Alts Weekly | 5.18.25: Insurance intersections

👋 Hi, I’m Michael.

Welcome to .

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good morning from Washington, DC, where I’m back from a week of meetings in NYC.

Yesterday’s edition of The Times UK included quite an interesting op-ed.

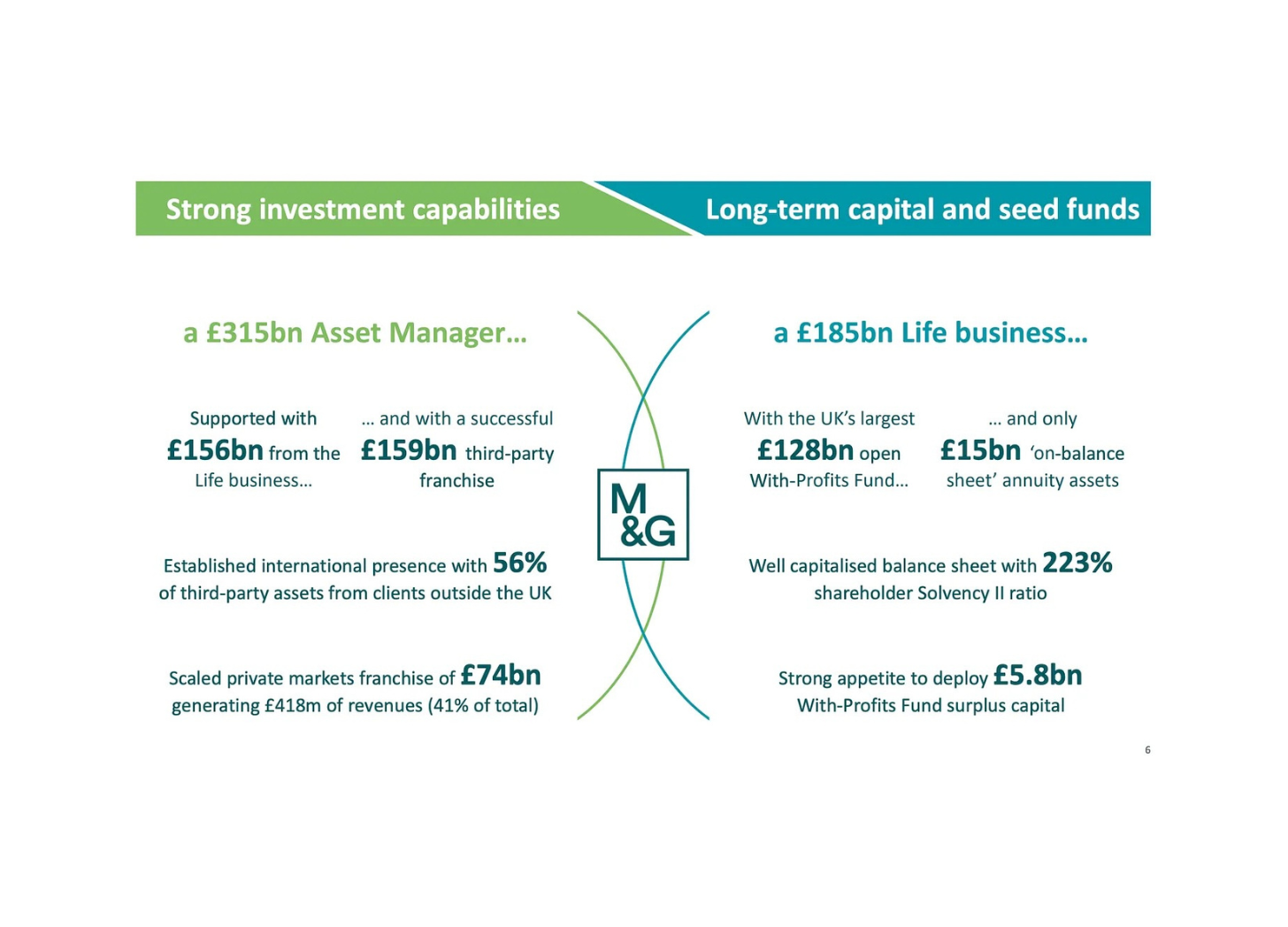

Andrea Rossi, the CEO of $395B AUM M&G, penned a piece titled, “Britain must grasp chance to be a true leader in private markets.” The op-ed explored the rationale for why private markets investments can be good for both individual investors and for Britain’s economic growth.

Rossi laid out the case for private markets, citing three clear benefits:

One, how private markets can “fuel economic growth in the UK … play[ing] an essential role in supporting the growth that [Britain] needs and in strengthening [Britain’s] social fabric.”

Rossi goes on to discuss how private markets are “an enabler of critical infrastructure, whether that is upgrading transport links, opening new schools and hospitals, or indeed, supporting British entrepreneurs to grow businesses and create jobs.”

Two, Rossi cites diversification as a benefit that differs from traditional asset classes.

And three, higher returns.

He also balances out the virtues of private markets with its risks: illiquidity, the question of transparency, and higher fees compared to listed assets.

Rossi’s op-ed comes on the heels of last week’s announcement that M&G became a signatory to the Mansion House Accord, which is a voluntary agreement to invest at least 10% of defined-contribution (DC) default funds in private markets by 2030. 5% of the total is expected to be allocated to the UK.

The announcement highlights how M&G has already been investing in private assets — in a big way. The firm’s press release includes a few of M&G’s investments in private markets that its customers, long-term savers, might have exposure to: a £1 billion investment into 40 Leadenhall, the largest office development to complete in the City of London during 2024, a long-term loan to the operator of Belfast International Airport, and a senior loan to Gail’s Bakery (which is amazing, by the way).

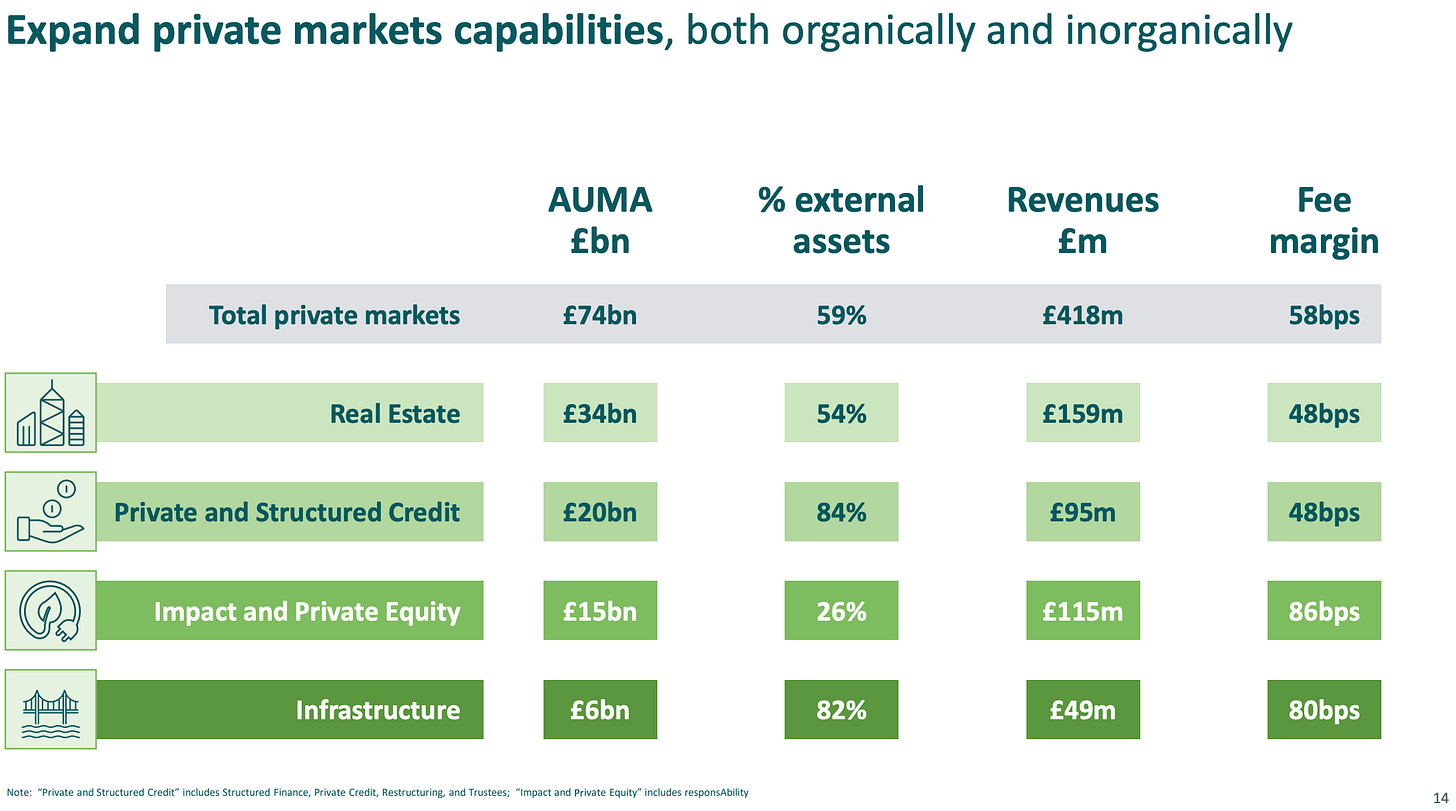

M&G has £74B in AUM in private markets across real estate, private credit, private equity, and infrastructure assets, as the below chart from M&G’s 2024 full-year results illustrates.

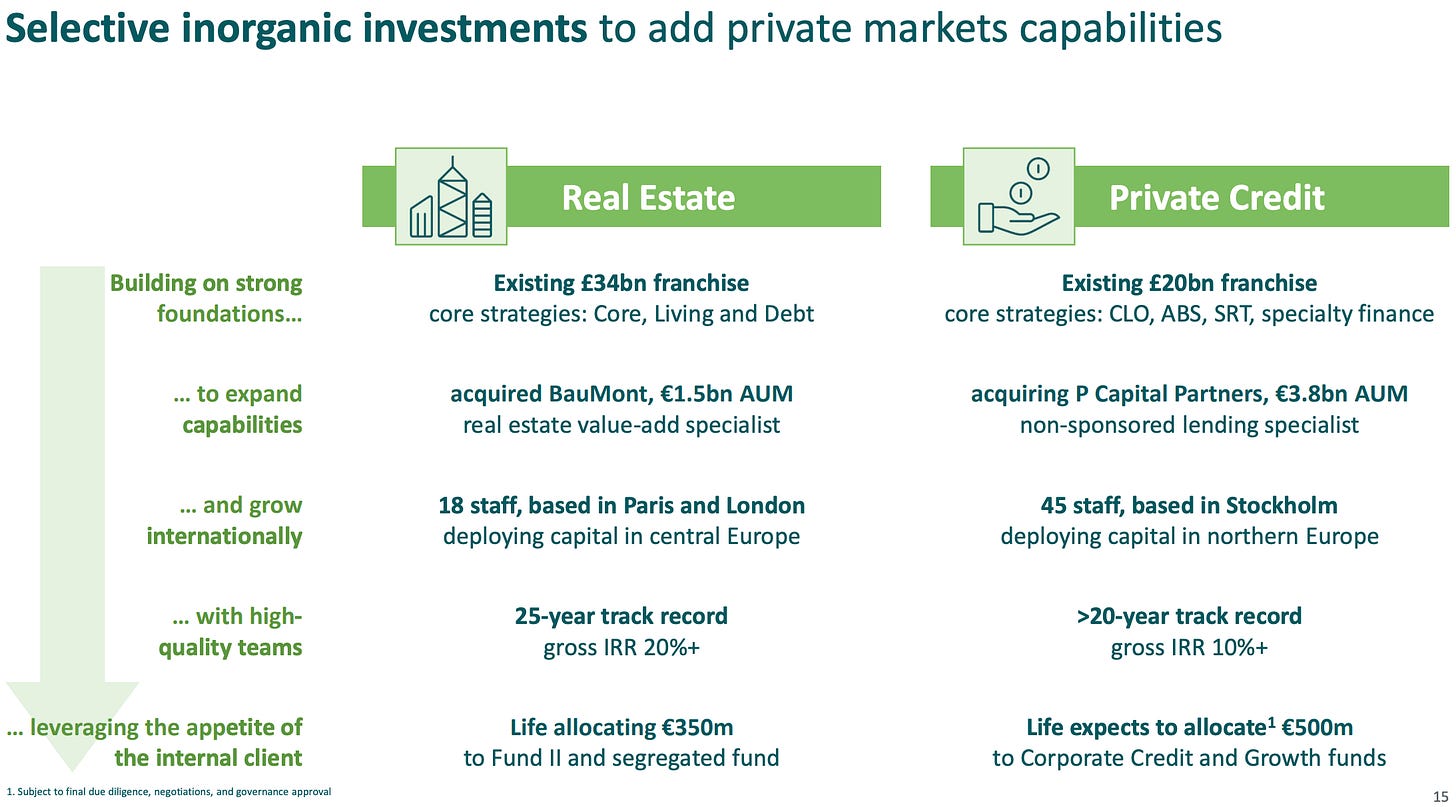

M&G has also been acquisitive, growing its private markets capabilities by adding specialist managers in real estate and private credit.

But Rossi’s write-up is much more than a piece to extol the virtues of private markets.

M&G is part of the piece of the puzzle of a bigger trend at work in private markets: the intersection of insurance and private markets.

M&G is one example of a firm that has combined insurance capabilities with asset management capabilities.

Both asset managers and insurers are looking for ways to generate returns that can help provide long-term income and better retirements.

Rossi’s article wasn’t the only news this week about helping investors generate returns to help them achieve more income for retirement.

Empower, a provider of retirement and wealth management services that administers $1.8T AUA for over 19 million individuals, announced this week that it would start offering private markets assets in its retirement portfolios later this year.

Empower will be partnering with a number of asset managers, including Apollo, Franklin Templeton, Goldman Sachs, Neuberger Berman, PIMCO, Partners Group, and Sagard, to likely embed these firms’ private markets products through collective investment trusts (CITs).

Empower’s CEO Edmund Murphy believes that this is just the beginning for 401(k) plans adopting private markets.

At an industry conference earlier this month, Murphy said that defined-contribution portfolios could allocate as much as 10-15% to private markets assets in the next 10 to 15 years.

The industry’s largest alternative asset managers have been readying for this moment.

Evergreen fund structures make it easier for 401(k) providers to include private markets assets into investment products for savers.

In Europe, the creation of the LTAF (long-term asset fund) has paved the way for pension plans to include private markets assets into its funds, particularly with defined-contribution plans.

A few months ago, Fidelity International announced that it would integrate private markets assets via a Long-Term Asset Fund (LTAF) into its £16.9B FutureWise default investment strategy for UK-based workplace pension schemes.

FutureWise’s investment strategy, which utilizes a “target date fund” (TDF) approach to invest members’ savings, will allocate to Fidelity International’s Diversified Private Assets LTAF when the fund launches. FutureWise plans to increase exposure over the next three years to 15% allocation to private markets assets via the LTAF, a figure that more closely mirrors institutional investors’ allocation to private markets.

Another dimension of the overlap between insurance and asset managers has manifested itself through partnerships.

It appears that partnerships between insurers and asset managers are fueling growth in private credit.

An article in the FT by Oliver Wyman’s Huw van Steenis notes that private credit assets funded by insurers at the top-seven North American-listed private capital firms now account for 43% of credit assets held by these alternative asset managers. That’s up a staggering 11% since 2021.

Earlier this year, Northwestern Mutual and Sixth Street partnered.

At the time, I wrote why the partnership should benefit both firms.

The strategic partnership will see Sixth Street initially managing $13B of assets for Northwestern Mutual as Sixth Street supports Northwestern Mutual’s long-term, diversified investment strategy for its $320B that is in its institutional investment portfolios. The $13B in capital will be invested across various strategies on Sixth Street’s platform, including asset-based finance and opportunistic investments in real estate and infrastructure debt and equity.

Northwestern Mutual will receive a minority equity stake in Sixth Street as part of the partnership.

The partnership looks like it will be mutually beneficial.

Sixth Street will have access to $13B in fresh capital, which is certainly a meaningful quantum in the context of the firm’s $100B in AUM and committed capital. They will also be working with a deep-pocketed LP in Northwestern Mutual that has the size, scale, and, likely, the appetite to commit more capital in the future.

Northwestern Mutual appears to be continuing to find ways to generate returns for its $321B general account. According to its 2023 Annual Investment Report on its General Account portfolio results, higher-risk assets contributed to 27% of net investment income despite being only 18% of the portfolio.

More recently, Lincoln Financial announced two major partnerships.

Lincoln Financial, a provider of retail life and annuity solutions and workplace benefits with over $321B in account balances and 17 million members, took in an $825M growth investment from Bain Capital in exchange for 9.9% of the firm and also launched two separate private markets funds in partnership with Partners Group and Bain Capital.

Bain Capital will partner with Lincoln Financial on a private credit evergreen fund that will include exposure to direct lending, asset-based finance, and structured credit. Partners Group will collaborate with Lincoln Financial to launch an evergreen fund focused on royalty assets, including intellectual property assets in pharmaceutical and entertainment industries, as well as areas like energy transition, sports, and brands.

Lincoln Financial’s CIO Jayson Bronchetti highlighted the significance of the partnership, noting that these asset management relationships will “create private market funds for our customers to invest directly into these strategies with Bain Capital and Partners Group.”

The other element of this partnership? Distribution. Lincoln Financial’s distribution network of advisors provides a massive channel for its asset manager partners to work with.

It’s not just the intersection of insurance and private markets that’s a big theme in private markets today. It’s also the intersection of insurance and wealth management, too.

Partnerships like Northwestern Mutual and Sixth Street, and Lincoln Financial and Bain Capital and Partners Group, are not just about the intersection between insurance and private markets. The partnerships are also about the distribution firepower that firms like Northwestern Mutual, which has $281B in AUM in client retail investment assets held or under management by Northwestern Mutual Wealth Management, can bring to alternative asset managers.

A big question that looms large?

Insurers are sometimes looking for a different rate of return than wealth channel clients. What does this mean for different product structures and return expectations?

As I said on the Capital Allocators podcast with Ted Seides, what matters most is that asset managers need to deliver the right product, at the right time, in the right way to the different investors with which it partners. That will be the key to ensuring success for the wealth channel and helping long-term savers achieve their goals for retirement.

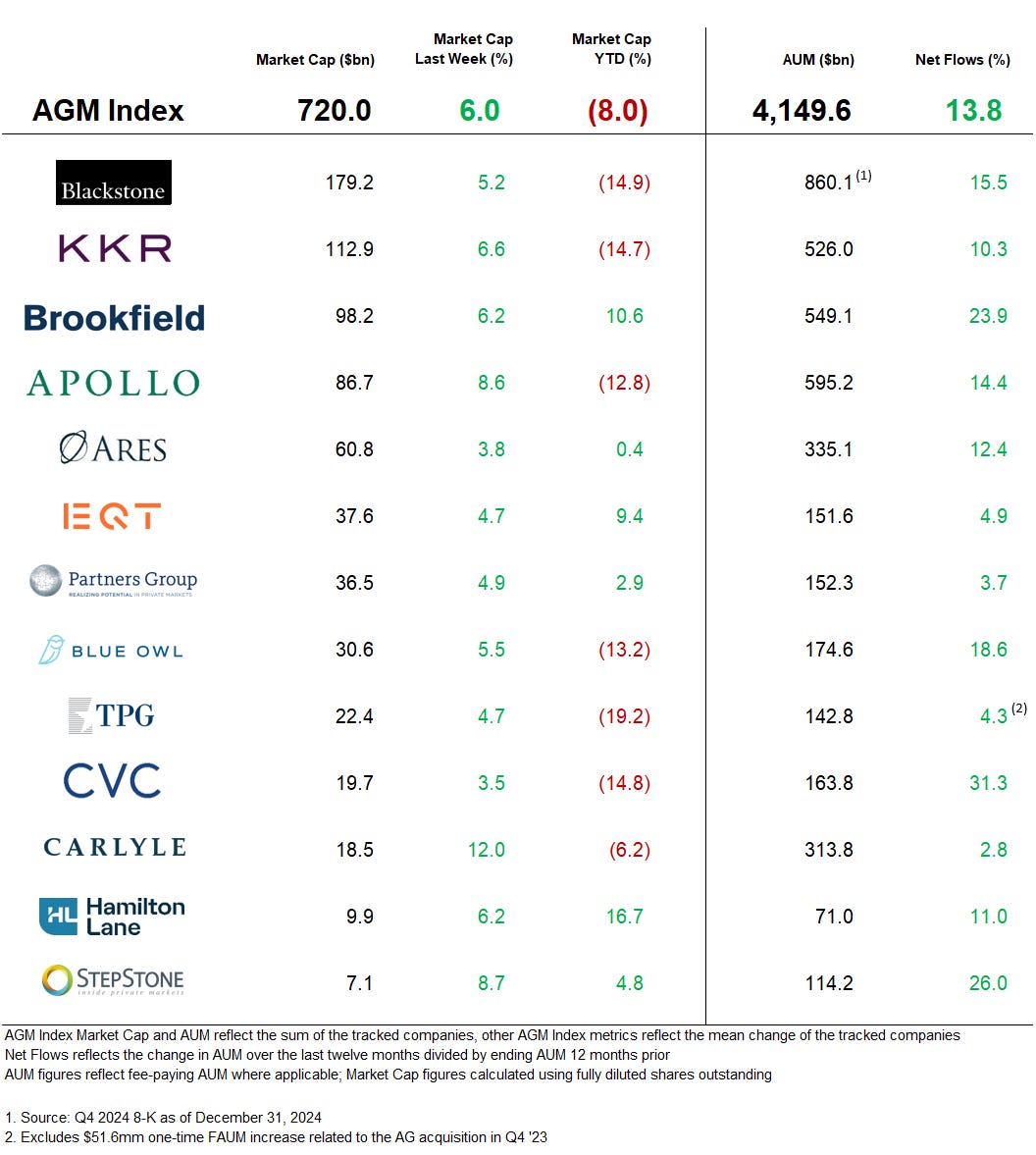

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Hg shared highlights from the firm’s Hg Digital Summit, where AI and cybersecurity were main topics of conversation.

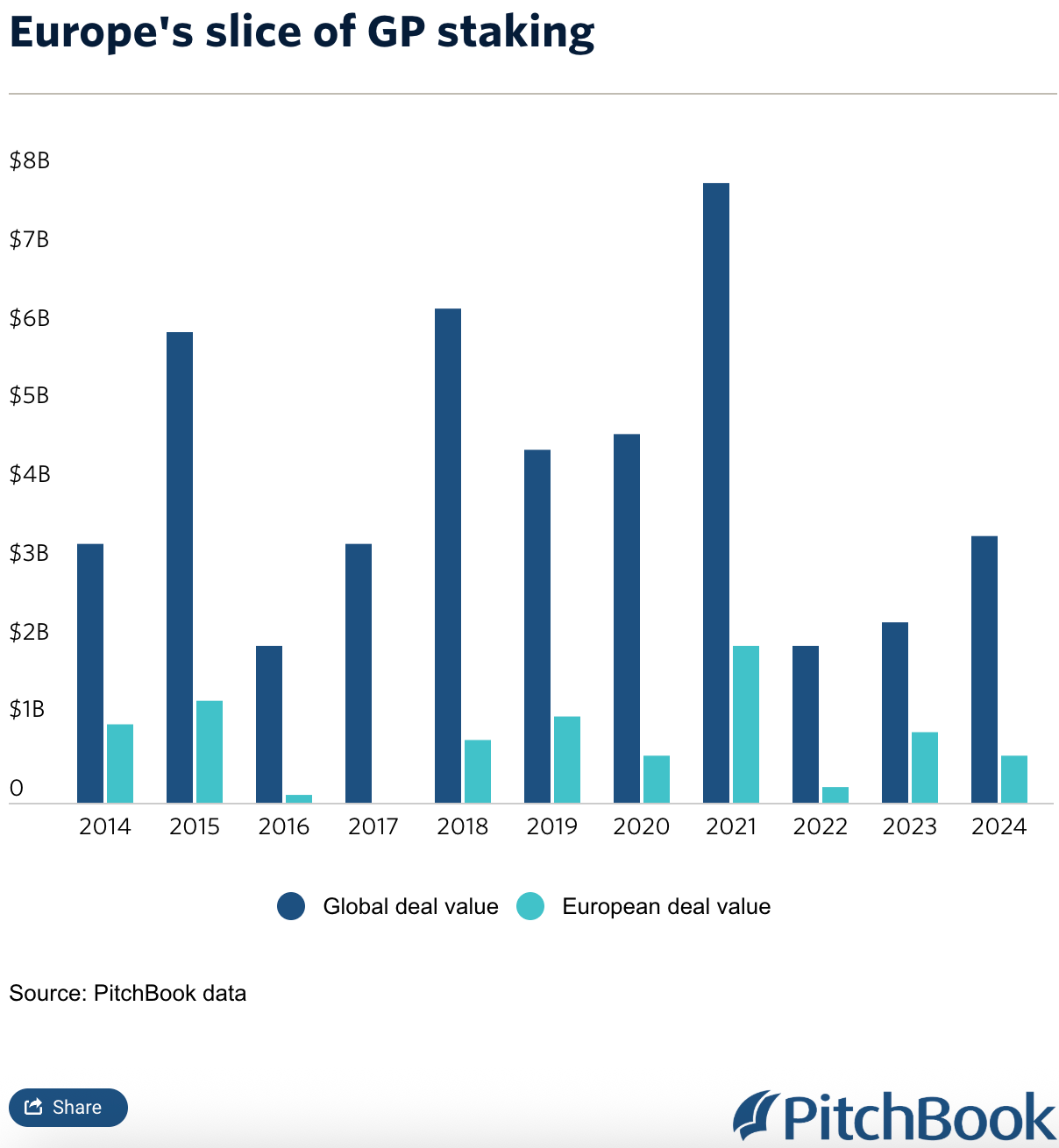

💡PitchBook’s Emily Lai reports on the growing interest and activity in GP stakes investing in Europe. According to Lai, in 2024, Europe saw only six middle-market GP stakes deals out of the 30 deals completed globally, representing only $560M of the $3.4B in deal volume. The largest deal last year in the middle-market itself almost bested Europe’s entire deal value. Goldman Sachs’ Petershill Partners $450M investment in US-based private credit firm Kennedy Lewis Investment Management, which valued the firm at $1.13B, was the largest deal in the middle-market.

AXA IM Prime’s Head of GP Stake Investments Gilles Dusaintpere said he expects GP staking to gain traction in Europe.

“Comparing to buyouts, GP stakes is a yielding strategy, so you receive regular distributions—you derisk the investment quite quickly and, along the way, with a stable and robust DPI,” he said.

Armen’s Deputy CEO and COO, Renaud Tourmente, echoed a similar sentiment that uncertainty in markets broadly is making GP stakes an attractive destination for some LPs that want exposure to private markets and the middle-market segment of private markets. “Geopolitical anxiety in the US is triggering a renewed interest in Europe, which is now viewed as both a value and strategic opportunity. Sovereign investment themes are taking shape across defense, energy, infrastructure, food, tech and AI. Capital is flowing into Europe with a clear ambition: to build tomorrow’s European champions through partnerships with tier-one investment firms and GPs,” Tourmente noted.

AXA IM Prime’s Dustaintpere said that mid-market managers in Europe are seeking strategic partnerships. AXA IM Prime, which focuses on firms with fee-paying AUM between €1B to €10B, looks to help GPs that it partners with on capital raising and advising the firm on domestic and international expansion.

Armen’s Tourmente noted that there are plenty of firms in Europe managing between €500M and €10B that are looking to expand. According to Armen data, Europe possesses around 1,000 GPs that manage capital in that size. And Tourmente also described why mid-market alternative asset managers can be attractive businesses: “GPs in the mid-market space are SMEs operating in the investment or financial services segment. They have got recurring revenue, good EBITDA margin, predictable cash flows and a very strong downside risk protection if something goes wrong.”

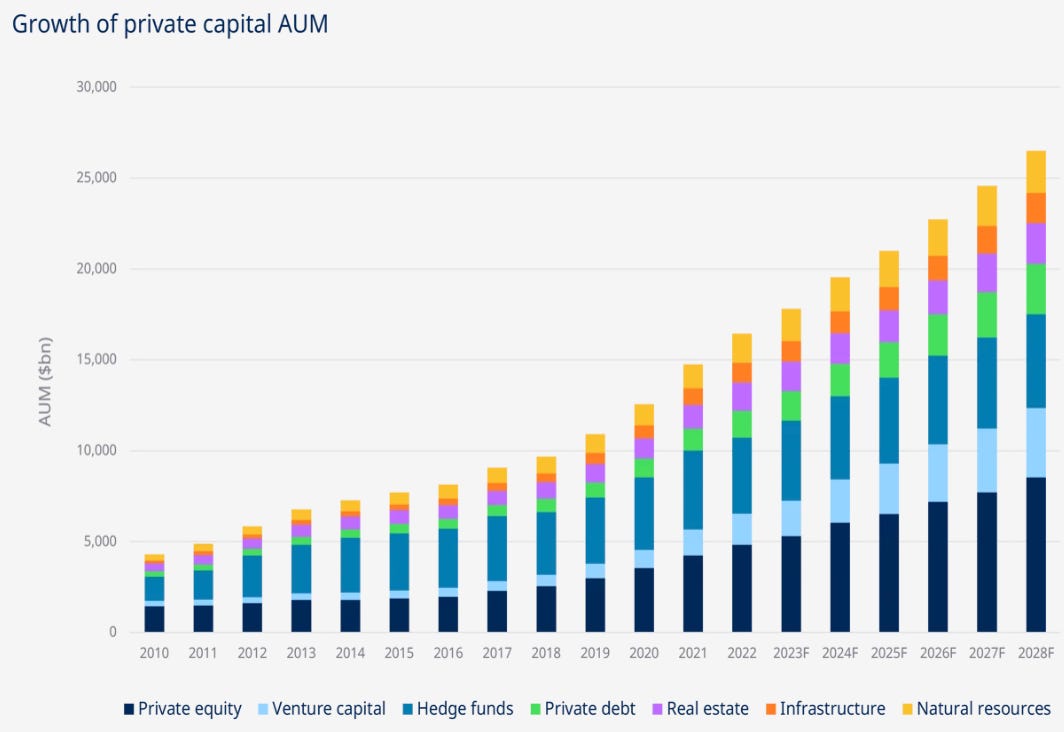

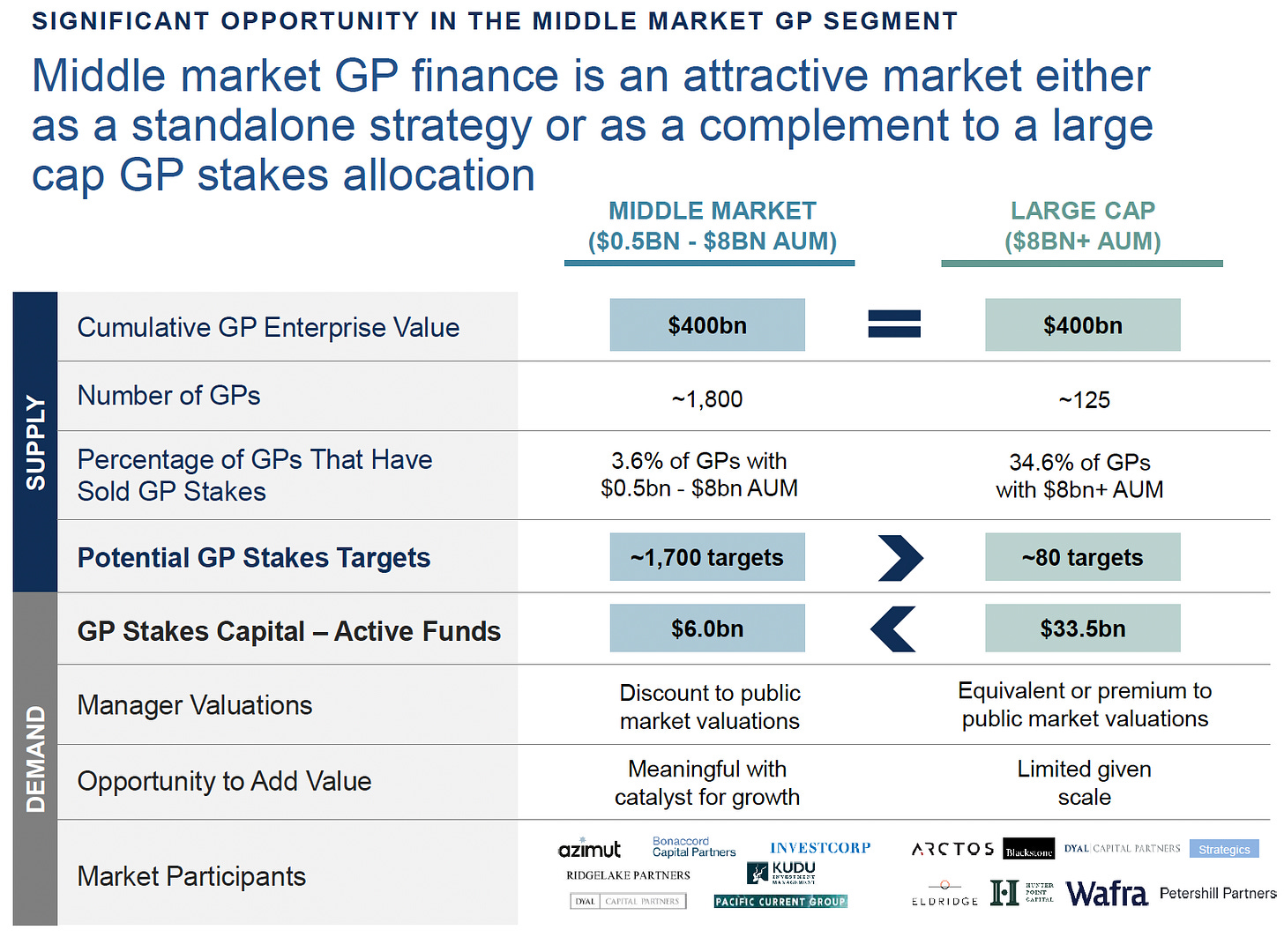

💸 AGM’s 2/20: As alternative asset management continues to evolve, so too does the GP staking industry. Historically, the upper-end of the GP stakes market has been where the lion’s share of the industry’s transactions have occurred. This trend makes sense, as funds have become firms — and these firms have grown AUM meaningfully. The growth of many of the largest alternative asset managers has meant that fund sizes have grown in parallel, creating the need for general partners and investment teams to size up their GP commitments to larger funds. That trend should continue as private capital AUM continues to grow, as this below chart from Blue Owl illustrates.

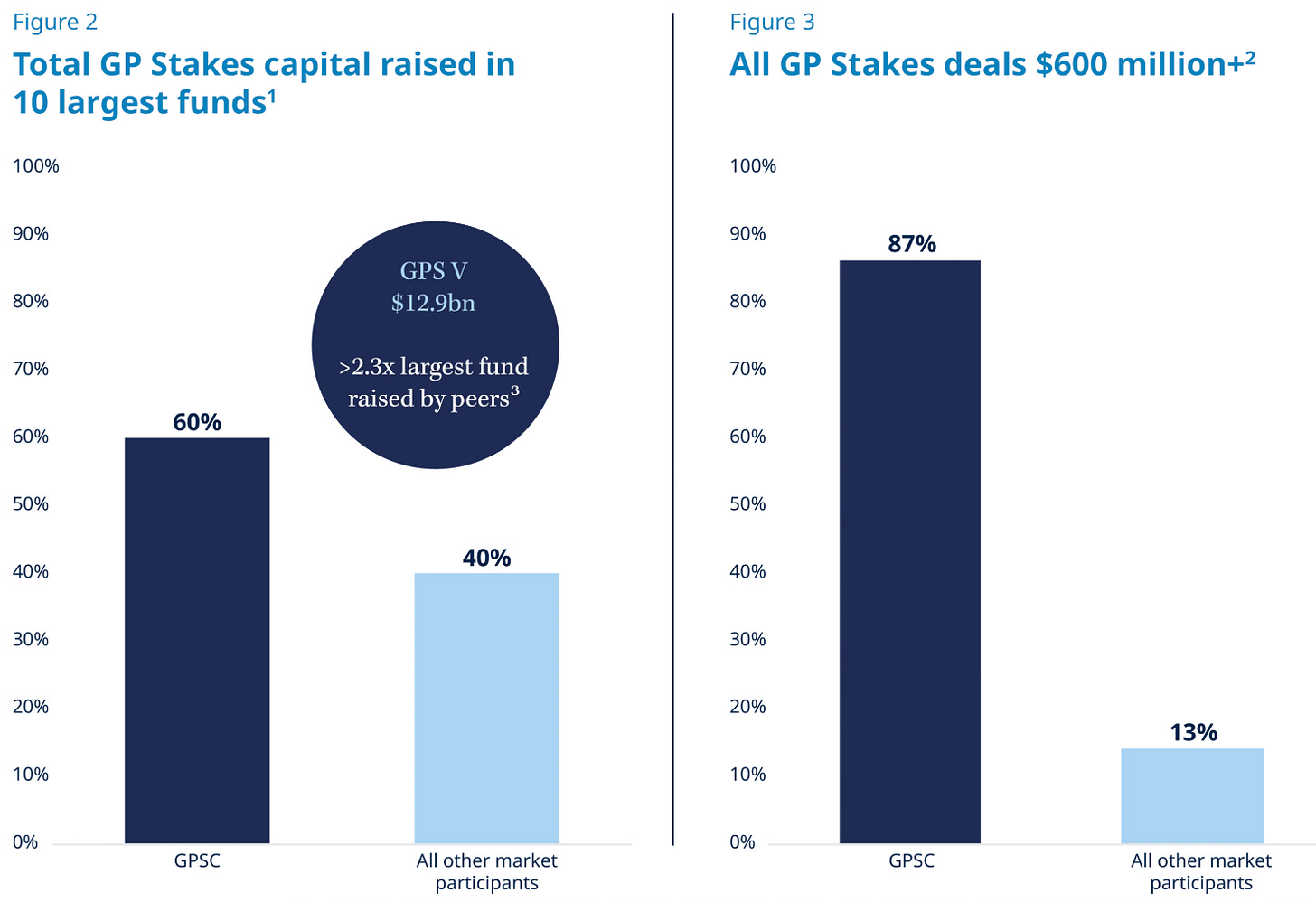

It therefore shouldn’t come as a surprise that Blue Owl, the largest player in the GP stakes universe, with over $33B invested in 60+ partner managers, has completed the majority (87%) of the GP stakes transactions $600M or greater in size.

The focus on the upper end of the market, which has resulted in a number of the industry’s largest players take in minority stake investments from the likes of Blue Owl and Blackstone (which is reportedly in the process of raising a new $5.6B GP stakes fund, according to Bloomberg), has been the defining feature of this market to date.

As the below chart from Blue Owl illustrates, a number of the industry’s largest alternative asset managers have taken in stakes to grow. Many of these firms have gone multi-strategy, acquired or built new private markets investment strategies, built or are in the process of building a wealth solutions business, and launching evergreen funds designed specifically for the wealth channel.

Many of the aforementioned firms, which I include in AGM’s Next Wave of firms that I think are on a growth path, ultimately either heading towards an IPO or some form of consolidation (either consolidated by a larger alternative or traditional asset manager or becoming a consolidator itself), reside in the upper end of the market.

The focus on the upper end of the market has made the middle-market an attractive and relatively untapped segment of the market.

Goldman Sachs’ Petershill has been a leader in the middle-market GP stakes space for quite sometime, backing a number of the industry’s larger or specialized firms, such as Clearlake, Francisco Partners, Accel-KKR, General Catalyst, and, more recently, Kennedy Lewis, which have gone onto scale their respective firms.

As the below chart from the 1.26.25 AGM Alts Weekly illustrates, the middle-market is starting to become a growing part of the GP stakes universe.

But, the middle-market, and particularly the lower end of the middle-market, still very much an untapped opportunity, as Cantilever’s Co-Founder and Managing Partner Todd Owens said on a recent Alt Goes Mainstream podcast.

Research from Cantilever finds that much of the middle-market in the US is still untapped. There’s been less than $10B of capital raised which focuses on lower middle-market GPs between $500M and $8B AUM — and a majority of the 1,800 GPs have not sold stakes, as the below chart illustrates.

Europe also represents a growing opportunity to invest into middle-market asset managers. News this week of Armen taking a minority stake in €1.1B Belgian-based consumer-focused buyout firm Vendis Capital highlights the growing trend of middle-market deals being consummated in Europe. This deal follows Armen’s investment for a 16% stake in Chorus Capital, a private credit fund focused on significant risk transfers (SRTs) in September 2024.

And much larger firms have transacted in Europe recently, as well.

Arctos Keystone made waves with its recent stake in Hayfin, a €33B European private credit manager, via its management buyout transaction, where it acquired British Columbia Investment Management Corporation’s majority stake.

Arctos Managing Partner Ian Charles called Hayfin “a very scarce asset in an industry that is rapidly consolidating” in a Private Equity International interview when the deal was announced (note: Charles made a point to note that the Hayfin-Arctos transaction is the opposite of a GP stakes transaction since Hayfin’s management team is buying equity in its firm as part of the MBO from BCI rather than the sponsor selling equity in its firm).

To tie in the developments in the GP stakes industry with the aforementioned topic of insurers playing an increasing role in private markets, it would not be surprising to see insurers find ways to deepen relationships with asset managers via GP stakes, either through relationships with GP stakes firms or by buying minority stakes in asset managers where they look to have strategic partnerships, as Northwestern Mutual recently did with Sixth Street.

And, will Europe continue to be a destination for GP stakes deals? My bet is that it will, particularly as larger alternative asset managers, such as KKR, state publicly that Europe is becoming a more attractive market, as KKR’s Co-Head of Europe Tara Davies noted to the FT recently that “Europe’s undergoing a bit of a renaissance.” Davies’ colleague Mattia Caprioli, KKR’s Co-Head of Europe, remarked that “[they are] very excited and very positive about the outlook for Europe, more so now than to some extent before.”

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

- Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

- Investor Relations Professional. Click here to learn more.

- Global Wealth Solutions - Investor Relations - Principal. Click here to learn more.

- Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

- Credit Executive Office, Senior Associate / Associate. Click here to learn more.

SVP - GCG Head of Content Strategy. Click here to learn more.

- Associate, Business Operations (Private Wealth). Click here to learn more.

- RIA, Family Office Business Development - Vice President. Click here to learn more.

- SVP Business Development, Private Markets. Click here to learn more.

Private Markets for Wealth - Executive Director - Frankfurt. Click here to learn more.

- SVP, Business Development. Click here to learn more.

- Alternative Investment Specialist. Click here to learn more.

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

Partner with Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Managing Director, Global Head of Alternatives, Third Party Wealth discuss how they are “standing on the shoulders of Goldman Sachs to be a complete partner” for the wealth channel. Watch here.

🎥 Watch Managing Director & Co-Head of Private Wealth Solutions discuss how Fortress has built a wealth solutions business from a whiteboard, leaning on the firm’s pioneering history of innovation. Watch here.

🎥 Watch President & Managing Partner on why there will be a $1T independent wealth management firm. Watch here.

🎙 Listen to , Founder of , and I discuss the convergence of the institutional world and the wealth world as we dive into the intersection of private markets and private wealth to kick off a mini-series on Private Wealth. Listen here.

🎥 Watch Managing Director, Co-Head of US Wealth Business, Senior Sponsor for Retirement Business and Chairman & CEO discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch Partner & Head of Private Wealth Americas discuss how the firm is bringing EQT’s success to the US wealth market. Watch here.

🎥 Watch Partner & Co-CEO of KKR Private Equity Conglomerate LLC (K-PEC) discuss how the firm has innovated in private markets, why KKR came up with the Conglomerate structure, and how evergreens can play a role in investors’ portfolios. Watch here.

🎥 Watch Co-Founder and Managing Partner in a live podcast from BTG Pactual’s NYC office share why GP stakes can be the best of all worlds. Watch here.

📝 Read The AGM Op-Ed with Private Markets Head on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch ’s Head of the Americas Client Business , Head of Product for US Wealth & Head of Alts to Wealth , and 's Co-Head of Private Wealth discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch the third episode of on Alt Goes Mainstream with Senior MD and Senior Research Analyst as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch CEO discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Partner & Chief Client Officerand Partner talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch , Co-CEO of , talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Co-CEO , where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to , Partner & Chief Client & Product Development Officer of , discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch , Founder & CEO of share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch , CEO of $72B AUM share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch , Global Head of Private Wealth Solutions at share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch , Senior Managing Director, Head of Global Wealth Advisory Services at live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch , Co-Founder of on building a single source of truth for private markets. Watch here.

🎥 Watch , Co-Founder & CEO of discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch , Chairman & CEO of on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Managing Director, Co-Head US Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Head of Americas, Global Wealth Solutions (GWS) and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Global Head of Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on in 2024. Read here.

📝 Read about the launch of the , a collaboration between and to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear General Partner and former Partner discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear ’s MD, Senior Investment Strategist & Co-Head of the Chicago Office discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch CEO discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM ’s Director of Institutional Asset Management bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Board Member and Senior Managing Director on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of and former and Partner discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear ’s President, Industries, and Co-Founder of DealCloud by Intapp discuss how data and automation are transforming private markets. Listen here.

🎙 Hear ’s CIO discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear discuss why and how alts are going mainstream on ’s Animal Spirits podcast with ’s and . Listen here.

🎙 Hear US Financial Intermediaries Leader and ’ MD and Head of Investments on following the fast river of alts. Listen here.

🎙 Hear Global Head of Private Markets share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch , Chairman & CEO at , on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend Chairman Emeritus and Former Managing General Partner discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Global Private Wealth President & CEOshare insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Managing Partner share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with and at , a mid-market GP stakes firm anchored by . Read here.

🎙 Hear how , Chairman, CEO, and Co-Founder of t has built a $29B credit investment firm and a winning NWSL soccer franchise, the . Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from , former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm . Listen here.

🎙 Hear , the CIO of $307B , discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear CTO discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Thank you for reading Alt Goes Mainstream by The AGM Collective. If you enjoyed this post, share it with anyone you know who is interested in private markets.