AGM Alts Weekly | 4.20.25: What happens when three $T asset managers walk into a bar?

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good morning from Washington, DC, where I’m back from a week of meetings and podcasts in NYC.

What happens when three of the world’s largest trillion-dollar plus asset managers walk into a bar?

They partner!

Holy Batman was a major partnership in private markets forged this week.

Vanguard, Wellington, and Blackstone announced a first-of-its-kind partnership to collaborate on creating multi-asset investment solutions that span both public and private markets.

The partnership combines the capabilities of public markets leaders with long histories of equity and fixed income investing — and, in Vanguard’s case, offering of low-cost index funds — with Blackstone’s position as a leader in private markets and working with the wealth channel.

It will be interesting to see what these three firms create together.

This significant development for private markets follows a number of partnerships between industry leaders across public and private markets.

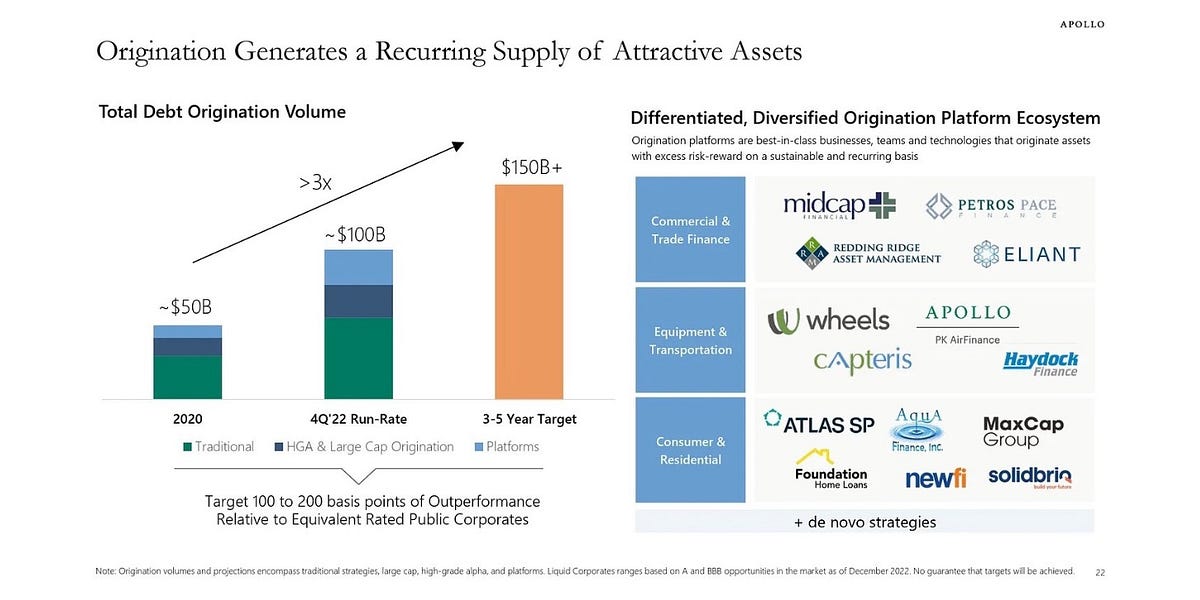

Apollo CEO Marc Rowan has talked about how the industry is going through “an entire rethink of public and private.” His comments in an illuminating talk at the Norges Bank Investment Management Investment Conference in May 2024 were followed by views shared in Apollo’s Q4 2024 Earnings Call:

And finally, and I think personally the most important driver of our business, is an entire rethink of public and private. And what I mean by that is our industry grew up where I think people thought private was risky and public was safe. And when something is risky, you put it in a small bucket and you call it an alternative, and you want very high rates of return from it. And 40 years later, after our industry start, I think that professionals in our industry now understand that private is safe and risky, and public is safe and risky. And if people are not watching closely, the largest asset manager, the traditional asset manager in our industry, has delivered a wakeup call to their entire peer set that private is going to be an important part of client solutions going forward.

The wakeup call Rowan was referring to? BlackRock, the largest traditional asset manager in the world (that no longer calls itself just a traditional asset manager, which one can discern if they read BlackRock Chairman and CEO Larry Fink’s Annual Letter closely), had just spent over $12B to acquire $150B credit manager HPS.

Public and private are certainly converging — in more ways than one.

Asset management firms have certainly been rethinking how they approach working with the wealth channel — and partnering is an integral part of the strategy.

The Blackstone, Vanguard, Wellington partnership follows a few other major partnerships between the industry’s largest traditional asset managers and the biggest players in private markets.

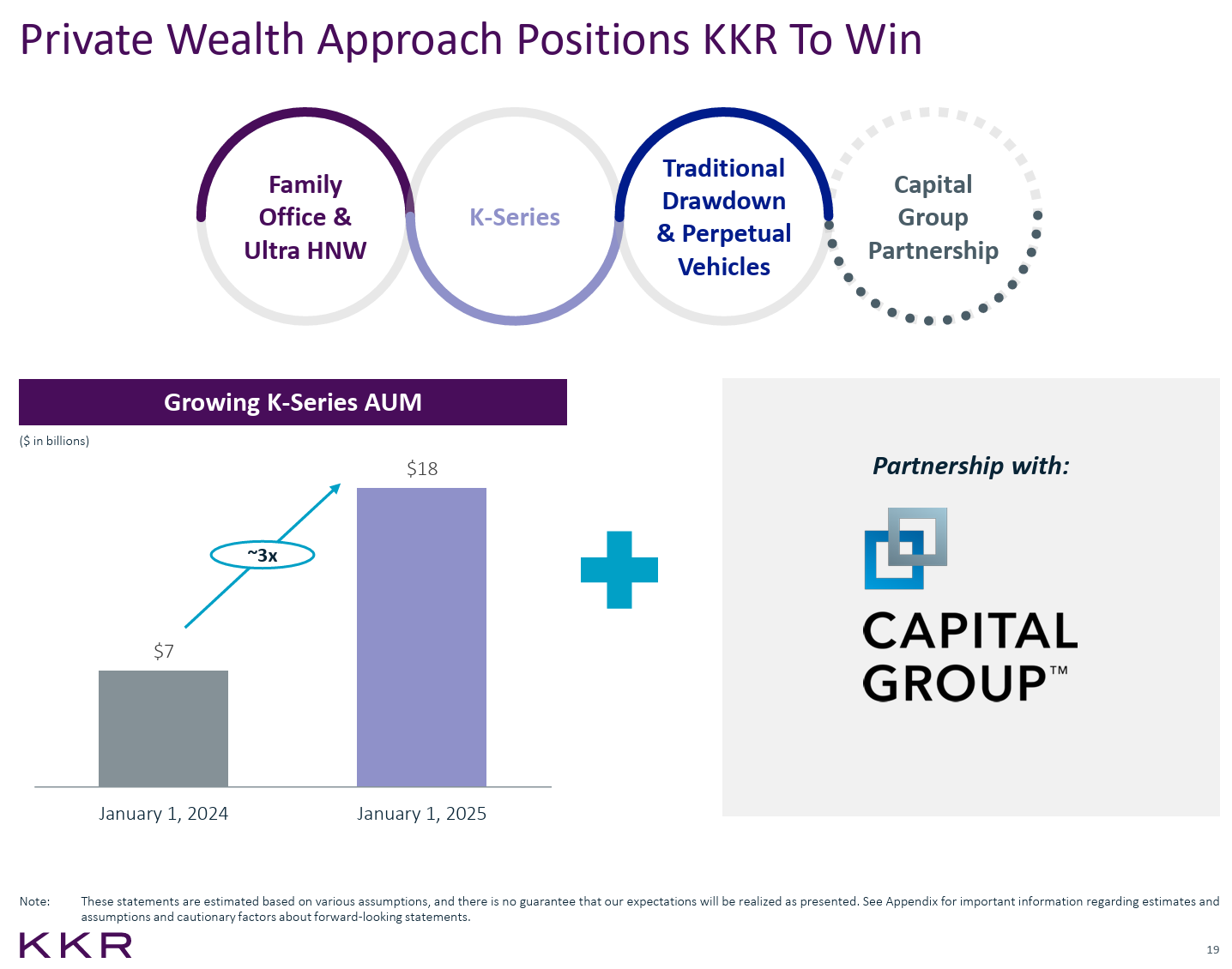

Last May, KKR and Capital Group announced that they were teaming up to create two hybrid public-private investment products to serve the wealth channel.

Later in 2024, Apollo and State Street announced a public-private credit ETF. The product, which they rolled out earlier this year in March, has almost $55M in assets. Fundraising appears to have slowed in recent weeks, in part due to the fact that the product is a new, innovative structure and in part due to market turbulence.

Late last year, BlackRock and Partners Group announced that they would be collaborating to create a private-markets specific model portfolio, leveraging Partners Group’s heritage in the evergreen fund space and BlackRock’s expertise in model creation, model management, and risk analytics to launch a multi-strategy private markets solution that will embed private equity, private credit, and real assets in a single portfolio (listen to BlackRock’s Joe DeVico and Jon Diorio and Partners Group’s Rob Collins discuss the partnership here on Alt Goes Mainstream).

Private markets-specific model portfolios are also in the early stages of being constructed and rolled out.

iCapital has launched model portfolios, announcing the firm’s iMap offering in May 2024 and, more recently, announced a partnership between BlackRock, GeoWealth, and iCapital to include both public and private markets exposure through a unified managed account (UMA).

In the 5.12.24 AGM Alts Weekly, I wrote why models are a critical piece of the puzzle for the adoption of private markets within the wealth channel.

The main reason? Ease of access and turnkey solutions.

The introduction of model portfolios that provide for a turnkey, streamlined solution for advisors to access alternatives in a diversified format is a significant development for private markets. Historically, access to private markets has been a deterrent to the adoption of private markets by the wealth channel. The industry appears to have hurdled over that bar with the creation of technology and product innovations that have unlocked accessibility to private markets. Yet still, many in the wealth channel have yet to allocate meaningfully to private markets because they have to figure out how and where it fits into an investors’ portfolio and how they should allocate across different strategies and funds. Many investment platforms have aimed to devise solutions that offer investors multi-manager vehicles to provide diversification. Even larger alternative asset managers have created products that combine a number of different strategies within their platforms to offer investors turnkey access to the different private markets funds. The iMap fund takes this to a different level. It represents a huge development in portfolio construction for the wealth channel as it provides a turnkey way for advisors to access a diversified set of high-quality managers across different strategies in private markets. iCapital has created a diversified portfolio based on a set of risk and return factors that offer advisors a fully-baked solution for private markets. The creation of a more robust and streamlined supply chain in private markets relies upon better technology, but it also relies on better product construction to meet the needs of advisors in their day-to-day workflows.

KKR and Capital Group’s joint announcement highlighted a critical point that could provide an explanation for why the industry’s largest firms in both traditional asset management and alternative asset management have been so focused on rolling out hybrid multi-asset or multi-manager solutions: the products simplify asset allocation decisions and make it easier for investors, particularly those in the wealth channel, to make a single investment decision to gain exposure to private markets.

The KKR / Capital Group announcement noted that the mass affluent investor is largely who is in focus here:

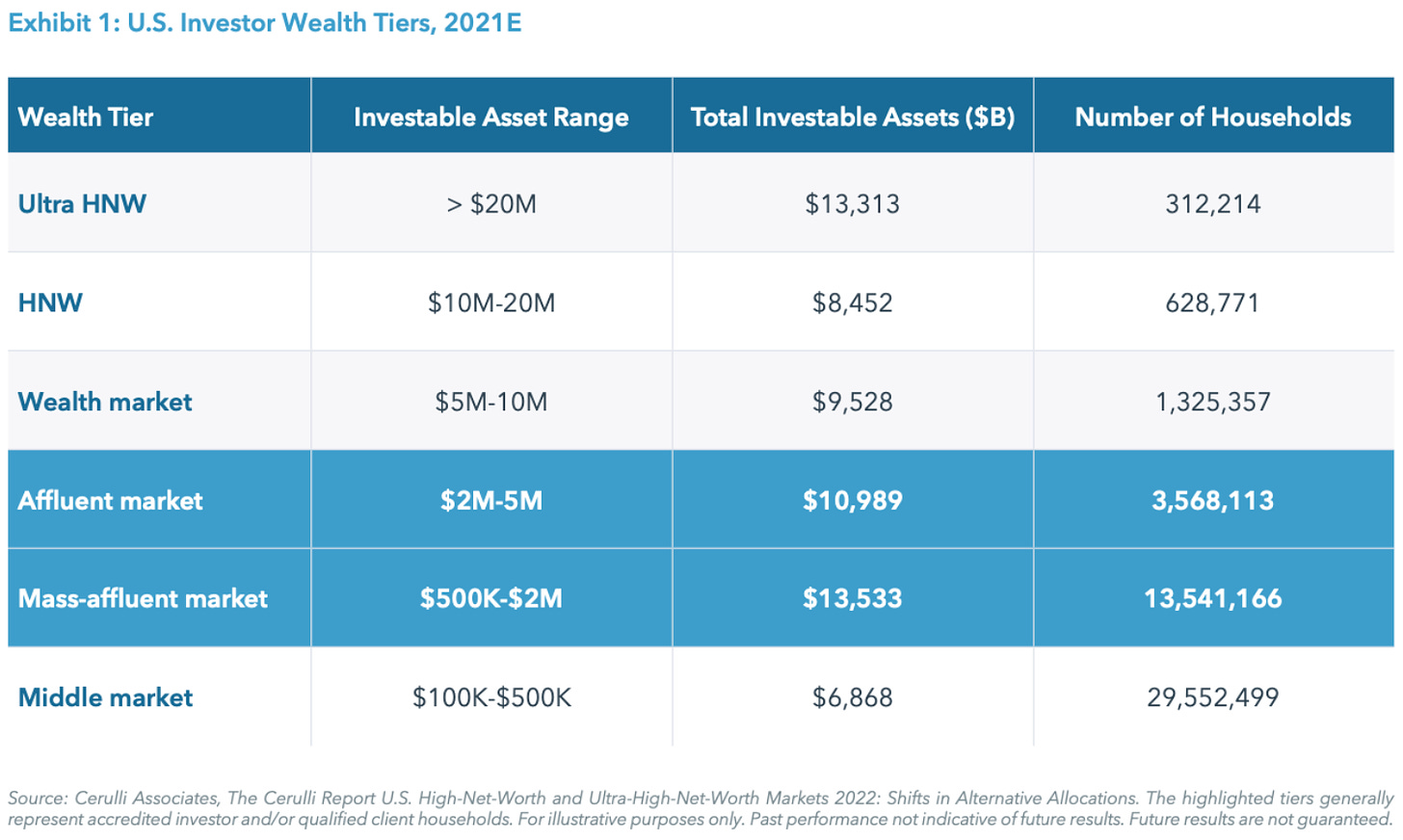

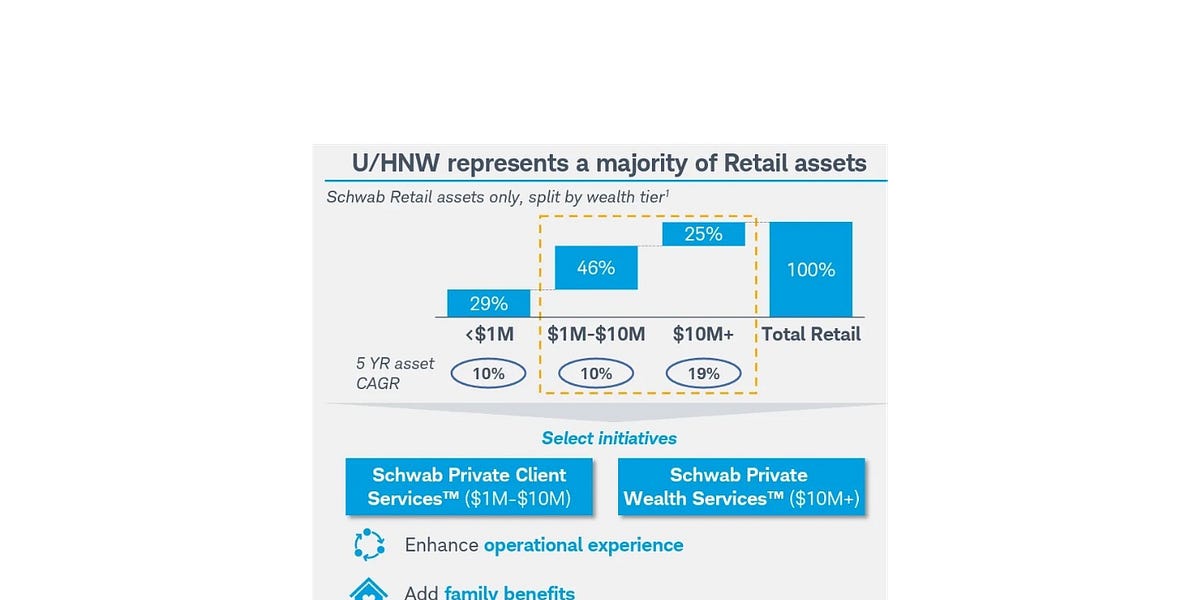

While alternatives have been available to high-net-worth individuals and accredited investors for some time, mass affluent investors, which represent more than 40% of the wealth market globally, have not historically had access to the asset class.

The mass affluent market is a massive portion of the wealth channel, accounting for 40% of the wealth market globally.

There’s a lot to play for — and with investors who have largely never had any exposure to private markets in the past.

That’s over $13.5T in the US alone (and that’s probably a bit outdated given that the data comes from 2021), according to a chart from the iCapital and Hamilton Lane “The Future is Evergreen” whitepaper.

Meeting the client where they are is a phrase that often comes up when asset managers and technology platforms discuss how to approach working with the wealth channel.

It’s a critically important mindset, as investors in the wealth channel have a number of features that require product innovation from asset managers.

It also means that there’s no one right answer to asset allocation strategy given the increasing set of choices for investors; it comes down to what’s the right choice for the specific client.

What are the different ways an investor can access private markets exposure?

Goldman published a white paper in October 2024 diving into the details on drawdown structures and evergreen funds. The white paper highlighted a number of different considerations that are important when thinking about private markets.

There’s no “universal ‘best’ choice,” they said. A chart from their white paper below illustrates why they believe that is the case.

Drawdown structures cede liquidity, investor discretion, and control. There’s the possibility for higher returns in drawdown structures, particularly in private equity and on an IRR basis, but it’s also worth noting that investment minimums have often made it prohibitive for many investors to access drawdown structures. Many firms, particularly those smaller in size and scale than the industry’s largest players, have yet to launch evergreen structures. So many investors, particularly those in the affluent and mass affluent channels, have been unable to access these funds and strategies.

Evergreen funds, on the other hand, enable access. The funds often allow for much lower investment minimums, sometimes as low as $1,000 or $10,000, which means that many investors in the wealth channel can access these funds. There is, however, less choice with these products. Goldman notes that the universe of US-domiciled evergreen funds at the time of writing was around 200 funds. That’s a small universe of product choices — and many of these funds are in its early days, meaning that investors may want to wait and see how the fund performs before allocation.

Public-private hybrid products and model portfolios add more options to the mix.

But a question sticks out in my mind. While the “why” of this product innovation makes sense, does the “how?”

Private markets must remain about returns. As Apollo’s Marc Rowan has said, private markets is about “excess return per unit of risk.”

As more capital flows into private markets and as more innovative products are structured and created, will returns remain in excess of public markets returns, net of fees?

I don’t doubt that the industry’s largest firms are acutely aware of these considerations — and also understand how critical it is to both deliver returns for investors and structure products in ways that work for their needs.

The industry is in the early days of working with the wealth channel. And it’s only just the start. The next major frontier is the $12T 401k / retirement market. Inserting private markets exposure into retirement accounts might require some of the innovation that firms are creating today in order for products to be eligible for the many requirements across liquidity and valuations that retirements products demand.

While the intent is certainly in the right place, is it possible that all of this product innovation is creating more complexity?

I wonder if there’s a simpler answer right in front of some firms and investors.

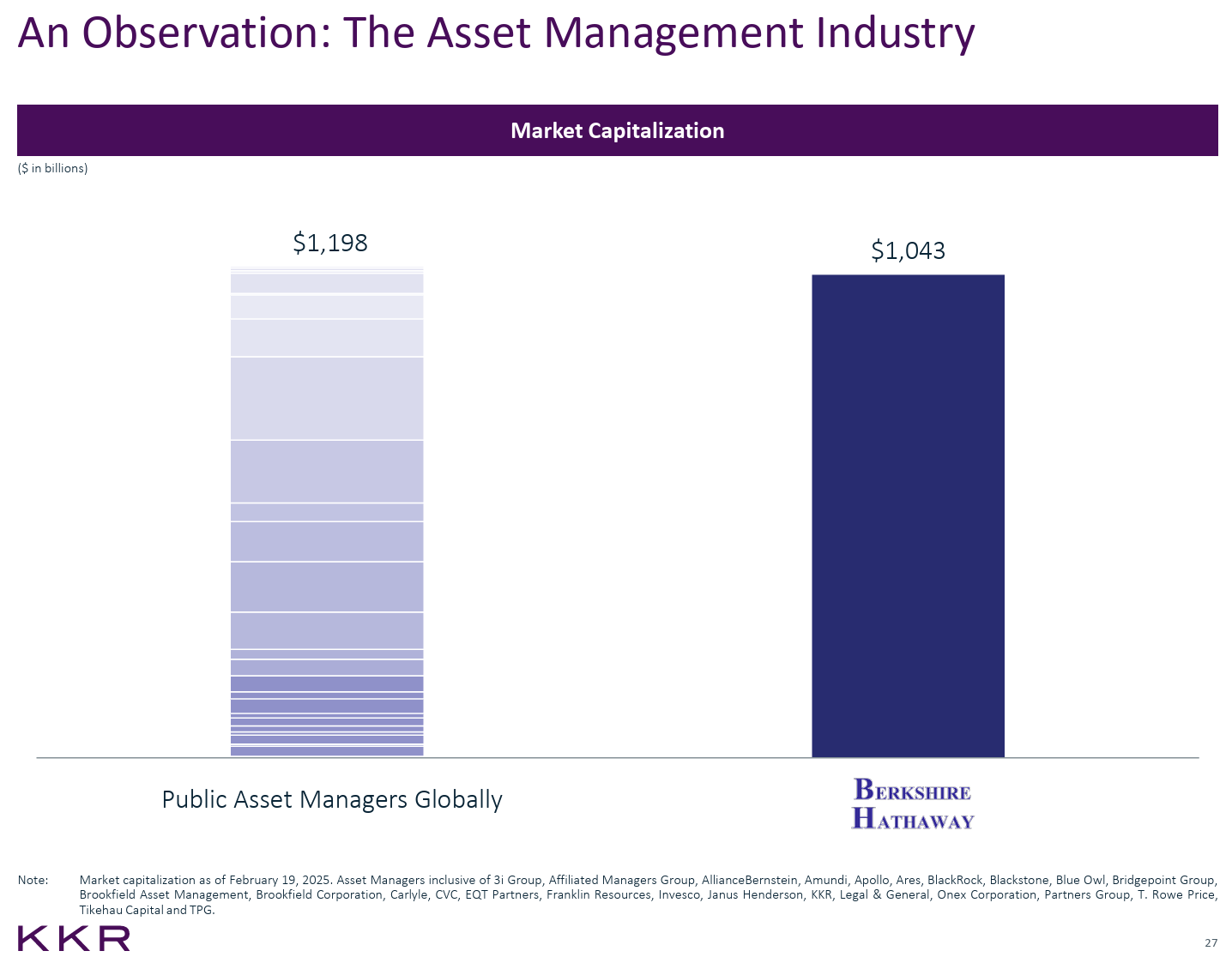

It was fascinating to see the talk about KKR’s Strategic Holdings business recently. Reportedly, KKR has been ramping up its investment off its balance sheet into businesses in a long-term ownership model, in a similar way to Berkshire Hathaway.

At the March Bloomberg Invest conference, KKR Co-CEO Joe Bae said “What we’re trying to build in Strategic Holdings is in some ways a mini Berkshire Hathaway.”

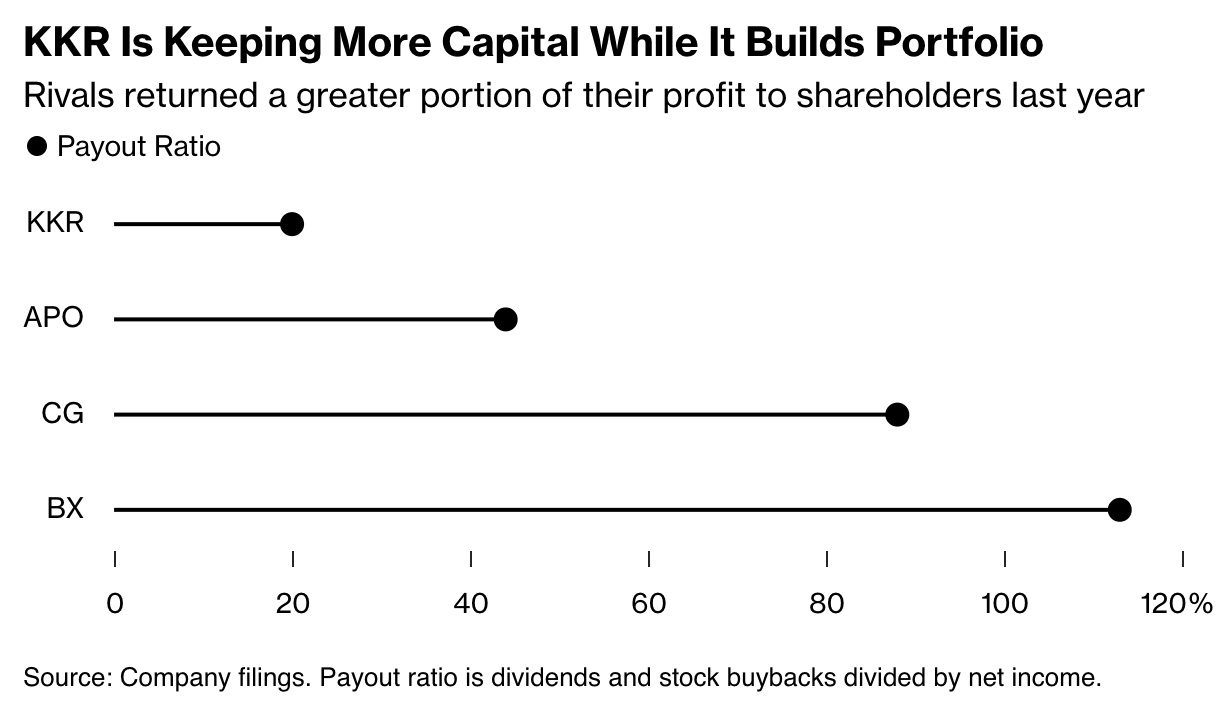

The firm has been keeping more of its capital on the balance sheet, which totals over $100B, to build out its portfolio as it reportedly aims to build a portfolio that can generate over $1B per year in dividends, as this chart from Bloomberg illustrates.

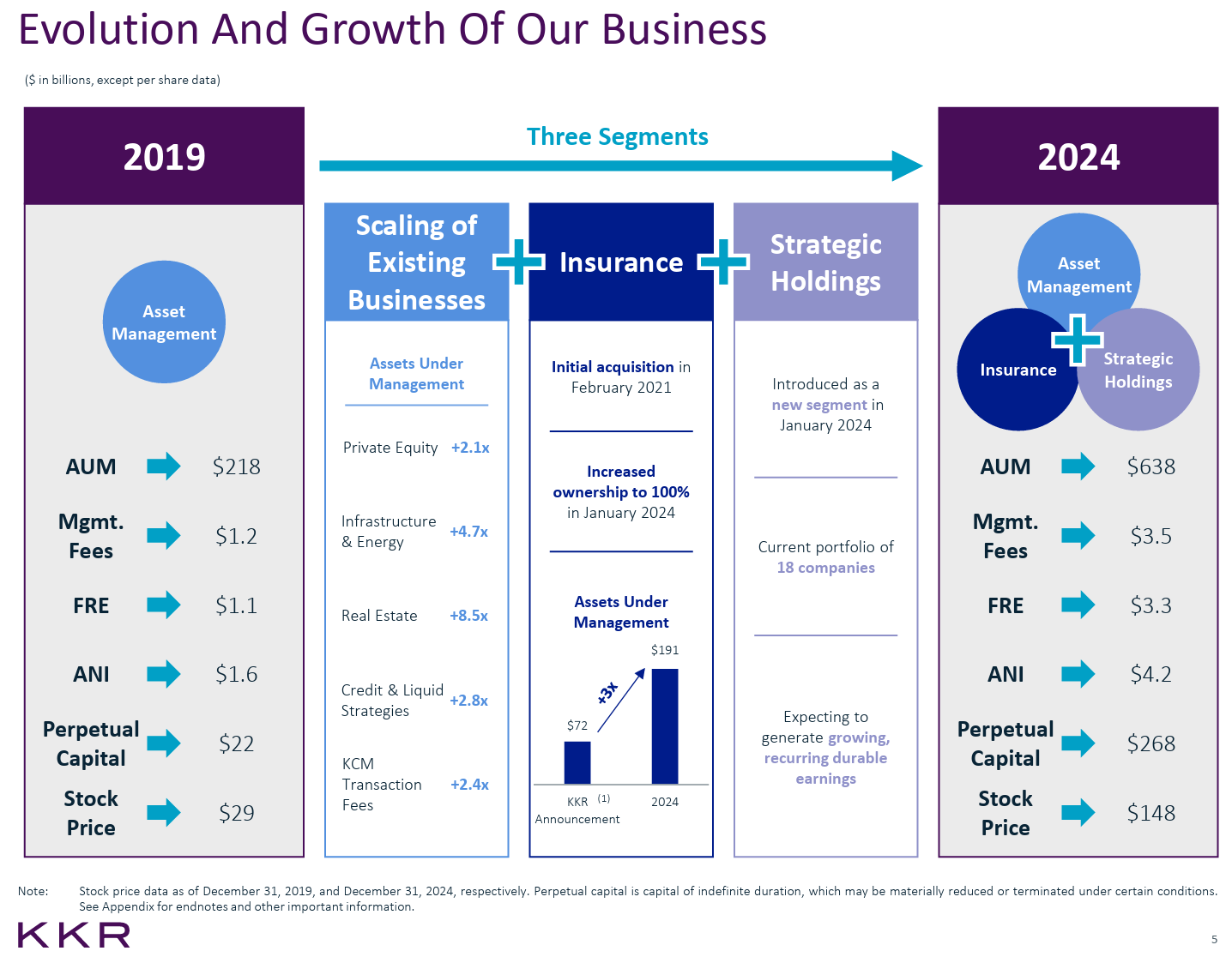

KKR’s February 2025 Overview Presentation provided more insight into the firm’s focus on building out its Strategic Holdings portfolio.

KKR lays out some compelling reasons to focus on long-term investments off its balance sheet.

Its reference point? Berkshire Hathaway.

In an August 2024 article in Fortune, Bae and Co-CEO Scott Nuttall discussed how they have learned from Berkshire Hathaway. “When Scott and I joined KKR, Berkshire’s market cap was $40B,” said Bae. “Now it’s $875B.” Adds Nuttall, “Buffett’s at 12 and a half, 13% [yearly gains] for 27 or 28 years, that’s how you get that,” noting the success of such long-term Buffett holdings as American Express and BNSF. “One of the things we learned: "invest in great businesses; let them continue to compound so they pay you cashflow; and allocate that cash back [to] new investments. That’s one of those insights [from] looking at what Buffett’s done.”

KKR has been busy investing off the firm’s balance sheet since January 2024 to build a diversified portfolio of 18 companies for the Strategic Holdings business. According to its Investor Day presentation, the collective portfolio has achieved 16% annualized revenue and EBITDA growth since 2018.

The investment strategy doesn’t deviate much from its Core Private Equity strategy, which has been a hallmark of the firm since its founding.

It’s just that the structure and product wrapper are different. Rather than invest in and own the aforementioned companies via its Private Equity funds, which in many cases have defined fund lives and require the firm to exit its positions, KKR’s Strategic Holdings unit has the ability to hold ownership positions in businesses for long — and even permanent — duration.

Strategic Holdings is just one of the three business segments at KKR. And its AUM focused business is still the critical component to the firm and its future success.

But it’s interesting to think about what growth in the Strategic Holdings segment could mean for the firm — and its shareholders and investors.

If the Strategic Holdings segment becomes a much larger part of KKR (and it’s worth mentioning that the firm has an Insurance segment as well following its acquisition of Global Atlantic in 2024), then it’s worth wondering if KKR could start to look more like Berkshire Hathaway from a stockholder’s perspective.

If alternative asset managers are looking to bring private markets into the wealth channel and into products like 401(k)s, well, publicly traded stock, like KKR, that is included in the S&P 500 is quite a simple, straightforward way for investors to have exposure to private markets.

Let me be very clear and state that owning the publicly traded stock of an alternative asset manager is not the same as investing into a drawdown private equity fund or an evergreen vehicle of a private markets investment strategy. These securities have different risk profiles, volatility metrics, and liquidity profiles. Public equity performance can behave in different ways than private equity fund performance for a number of reasons, including those that are out of control of the manager and the company at times. But if KKR continues to build its Strategic Holdings portfolio over time and it becomes a larger part of the firm’s revenues and dividend structure, then investing in KKR stock would offer indirect private markets exposure.

Interestingly, KKR employees own 30% of the firm’s stock. And KKR isn’t the only firm to offer meaningful stock-based compensation to its employees and executives. Ares did so recently, and other firms have also done the same.

KKR’s Strategic Holdings unit isn’t the firm’s first innovative move leveraging the concept of permanent capital or operating company structures.

KKR launched the K-Series Funds, including KKR Private Equity Conglomerate LLC (“K-PEC”).

Why is the K-PEC fund an LLC, one might ask? The company is structured as an operating company that was “formed to acquire, own, and control portfolio companies.”

K-Series, which also includes other strategies beyond K-PEC in private equity to span categories like infrastructure, has been successful in attracting capital from the wealth channel.

In the past year, K-Series AUM has almost tripled, from $7B to $18B by January 2025.

Other firms have begun to follow suit with the innovative operating company structure model.

EQT CEO Christian Sinding discussed in March 2024 at EQT’s Capital Markets Day about creating a “structure that is evergreen, across asset classes, even.” Sinding noted that these fund structures would enable EQT to hold assets they want to retain ownership of beyond the typical fund life of a drawdown private equity vehicle.

EQT’s Co-Founder and Chairman Conni Johnson echoed Sinding’s comments, saying there’s value in not being “forced to exit assets we know we can grow and make better in the long run.”

A year later, EQT has brought that vision to life. The firm has created a US private equity operating company, EQPE, led by Gautam Nadella that will invest alongside the firm’s core private market strategies, putting wealth clients side by side with EQT’s institutional investor base, according to an article recently written by Nadella.

Could these operating company / conglomerate structures be foreshadowing of a broader trend of firms looking to create holding company structures, leveraging their balance sheets to make investments into companies they look to hold for the long term?

Perhaps so. It seems that alternative asset managers are starting with specific funds that are structured as operating companies. Then, will the firms transition some of its investing activity to its balance sheets so that investors can gain exposure to its private equity activities via its publicly traded stock?

Berkshire Hathaway and KKR aren’t the only firms to create a holding company structure that investors can access via public markets.

Brookfield, Apollo, and Pershing Square have all built out their own versions of conglomerate or holding company structures.

Constellation Software has done this in the software industry, which gives rise to the question: would a software specialist like Vista Equity Partners or Hg Capital eventually do the same in software?

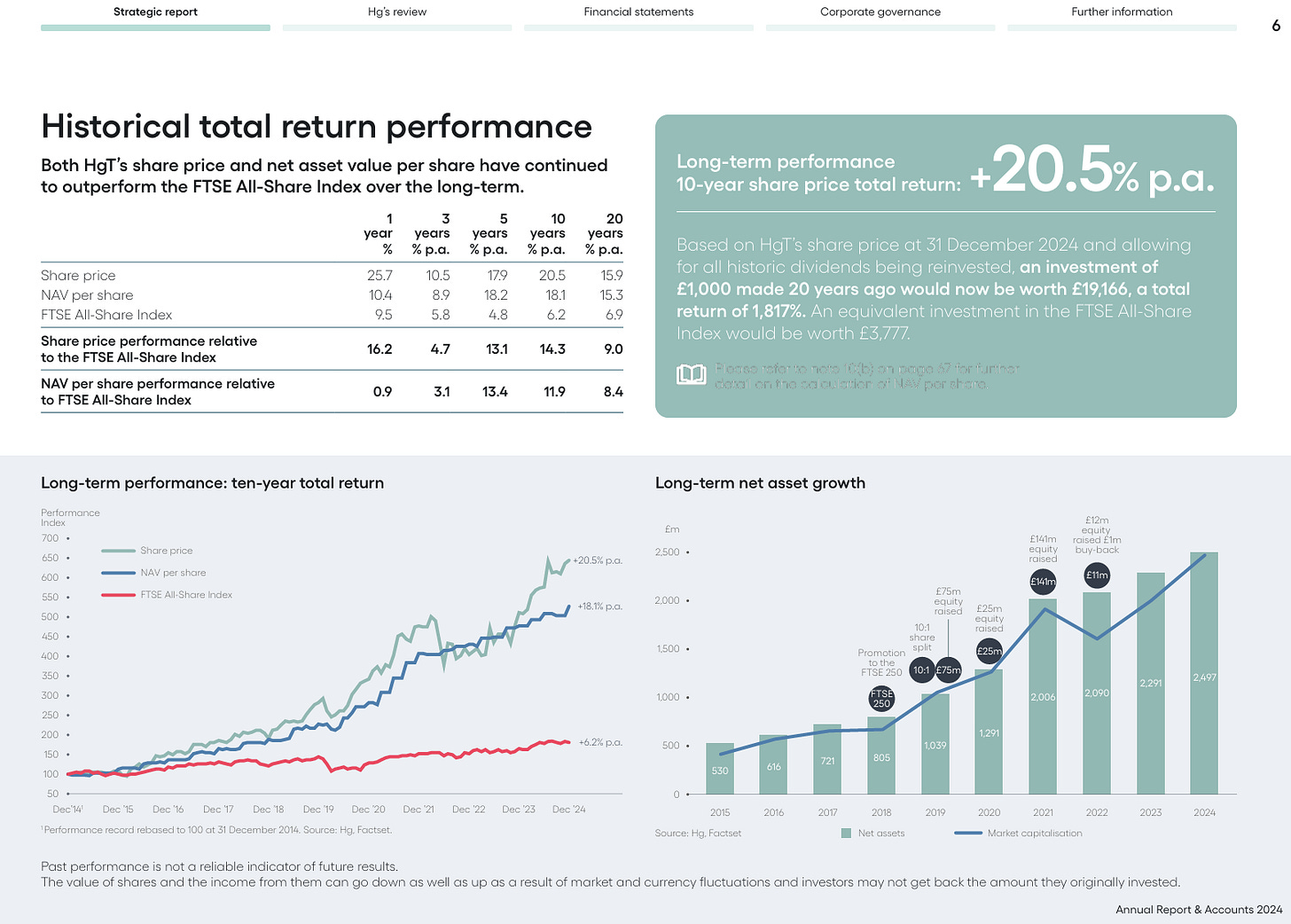

Although slightly different than the entire firm being a public company and having its stock tradable on an exchange, the privately owned Hg Capital has had a listed investment trust in the UK since 1989. Originally established in 1989 as a British investment trust, Hg Capital Trust (HgT) is now a FTSE 250 constituent, investing in unquoted companies sourced by its investment manager, Hg Capital, with its capital invested pro rata alongside Hg Capital’s institutional clients.

HgT’s performance over a long period of time has bested that of the FTSE All-Share Index, as the below chart from HgT’s 2024 Annual Report shows.

In a publicly traded entity like an investment trust, the share price sometimes trades at either a discount or a premium to NAV, which makes the behavior of this security different from owning an interest in a closed-end private equity vehicle, where a fund is able to exit its investments at a specific price, at a specific time. But this type of structure does enable anyone to invest into a portfolio of private companies.

As alternative asset managers evolve as businesses — and as traditional asset managers begin to think about how they can play a bigger role in delivering private markets exposure to investors’ portfolios — there’s plenty of innovation occurring as firms look to enable the individual investor to access private markets. There’s no one right way for investors to access private markets — there’s just a difference in choice and structure. As Goldman’s white paper on drawdown structures and evergreen funds highlighted, there are tradeoffs with each investment structure. New frameworks and structures will continue to be built to provide investors with access to private markets — and to both public and private markets simultaneously, as we just witnessed with the Blackstone, Vanguard, and Wellington partnership announced this past week.

But as increasing product innovation takes shape in private markets, is a simple answer looking right at the industry’s largest alternative asset managers: investing off the balance sheet into companies with the expectation of a long-term hold so that any investor can gain exposure to these investments indirectly by buying the firm’s stock? And will more of the industry’s largest firms look to follow in KKR’s footsteps?

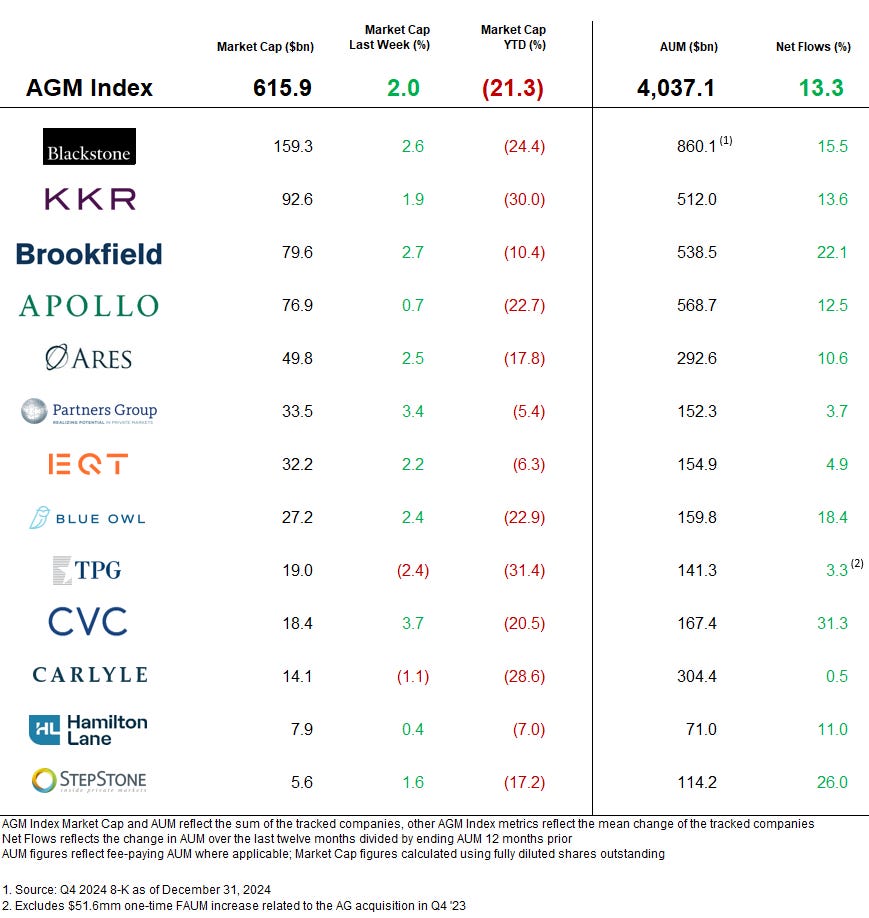

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

BlackRock asked portfolio managers what they see driving market returns over the next year. What did they say?

📝 How Cliffwater interval funds led a private wealth fundraising bonanza | Alexander Davis, PitchBook

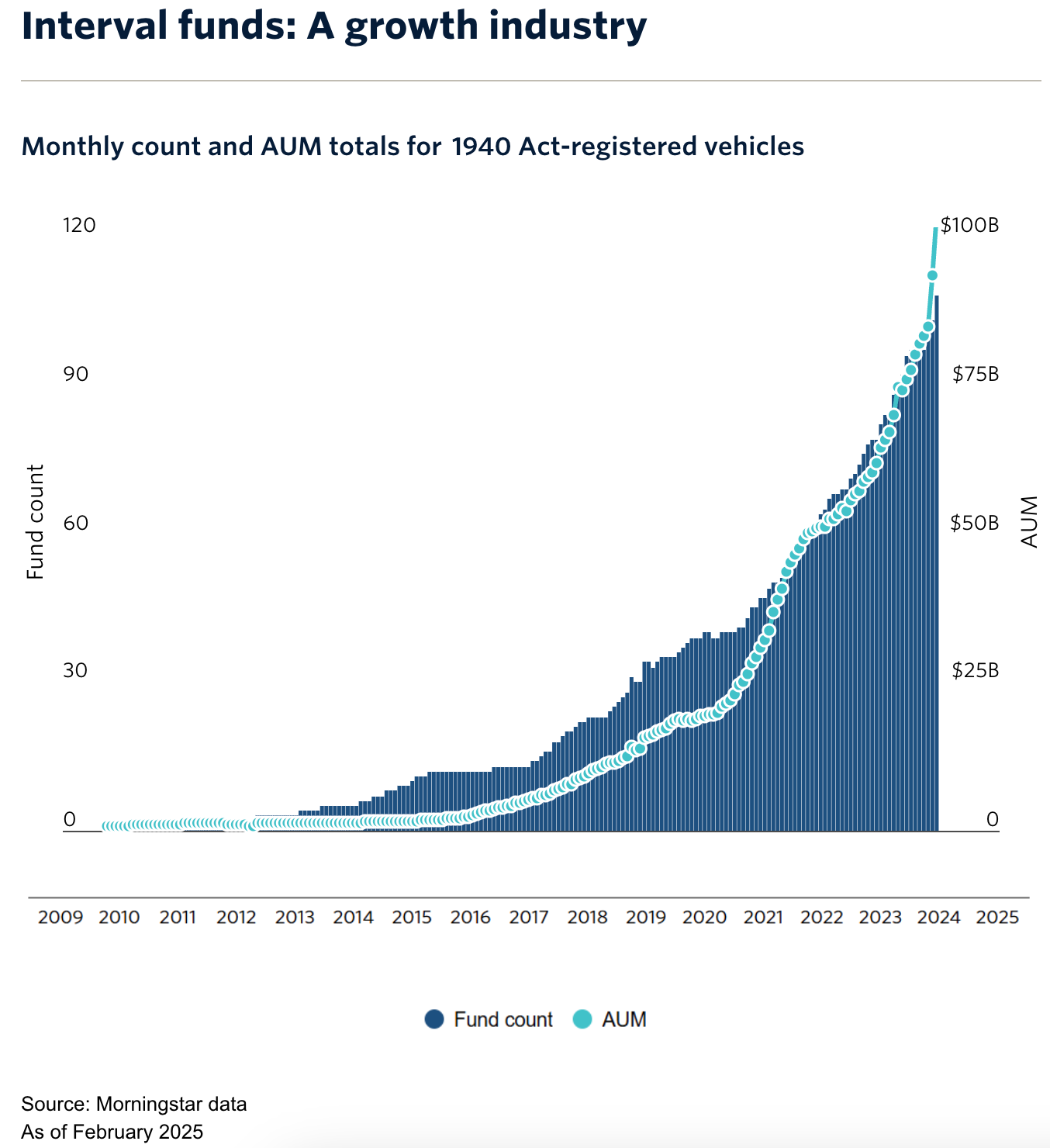

💡PitchBook’s Alexander Davis dove into the rise of Cliffwater’s interval funds and how it’s helped to propel an explosion of evergreen funds built for the wealth channel. Davis notes that one firm, which started its fund management business in 2019 with a debut evergreen fund dedicated to private credit across a diverse set of middle-market credit managers, has helped to shape the space. Cliffwater launched its flagship Cliffwater Corporate Lending Fund in 2019 and has grown to over $28B, largely from the wealth channel. Cliffwater chose an interval structure with a ticker symbol (CCLFX) that trades on the Nasdaq. Cliffwater’s focus on the wealth channel by serving up an evergreen interval fund comes at a time when interval funds are becoming an increasingly popular way for firms to launch products designed for the wealth channel.

Cliffwater’s rapid growth has served as somewhat of a blueprint for others looking to replicate its success. To meet the demands of many RIAs, firms are creating evergreen structures. “Semi-liquid investment products are a game-changer for the registered investment adviser community,” said Dave Donahoo, Head of US Wealth Management in Franklin Templeton’s alternative assets division. “RIAs are looking for more scalable options.”

Evergreen capital has driven fundraising activity for many of the largest alternative asset managers. According to PitchBook research, evergreen or perpetual capital made up 41% of the capital raised by the top publicly traded alternative asset managers in Q4 2024. Lowering the barriers to entry has been a major driver of these products’ success. Many evergreen structures have lower investment minimums, enabling advisors to allocate larger portions of client assets to these private markets products.

Cliffwater has outpaced its peers when it comes to raising capital through interval funds. The firm’s three vehicles totaled $36B as of March 31, 2025, according to the firm. Its AUM in these structures only falls short of Blackstone and Blue Owl. And it’s not just individual investors that are interested in evergreen structures. Some institutional investors are allocating to interval funds as well. Head of Portfolio Solutions at Cliffwater Phil Huber noted that there’s value in having capital start to compound right away. “Whereas in the evergreen structure, you just retain more control over entry and exit timing, position sizing, and rebalancing over time,” Huber said. “That semi-liquidity feature can be helpful in that regard.”

The big question on funds’ and allocators’ minds? Liquidity. Asset liability management is critical with these fund structures. In an interval fund, managers are generally expected to buy back up to 5% of NAV at certain intervals. Managers are not always obligated to do so, but they are expected to make a best efforts case to provide liquidity to investors. The bigger the fund grows in size, the larger the liquidity pool a fund must have to draw on in the event that the fund buys back shares at NAV. Cliffwater’s flagship fund, now at $28B, must maintain $1B in liquidity to manage redemptions.

💸 AGM’s 2/20: The evergreen fund market is at an interesting inflection point. It makes sense that the industry’s largest alternative asset managers (and traditional asset managers) are launching funds to serve the wealth channel.

The wealth channel is not one defined investor type. There are many different sub-channels within the wealth channel — it’s far from monolithic, as I discussed in the 10.13.24 AGM Alts Weekly. UHNW private bank clients and multi-billion dollar AUM family offices comprise part of the wealth channel. So do the 13.5M mass-affluent households that hold over $13.5T of assets (as of 2021).

Delivering investment products that serve the wide-ranging characteristics of the wealth channel is not easy. It requires engineering the entire operation of a firm — from pre-investment to post-investment — in a manner that can deliver on what’s required with an evergreen structure, from deal sourcing and pipeline management to proper portfolio construction and management to liquidity management and operational resourcing. There are only a certain number of firms that have the resources to build, market, and manage these types of investment structures. But surely, many firms are looking at Cliffwater’s rapid rise and wondering how they can do the same.

What Cliffwater did is not so easy, however. Not only did they start with a unique advantage — the creation of the Cliffwater Direct Lending Index, the industry’s first private credit benchmark — but the firm was also an early mover in creating diversified exposure to private credit by working with 20+ “premier partners,” as Cliffwater notes in the CCLFX materials. At $28B in AUM, CCLFX has become somewhat of an “index” of the private credit category, offering exposure across a variety of sponsors, industries, and underlying credits in a way that another investment firm that provides access to only their own funds cannot offer. Firms will approach the evergreen fund structure space in ways that they see fit. But firms that are independent and can partner with sponsors due to their previous perch as either an investment consultant or an access point — such as Cliffwater, Hamilton Lane, Stepstone, iCapital, and others — are well-positioned to grow and scale evergreen structures over time.

📝 The Troubles That Continue to Plague Private Capital Created a Windfall for One Market | Michelle Celarier, Institutional Investor

💡Institutional Investor’s Michelle Celarier observes that secondaries could come first in the current market environment. A challenging fundraising environment, delayed distributions, and an uncertain timeline for exits could be setting up secondaries to have another strong year. In 2024, secondaries had a record year, raising what PitchBook estimates was $101.6B. This figure bested 2023 by 23%. The secondaries market is helping to make up for the lack of distributions from private equity funds, a trend that has been occurring since 2022. And tariffs and market instability in 2025 are influencing the market in a way where secondaries could play an important role in providing liquidity. “It’s like the gears of the economy are grinding, and the only release valve is the secondaries market,” said Charles Jaskel, co-founder of New Vintage Partners, a secondaries firm founded in 2023 to buy investors’ stakes in venture capital and growth funds in the wake of the 2022 downturn. It’s likely that investors will be increasingly looking to the secondary market for liquidity if capital markets activity is dampened due to volatility and uncertainty. LP-led transactions experienced a tighter spread in 2024 than 2023, with the average deal coming in at 89% of NAV, less than the 85% discount in 2023, according to Jefferies’ 2024 global secondary market report. Jefferies noted that GP-led secondaries were also a large part of the secondaries market. Jefferies said that GP-led secondaries are approximately 45% of the market, with a portion of the activity coming via continuation vehicles.

💸 AGM’s 2/20: Secondaries sit in an interesting place in private markets — and one that is becoming increasingly more interesting as a few major trends impact private markets. Private companies are staying private longer. There are now new vehicle structure innovations, such as continuation vehicles, that enable managers to hold assets for longer periods of time rather than entirely exit those positions. And the current market dynamics mean that LPs may be seeking liquidity either because they want to or have to. Yale’s recent federal funding challenge has resulted in the endowment seeking to sell up to $6B of its private equity portfolio in the secondaries market. A recent survey from Coller Capital in the firm’s 41st edition of the Global Private Capital Barometer finds that the majority of the LPs surveyed by Coller declined to re-up with current GPs in large part due to performance or capital availability. LPs look to consolidate relationships with fewer GPs, a trend that has been the case for a period of time. But another big reason why LPs are less likely to re-up with GPs is partly due to the lack of distributions. As a result, many LPs view secondaries as a core part of their private markets asset allocation strategy because it can play a key role in active management of their private markets portfolio. This view should only serve to help the largest secondaries firms both in terms of capital raising efforts and in terms of LP-led secondaries dealflow. It, therefore, shouldn’t come as a surprise that some of the largest fundraises as of late have come from the industry’s leading secondaries firms. Ardian recently closed on the largest ever secondaries fund to date earlier this year, bringing in $30B of capital for its ninth fund. This figure was significantly larger than its prior fund, Fund 8, which raised $19B in 2020. The wealth channel was an integral part of Ardian’s fundraise, accounting for 22% of the capital raise, which was double the figure from its prior fund. Ardian’s successful fundraise follows Lexington Capital Partners X, the largest secondaries fundraise in 2024, where the firm brought in $22.7B, and Dover Street XI, HarbourVest’s secondaries strategy, which was oversubscribed at $15.1B. Given some of the recent market dynamics, it looks like secondaries firms that have recently raised and have dry powder to put to work in the coming years will have an opportunity to deploy capital at a atime when LPs and GPs are looking for avenues for liquidity.

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Investor Relations Professional. Click here to learn more.

🔍 KKR (Alternative asset manager) - Global Wealth Solutions - Investor Relations - Principal - Japan. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of Global Product Marketing Management. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Credit Executive Office, Senior Associate / Associate. Click here to learn more.

🔍 Brookfield (Alternative asset manager) - VP, Private Markets Products. Click here to learn more.

🔍 Vista Equity Partners (Alternative asset manager) - Coverage Associate, Strategic Partnerships (Private Wealth). Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Private Markets, Due Diligence Manager – Senior Vice President. Click here to learn more.

🔍 Goldman Sachs Alternatives (Alternative asset manager) - Private Markets for Wealth - Executive Director - Frankfurt. Click here to learn more.

🔍 MSCI (Capital markets research, data, technology provider) - Vice President, Private Assets Product. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Head of Registered Alternative Products. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🔍 Hightower Advisors (Wealth management platform) - Manager, Merger & Acquisitions. Click here to learn more.

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

Partner with Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Cantilever Group’s Co-Founder and Managing Partner Todd Owens in a live podcast from BTG Pactual’s NYC office share why GP stakes can be the best of all worlds. Watch here.

📝 Read The AGM Op-Ed with Arcesium Private Markets Head Cesar Estrada on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch BlackRock’s Head of the Americas Client Business Joe DeVico, Head of Product for US Wealth & Head of Alts to Wealth Jon Diorio, and Partners Group's Co-Head of Private Wealth Rob Collins discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch the third episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch Brookfield Oaktree Wealth Solutions CEO John Sweeney discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Cerity Partners’ Partner & Chief Client Officer Tom Cohn and Partner Amita Schultes talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

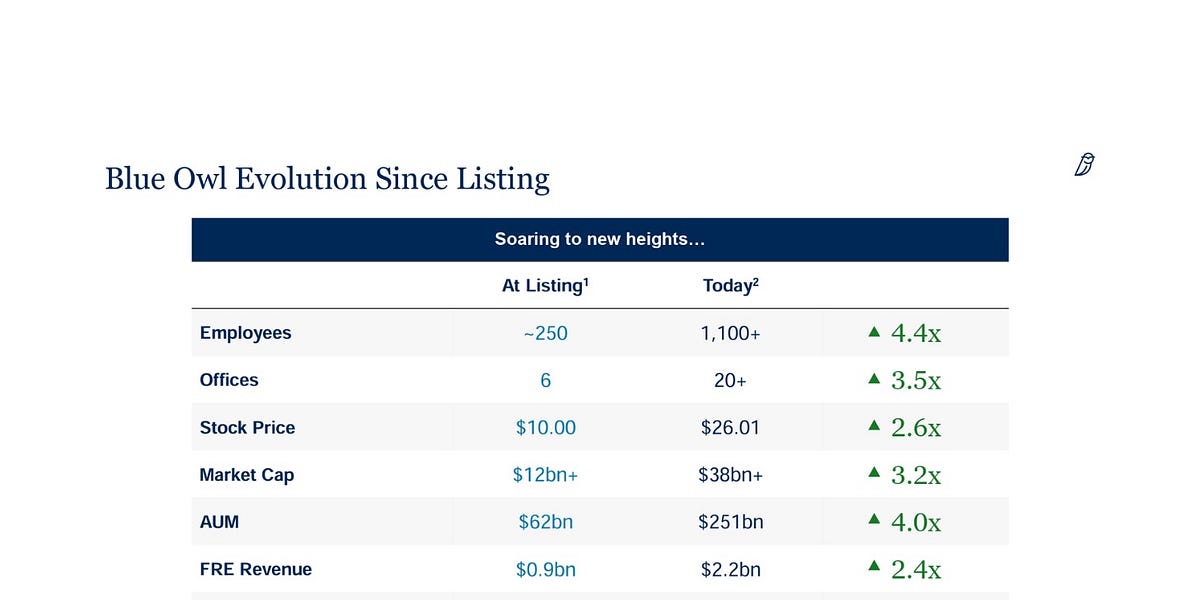

🎥 Watch Marc Lipschultz, Co-CEO of Blue Owl, talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Blue Owl Co-CEO Marc Lipschultz, where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to Stephanie Drescher, Partner & Chief Client & Product Development Officer of Apollo, discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch Eric Satz, Founder & CEO of Alto share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch Mike Tiedemann, CEO of $72B AUM AlTi Global share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch Joan Solotar, Global Head of Private Wealth Solutions at Blackstone share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Thank you for reading Alt Goes Mainstream by The AGM Collective. If you enjoyed this post, share it with anyone you know who is interested in private markets.