AGM Alts Weekly | 4.27.25: Asset managers making moves on the Big Board?

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good morning from Washington, DC, where I’m back from a week of meetings and podcasts in NYC.

The NFL Draft took place this weekend. It’s the annual opportunity for teams to improve their rosters and for the next wave of talented young football players to make their mark in professional football.

Last year, I wrote about the diligence paradox — about how what’s on paper doesn’t always pencil out to success, as former NFL players Ryan Kalil and Damiere Byrd shared in the 4.28.24 AGM Alts Weekly.

That rings true whether it’s the NFL or investing.

When picking players, some teams and general managers aim to match talent with need and fit. Others look for “best player available” (BPA), stockpiling talent — and potential assets to trade — with an eye towards the future.

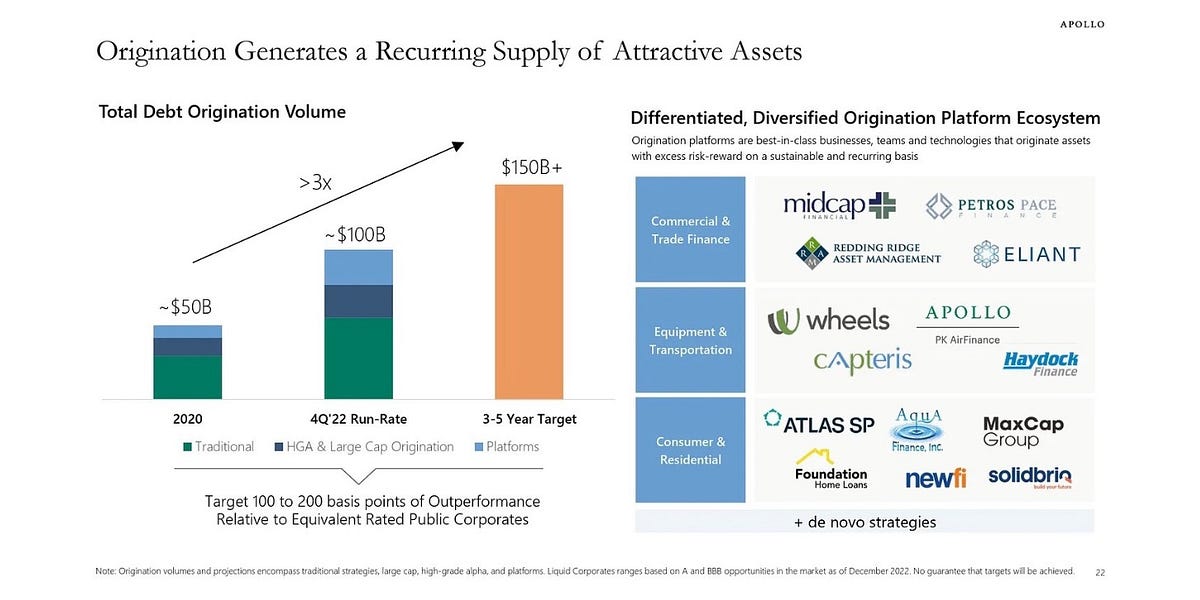

Last week, Apollo announced quite an interesting move that signals a stockpiling of more talent and more offerings — with an eye towards shaping the future of the firm.

Apollo launched a new division, New Markets, that will combine four business lines: traditional asset management, defined contribution, tax-advantaged solutions, and digital markets. The division, which will be led by 17-year Apollo veteran and Global Head of Strategy Neil Mehta, will aim to bridge alternative asset management and traditional asset management.

Apollo also identified the leaders of each initiative within the New Markets Group.

Apollo’s Andrew Gosden will oversee traditional asset management. Steve Ulian will lead defined contribution, working with Sean Brennan and Rebecca Tadikonda at Apollo’s Athene unit. John Hillman will manage the tax-advantaged solutions line, and digital markets will be led by Christine Moy.

What is Apollo looking to achieve?

Bridging the worlds of public and private.

The prize is worth playing for.

Apollo CEO Marc Rowan and President Jim Zelter reportedly noted in the memo that the potential pool of assets it could tap across the four business lines totals $60 trillion, with around $40 trillion in actively managed public assets and around $20 trillion in defined-contribution plans.

This announcement follows BlackRock CEO and Chairman Larry Fink’s Annual Letter, where arguably the most notable characterization he made was that $11T AUM BlackRock is no longer a traditional asset manager.

BlackRock has always had a foot in private markets. But we’ve been—first and foremost—a traditional asset manager. That’s who we were at the start of 2024. But it’s not who we are anymore.

As I wrote in the 4.6.25 AGM Alts Weekly, BlackRock is very much a private markets behemoth following its monster acquisitions of GIP and HPS.

Following the acquisitions of HPS and GIP, BlackRock’s private markets franchise stands at over $600B in AUM, placing it amongst the top five managers of alternative assets by AUM. According to figures cited in Fink’s letter, the franchise generates over $3B in revenue.

BlackRock is certainly operating at the intersection of both public and private markets — and the firm is right in the middle of two industries that appear to be on a path of convergence.

Perhaps Apollo’s moves here shouldn’t come as a shock. These two worlds are converging, in part due to Rowan’s framework for looking at the way the markets structures of both public and private markets are evolving.

Rowan has often posed the thought-provoking question: “What is public? What is private? What is safe and what is risky?” In his answers, he’s shared the view that private markets can be either safe or risky, much like public markets, with the main difference being liquidity, not risk.

If private markets can be both safe and risky, and public markets can be both safe and risky, perhaps allocators should be re-thinking how they approach both public and private.

Equity becomes a decision between public and private — and a choice of where investors want to sit on the spectrum of liquidity (and risk). Same with credit. I wrote about this framework for asset allocation in the 1.14.24 AGM Alts Weekly, as investors may be changing the way they approach asset allocation.

Buckets and spectrums rather than slices of a pie

Are we moving towards a world where allocators live in buckets and spectrums rather than slices of a pie? What I mean by this is that allocators will look at their equity bucket across the spectrum of public equity and private equity and allocate accordingly, rather than think about their private equity exposure as a different piece of the pie than equities. Same with credit. This sentiment echoes what a number of others in private markets, including Apollo’s Chief Client & Product Development Officer Stephanie Drescher and iCapital’s Chairman & CEO Lawrence Calcano, have said.

This re-shaping of risk is making alternative and traditional asset managers re-think how they build investment solutions for the wealth channel.

Perhaps this explains why Apollo, an alternative asset manager, would want to move closer to the traditional asset management world by building out its New Markets division. If the firm can become a manufacturer of product that combines both public and private, which they’ve already started doing through partnerships and the buildout of hybrid public / private credit products, then they might as well figure out how to own the entire value chain, not to mention innovate their way to the future state of asset management. This future state might include lower fees, hybrid products, and turnkey solutions that include model portfolios, not to mention digital solutions, such as distributed ledger and tokenization, which could help drive down costs to administer products that include greater numbers of smaller investors.

On Draft Day, General Managers are thinking about their board and what moves they need to make to improve their team.

Now, let’s go to the big board for private markets.

What’s the next move on the board for the industry’s largest alternative asset managers?

After GIP’s $12.5B acquisition by BlackRock, there are a few large infrastructure managers that remain independent. Firms like Stonepeak ($73B AUM), DigitalBridge ($96B AUM), and Antin Infrastructure Partners (€33B AUM) stand tall as pure-play infrastructure investment firms.

The past few years have seen large alternative asset managers make moves on their draft board to build out multi-strategy capabilities, which include infrastructure. CVC bought DIF. General Atlantic bought Actis.

Many of the publicly traded alternative asset managers have built out infrastructure investment businesses. Blackstone, Brookfield, KKR, EQT, Apollo, Ares, Blue Owl, Carlyle, Partners Group, Bridgepoint, Eurazeo, and Tikehau all have infrastructure or real asset investment strategies.

TPG does not yet have a dedicated infrastructure strategy. Could they be the next firm to acquire an infrastructure specialist?

Could an infrastructure specialist look to combine with another large asset manager that possesses specialist qualities in another category?

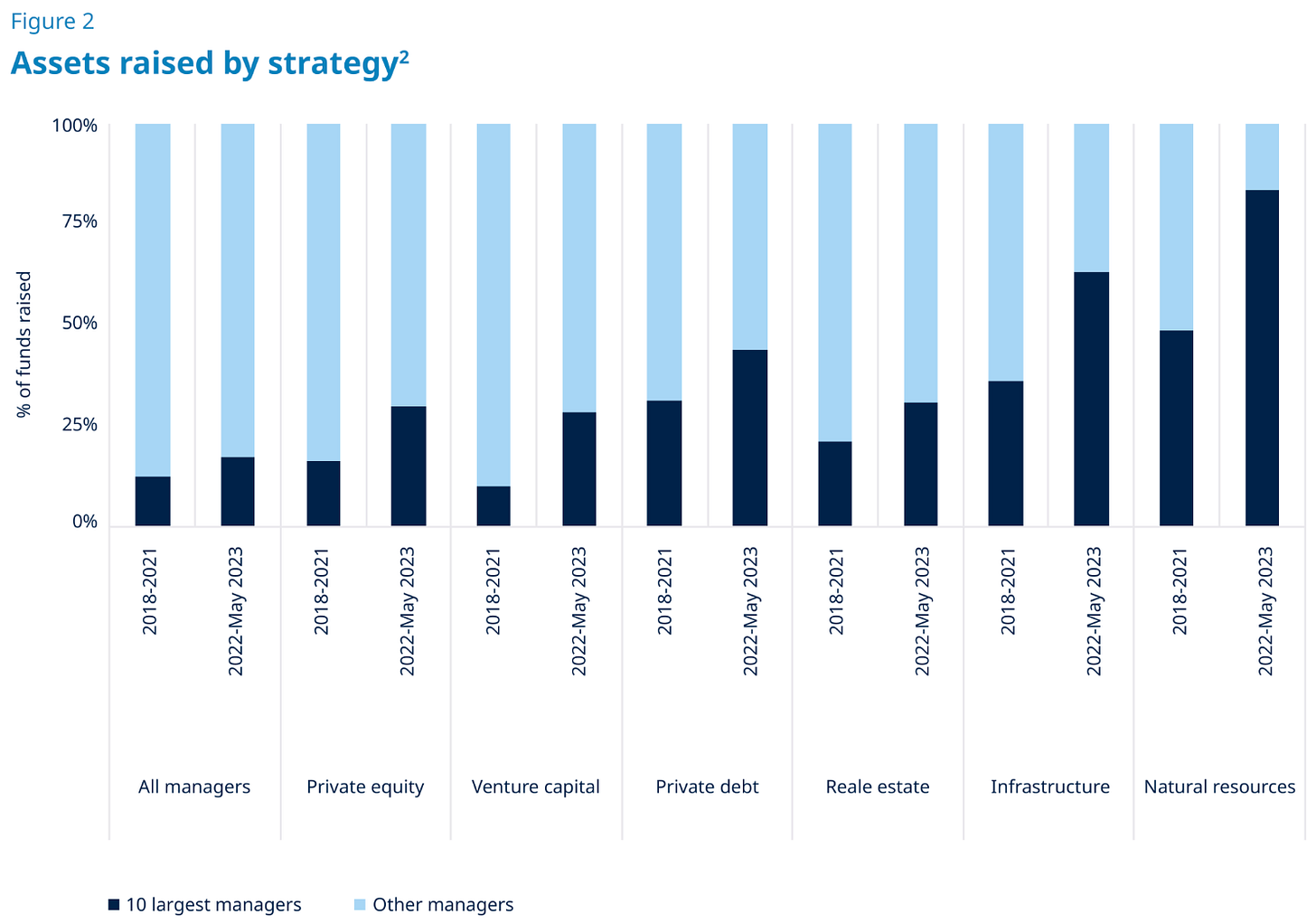

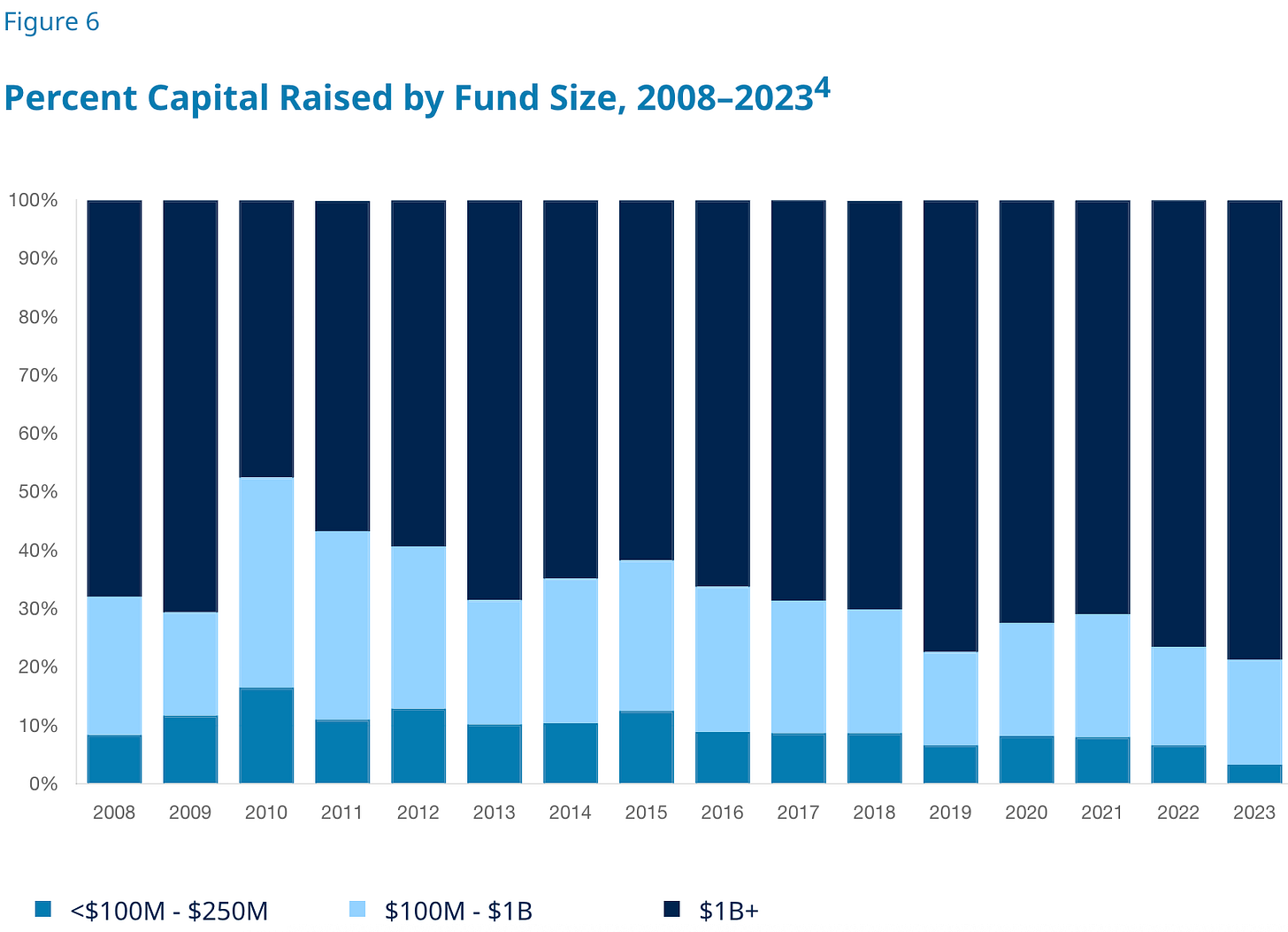

Infrastructure is an asset class where scale can help win deals with certainty of capital. So, capital formation will likely concentrate with the largest firms. Multi-strategy platforms will want to continue to position themselves to be able to aggregate meaningful amounts of capital, so the largest infrastructure managers should continue to raise the largest quantum of assets, as the below chart from Blue Owl’s 2024 Market Outlook illustrates.

Secular trends and structural dislocations define the current state of the secondaries market.

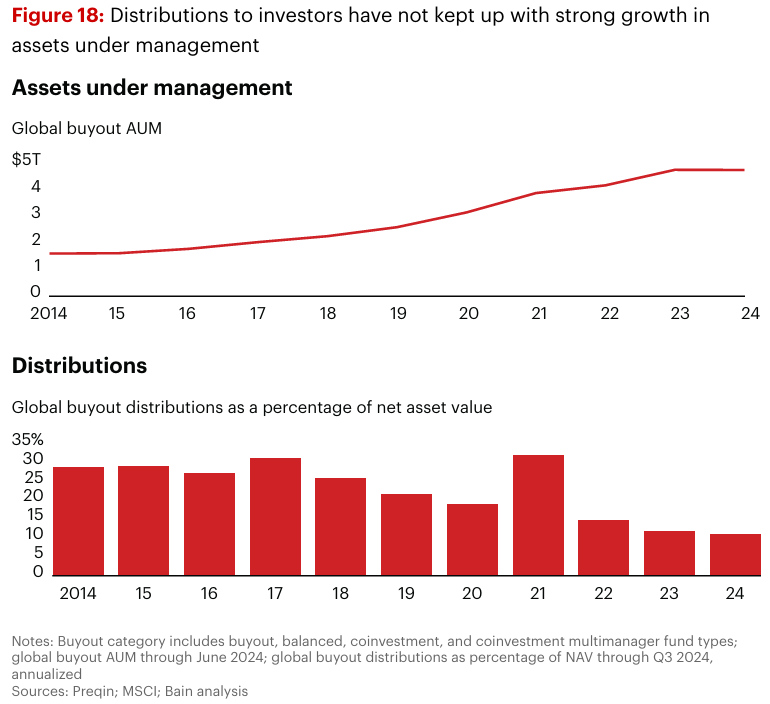

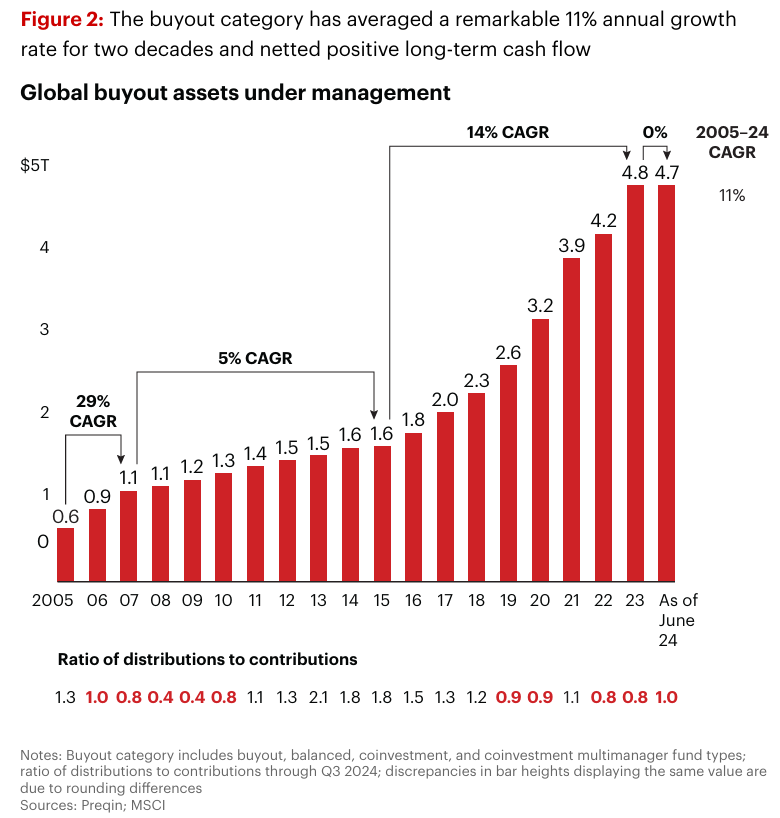

In private equity, distributions have failed to outpace AUM growth in recent years, as the below chart from Bain & Company’s 2025 Global Private Equity Report shows.

2022 and 2023 proved to be tough years for distributions. Distributions ground to a halt in recent years, with the ratio of distributions to contributions coming in at 0.8 in both 2022 and 2023.

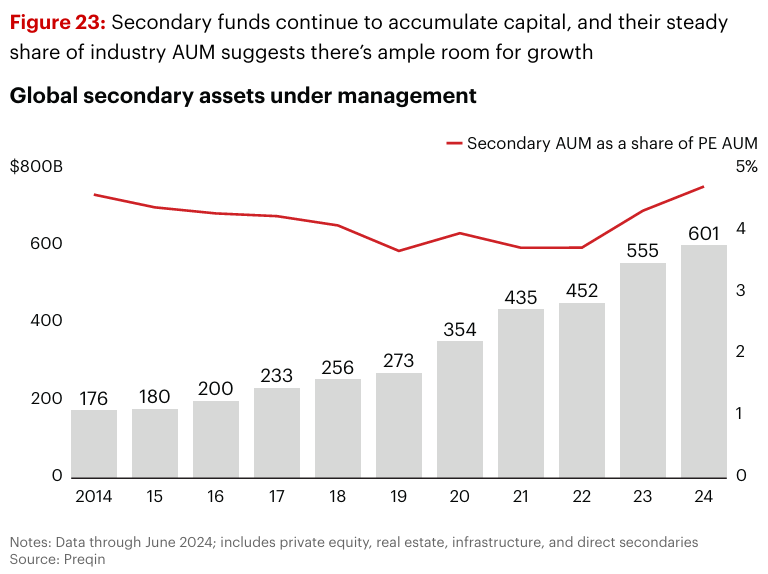

Secondaries firms continue to grow their share of AUM relative to overall PE AUM.

And recent denominator effect challenges and regulatory headwinds for many of the industry’s largest institutional investors, such as Yale and Harvard’s endowments, mean that structural dislocations are being created for secondaries buyers to purchase assets from LPs that are seeking liquidity.

On the GP side, the continuation vehicle (CV) market continues to grow to provide a solution for managers that want to hold onto high-quality assets in private markets but also provide a liquidity solution to existing fund LPs.

The secondary market has already begun the process of consolidation. Franklin Templeton acquired Lexington Partners. Ares acquired Landmark. CVC acquired Glendower Capital before going public.

Just this past week, it’s been reported that TA Associates is said to be nearing an agreement to purchase a significant stake in $4.2B AUM secondaries firm Kline Hill, valuing the firm at around $500M. It looks like TA has beaten out Sixth Street, Bridgepoint, First Eagle, and Tikehau, all of whom don’t currently have a secondaries solution.

Who else is on the big board?

Coller Capital (which has a minority stake from Hunter Point), Dawson Partners, AltamarCAM (in which Permira owns a 40% stake), Banner Ridge Partners (which has a minority stake from Investcorp), Adams Street Partners, Industry Ventures (which has a minority stake from Petershill), Pomona Capital could all become targets for larger alternative asset managers and traditional asset managers that want to add secondaries capabilities.

Secondaries are also a very attractive strategy for the wealth channel, particularly as an entry product for many new investors, so adding secondaries capabilities could make sense for a larger manager that’s looking to work with the wealth channel. In many cases, secondaries offer instant vintage diversification, strategy diversification, and a reduced J-curve that might appeal to advisors and wealth clients.

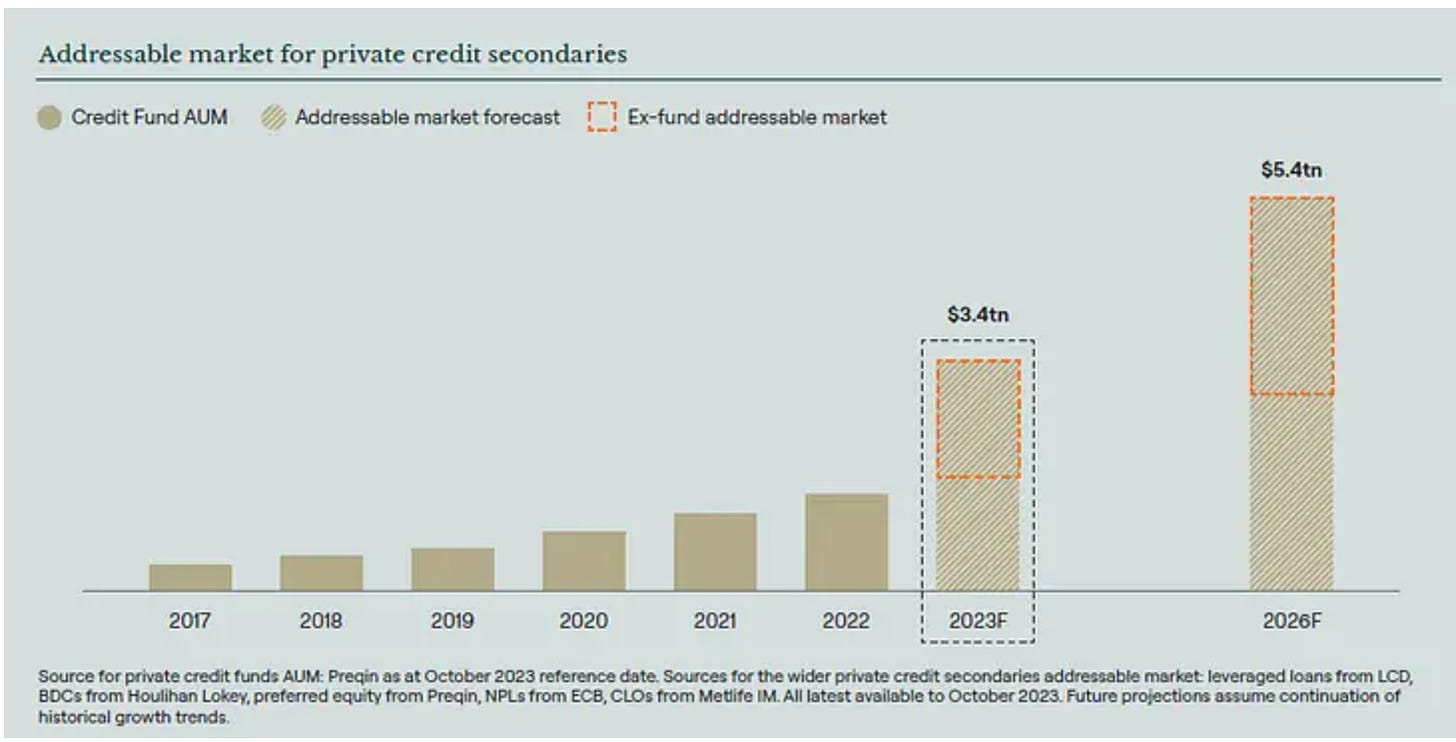

Private credit secondaries, while a smaller part of the secondaries ecosystem, should only continue to grow as private credit expands into a multi-trillion dollar asset class.

An illustration in an August 2024 Coller Capital report on private credit secondaries highlights the growth in private credit — and the opportunity set for private credit secondaries in a growth market.

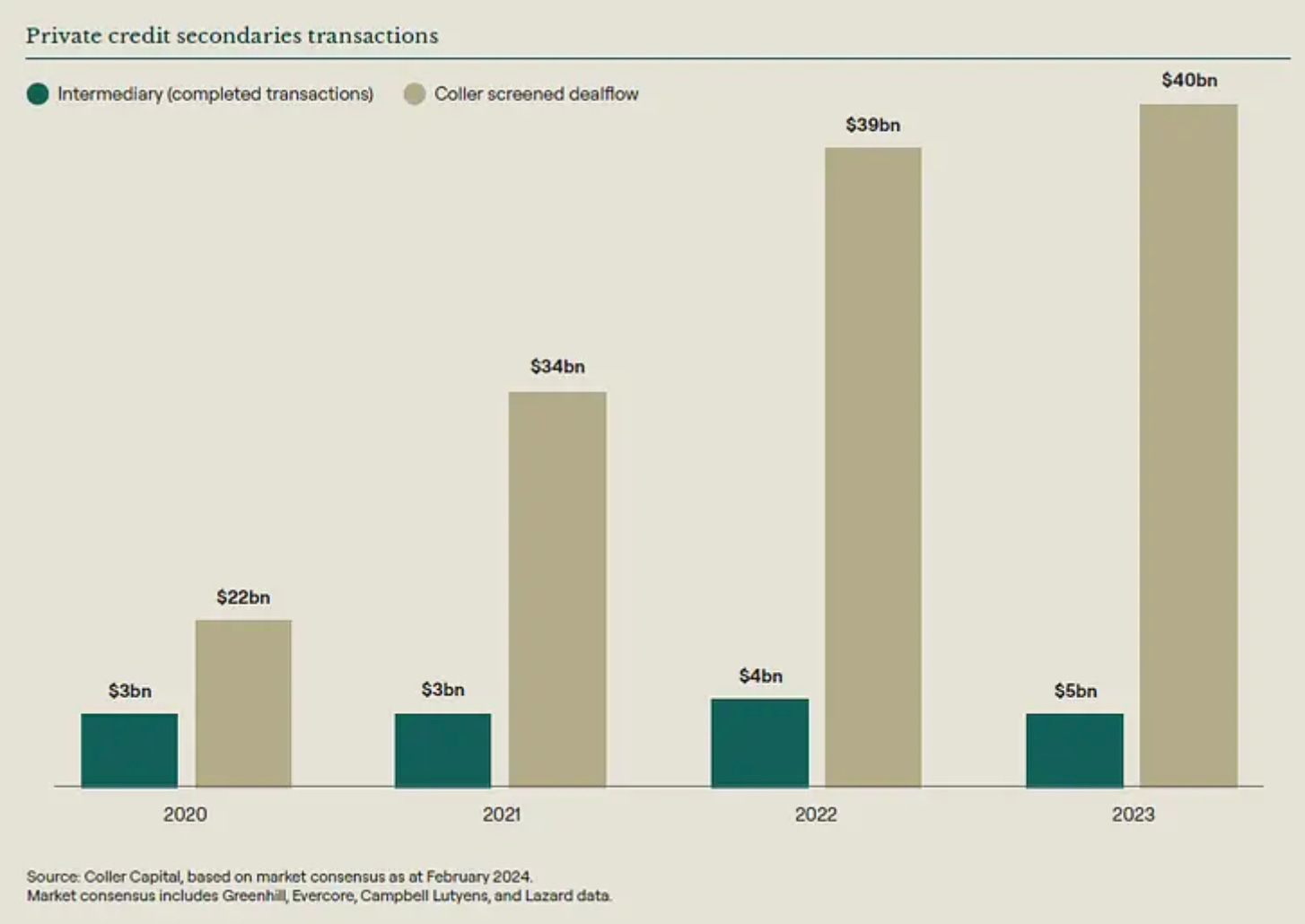

Firms like Ardian, Apollo, Ares, Coller, and Pantheon have all launched dedicated private credit secondaries strategies. While the market is still small relative to private equity secondaries, the below chart from Coller’s August 2024 report highlights that the market has grown meaningfully over the past few years based on screened dealflow on private credit secondaries transactions.

Traditional asset managers also see the opportunity. Last week, Generali launched a private credit secondaries fund in Partners Group.

Some, like FoxPath, which was founded by 17 year Morgan Stanley veteran Tony Colarusso and Apollo credit secondaries founding team member Brian Laureano, see the promise of launching a new fund to capture some of the market as an independent firm.

As private credit secondaries grow in size, expect more firms to launch and larger firms look to acquire capabilities in this area.

Additionally, other, more niche areas of credit, like risk transfer, where firms such as Pemberton and Chorus Capital play major roles, could be appealing to larger managers that are looking to add capabilities to existing credit platforms.

As private markets become larger in size and scale, so too should GP stakes.

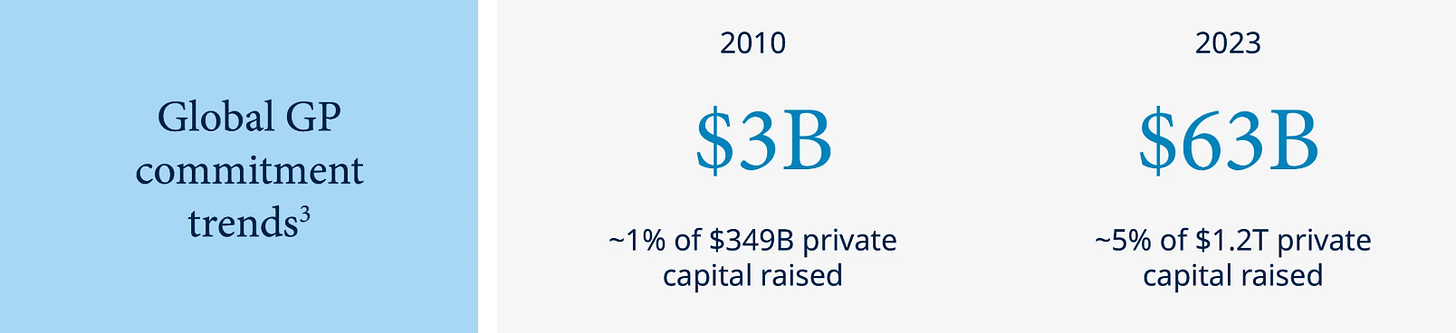

As funds become larger, so do GP commitments.

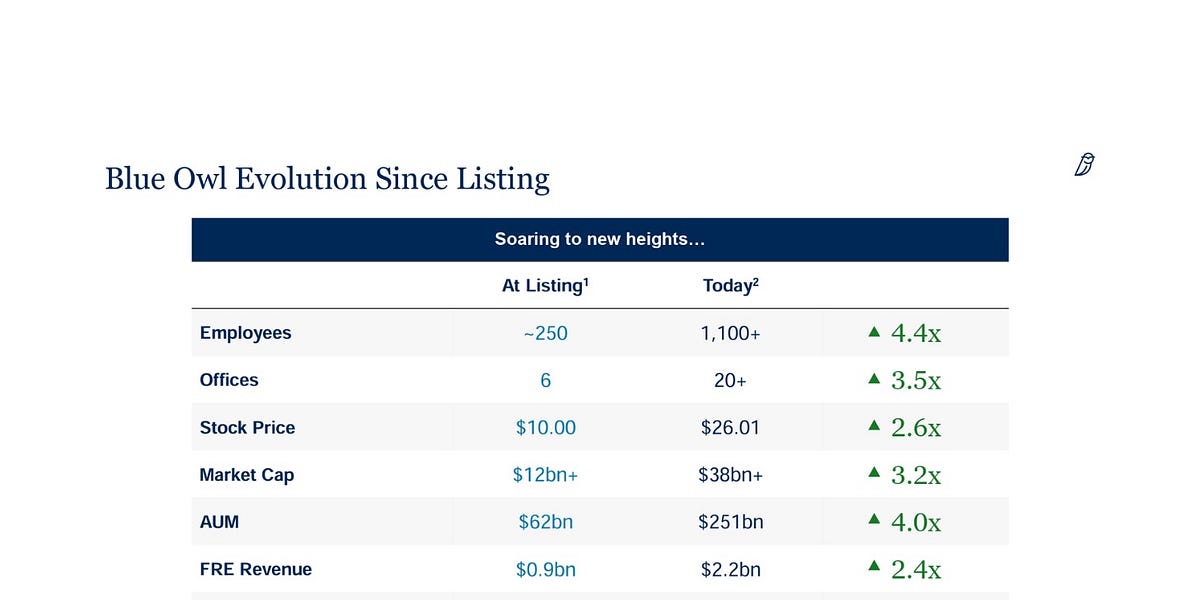

Blue Owl’s President & CEO of Global Wealth Sean Connor and MD on the GP Strategic Capital team Michael Conley noted in an interview that as private markets has grown from $3T in 2010 to $13T AUM, the average GP commitment has experienced a ~20x increase by dollar amount.

The increase in capital required to finance GP commitments has helped fuel the growth of the GP stakes industry.

Larger funds have raised the lion’s share capital — and increasingly so in recent years.

To date, Blue Owl has completed 87% of all stakes deals $600M or greater in size, as many of the largest private alternative asset managers have looked to stakes when they

The GP stakes space, at the upper end of the market, is covered largely by three firms — Blue Owl, Blackstone, and Goldman Sachs’ Petershill (note: Arctos is also working with large firms, such as Hayfin, the €33B European alternative asset manager).

Given that these firms would understand the fundamentals of GP stakes and have relationships with a large number of managers, could another large multi-strategy firm, particularly one with either a credit DNA or a secondaries DNA, look to enter the stakes space?

Secondaries firms are already solutions providers to GPs, particularly with the rise in CVs, so it’s possible that they extend those capabilities to add GP stakes, which is also a form of being a solutions provider to a GP.

It’s also worth noting that regionally-focused stakes firms could come into focus. If the world continues the trend of de-globalization, then perhaps regional footprints and on the ground relationships will become increasingly more important and firms will focus more on regions where they are from and where they have structural advantages.

With Apollo crossing the Rubicon to enter traditional asset management, would other alternative asset managers think about building out traditional asset management or wealth management capabilities?

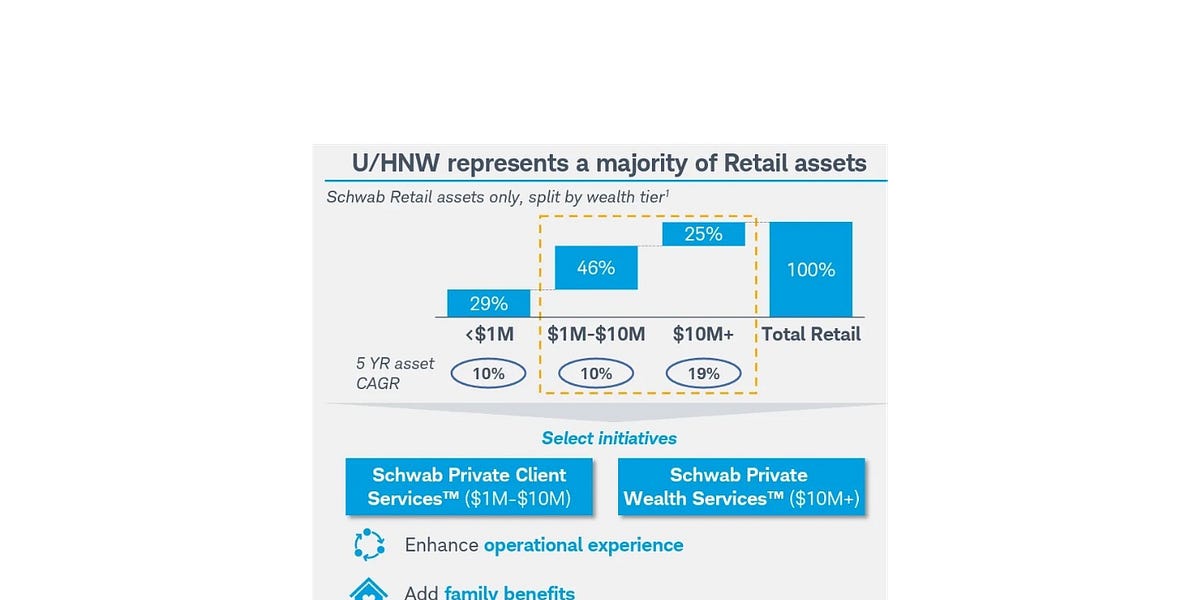

A wealth management business, particularly one focused on the upper end of the wealth management market to help UHNWs access private markets in unique and bespoke ways, could be an interesting addition to an alternative asset manager. I’ve written in the past about an alternative asset manager acquiring a wealth management business or adding that capability to its platform. To date, it’s mainly been global investment banks, such as Goldman or Morgan Stanley, that possess both capabilities under one roof. But perhaps that might change if the theme of convergence continues.

Perhaps starting with employees and partners of a firm — and then extending those services to external clients? This concept is not a new one. Hence, the name Partners Capital which was built initially to serve partners of private equity firms. The firm, which now has over 400 clients and $60B in AUM, started in 2001 as a way for partners at many of the top private equity firms to navigate portfolio construction to manage their wealth via an endowment-style investing model.

We’ve seen many alternative asset managers invest into wealth managers because they see the merits of owning wealth management businesses due to the relatively steady and compounding revenues and (often) low churn and high client retention.

We’ve also seen alternative asset managers take stakes in OCIOs, as General Atlantic did with Partners Capital.

Would an alternative asset manager ever build out wealth management capabilities?

I’ve noted in the past that private markets are not just a nice to have for wealth management firms. It is a need to have.

Some investment firms have built both wealth management and asset management capabilities.

Iconiq, the $80B AUM firm in which Blue Owl’s GP Strategic Capital owns a stake, started as an investment management and multi-family office before extending into the higher fee-paying asset management business, benefitting from the flywheel of providing its wealth clients with access to investing and unique manufactured investment strategies and funds.

General Catalyst, the $35B venture capital firm (now calling themselves an “investment transformation company,” since they invest from early to late stage and incubate businesses, including those in industries where the companies look less like venture-backed businesses and more like private equity-backed companies), recently announced that it incubated $2.3B AUM GC Wealth. GC has an initial client base to choose from: GC Partners, entrepreneurs within the GC network, and LPs that have invested in GC funds.

What GC has done is something that I would imagine is on the mind of many alternative asset managers.

GC Wealth has figured out a way to manufacture distribution for its private markets funds and also extend beyond its own walls and invest into the products of other firms.

Access to private markets is now table stakes for the wealth channel, thanks to the growth of investment platforms like iCapital, CAIS, and others. It feels like the wealth channel is at a place where some investors, particularly those in the UHNW and large wealth management platform segments, are seeking customization and differentiation.

Could a wealth management business as part of a larger alternative asset management platform or an in-house OCIO capability be a way to help the wealth channel navigate private markets?

Some firms, such as Ares, Sixth Street, and Blue Owl have built out dedicated sports investment strategies to complement other aspects of its investing activities. Some firms, like CVC, Clearlake Carlyle, and Silver Lake, amongst others, have invested into sports leagues, teams, or adjacent sports properties out of funds that include a focus on sports or media properties.

Other firms, such as Arctos and RedBird Capital Partners, have focused on sports as a core part of their investment strategy.

If alternative asset managers think of their marketing and sales efforts with the wealth channel as an exercise of building a consumer brand, then sports can be a vehicle to resonate with the end consumer.

Many people may not know what private equity is or what it does, but many people likely know their city’s sports team.

Sports can also boost the social and economic fabric of a community, as I wrote in the 11.5.24 AGM Alts Weekly.

And there’s an opportunity for sports teams and leagues to grow a fanbase by leveraging media and entertainment to tell stories, as Ryan Reynolds’ and Rob McElhenney’s Wrexham AFC has done so well (and what a story they have to tell after achieving promotion to the EFL Championship yesterday).

Sports investing can serve as a vehicle to help alternative asset managers educate their end consumer, the wealth channel, understand who they are and what they do. That’s why it wouldn’t be surprising to see the industry’s largest firms acquire or build dedicated sports investing capabilities in part because it can further brand equity and brand resonance.

What’s next on the Big Board? Alternative asset managers, much like GMs, have a lot of moves they could make. Some of these moves, like draft day, won’t materialize for a few years, but perhaps they make the team better in the long run. What Apollo did this past week is certainly an example of investing some of its draft capital in the future. Time will tell if the moves they’ve made will garner the same praise that Philadelphia Eagles GM Howie Roseman has earned for years of deft drafting and deal-making that has resulted in a Super Bowl trophy.

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

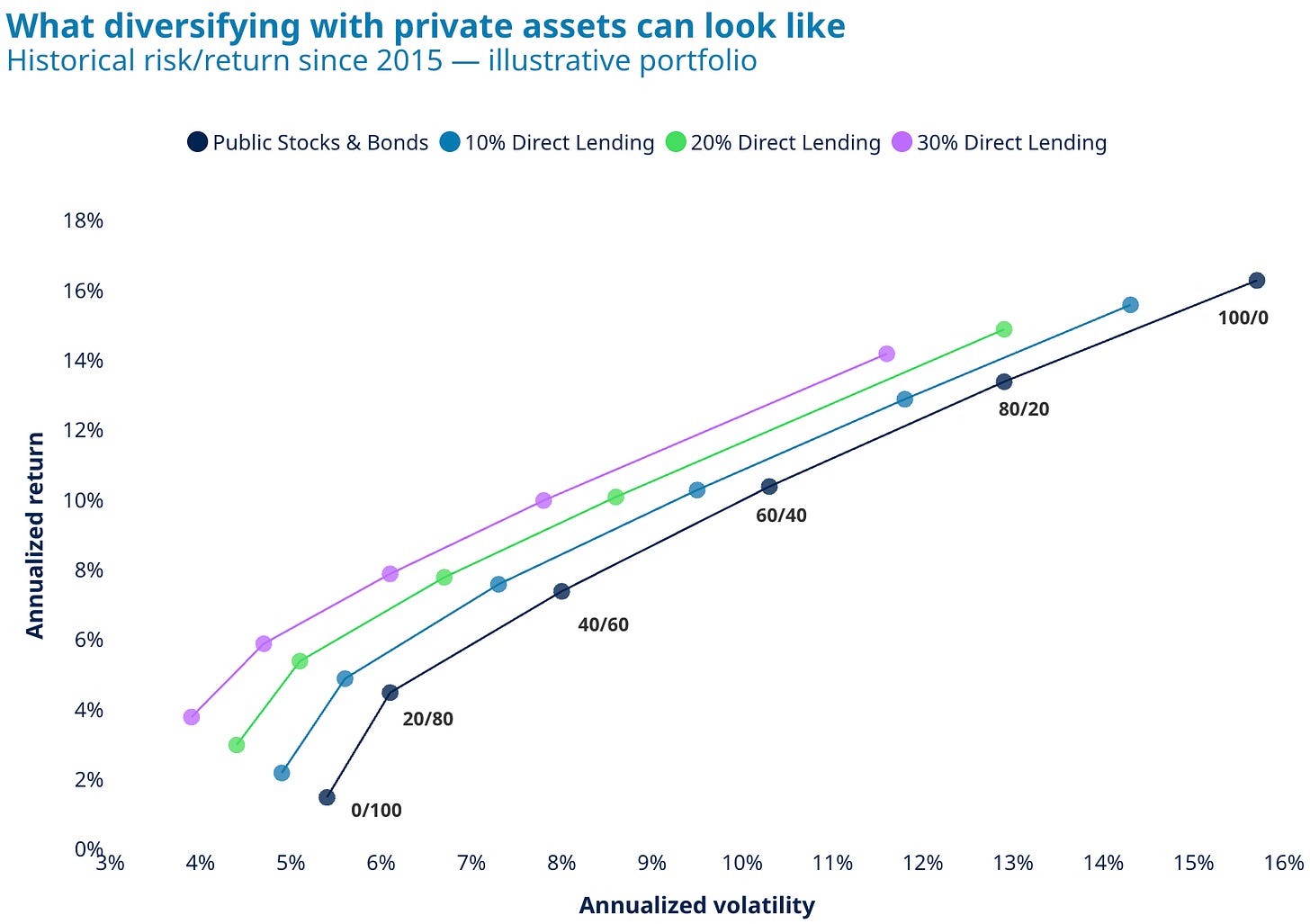

Blue Owl shared a post on LinkedIn on why direct lending could help increase return and decrease volatility.

Adding direct lending to a traditional portfolio could increase returns and decrease volatility, according to this Blue Owl article.

📝 Pension groups cut back on pioneering private equity investments | Mary McDougall, Alexandra Heal, Sun Yu, Financial Times

💡Financial Times’ Mary McDougall, Alexandra Heal, and Sun Yu report that top pension funds are scaling back on direct investments, instead focusing on co-investments alongside private equity firms. For years, some of the industry’s largest institutional investors have built out direct investment teams, which sometimes pitted them against the private equity firms that they used to partner with. This was part of a trend that saw large institutional investors invest in capabilities to build in-house investment teams in a bid to reduce fees paid to alternative asset managers. That appears to have changed. CDPQ and OMERS are scaling back the proportion of their funds exposed to directly owned private companies, while OTPP has said it’s focused on strategic partnerships. Difficulties generating distributions over the past two years have precipitated this strategic shift. Exits have been tougher to come by, which has encouraged the Canadian pension groups to back companies alongside private equity managers since direct ownership has become more challenging, requiring big in-house investment teams and more risk appetite. “The private equity downturn is making the direct investing model harder as we are facing a shortage of viable projects and difficulty in exiting from our existing investments,” said an executive at one of the funds. There are three main ways pension funds allocate to private equity: direct investing, investing into a private equity fund, or co-investing alongside a private equity fund, often blending down fees in the process. Canada’s $3.2T pension system is a major private equity investor. 22% of its public sector funds are allocated to the asset class, according to think-tank New Financial. Half of Canada’s nine biggest pension funds have around half of their private equity exposure through buyout funds and half through direct holding and co-investments, according to analysis from CEM Benchmarking. However, as dealmaking has become more competitive and as more capital has come into private equity, securing access to the best co-investment deals has become more challenging. CDPQ is in the second year of a five-year plan to lower the proportion of direct private equity investments from 75% to 65%. OMERS announced last September that it would no longer invest directly in European opportunities. OTPP has said that it is “tactically looking to invest more with other partners in areas where it makes sense as the portfolio and market evolves.” A big reason why? Paying for talent. It is “difficult for Canadian pension funds to compete for talent with Apollo that pays much better,” a fund executive said. Another reason is the hands-on management required to manage these businesses. Marlene Puffer, former CIO at Alberta Investment Management Corporation, said Canadian pension funds were “in the boat of having to add more value into every holding because exits are more challenging now — they have to do more hands on management and it becomes increasingly complex.” CDPQ’s Head of Private Equity and Credit Martin Longchamps said the rationale behind its shift towards more partnerships was to “drive access to deal flow through those relationships.”

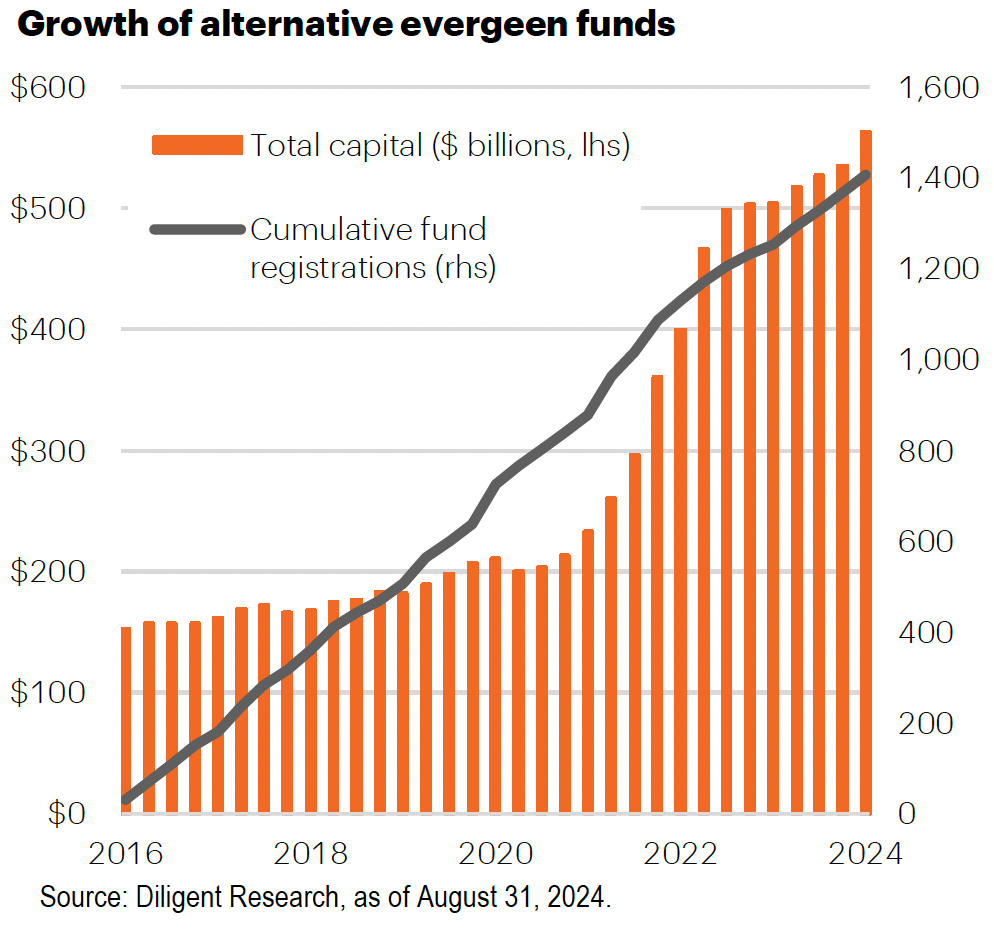

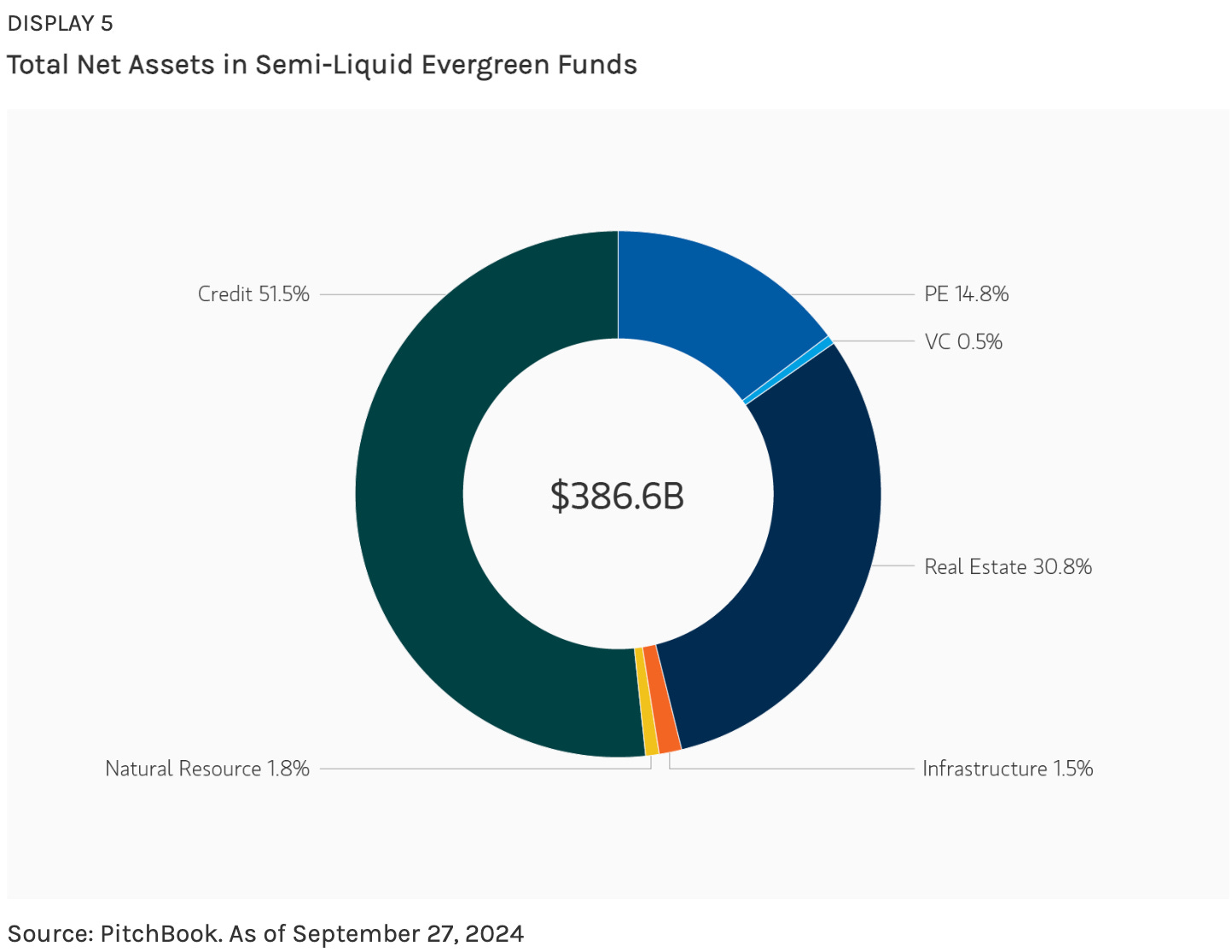

💸 AGM’s 2/20: The industry is at an interesting point in its evolution now that large institutional LPs are scaling back direct deal capabilities and focusing more on co-investment partnerships. This move comes at a time when there are structural challenges for LPs, particularly around distributions. It’s also worth noting that private equity firms have grown bigger in size, meaning they can execute deals without the need for co-investment capacity, at times. The other trend, not mentioned in this article, is that the rise of evergreen funds might be impacting the availability of co-investment capacity for institutional investors. As larger funds grow evergreen fund structures geared towards serving the wealth channel, these structures might consume what otherwise would have been co-investment capacity for institutional investors. From a business perspective, it is understandable why alternative asset managers might replace fee-free (or lower fee) co-investment capacity with evergreen structures. Evergreens represent a large and growing segment of the private markets universe, as this below chart from FS Investments illustrates.

Now, it’s worth noting that a good portion of the assets in evergreen structures are in credit, rather than private equity. So the impact on evergreen funds consuming co-investment capacity from institutions may not be as pronounced as it might seem. This below chart from a March 2025 Morgan Stanley report on evergreen funds shows where the majority of the assets in evergreen funds have been allocated. Credit represents the overwhelming majority of net assets in evergreen structures.

But it’s worth pondering what the continued growth of private equity evergreen structures could mean for institutional investors. In some cases, institutional allocators are employing evergreen structures as part of the asset allocation framework, as KKR Partner & Co-CEO of KKR Private Equity Conglomerate Alisa Wood said in a recent Alt Goes Mainstream podcast. Evergreens can serve as a complement to closed-end fund structures, as a recent Goldman Sachs white paper on evergreen and closed-end fund vehicles discusses. The growth in evergreen structures, along with the simultaneous structural changes in how pensions and institutional investors navigate private markets today, just represent yet another stage in the evolution of an industry that is now at a crossroads trying to figure out how to grow its exposure with a new investor cohort, the wealth channel, while also continuing to figure out how to serve its existing customer cohort, the institutional investor.

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Investor Relations Professional. Click here to learn more.

🔍 KKR (Alternative asset manager) - Human Capital - COO. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Head of Global Product Marketing Management. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Credit Executive Office, Senior Associate / Associate. Click here to learn more.

🔍 Brookfield (Alternative asset manager) - SVP - GCG Head of Content Strategy. Click here to learn more.

🔍 Vista Equity Partners (Alternative asset manager) - Coverage Associate, Strategic Partnerships (Private Wealth). Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Private Markets, Due Diligence Manager – Senior Vice President. Click here to learn more.

🔍 Goldman Sachs Alternatives (Alternative asset manager) - Private Markets for Wealth - Executive Director - Frankfurt. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Head of Registered Alternative Products. Click here to learn more.

🔍 Dynasty Financial Partners (Wealth management platform) - Alternative Investment Specialist. Click here to learn more.

🔍 Hightower Advisors (Wealth management platform) - Manager, Merger & Acquisitions. Click here to learn more.

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

Partner with Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch KKR Partner & Co-CEO of KKR Private Equity Conglomerate LLC (K-PEC) Alisa Wood discuss how the firm has innovated in private markets, why KKR came up with the Conglomerate structure, and how evergreens can play a role in investors’ portfolios. Watch here.

🎥 Watch Cantilever Group’s Co-Founder and Managing Partner Todd Owens in a live podcast from BTG Pactual’s NYC office share why GP stakes can be the best of all worlds. Watch here.

📝 Read The AGM Op-Ed with Arcesium Private Markets Head Cesar Estrada on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch BlackRock’s Head of the Americas Client Business Joe DeVico, Head of Product for US Wealth & Head of Alts to Wealth Jon Diorio, and Partners Group's Co-Head of Private Wealth Rob Collins discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch the third episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch Brookfield Oaktree Wealth Solutions CEO John Sweeney discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Cerity Partners’ Partner & Chief Client Officer Tom Cohn and Partner Amita Schultes talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch Marc Lipschultz, Co-CEO of Blue Owl, talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Blue Owl Co-CEO Marc Lipschultz, where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to Stephanie Drescher, Partner & Chief Client & Product Development Officer of Apollo, discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch Eric Satz, Founder & CEO of Alto share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch Mike Tiedemann, CEO of $72B AUM AlTi Global share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch Joan Solotar, Global Head of Private Wealth Solutions at Blackstone share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Thank you for reading Alt Goes Mainstream by The AGM Collective. If you enjoyed this post, share it with anyone you know who is interested in private markets.