AGM Alts Weekly | 5.4.25: The next level - by Michael

👋 Hi, I’m Michael.

Welcome to .

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good morning from Washington, DC, where I’m back from a week of meetings in NYC. In DC, I had the chance to join Angel City FC Founder and CEO Julie Uhrman at Audi Field to watch ACFC win a 4-3 thriller against the Washington Spirit.

Speaking of sports, this week there was interesting news at the intersection of private markets and sports investing.

Bloomberg reported that EQT is “considering a range of options for a possible partnership, including making a strategic investment” into sports and GP solutions investment firm Arctos.

EQT, which has grown to over €269B (and €136B in fee-paying AUM - figures from its 2024 year-end report) since its founding in Stockholm in 1994, has expanded both organically and through acquisition. The firm has added a plethora of capabilities to its DNA, which was initially focused on its roots and Nordic heritage: industrial companies in Sweden and neighboring countries.

Over the years, EQT has gone from “more than capital” to companies in its region to more capital in more places, as a chart from its October 2024 Capital Markets Day illustrates.

The firm added to its private equity strategies by building out a Real Estate investing unit in 2015, which was augmented by a combination with Exeter Property Group in 2021.

EQT built out a venture capital strategy, EQT Ventures, as part of its Private Capital unit in 2016 before going public in 2019.

The firm has continued to supplement its existing strategies and competencies through acquisitions via its framework of “locals-with-locals.” The landmark €6.8B acquisition of Baring Private Equity Asia (BPEA) in October 2022 illustrated this vision in action.

BPEA added private capital exposure to Asia for EQT, a fast-growing market where EQT wanted exposure and boots on the ground in a big way. Another benefit? EQT’s Real Estate business was bolstered by BPEA’s Real Estate investment unit.

As Arctos Co-Founder Ian Charles noted in a February 2025 Capital Allocators Podcast with Ted Seides (this was a must-listen for anyone interested in the evolution and the business of asset management), “15 firms, which is 0.2% of the universe [they] track, control about 20% of the AUM.”

In response to Ted’s question about how Arctos devised its leveling framework, Ian notes:

“It’s designed to look like a pyramid, where at the very top are the most complex, the largest, the most sophisticated firms. We call them Level 10s. All the way at the bottom, at the base of that pyramid, the Level Ones … We track 6,000 private equity firms predominately in the US and Europe who have raised institutional capital in the last seven years. And each firm is put into one of the 10 levels that are defined by the size of the firm, the breadth of their product mix, the number of asset classes that they serve, the types of products that they offer, their own capabilities. Are they local or are they global? Do they have public stock as a currency? Do they have their own balance sheet, their own wealth distribution capabilities? Do they own a captive insurance business?”

It is interesting to think about the effect of adding dedicated sports and GP stakes strategies to a large alternative asset manager’s platform.

I’ve noted before that both of these categories could evolve into full-fledged asset classes and strategies that become bigger parts of the private markets puzzle.

In an AGM Weekly Newsletter from 6.23.24 that peered into the future of private markets, 15 years from now, I wrote about GP stakes and sports becoming more mature categories:

GP stakes and sports investing are in the early innings of their evolution as asset classes.

There are now enough dedicated funds in both GP staking and sports investing strategies to consider categorizing them by area of focus.

GP stakes represents one example where categorization and focus is starting to occur. There are a handful of market-leading funds that focus on “large cap” alternative asset managers. Blue Owl / Dyal is the largest firm that focuses on investing in the industry’s biggest alternative asset managers. They have $55.8B AUM, mainly investing in some of the industry’s most established alternatives managers. More recently, firms focused on the middle-market and lower-middle market have emerged, such as Hunter Point, Investcorp, Bonaccord, Armen, Cantilever, Kudu, and Blue Owl’s new mid-market focused fund, and others.

As GP stakes evolves, investors will look at the space as a full-fledged asset class where they might seek to gain exposure across lower-middle market, middle-market, and upper-end of the market to access the different strategies and risk / return characteristics of the entire space. Just like we see investors gain exposure to large-cap, mid-cap, and small-cap stocks in traditional equities and buyout and lower mid-market companies in private equity, we’ll see investors access GP staking in the same manner, allocating to funds specialized in each category of the market.

A similar phenomenon will occur in sports. The space will grow to a size and scale where managers will look to specialize in specific strategies or categories — some managers will focus on equity, others will focus on debt. Some will focus on major leagues and teams, others will focus on emerging leagues and teams. Some firms will scale to do both. Others will stick to a specialization. Investors will try to access sports by investing across the spectrum of opportunities.

It’s also worth noting that categories like GP stakes and sports could appeal to the wealth channel — for different reasons.

GP stakes has shades of private credit, secondaries, and private equity all rolled into a single line item investment. That could make it a good entry point for newer investors to private markets as a turnkey way to gain some level of exposure to the space.

GP stakes could also be a high-quality and vetted sourcing mechanism for GPs to build relationships with alternative asset managers they want to acquire in the future, as Blue Owl GP Strategic Capital (Dyal at the time) did with Oak Street Capital, which has become Blue Owl’s Real Estate business unit and, more recently, with Atalaya, which added alternative credit capabilities to its credit unit.

Sports has been viewed as less correlated to equity markets, and can be seen as a vehicle for helping asset managers to build a brand in the wealth channel. Sports investing is becoming more specialized, particularly as different areas of sports investment opportunities grow across established leagues and teams, emerging leagues and teams, and sports-adjacent investments across media properties and mixed-use real estate. The space is, therefore, becoming big enough for firms to build out specialized sports investing teams.

As this trend has continued, private equity has become a major player in sports investing.

In today’s world of alternative asset management, the stakes have never been higher as relationships are consolidating with fewer GPs, as KKR Co-CEO Scott Nuttall noted on this past week’s earnings call, and as scaled players compete for capital in the wealth channel.

Firms are looking to “level up,” as Charles said on Seides’ podcast. And to use another quote from Charles, it gives GPs “the right to win.”

Speaking of leveling up, a number of alternative asset managers reported their first quarter earnings this past week, including KKR, Apollo, and Blue Owl.

A few interesting themes emerged from their earnings calls:

Each of the three firms — KKR, Apollo, and Blue Owl — extensively covered how much permanent or perpetual capital they possess.

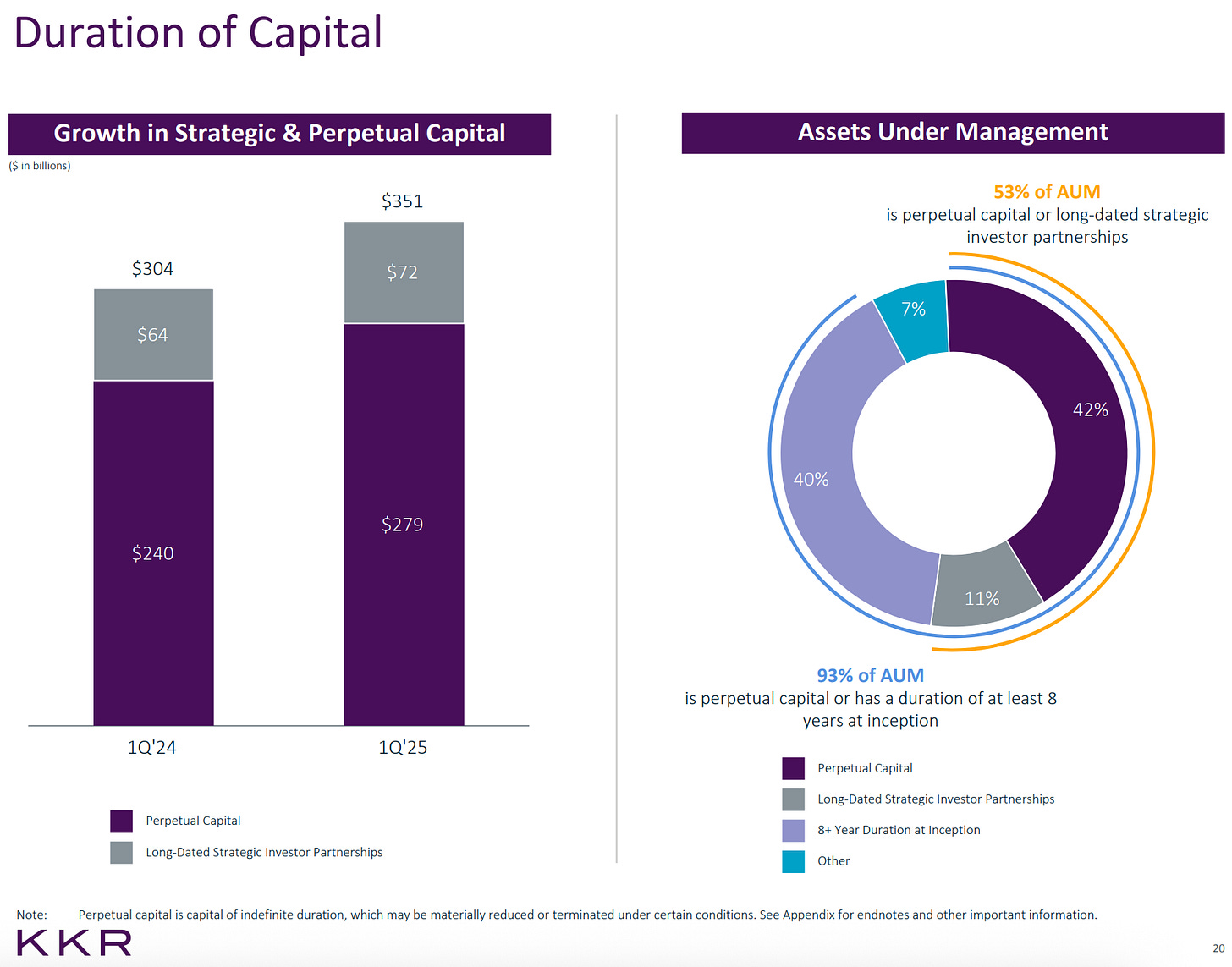

KKR noted that 93% of its AUM is either perpetual capital or has a duration of at least 8 years at inception.

The firm has also grown its perpetual capital base from $240B AUM in Q1 2024 to $279B in Q1 2025.

Notably, KKR’s K-Series, its evergreen structures designed predominately for the wealth channel, grew to $21B of AUM, up from $9B at the same time last year.

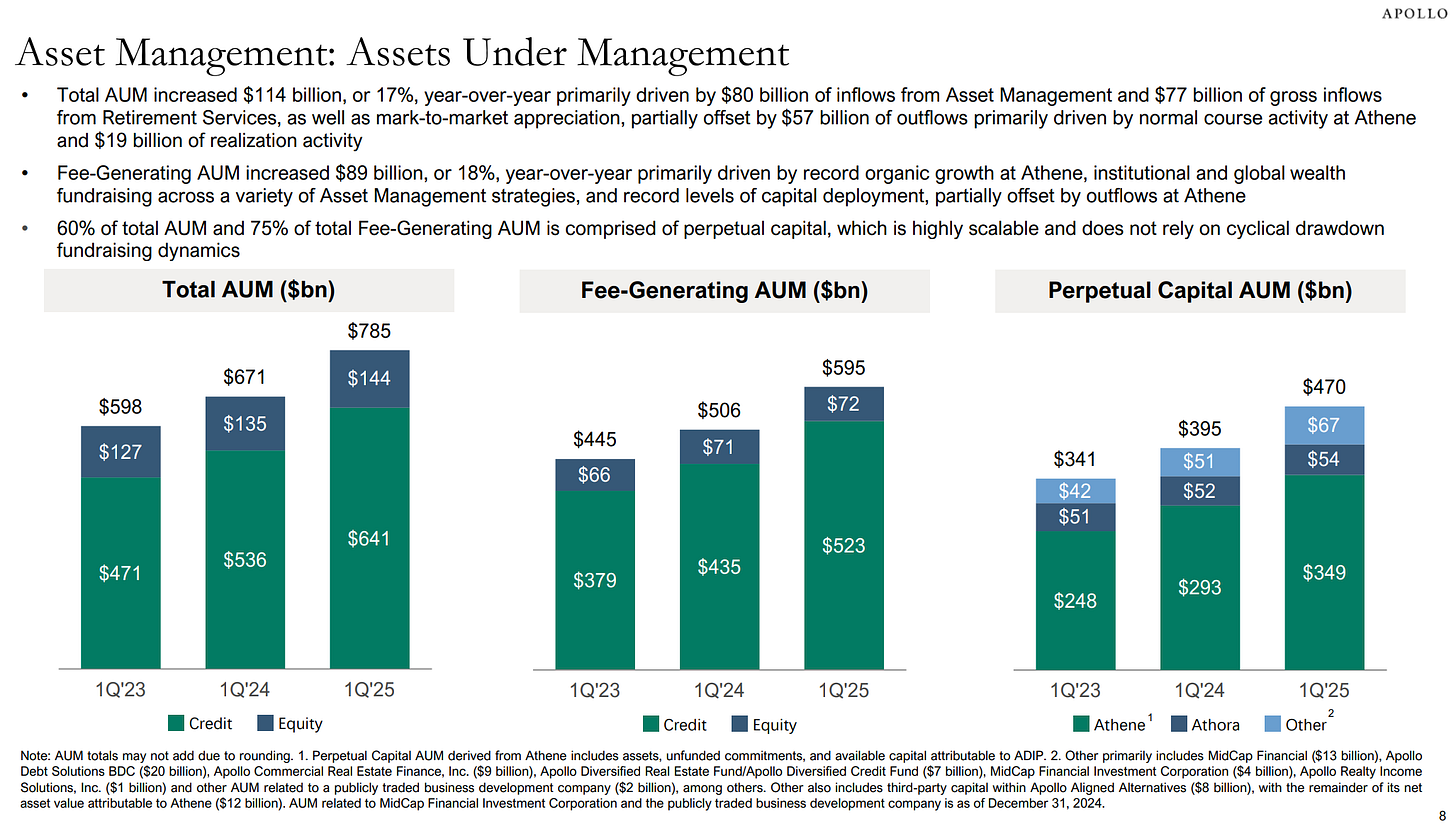

Apollo reported that 60% of its total AUM and 75% of its total fee-paying AUM is comprised of perpetual capital, totaling $470B in AUM. That figure bested the $395B in perpetual capital at the same time last year.

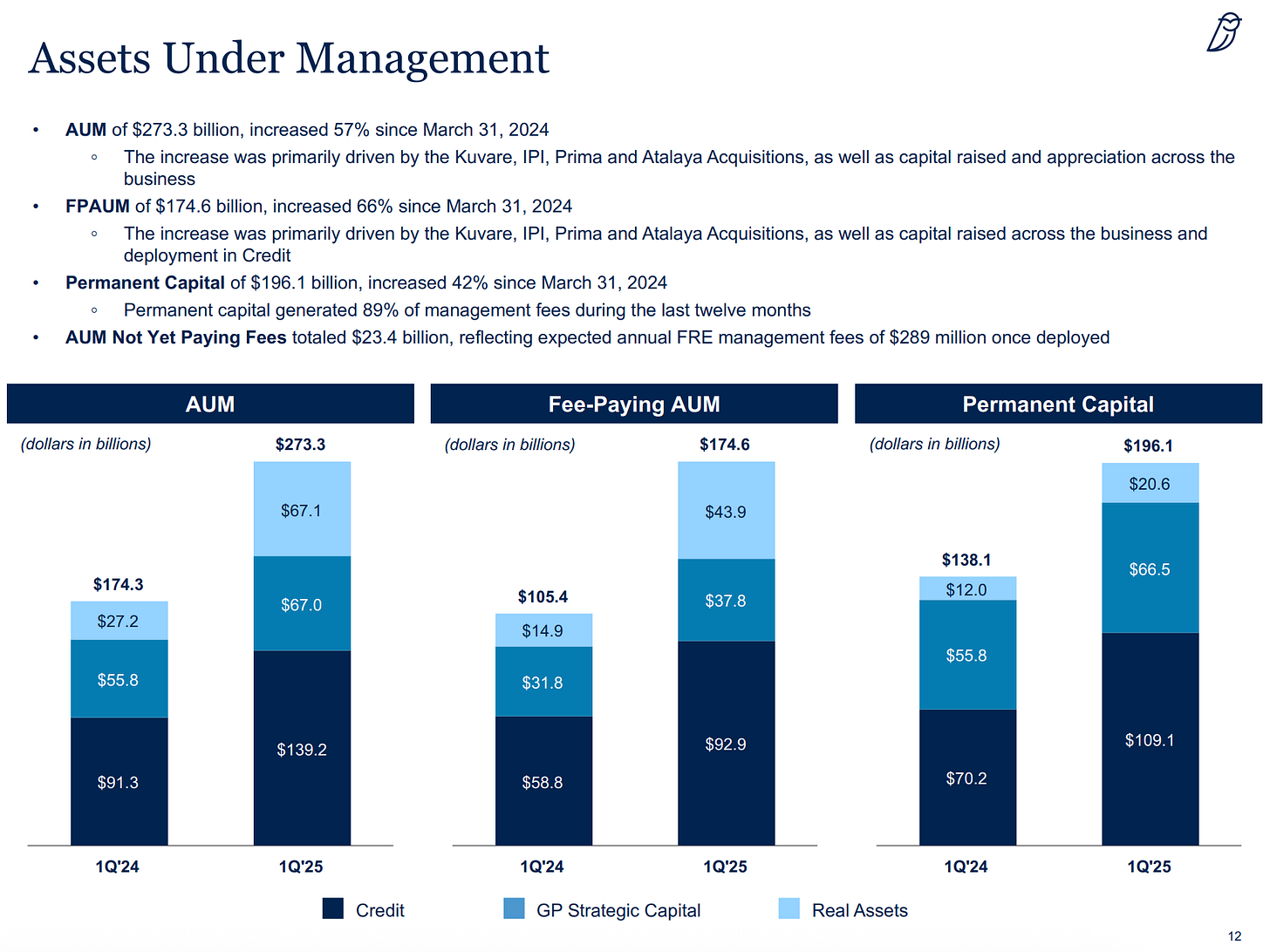

Blue Owl’s permanent capital increased 42% year-over-year. Permanent capital, which generated 89% of management fees during the past 12 months, increased to $196.1B.

All noted that the power of permanent capital is helpful for their businesses due to the certainty and resiliency of the nature of these revenues.

Each of the executives from these firms acknowledged that it’s a volatile and uncertain market environment.

They also pointed out that in periods of dislocation, it’s certainty of capital (Blue Owl), disciplined investment pacing and linear deployment (KKR), and cash on hand and a strong balance sheet (Apollo) that make them well-positioned to maneuver through a period of volatility.

Apollo CEO Marc Rowan had an interesting comment. He said, “We believe we are one of the largest active buyers of assets post Liberation Day, $25B in April alone” (note: Rowan then said that it was mostly in public markets).

KKR Co-CEO Scott Nuttall noted: “The key is to use our global and diversified business model with significant locked-up capital and $116 billion of dry powder to keep investing when others are scared.”

It appears that the industry’s biggest firms are looking to pick their spots and allocate capital where appropriate in the current market.

It was interesting to hear KKR reference their “global and diversified business model” a number of times in its earnings call. The firm noted its global presence as a differentiator, which could certainly prove to be the case in the current environment.

All three firms referenced, in their own way, the importance of patience. They are “waiting for the fat pitch,” as Rowan noted in Apollo’s call.

Blue Owl Co-CEO Marc Lipschultz had a view about opportunities in the current environment:

“… we intend to be very front footed about opportunities that arise in this current environment. So we've observed that, during periods of elevated volatility, market share accrues to solutions providers like us. And people are willing to pay more for our valuable capital.”

It's certainly not an easy market to invest in right now. And there are some major structural challenges in private markets around liquidity and denominator effect issues for some of the industry’s institutional LPs, but the biggest firms appear to be in a position to invest opportunistically where they see fit.

Another interesting element of KKR and Apollo’s earnings calls was the extent to which management discussed target date funds and model portfolios.

Both KKR and Apollo mentioned model portfolios and target date funds multiple times.

KKR’s Nuttall made an interesting comment that could be foreshadowing for the coming adoption of private markets products in target date funds and 401(k) products:

“But what's coming, private equity, real estate, infrastructure models and figuring out how to access more efficiently the broader investor universe and target date, what can we do in 401(k)? So there's a lot more coming attractions than there is work done to date, and we think the opportunity is immense. But our focus, to be super clear, is investment performance that we generate for the client”

Apollo’s Rowan also shared insightful commentary on how he views the partnerships between traditional asset managers and alternative asset managers.

“Traditional asset managers are in the process of redefining what active management is. We always thought of active management as the active buying and selling of stocks and bonds. I now believe we will see active management as the public market beta married with appropriate private market assets in structures that investors understand, like mutual funds and ETFs and interval funds and otherwise. These traditional asset managers, I expect, will be large consumers of private assets and will reach clients that our industry probably would not have reached on its own, whether we see the interesting innovations in model portfolios or the interesting partnerships. Or we just look at what we're doing on our own, whether it is access to private credit in a daily liquid wrapper through the State Street PRIV ETF, or the income solutions we've launched with Lord Abbett through an interval fund, or it's introducing privates into retirement solutions through a target date fund partnered with State Street. Across the board we are working with traditional asset managers to integrate private assets in an appropriate way into products that we and the industry never really expected.”

On the heels of the rollout of its new division, the New Markets Division, which I wrote about in last week’s 4.27.25 AGM Alts Weekly: “Asset managers making moves on the Big Board?",Rowan went on to share:

“We're also seeing interesting innovations across our business that I would call out, not just in traditional asset management, but the early signs of progress in defined contribution, in 401(k) and tax-advantaged, tokenization and digital markets, structured notes and portfolio solutions.”

Rowan also made an important point that the industry would do well to heed as the wealth channel comes into focus:

“These strong sources of demand, starting with the original institutional base and now moving all the way for traditional asset management, I think, portend very well for our industry, so long as we are focused as not growing too fast. And too fast to me, we are in the business of excess return per unit of risk, therefore, we are able to grow only as fast as we are able to originate good assets that offer those risk/reward characteristics, thus, our relentless focus on origination as much as we possibly can across the board in most of the asset classes.”

The extent to which KKR and Apollo referenced target date funds and model portfolios begs the question: Is the industry closer to adding private markets exposure to retirement products than it might seem?

This subject also highlights the continued convergence between public and private. KKR and Capital Group reportedly considered a full-scale merger, according to Sujeet Indap from the Financial Times, but ultimately settled on the current partnership structure. The industry is in the early days of public becoming more private and private becoming more public. It will be interesting to see how this trend continues to unfold.

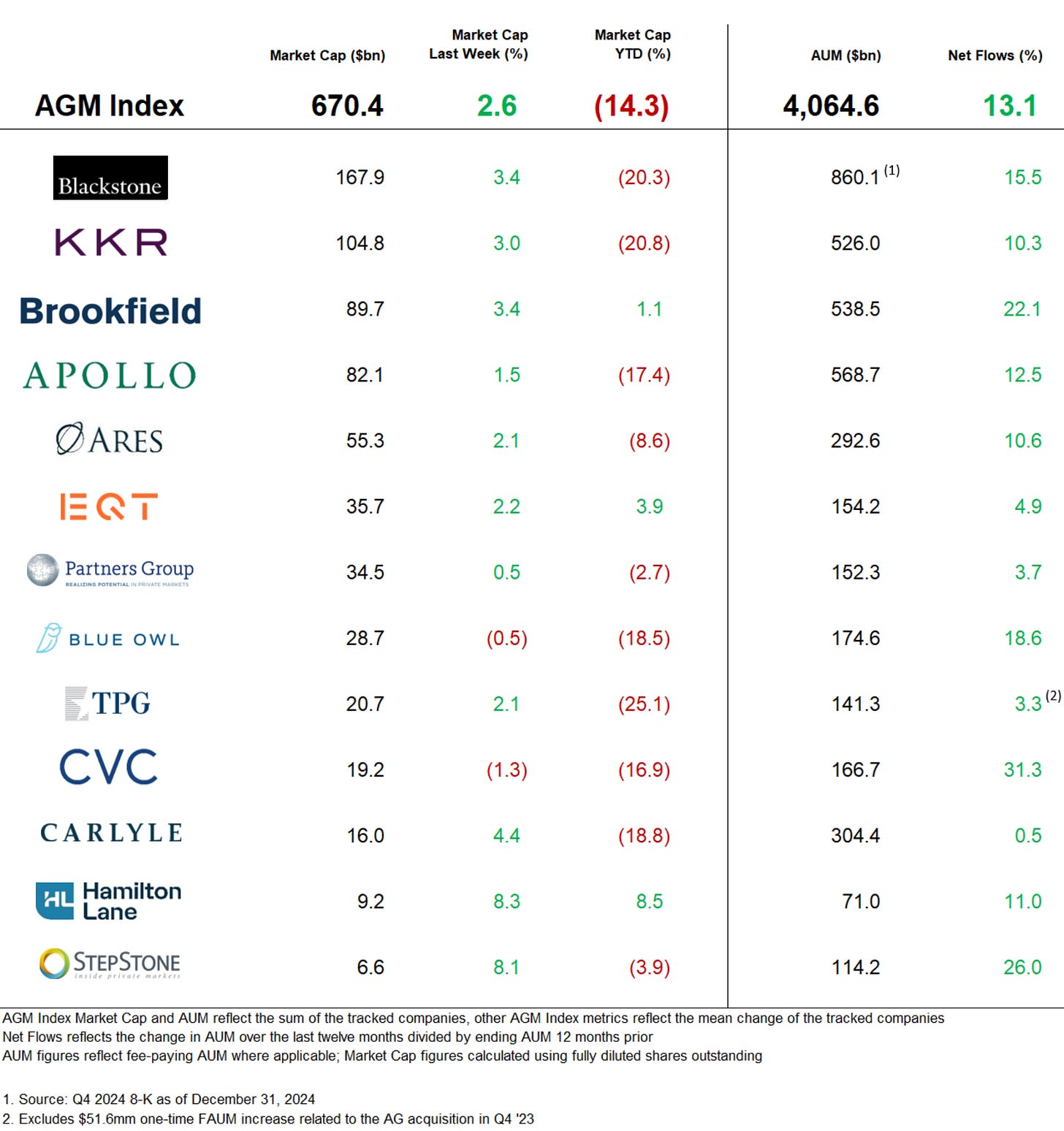

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

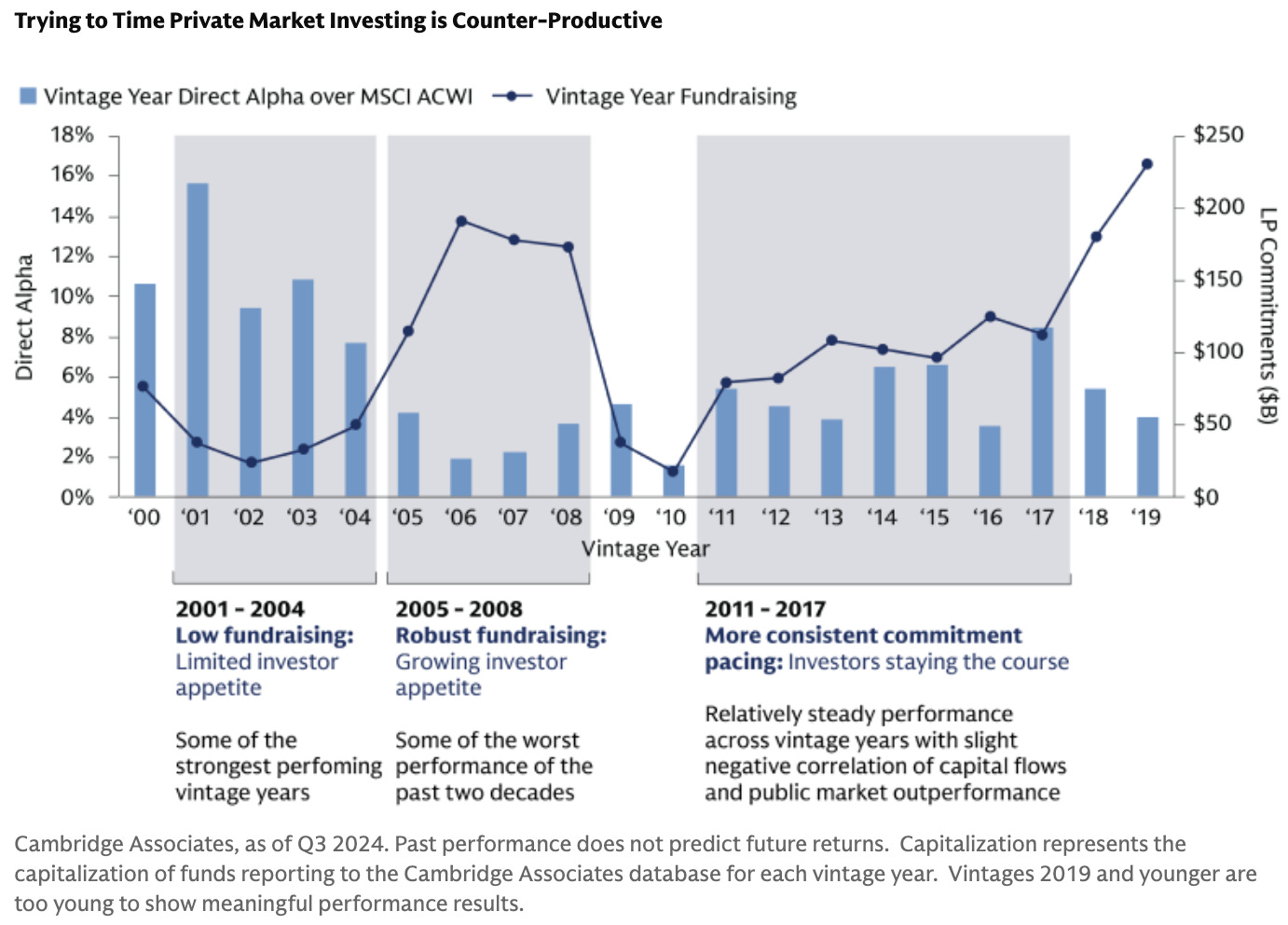

Trying to time private market investing is counter-productive, according to an article titled “Allocation Conundrum” from Goldman Sachs’ Daniel Murphy, Juliana Hadas, and James Gelfer.

| Silla Brush, Bloomberg

💡Bloomberg’s Silla Brush reports that T. Rowe Price (TRP) CEO Rob Sharps said that private assets will be integrated into retirement accounts. Sharps also noted that the $1.6T asset manager is looking for partnerships with alternative asset managers. Sharp told analysts during TRP’s earnings call that “there’s no question that will eventually happen … it does make sense that 401(k) participants and retirement investors would trade liquidity for return, given the very long time horizons that retirement investors have.” TRP is a major provider of investment products to retirement savers, with around $1T of such assets. TRP is reportedly looking into how to include private markets exposure in target date funds, which have historically been a mix of equities and public fixed income. TRP acquired Oak Hill Advisors, a private credit firm, in 2021 to expand into private markets, starting with direct lending and alternative credit. Sharps noted that they “have had substantial discussions with a number of alternative investment firms,” with investment-grade private credit, infrastructure, real estate, private equity, and secondaries all under consideration. Sharps didn’t provide a timeline for when private markets exposure would end up in retirement products and target date funds, saying “you can debate timing and magnitude.” But he noted that “at some point and to some degree, defined contribution, more traditional high-net-worth and mass affluent will get access to private market alternatives.”

💸 AGM’s 2/20: Sharps’ comments come at a time when partnerships and strategic moves by both traditional and alternative asset managers are being made to ready the industry for its move into retirement accounts and target date funds. The industry is in the early innings of creating the right products to serve the mass affluent and individual investor channels — but it’s starting to happen. Partnerships between traditional asset managers and alternative asset managers are being rolled out: Capital Group and KKR, Apollo and State Street, Vanguard, Wellington, and Blackstone. It was notable that KKR and Apollo management teams discussed retirement assets and target date funds multiple times on their respective earnings calls. It’s clearly something that’s a major focus for the industry’s largest firms. And it’s not just talk. Apollo recently announced the formation of the New Markets Division, which will bring traditional asset management, defined contribution, tax-advantaged solutions, and digital markets all under one roof. These components, in some respects, go hand in hand. Continuing to build out the market infrastructure and suite of products to properly serve the individual investor and provide appropriate retirement solutions are critical to both making regulators and firms comfortable with adding private markets investments to target date funds and retirement accounts. There’s a lot that will need to play out for large-scale adoption of private markets within target date funds and retirement accounts — but one thing is clear: the industry’s largest players are very focused on this as an area of growth for the space.

| John Crabb, Institutional Investor

💡Institutional Investor’s John Crabb reports that family offices might fill the gap left open by an exit log jam in private equity. With reduced M&A activity and a lack of exits in public markets, private equity funds are looking for other avenues to generate liquidity with their investments. Secondaries are one avenue. Continuation vehicles are another. Another possible source of liquidity? Family offices. According to the chief executive of one private equity firm, the current exit environment isn’t panning out as expected: “It's kind of like a log jam. We all thought this would be the year that some of that would get unclogged but in some ways it's just more of the same. Sellers need to be more realistic about price expectations and take the hit. But that is not happening.” Sources say family offices, which have less constraints than managers that have specific mandates and LPs, have an opportunity to step up and fill some of that gap with acquisitions of private equity-backed companies. Families manage $5.4T in the US, according to data from S&P Global. “The power of SFOs and MFOs has really accelerated in the last two or three years, they're acting like really big investment houses now with levels of sophistication that's never been there before,” said Peter Hughes, founder and CEO of Apex Group. “I do think that they will be picking up some of that slack.” Family offices have some structural advantages when it comes to investment decision-making. They don’t have fundraising cycles, distribution mandates, or as many worries over internal rate of return (they sometimes focus more on multiple on invested capital and TVPI). One of the most high-profile examples is the Mars family’s “take private” of Kellanova, formerly Kellogg’s, which is set to close in the coming months at a valuation of $36B, valuing the firm at over 16 times earnings. “Family offices have a more attractive pitch to the CEO of a private company that is thinking about taking some liquidity from the business it has built,” said Charles Otton, Head of Global Family and Institutional Wealth at UBS. “Companies can be very mindful of not selling to a deep, hostile private equity firm. So some family offices are positioning themselves very cleverly as well, saying ‘we're long-term focused family office money, we’d be a natural owner or partner for you, rather than a rapacious private equity firm.’”

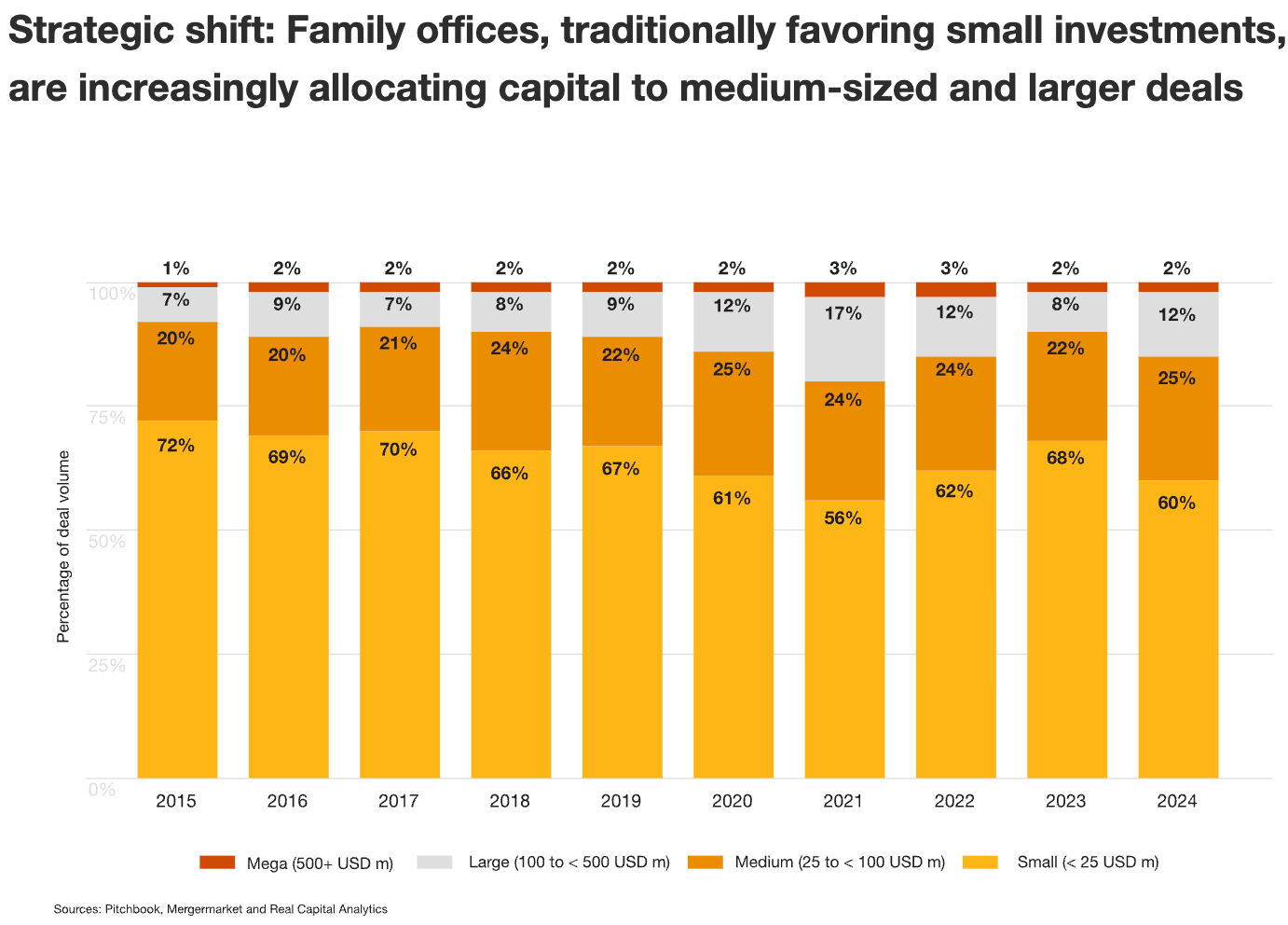

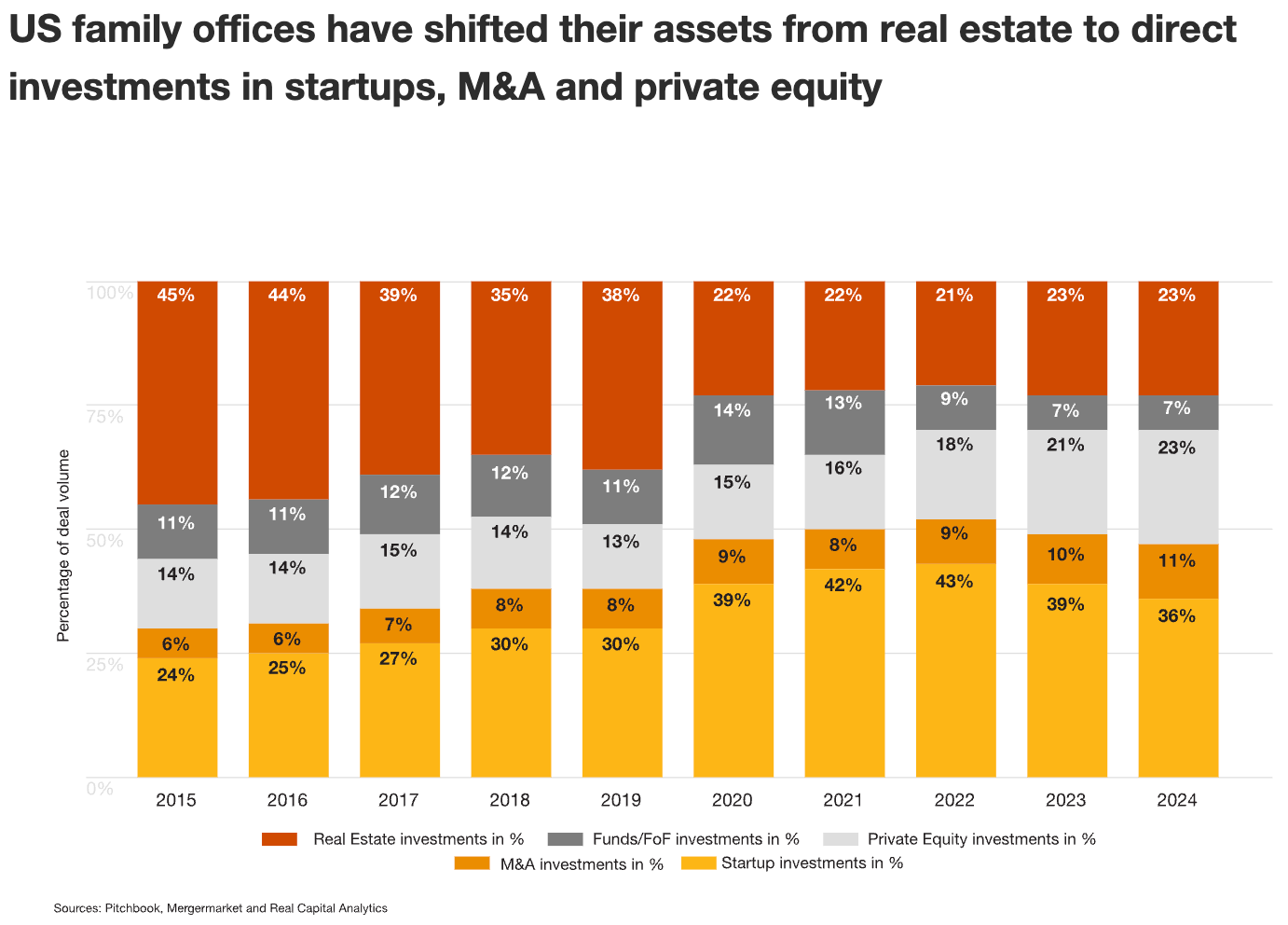

💸 AGM’s 2/20: Family offices have ramped up direct deal activity at a time when exits have been harder to come by for many funds. Family offices have now shifted a focus towards larger, complex deals, according to a recent study on global family office deals by PwC.

In recent years, there’s been a shift towards $25-100M and $100-500M investments from family offices.

The shift in deal size also coincided with a focus on direct investments.

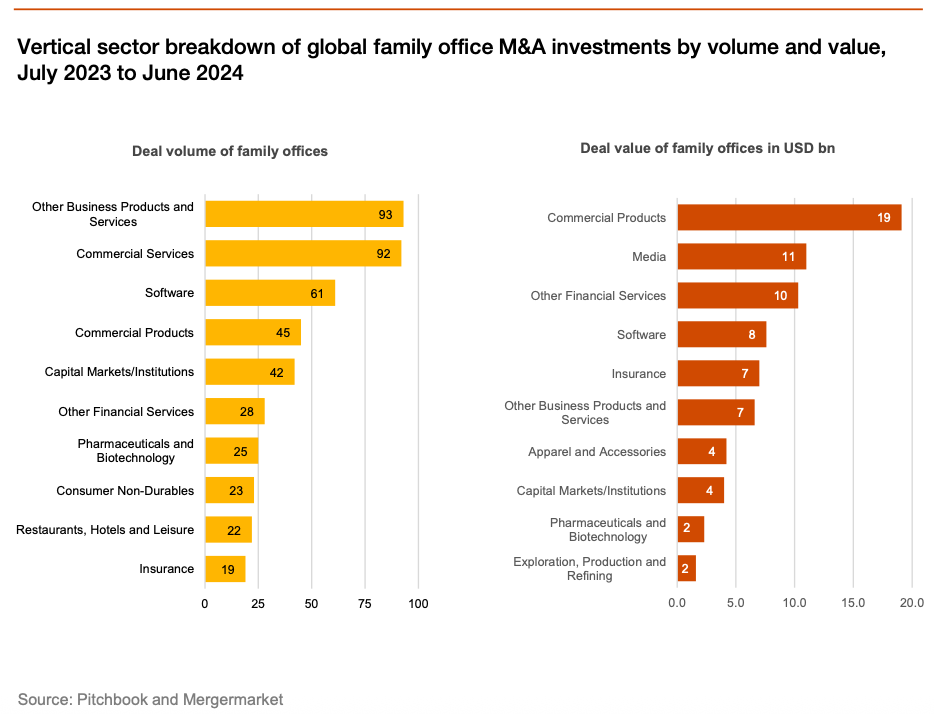

Family offices appear to have a clear preferences for products and business services. Deal volume and deal value was highest in business products and services and commercial services.

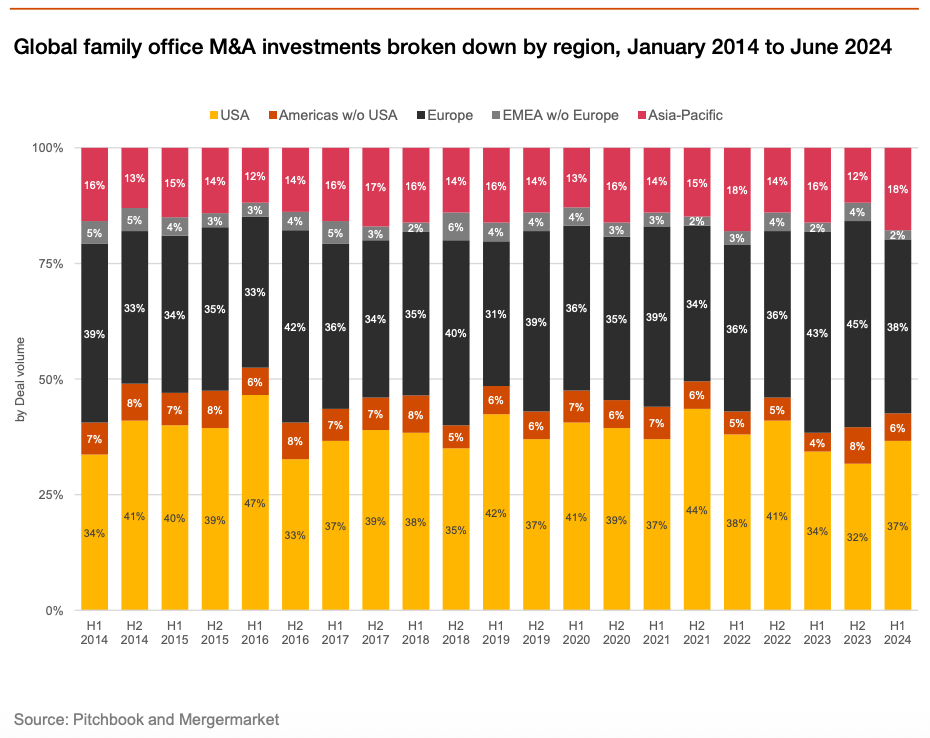

On the direct investment side, Europe remained the most popular region for family offices to buy other private businesses.

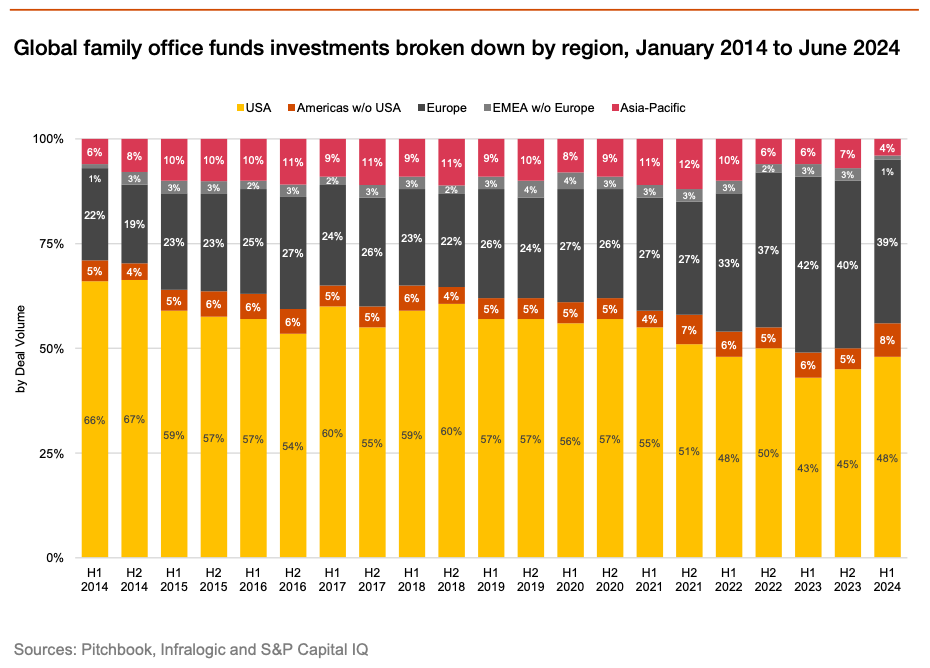

On the fund side, US funds remained more popular than European funds. This data could perhaps help make sense of recent actions by firms like Apollo and Blue Owl, which have recently intensified a focus on building out family office focused distribution teams to specifically serve the family office community.

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

- Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

- Investor Relations Professional. Click here to learn more.

- Human Capital - COO. Click here to learn more.

- Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

- Private Wealth, Head of Global Product Marketing Management. Click here to learn more.

- Credit Executive Office, Senior Associate / Associate. Click here to learn more.

SVP - GCG Head of Content Strategy. Click here to learn more.

- Coverage Associate, Strategic Partnerships (Private Wealth). Click here to learn more.

- Private Markets, Due Diligence Manager – Senior Vice President. Click here to learn more.

- SVP Business Development, Private Markets. Click here to learn more.

Private Markets for Wealth - Executive Director - Frankfurt. Click here to learn more.

- Head of Registered Alternative Products. Click here to learn more.

- Alternative Investment Specialist. Click here to learn more.

- Manager, Merger & Acquisitions. Click here to learn more.

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

Partner with Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Managing Director, Co-Head of US Wealth Business, Senior Sponsor for Retirement Business and Chairman & CEO discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch Partner & Head of Private Wealth Americas discuss how the firm is bringing EQT’s success to the US wealth market. Watch here.

🎥 Watch Partner & Co-CEO of KKR Private Equity Conglomerate LLC (K-PEC) discuss how the firm has innovated in private markets, why KKR came up with the Conglomerate structure, and how evergreens can play a role in investors’ portfolios. Watch here.

🎥 Watch Co-Founder and Managing Partner in a live podcast from BTG Pactual’s NYC office share why GP stakes can be the best of all worlds. Watch here.

📝 Read The AGM Op-Ed with Private Markets Head on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch ’s Head of the Americas Client Business , Head of Product for US Wealth & Head of Alts to Wealth , and 's Co-Head of Private Wealth discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch the third episode of on Alt Goes Mainstream with Senior MD and Senior Research Analyst as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch CEO discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Partner & Chief Client Officerand Partner talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch , Co-CEO of , talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Co-CEO , where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to , Partner & Chief Client & Product Development Officer of , discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch , Founder & CEO of share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch , CEO of $72B AUM share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch , Global Head of Private Wealth Solutions at share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch , Senior Managing Director, Head of Global Wealth Advisory Services at live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch , Co-Founder of on building a single source of truth for private markets. Watch here.

🎥 Watch , Co-Founder & CEO of discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch , Chairman & CEO of on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Managing Director, Co-Head US Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Head of Americas, Global Wealth Solutions (GWS) and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Global Head of Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on in 2024. Read here.

📝 Read about the launch of the , a collaboration between and to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear General Partner and former Partner discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear ’s MD, Senior Investment Strategist & Co-Head of the Chicago Office discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch CEO discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM ’s Director of Institutional Asset Management bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Board Member and Senior Managing Director on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of and former and Partner discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear ’s President, Industries, and Co-Founder of DealCloud by Intapp discuss how data and automation are transforming private markets. Listen here.

🎙 Hear ’s CIO discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear discuss why and how alts are going mainstream on ’s Animal Spirits podcast with ’s and . Listen here.

🎙 Hear US Financial Intermediaries Leader and ’ MD and Head of Investments on following the fast river of alts. Listen here.

🎙 Hear Global Head of Private Markets share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch , Chairman & CEO at , on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend Chairman Emeritus and Former Managing General Partner discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Global Private Wealth President & CEOshare insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Managing Partner share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with and at , a mid-market GP stakes firm anchored by . Read here.

🎙 Hear how , Chairman, CEO, and Co-Founder of t has built a $29B credit investment firm and a winning NWSL soccer franchise, the . Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from , former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm . Listen here.

🎙 Hear , the CIO of $307B , discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear CTO discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Thank you for reading Alt Goes Mainstream by The AGM Collective. If you enjoyed this post, share it with anyone you know who is interested in private markets.