AGM Alts Weekly | 5.11.25: The duality of private markets

👋 Hi, I’m Michael.

Welcome to .

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good morning from Washington, DC, where I’m back from a week of meetings in NYC.

Private markets continues its momentum in the wealth channel. The rapid pace of innovation of the wealth channel’s adoption of private markets is creating a very interesting duality: the juxtaposition of “making it easy” balanced with customization and differentiation.

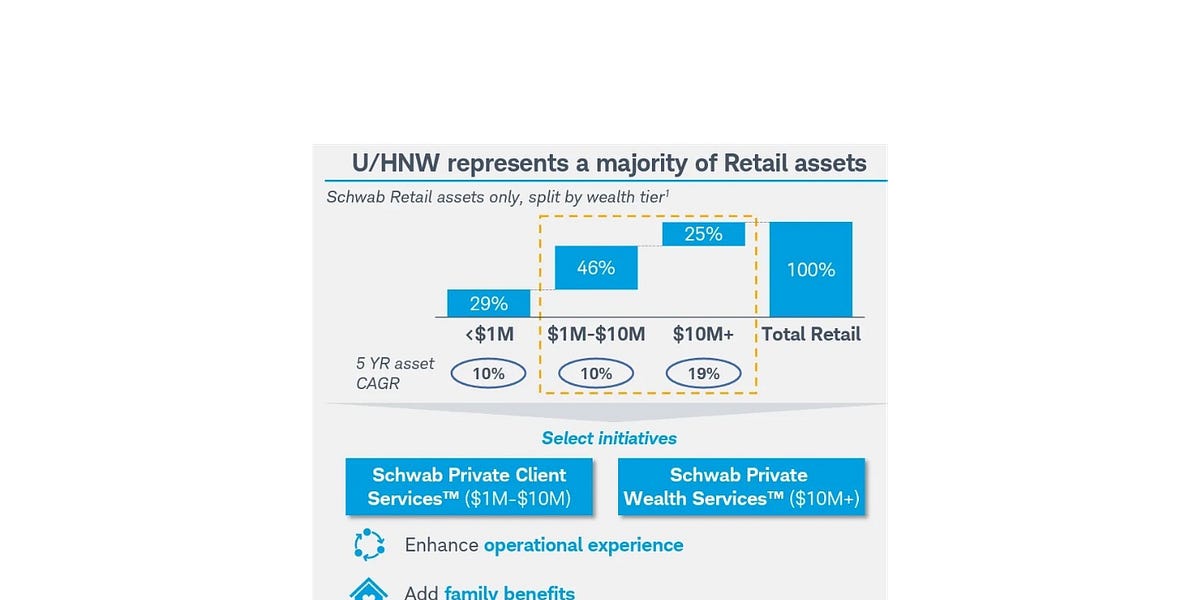

Across the entire wealth channel, which spans around $140-150T globally according to a Bain & Company chart, many are still structurally underallocated to private markets. The majority of the wealth channel isn’t allocated to private markets — and even the “very HNW” category, which is $5-30M net worth range, is 1-5% allocated to private markets at best (for more on how to categorize the wealth channel, I wrote about it here in the 10.13.24 AGM Alts Weekly).

Two interesting and notable trends have emerged.

Investing in private markets needs to be seamless and turnkey. Ease of use includes everything from product structure (read: evergreens, which enable investors to be fully invested from day one) to investor onboarding and KYC, to subscription document processing, to reporting and data management.

For the majority of investors in the wealth channel, making it easy is critical.

That’s why the advent of model portfolios and, more recently, the rollout of private markets products in unified managed accounts (UMAs), as BlackRock, iCapital, and GeoWealth announced at iCapital Connect in March 2025 are likely to usher in a new wave of adoption of private markets by many advisors and end clients that have yet to allocate to private markets.

The rollout of combining public and private investments into a single solution continued this week with a few major announcements.

One was Blackstone, Vanguard, and Wellington filing the Form N-2 for the “WVB All Markets Fund, ” an interval fund that will combine strategies managed by Blackstone, Vanguard, and Wellington into a single fund.

The N-2 notes that the fund will have “exposure to a broad range of public and private market investments through individual securities, pooled investment vehicles, and derivatives. The Fund will utilize a flexible investment strategy across public and private equity and fixed income markets.”

Under normal market conditions, the Fund will seek investment exposure within the Fund’s portfolio to: (i) public equities investments in the range of 40% to 60% of the Fund’s net assets, (ii) public fixed income investments in the range of 15% to 30% of the Fund’s net assets, and (iii) private markets investments in the range of 25% to 40% of the Fund’s net assets (collectively, the “Underlying Exposures”). “Private markets” refers generally to strategies focused on asset classes such as private equity, private credit, real estate and infrastructure, among others.

On a panel at the Milken conference this week, Blackstone’s Global Head of Private Wealth Solutions Joan Solotar said that she believes multi-asset products are a major part of the future of private markets (you can listen to the Alt Goes Mainstream podcast with Joan here).

Citywire’s Tania Mitra shared a quote from Joan in her article about the panel: “I think the path of travel is multi-asset, weaving things together, making them more accessible.”

It appears that combining public and private into a single product is indeed the path that private markets is heading down.

This week, Goldman Sachs Asset Management (GSAM) announced the rollout of its new custom model portfolio capabilities that will include both public and private investments by leveraging iCapital and GeoWealth’s technology.

According to a press release about the product rollout, “RIAs will be able to allocate to and implement evergreen accredited investor alternatives alongside mutual funds, ETFs, and equity SMAs within their own models or via Goldman Sachs Asset Management-designed custom models on GeoWealth’s platform.”

Global Head of Asset and Wealth Management for Goldman Sachs Marc Nachmann said: “Sophisticated RIAs have been seeking to modernize portfolios by incorporating public and private investment strategies. However, managing rebalancing and redemptions at scale has been a challenge. We are pleased that together with GeoWealth and iCapital, we have solved that problem. Leveraging our multi-asset expertise building public and private portfolios for institutions, we are now offering custom portfolios to our RIA partners. This is an inflection point for advisors as they look to give their clients the investment solutions they need, deliver excellent service and scale their practices.”

Nachmann’s quote referenced a few important themes: one, managing rebalancing and redemptions and subscriptions at scale are a challenge for many wealth management firms.

The other word of note? “Custom portfolios.”

Advisors want to be able to create customized, bespoke solutions for clients.

As more wealth management firms adopt private markets, access and allocations become table stakes. It’s customization that will differentiate wealth platforms.

I wrote about this phenomenon in the 4.14.24 AGM Alts Weekly, after Cerity Partners merged $15B OCIO Agility into their $85B platform (you can listen to this Alt Goes Mainstream podcast with Cerity Partners’ Tom Cohn and Agility’s Amita Schultes on this topic here).

Access to private markets is now table stakes. Many allocators in the wealth channel now have it if they want it.

The next step? Customization. To differentiate their offerings, wealth platforms will aim to customize allocations to private markets for their clients. To customize, wealth platforms will have to properly cover private markets.

This acquisition triggered a wave of other major combinations between wealth management platforms, with Hightower buying NEPC and Pathstone acquiring Hall Capital Partners.

I talked about this phenomenon on this past week’s Capital Allocators podcast with Ted Seides, where I noted that the institutionalization of the wealth management space is also helping to increase adoption of private markets by the wealth channel.

And it’s not just the industry’s $100B+ platforms that are working on ways to serve clients in more customized fashion.

The past few weeks have seen the continuing trend of multi-billion dollar RIAs launching their own custom solutions.

Krilogy, an independent wealth management firm and family office overseeing over $3.6B in assets, selected Allocate to build out a custom offering for its clients. Krilogy will leverage Allocate's digital infrastructure to seamlessly integrate private equity, venture capital, and private credit opportunities into its wealth management offerings that they will source and select independently as well as collaborate with Allocate to source and access managers.

MAI Capital Management, a $30B RIA, announced this past week that they selected iCapital to scale its custom alternatives platform.

MAI CIO Kurt Nye said, “Our focus is to build and manage bespoke portfolios built to preserve and create wealth across generations. With the support of iCapital, our team can now spend more time focusing on our diversified portfolios, balancing risk and deepening client relationships, instead of being bogged down by the operational intensity of alternative investments.”

I had a chance to sit down with Kurt at iCapital Connect for a conversation where we discussed MAI’s approach to investing in private markets and why iCapital’s technology and workflows will enable MAI to deliver a customized solution to clients at scale.

Kurt shared a number of interesting perspectives, including the importance of customizing solutions at scale. He said that MAI aims to “fully integrate private markets into its investment framework.” But in the past, the firm would have to fill out thousands of subscription documents for investments. A “full cycle alts experience from iCapital allows us to scale, transferring over $1B in assets to the iCapital platform.”

Many firms in the wealth channel are thinking about how to incorporate private markets.

Not every firm should, however. Not every client should be invested into private markets, particularly if they don’t understand it or don’t have the ability to handle illiquidity. The Compound’s Ben Carlson and Duncan Hill had me join their live show this past week to discuss the adoption of private markets by the wealth channel — and the importance of education.

But for firms that are working with the UHNW and HNW client, private markets can not only make sense in certain client portfolios, but also a differentiator for their business.

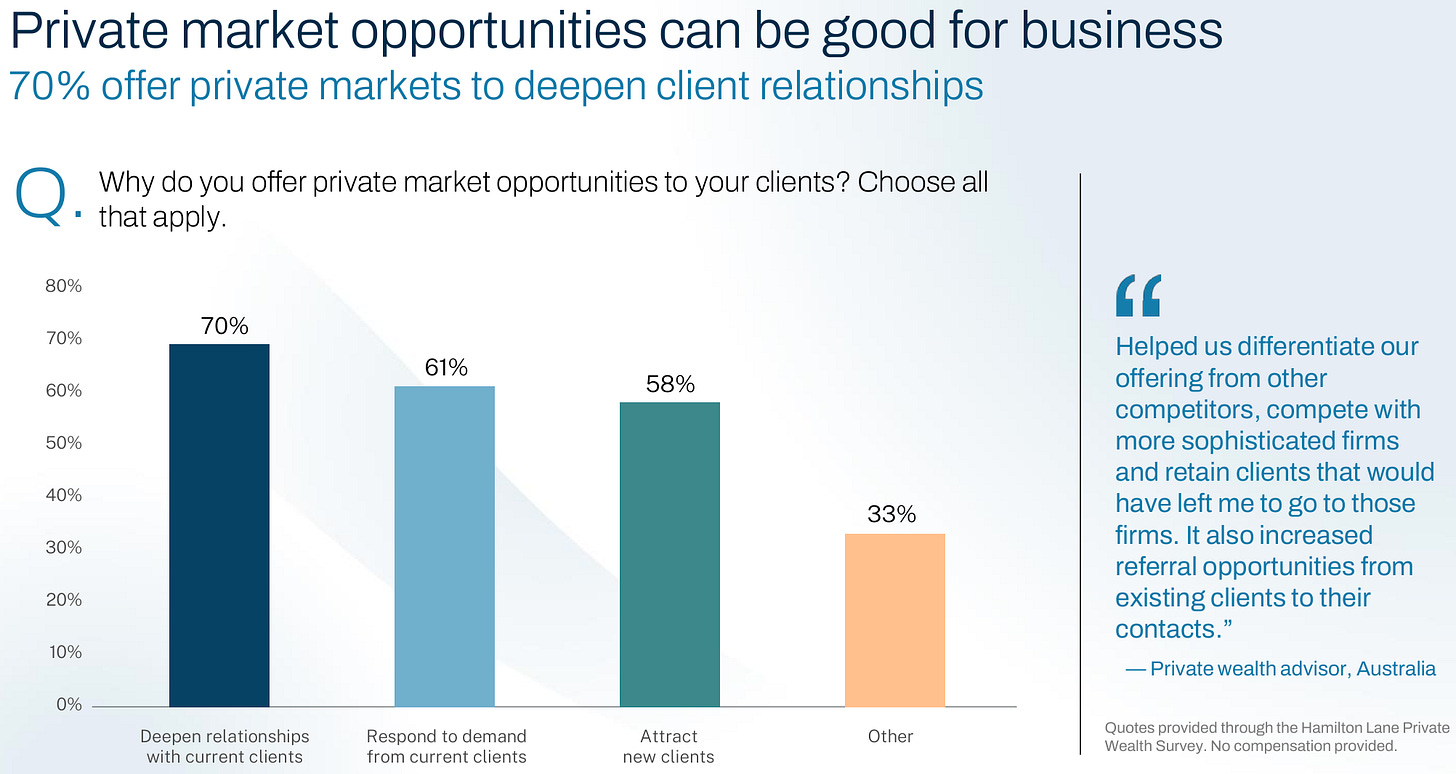

Access to private markets offerings can also be good for advisors’ business. It can serve to deepen client relationships and attract new clients, according to advisors that responded to the Hamilton Lane’s 2025 Annual Global Private Wealth Survey.

This was a topic that $1B AUM Constellation Wealth Capital President & Managing Partner Karl Heckenberg and I covered on our podcast earlier this week.

A number of firms that Constellation works with — like AlTi Global, Cresset, Requisite, AlphaCore, CV, Lido, and others — have, in some respects, put private markets capabilities and offerings at the core of what they do.

Karl made an important point. He noted that firms should “build an authentic client offering around [the] experience” that suits their firm and client demographic.

For many of the UHNW and HNW-focused advisors? That experience will likely include private markets.

Cresset integrated private markets offerings into their platform from the outset, which they recently spun out into an independent brand, Peakline Partners.

Other firms might choose to partner for private markets solutions.

That’s why we saw the recent launch of Peak Altitude Partners (PeakAlts), an investment firm that provides private markets solutions to the wealth channel.

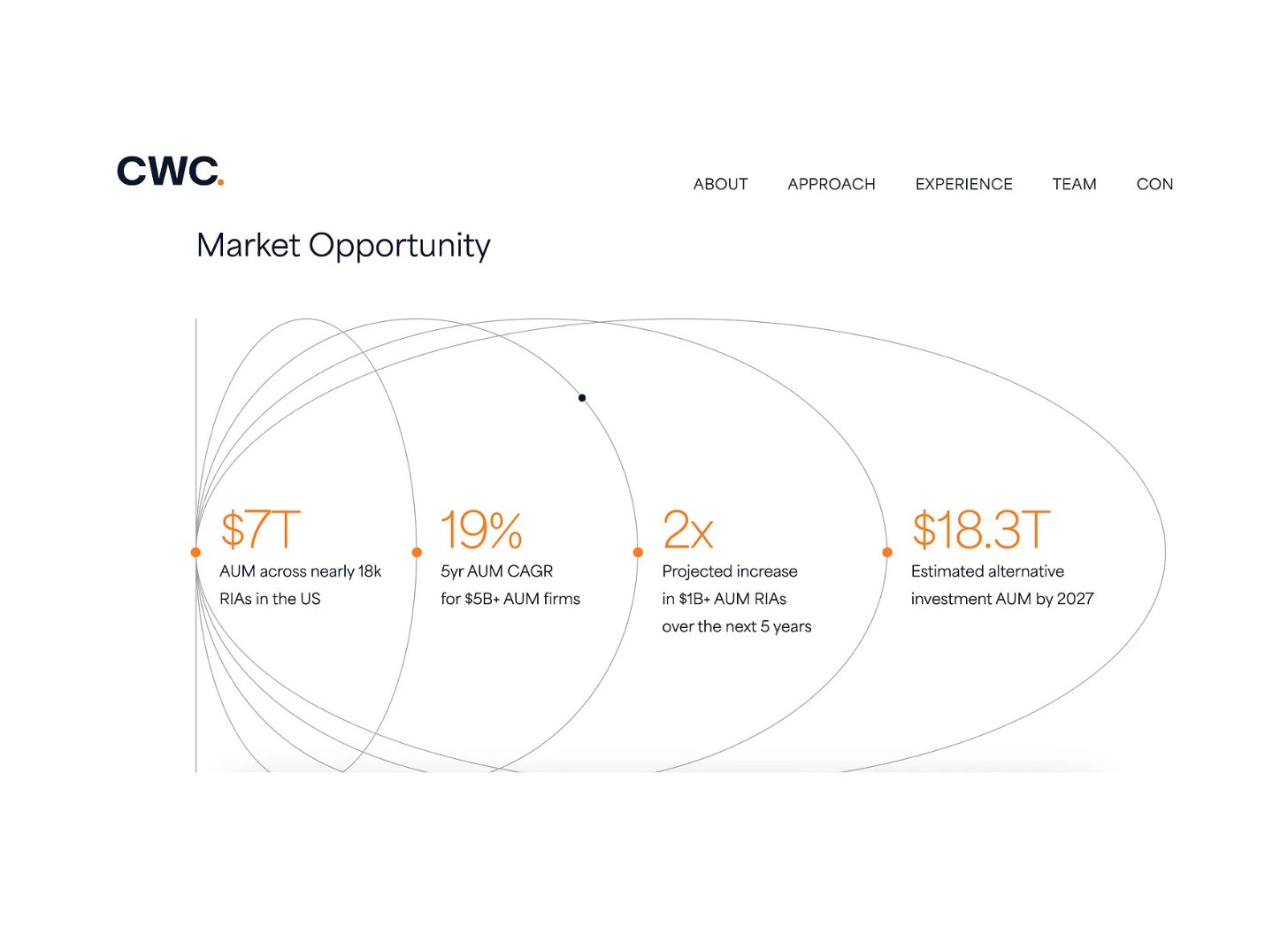

With the continued growth of US wealth, which Karl pegs at “$70T of wealth in the US and growing,” more advisors and clients might need more access to private markets.

I’d anticipate that wealth management firms continue to look for ways to deliver private markets capabilities, whether that’s developing the offering in-house or leveraging a partner like an OCIO or a firm that specializes in private markets diligence and access.

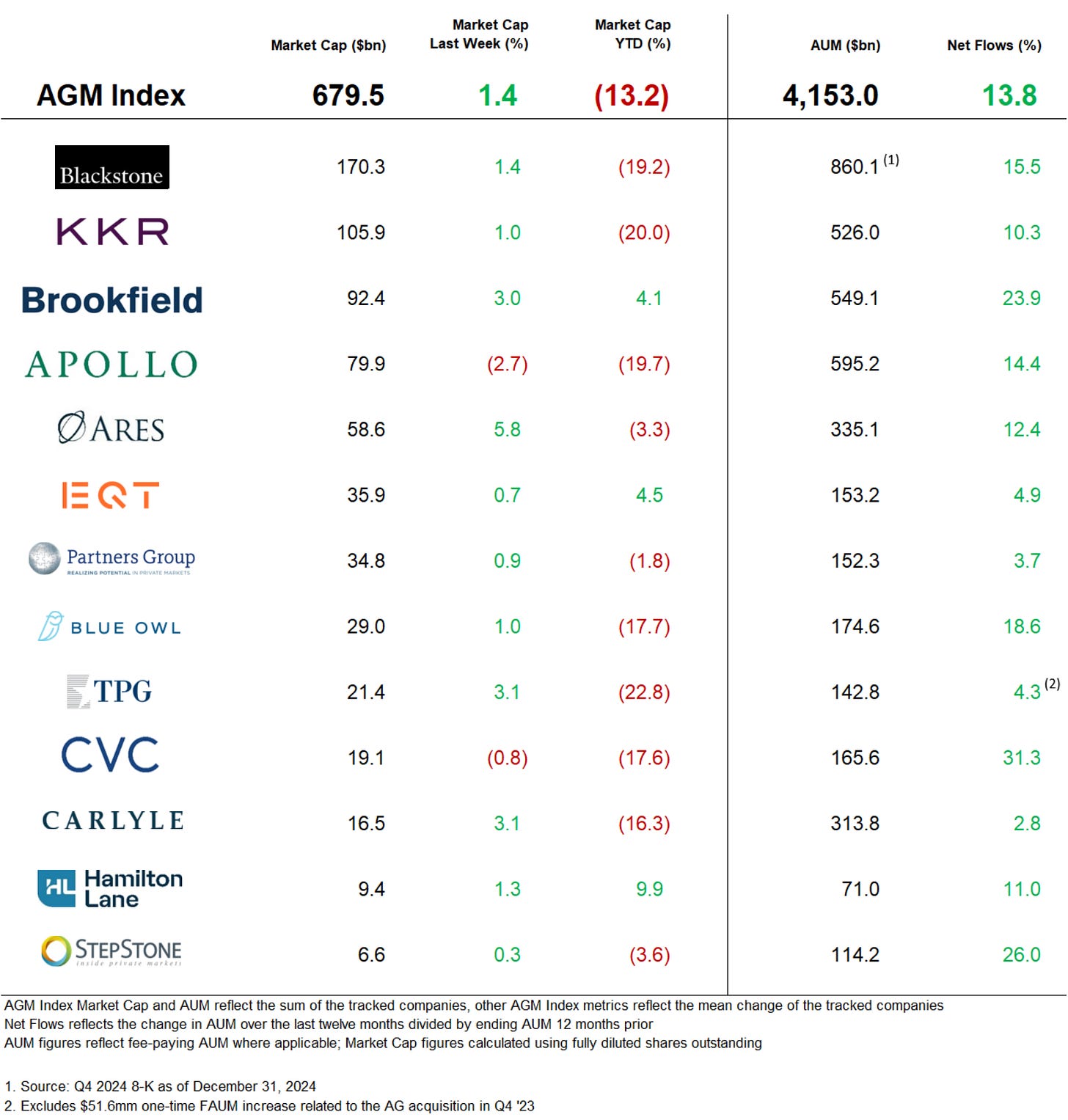

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Bloomberg’s Sonali Basak interviewed Ares Co-Founder and CEO Mike Arougheti at Milken this past week. Arougheti said that “we have actually grown faster through periods of dislocation. The fastest growth we’ve ever had was through the GFC … in terms of our profitability and our AUM. Second was through the Covid pandemic … Typically whenever we have volatile markets and or dislocation it creates opportunity.”

Some other notable quotes from Arougheti:

“What’s unique about this moment is the amount of investments that have been made in private markets at high valuations that were reflecting lower rate environment is of a magnitude that we haven’t seen before.”

“The resolution, if you will, of all of those assets … present a massive opportunity in areas like secondaries, opportunistic credit, and opportunistic real estate.”

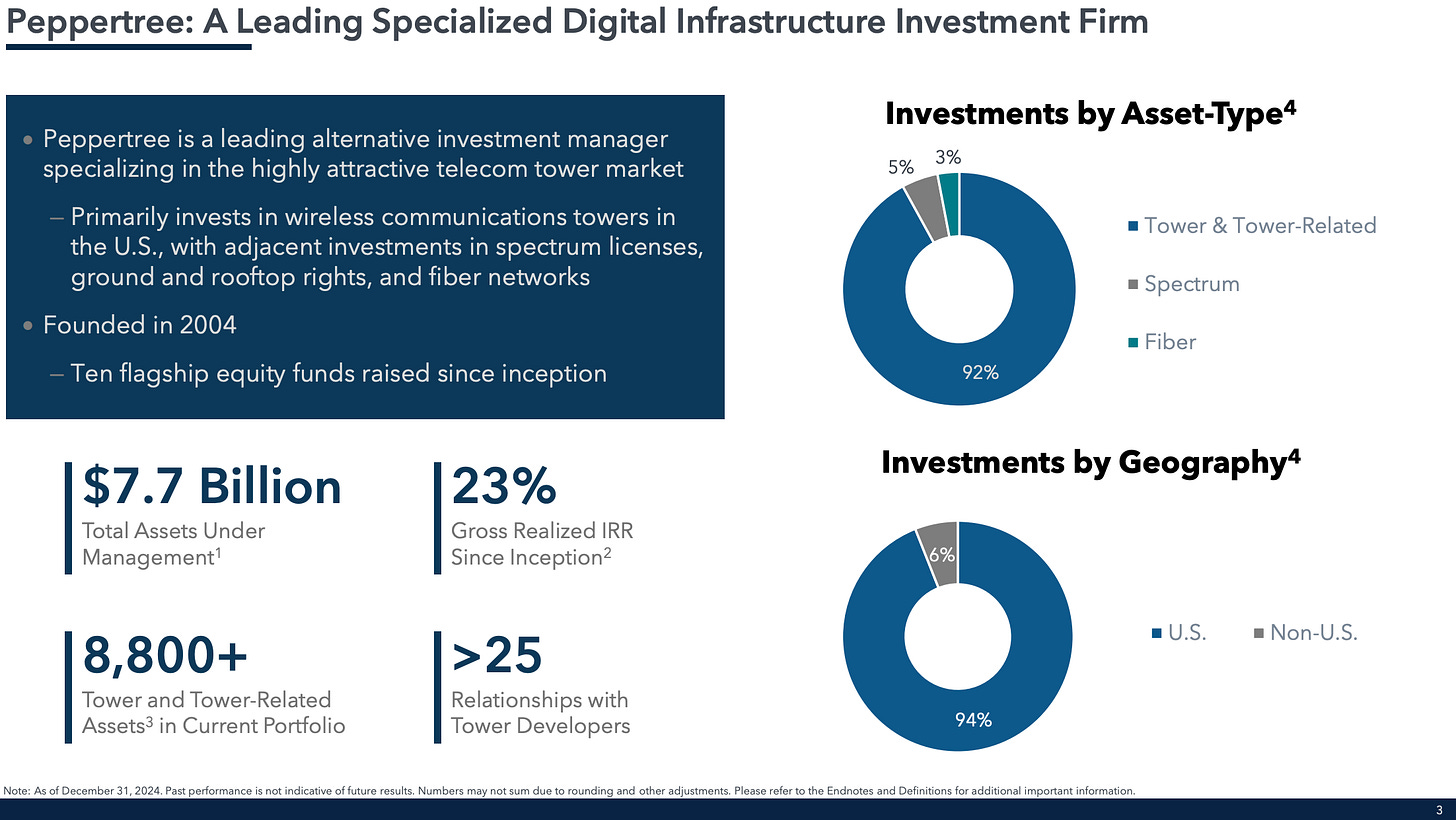

💡Bloomberg’s Allison McNeely reports that TPG will acquire infrastructure investment firm Peppertree Capital Management to continue its expansion into digital infrastructure. TPG, which will now have $253.6B AUM after the acquisition of $7.7B AUM Peppertree, will acquire the infrastructure investor for almost a combined $960M when accounting for earnouts. TPG will pay Peppertree and its investors $242M in cash and up to $418M in equity. Affiliated Managers Group is amongst the investors in Peppertree. The deal reportedly includes earnouts valued up to $300M based on Peppertree’s future performance. Ohio-based Peppertree was founded in 2004 and is an experienced investor in wireless communication infrastructure assets. The firm has invested in the construction and acquisition of more than 10,000 wireless communication assets.

💸 AGM’s 2/20: A week after TPG announced that it would be teaming up with Grand Slam golfer Rory McIlroy on a dedicated sports investing business, they were back at it again to continue expanding their platform. TPG announced its acquisition of Peppertree, a specialized digital infrastructure investment firm. This acquisition, which could amount to over $960M after earnouts of $7.7B for Peppertree, signals that TPG is continuing to expand its platform. This deal follows TPG’s 2023 acquisition of Angelo Gordon for $2.7B to build out its credit platform.

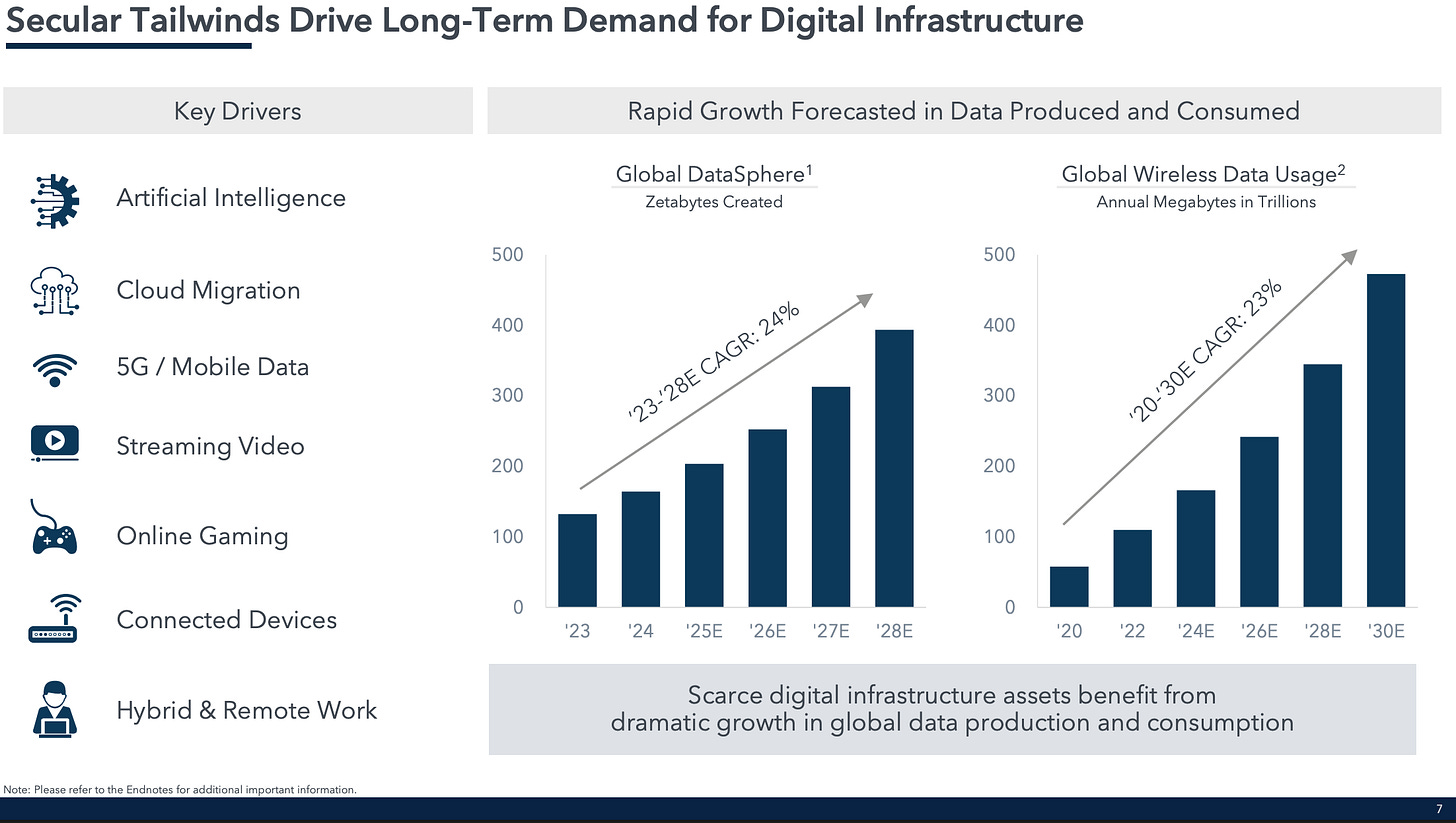

Peppertree adds another dimension to TPG’s platform at a time when infrastructure investing is on the rise. There are secular tailwinds in global data usage, which requires the continued buildout and financing of digital infrastructure assets, as this slide from TPG’s presentation illustrates.

Peppertree has been a leader in this category, specializing in investing in wireless communication towers, spectrum licenses, ground and rooftop rights, and fiber networks across its 10 flagship equity funds since 2005.

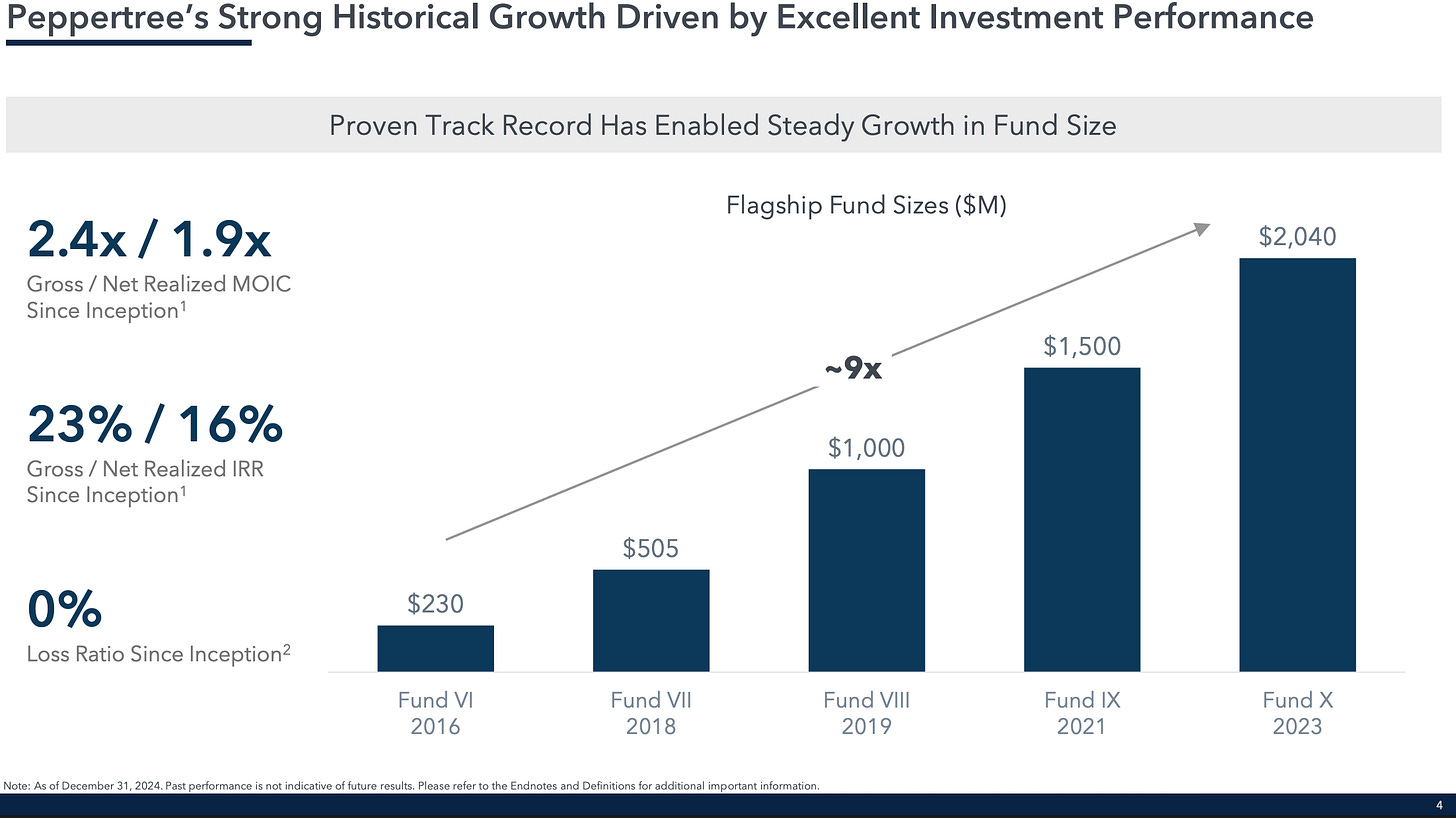

Fund size for Peppertree has seen secular growth since 2016, with a 9x growth in flagship fund size.

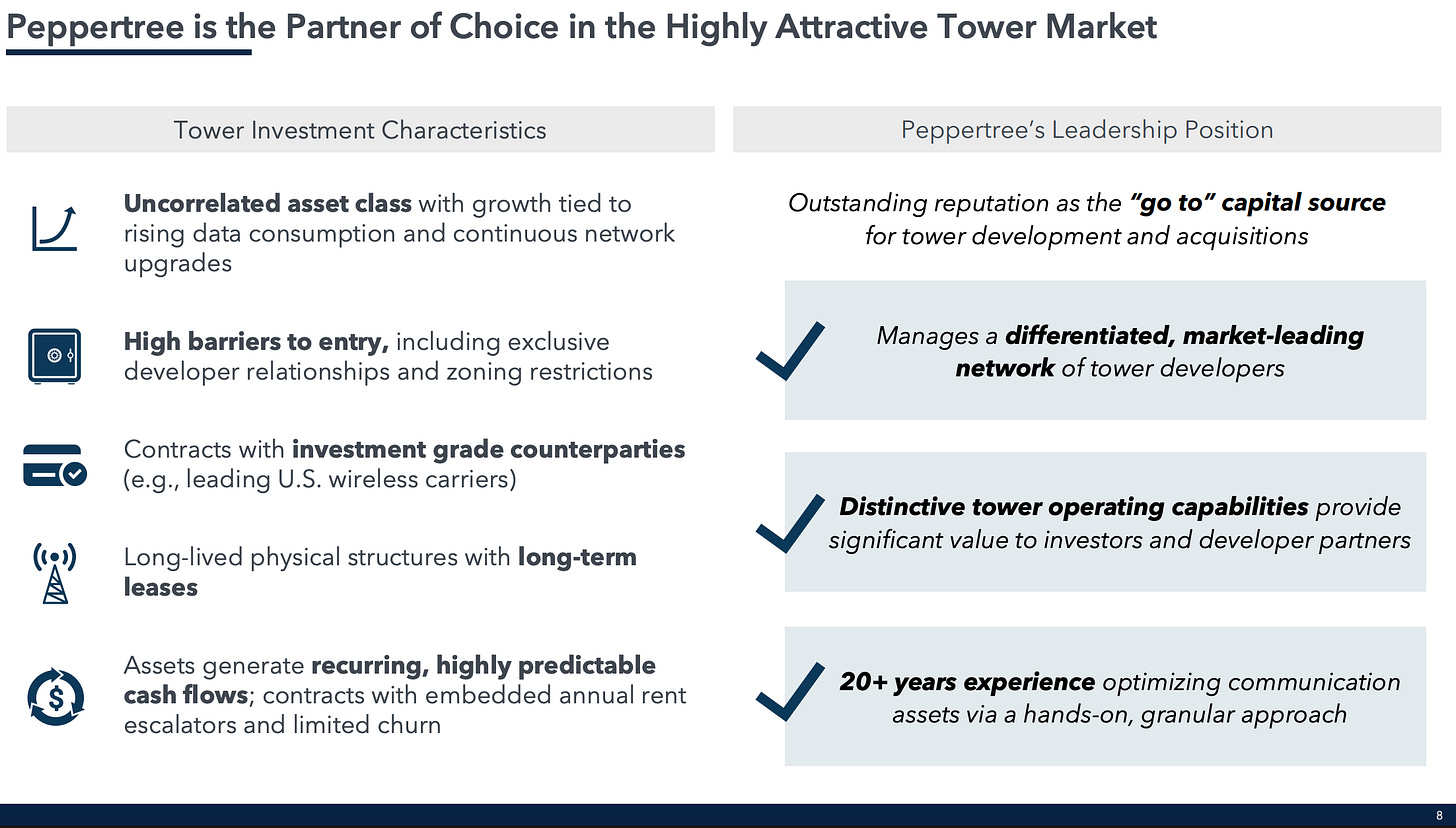

Infrastructure investing should certainly be additive to TPG’s platform. It’s a category that is often seen as an uncorrelated and inflation protected asset class. These investments also often have long-term leases with investment grade counterparts (leading US wireless carriers) that result in recurring, predictable cashflows and limited customer churn, as this slide from TPG’s presentation shows.

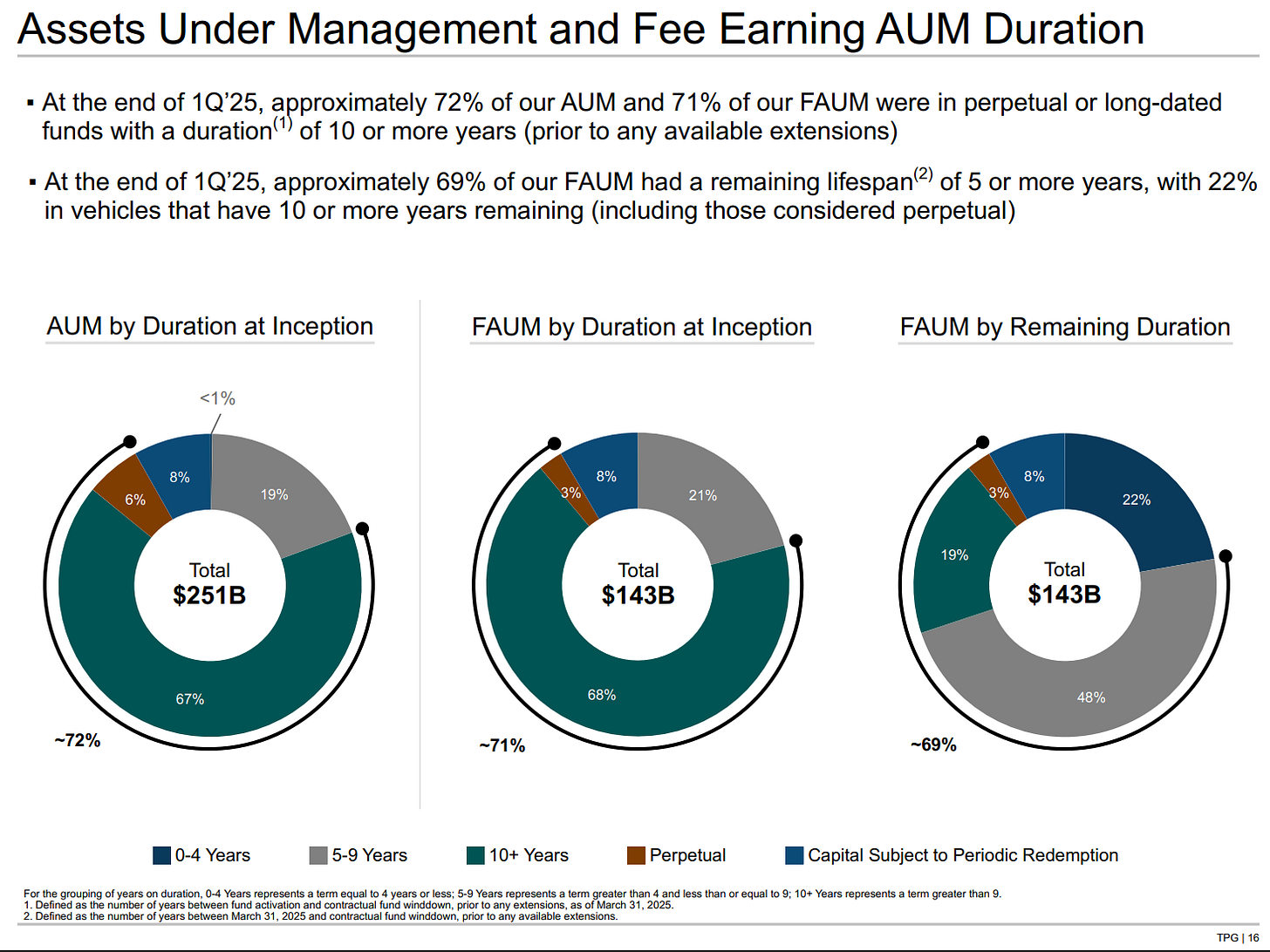

These features should align well with TPG’s continued push to grow its perpetual and long-dated fund fee-earning AUM. As a slide from its Q1 2025 earnings call illustrates, approximately 72% of TPG’s AUM and 71% of its FAUM were in perpetual or long-dated funds with a duration of 10 or more years.

Last week’s newsletter highlighted the power of permanent capital. KKR, Apollo, and Blue Owl all reported in its respective earnings calls that the majority of its capital resided in perpetual or long-duration funds. KKR noted that 93% of its AUM is either perpetual capital or has a duration of at least 8 years at inception. Apollo reported that 60% of its total AUM and 75% of its total fee-paying AUM comprised of perpetual capital. And Blue Owl reported that its $196.1B of permanent capital generated 89% of its fees in the last 12 months on a total AUM figure of $273.3B.

As firms like TPG continue to grow to compete with its publicly traded peers, it won’t be surprising to see accretive acquisitions continue to shape these firms, particularly in areas where permanent or long-dated capital — and categories that have the potential to raise meaningful amounts of capital, like infrastructure — are features of the target firm.

💡Bloomberg’s Leonard Kehnscherper reports that Man Group, the world’s biggest publicly listed hedge fund, is in discussions to acquire credit investment firm Bardin Hill Investment Partners. Bardin Hill, which specializes in middle-market, special situations, and broadly syndicated credit, manages $3.3B in assets. This deal would follow the firm’s continued push into private credit and would represent yet another acquisition of a US-based credit firm. Man acquired Varagon Capital Partners in 2023 for $183M to build out its private credit capabilities. These actions follow comments from Man’s CEO Robyn Grew, who said last year at Bloomberg’s Money, Women, and Power conference that she sees a “cracking opportunity” in the credit space. The race to establish a foothold in private credit is certainly on, particularly as banks retreat from lending and higher rates continue to persist.

You can listen to this episode of the Alt Goes Mainstream podcast with former CEO of Man Group Luke Ellis to hear more about Man.

💸 AGM’s 2/20: It’s not just private equity and private credit-focused firms that are moving into private credit in a big way. It’s hedge funds, too. This trend signals that the theme of blurring of lines is continuing. The Bardin Hill news is part of a growing trend of hedge funds looking to move into private credit.

What is private? What is public? Who does privates? Who does publics? As the long read mentioned, Blackstone, Vanguard, and Wellington have partnered to build out public and private hybrid products. That follows Apollo and State Street’s partnership on a credit ETF, and KKR and Capital Group’s partnership.

It’s interesting that hedge funds are looking to move into private credit, but not a surprise. From a business building perspective, it offers them a chance to offer products with longer lockups. As the FT reported in October 2024, Millennium was reportedly looking into launching a credit vehicle that would target less liquid private credit assets. Much of Millennium’s capital was reportedly in a long-term share class, with many investors signing up for a five-year lock-up period before any redemptions would be allowed.

As Ted Seides and I discussed on his recent episode on Capital Allocators, it’s not just private equity-focused alternative asset managers that are looking to push into the wealth channel in a big way. It’s hedge funds too … and it’s the multi-strategy “pod shops” like Man, Millennium, Citadel, and others that have scaled platforms themselves that will continue to find ways to expand their businesses to capture the growing presence of private markets in financial services and in investors’ portfolios.

And it’s not just private credit that hedge funds are eyeing. Coatue launched an interval fund that will combine private and public equity investments into a single vehicle. The $70B AUM firm, which has investment strategies that span both public equities and private equity / growth and venture, recently introduced the Coatue Innovation Fund (CTEK), which was launched with a $1B commitment from Bezos Expeditions, Jeff Bezos’ family office, and DFO Management, LLC, the family office of Michael Dell.

On the Man / Bardin Hill talks, it’s also worth noting that Bardin Hill had a minority equity stake held by Blue Owl’s GP Strategic Capital (the investment was made when the firm was called Dyal and was exited to Navigator in 2020* — editors note: in the email sent out via Substack I incorrectly noted that Blue Owl currently holds a stake in Bardin Hill. That is not the case anymore.)

I’ve talked before about the next wave of alternative asset managers that could be on the radar of the industry’s largest firms or who could be on a path to go public themselves (here, here, and here), in part because many of them have taken in GP stake investment or because they are making a concerted effort to move into the wealth channel.

Many of these firms are on a growth path themselves. Some have taken in a GP stake investment, often from Blue Owl, Goldman’s Petershill Partners, or Blackstone Strategic Partners. Others remain independently held.

Who could be next?

💡Schroders Capital’s CIO Nils Rode shared perspectives on Schroders’ outlook on the market and where to think about allocating in private markets given the current environment.

AGM 2/20: Rode shared in his note that private markets can insulate investors from “public market volatility and [can even] thrive amid uncertainty.”

Private markets generally offer protection against public market volatility and can even thrive amid uncertainty, as we have shown previously in relation to private equity in particular. Nevertheless, we find that in the current market environment some private market strategies exhibit notably better risk/return profiles than others. Consequently, we urge investors to be particularly discerning in selecting strategies and investments. Additionally, diversification across strategies is important.

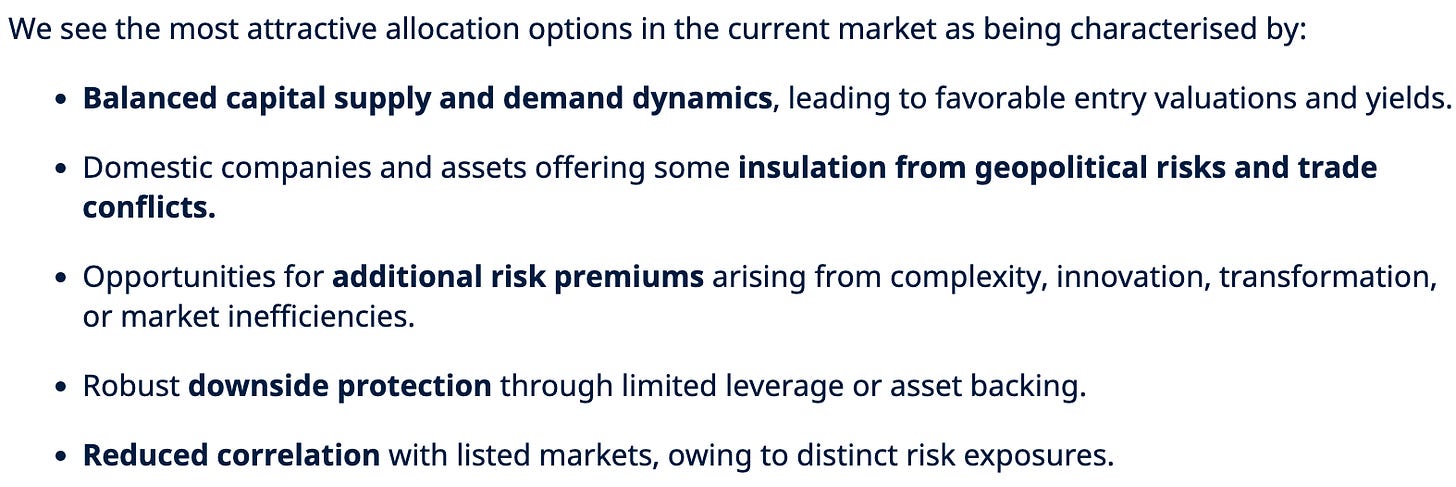

Rode shared where they see the most attractive allocation options in the current market:

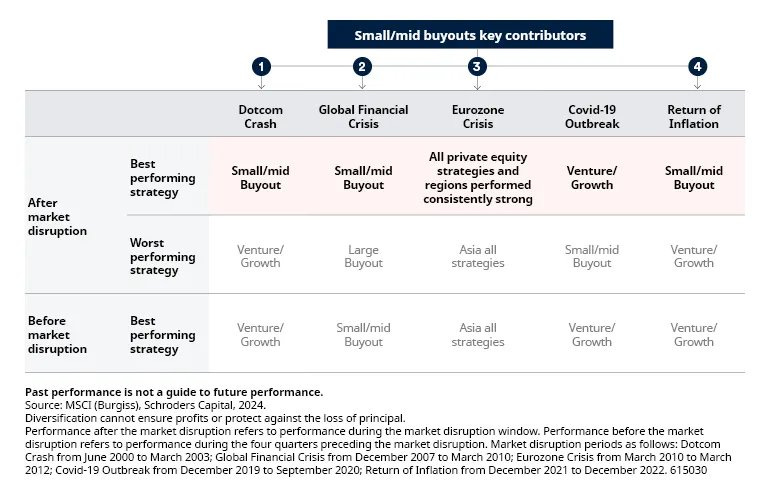

Rode also included an interesting chart on small and mid-market buyout strategies and when it tends to perform well compared to other categories of private equity. I wrote more about the middle-market private equity landscape in the 8.11.24 AGM Alts Weekly about how “the middle-market is not so middling.”

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

- Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

- Investor Relations Professional. Click here to learn more.

- Global Wealth Solutions - Investor Relations - Principal. Click here to learn more.

- Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

- Credit Executive Office, Senior Associate / Associate. Click here to learn more.

SVP - GCG Head of Content Strategy. Click here to learn more.

- Associate, Business Operations (Private Wealth). Click here to learn more.

- Private Markets, Due Diligence Manager – Senior Vice President. Click here to learn more.

- SVP Business Development, Private Markets. Click here to learn more.

Private Markets for Wealth - Executive Director - Frankfurt. Click here to learn more.

- SVP, Business Development. Click here to learn more.

- Alternative Investment Specialist. Click here to learn more.

- Manager, Merger & Acquisitions. Click here to learn more.

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

Partner with Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Managing Director & Co-Head of Private Wealth Solutions discuss how Fortress has built a wealth solutions business from a whiteboard, leaning on the firm’s pioneering history of innovation. Watch here.

🎥 Watch President & Managing Partner on why there will be a $1T independent wealth management firm. Watch here.

🎙 Listen to , Founder of , and I discuss the convergence of the institutional world and the wealth world as we dive into the intersection of private markets and private wealth to kick off a mini-series on Private Wealth. Listen here.

🎥 Watch Managing Director, Co-Head of US Wealth Business, Senior Sponsor for Retirement Business and Chairman & CEO discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch Partner & Head of Private Wealth Americas discuss how the firm is bringing EQT’s success to the US wealth market. Watch here.

🎥 Watch Partner & Co-CEO of KKR Private Equity Conglomerate LLC (K-PEC) discuss how the firm has innovated in private markets, why KKR came up with the Conglomerate structure, and how evergreens can play a role in investors’ portfolios. Watch here.

🎥 Watch Co-Founder and Managing Partner in a live podcast from BTG Pactual’s NYC office share why GP stakes can be the best of all worlds. Watch here.

📝 Read The AGM Op-Ed with Private Markets Head on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch ’s Head of the Americas Client Business , Head of Product for US Wealth & Head of Alts to Wealth , and 's Co-Head of Private Wealth discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch the third episode of on Alt Goes Mainstream with Senior MD and Senior Research Analyst as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch CEO discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Partner & Chief Client Officerand Partner talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch , Co-CEO of , talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Co-CEO , where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to , Partner & Chief Client & Product Development Officer of , discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch , Founder & CEO of share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch , CEO of $72B AUM share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch , Global Head of Private Wealth Solutions at share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch , Senior Managing Director, Head of Global Wealth Advisory Services at live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch , Co-Founder of on building a single source of truth for private markets. Watch here.

🎥 Watch , Co-Founder & CEO of discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch , Chairman & CEO of on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Managing Director, Co-Head US Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Head of Americas, Global Wealth Solutions (GWS) and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Managing Director, Global Head of Private Wealth Solutions and Co-Founder & Managing Partner discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on in 2024. Read here.

📝 Read about the launch of the , a collaboration between and to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear General Partner and former Partner discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear ’s MD, Senior Investment Strategist & Co-Head of the Chicago Office discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch CEO discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM ’s Director of Institutional Asset Management bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Board Member and Senior Managing Director on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of and former and Partner discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear ’s President, Industries, and Co-Founder of DealCloud by Intapp discuss how data and automation are transforming private markets. Listen here.

🎙 Hear ’s CIO discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear discuss why and how alts are going mainstream on ’s Animal Spirits podcast with ’s and . Listen here.

🎙 Hear US Financial Intermediaries Leader and ’ MD and Head of Investments on following the fast river of alts. Listen here.

🎙 Hear Global Head of Private Markets share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch , Chairman & CEO at , on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend Chairman Emeritus and Former Managing General Partner discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Global Private Wealth President & CEOshare insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Managing Partner share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with and at , a mid-market GP stakes firm anchored by . Read here.

🎙 Hear how , Chairman, CEO, and Co-Founder of t has built a $29B credit investment firm and a winning NWSL soccer franchise, the . Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from , former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm . Listen here.

🎙 Hear , the CIO of $307B , discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear CTO discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Thank you for reading Alt Goes Mainstream by The AGM Collective. If you enjoyed this post, share it with anyone you know who is interested in private markets.