Africa’s 10 Weakest Currencies at the Start of 2026: What Drives Their Decline

Currency strength remains one of the most telling indicators of a country’s economic health. When a currency is weak, meaning it requires many units to purchase a single US dollar, and it often signals inflationary pressures, limited foreign exchange reserves, trade imbalances, and structural economic challenges.

Weak currencies can exacerbate the cost of imports, reduce purchasing power, and create difficulties for governments trying to fund development projects or service debts.

Across Africa, several recurring patterns explain low currency valuations: high dependence on imports, narrow export bases, inflationary pressures, limited monetary policy flexibility, political instability, and structural inefficiencies.

Let look at the ten weakest African currencies as of early 2026, using current exchange rate data to show how much one USD buys in each nation.

1. São Tomé & Príncipe Dobra (STN) – 22,282 Dobra = 1 USD

The dobra tops the list as Africa’s weakest currency. São Tomé & Príncipe’s economy is extremely small, heavily reliant on imports for essential goods, and primarily dependent on cocoa and tourism revenues.

High import bills combined with limited foreign reserves and rising domestic spending keep the dobra under pressure. Inflationary tendencies have further eroded its value over the past decade.

2. Sierra Leonean Leone (SLL) – 20,970 Leone = 1 USD

Sierra Leone has attempted redenominations to stabilize the leone, yet the currency continues to struggle. Persistent inflation, limited export diversification, and reliance on imports for food and energy maintain downward pressure.

Political uncertainty and fluctuating mining revenues, particularly from diamonds, also affect investor confidence.

3. Guinean Franc (GNF) – 8,700 Franc = 1 USD

Guinea’s franc is weighed down by political instability, narrow export diversity, and infrastructural bottlenecks.

While Guinea has abundant mineral resources, including bauxite and gold, limited processing capacity and dependence on raw exports mean foreign exchange inflows are inconsistent.

Inflation and weak monetary policy enforcement have further deepened the franc’s vulnerability.

4. Malagasy Ariary (MGA) – 4,483 Ariary = 1 USD

Madagascar’s ariary reflects the challenges of a largely import-dependent economy. Infrastructure deficits, a weak industrial base, and frequent fiscal constraints make the country heavily reliant on foreign aid and imports.

Inflation pressures, especially in food prices, continue to limit the currency’s value, despite some growth in vanilla and seafood exports.

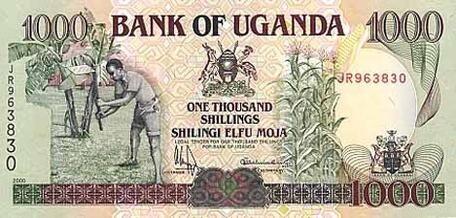

5. Ugandan Shilling (UGX) – 3,541 Shillings = 1 USD

The shilling has maintained a low value due to trade imbalances and heavy import reliance, particularly in energy and machinery.

Uganda’s economic growth, driven by agriculture and oil discoveries, has not yet translated into strong currency stability.

Foreign exchange shortages and monetary tightening policies have had limited impact on stabilizing the shilling.

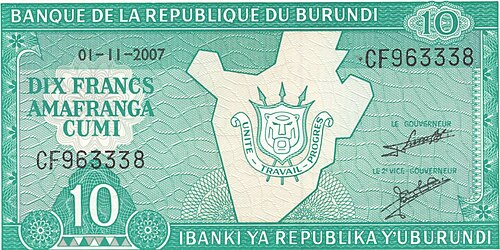

6. Burundian Franc (BIF) – 2,938 Francs = 1 USD

Burundi’s franc reflects a fragile economy with narrow foreign revenue streams. Agricultural exports, mainly coffee and tea, provide most of the country’s foreign exchange.

Political instability and limited access to external financing exacerbate currency weakness. Inflation remains a persistent challenge for the central bank.

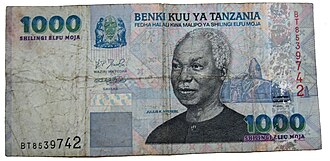

7. Tanzanian Shilling (TZS) – 2,548 Shillings = 1 USD

The Tanzanian shilling faces inflationary pressures and external trade gaps, despite steady GDP growth in sectors like tourism, mining, and agriculture.

High import dependence, particularly for industrial goods and refined petroleum, places continuous pressure on the shilling. Government borrowing and public spending further complicate currency stabilization efforts.

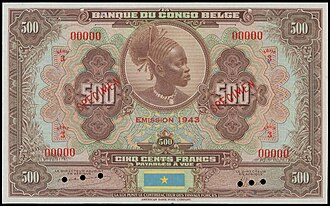

8. Congolese Franc (CDF) – 2,279 Francs = 1 USD

Despite the Democratic Republic of Congo’s immense mineral wealth, including cobalt, copper, and diamonds, the franc remains weak due to political risk, governance challenges, and infrastructure deficits.

Corruption, volatile commodity prices, and limited industrialization reduce consistent foreign currency inflows, keeping the franc among Africa’s weakest.

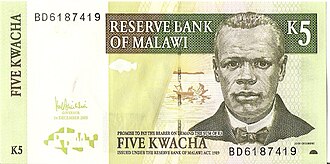

9. Malawian Kwacha (MWK) – 1,720 Kwacha = 1 USD

Malawi’s kwacha struggles primarily because of foreign exchange shortages, reliance on imports, and limited export capacity.

Tobacco exports, the mainstay of foreign earnings, are subject to global price fluctuations. Inflation pressures on food and fuel further weaken the currency, despite macroeconomic reform efforts.

10. Rwandan Franc (RWF) – 1,447 Francs = 1 USD

Rwanda rounds out the list with its franc, weakened by trade imbalances and a narrow export base. Although Rwanda has achieved impressive economic growth post-1994, its dependence on imports, primarily machinery and fuel, limits currency strength.

Government policies have focused on stability and investment promotion, yet global price shocks continue to affect exchange rates.

Understanding Weak Currencies in Africa

Weak currencies affect ordinary citizens, businesses, and foreign investment. Higher import costs increase living expenses, while exporters may struggle with limited access to foreign buyers due to price fluctuations.

Governments are often forced to raise interest rates or intervene in forex markets, which can limit growth. Policymakers across these countries face the delicate task of balancing growth, inflation, and currency stability.

Key drivers of weak currencies include:

Heavy import dependence for essential goods.

Limited diversification of export products.

Inflationary pressures and monetary policy challenges.

Political instability and governance risks.

Global commodity price shocks impacting earnings.

Africa’s currency landscape demonstrates that strong economic fundamentals, trade diversification, and political stability are essential to achieving stronger and more resilient currencies.

For now, these ten nations face a continuing battle to stabilize their money against the US dollar, with implications for growth, trade, and everyday life.

You may also like...

Haaland's Shock Confession: Star Striker Admits 'Not Enough Goals,' Vows Improvement!

Manchester City's Erling Haaland acknowledges a need for personal improvement despite his decisive role in their 2-1 vic...

Rooney Drops Bomb: Tottenham 'In Relegation Battle' Shakes Premier League!

Tottenham Hotspur is facing a severe crisis, with Wayne Rooney stating the club is in a relegation battle after a dismal...

Spielberg's Sci-Fi Comeback: First Look at His New Epic Stuns Super Bowl Audience!

Legendary director Steven Spielberg is set to release his new sci-fi film, <em>Disclosure Day</em>, on June 12, 2026. Pe...

Brad Pitt Shocks Fans: Cliff Booth Returns in Surprise 'Once Upon a Time in Hollywood' Sequel!

Get ready for "The Adventures of Cliff Booth," the highly anticipated sequel to "Once Upon a Time in Hollywood," hitting...

Super Bowl LX Shocker: Bad Bunny's Halftime Performance Ignites Frenzy With All-Star Guests and Fierce Controversy

Bad Bunny's Super Bowl LX halftime show sparked immense debate, with his Puerto Rican pride-filled performance featuring...

Lili Reinhart Unleashes Inner Regina George in 'Forbidden Fruits': A Witchy 'Mean Girls' Exclusive

Discover "Forbidden Fruits," the anticipated film starring Lili Reinhart, Lola Tung, Alexandra Shipp, and Victoria Pedre...

Celebrity Ayobami Esther Akinnagbe Unveils Remote Work-Life Balance Secrets for Career Growth

Remote work, while offering immense flexibility, necessitates intentional strategies to prevent burnout and maintain a h...

Medical Marvel: Mounjaro Jab Unveils Power to Reverse Deadly Liver Disease

A growing number of patients are finding hope in GLP-1 weight-loss drugs for treating severe liver disease, including fi...