WHO Urges Health Taxes Again in 2026: Countries Should Raise Sugary Drink and Alcohol Prices

The World Health Organization (WHO) has recently raised the alarm about the affordability of sugary drinks and alcoholic beverages in many countries.

The question should be why is an alarm being raised? Isn't it a good thing that there is affordability of the products?

Understanding this, WHO says low taxes on these products are making them cheap, which encourages higher consumption.

Now, this is where the problem lies,

While sugary drink and alcohol taxes have been discussed for many years, the World Health Organization (WHO) hasissued a new warning in January 2026, showing that these products remain too cheap in many countries, contributing to rising obesity and diabetes rates.”

Cheap Sugary Drinks and Alcohol Affect Health

Sugary drinks, such as sodas, sweetened juices, energy drinks, and sweetened teas are high in calories and added sugar.

When people consume them regularly: Weight gain and obesity can develop, Type 2 diabetes risk rises due to high sugar intake, Heart disease and dental problems can also increase.

Alcohol consumption is linked to liver disease, certain cancers, heart problems, injuries, and mental health issues.

In many countries, alcohol taxes are too low, making beer, wine, and spirits increasingly affordable.

This affordability drives higher consumption and worsens public health outcomes, and this led to Health taxes.

According to WHO experts, governments can use health taxes to make these products less affordable.

This is one of the most effective tools to protect public health and generate revenue for health programs.

What Are Health Taxes?

Health taxes are designed to reduce consumption of harmful products like sugary drinks, alcohol, and tobacco while raising money for health services.

They work by increasing prices, which makes consumers think twice about purchasing these items.

Countries that have implemented strong sugary drink taxes have seen significant reductions in consumption.

For example, South Africa and the United Kingdom reported decreased sugary drink purchases and encouraged companies to reformulate products with less sugar.

The WHO “3 by 35 Initiative”

Building on this, Last year, WHO launched the “3 by 35 Initiative”, which aims to increase the real prices of three harmful products which are sugary drinks, alcohol, and tobacco, by at least 50% by 2035.

The idea is simple: higher prices lead to lower consumption, which reduces the burden of diseases like obesity, diabetes, heart disease, and alcohol-related injuries.

Health taxes also provide funding for public health programs, which is especially important in countries facing healthcare funding shortages.

Challenges in Implementing Health Taxes

Although health taxes are effective, there are challenges:

Industry resistance: Beverage and alcohol companies often lobby against higher taxes.

Political concerns: Price increases may be unpopular with voters.

Tax design: Taxes must cover a wide range of products and be adjusted for inflation to remain effective.

Despite these challenges, countries with strong, carefully designed taxes have successfully reduced harmful consumption while raising funds for health programs.

Why This Matters in Africa and Nigeria

In Nigeria and many African countries, sugary drinks and alcohol are widely available and often inexpensive. Rising consumption is contributing to higher rates of obesity and diabetes, especially in urban areas.

Well-designed health taxes can also work in African contexts. Countries like South Africa have already shown that taxing sugary drinks can reduce purchases and encourage healthier habits.

Conclusion

Cheap sugary drinks and alcohol are more than just a convenience, they are a growing public health risk.

WHO’s recommendations show that taxes and pricing strategies are proven, evidence-based tools to improve health and save lives.

Making unhealthy products less affordable is a simple step that could save millions of lives over the next decade.

You may also like...

NBA Shocker: Stephen Curry Sidelined with Knee Injury, Warriors Face Uphill Battle

Golden State Warriors star Stephen Curry is slated to miss at least five additional games due to a lingering right knee ...

Geopolitical Turmoil Snags Super Eagles: Troost-Ekong Stranded Amid Middle East Crisis

Former Super Eagles captain William Troost-Ekong and other international football stars are stranded in Qatar due to a m...

Victory! 'Sinners' Sweeps Actor Awards with Michael B. Jordan's Dual Performance Stealing the Spotlight

Ryan Coogler's film "Sinners" has taken home the Outstanding Performance by a Cast award, with star Michael B. Jordan al...

Panic! 'Scary Movie 6' Trailer Unleashed After 13-Year Hiatus, Ready to Invade Your Safe Space

The iconic Wayans Bros. are reuniting after 18 years for "Scary Movie 6," bringing back original stars Anna Faris and Re...

Tragic Loss: Beloved Gospel Singer Taiwo Adegbodu Passes Away

The gospel music community is in mourning following the death of Taiwo Adegbodu, one half of the celebrated Adegbodu Twi...

Pop Icon Pink Silences Separation Rumors with 20-Year Husband

Pop star Pink has publicly refuted claims of a second separation from her husband, Carey Hart, labeling the reports as "...

HBO Hit 'Industry' Creators Spill on Season 5's Grand Finale Vision

Discover the intricate dynamics of <i>Industry</i> Season 4, as creators Mickey Down and Konrad Kay discuss the show's e...

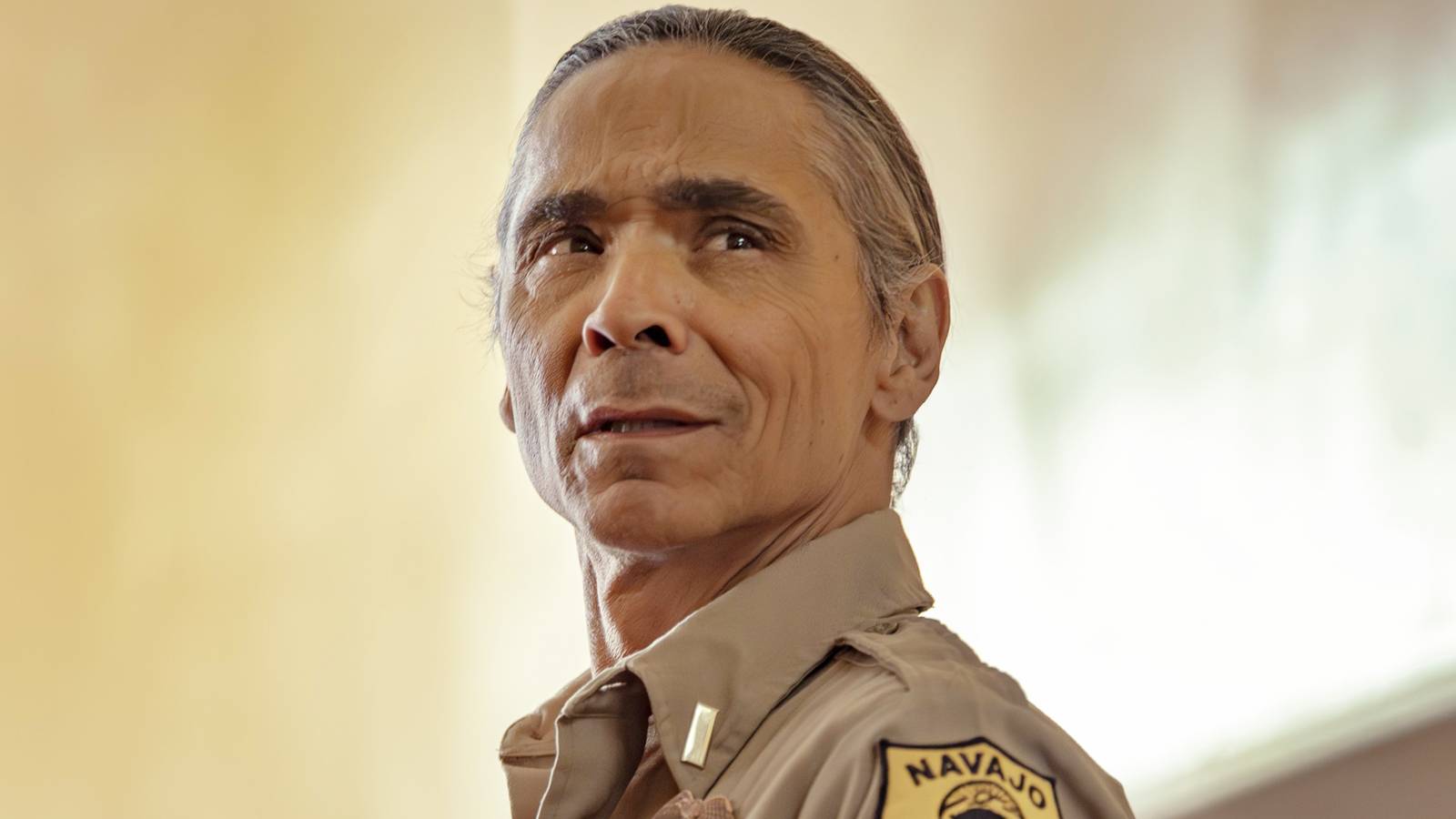

'Dark Winds' Star Zahn McClarnon Teases Joe's Perilous Future After Shocking Showdown

In <i>Dark Winds</i> Season 4, Zahn McClarnon discusses the compelling dynamic between Lt. Joe Leaphorn and new antagoni...