West Africa's BRVM Celebrates 29 Years of Anchoring Regional Capital Markets

The Regional Stock Exchange (BRVM), the world’s only fully regional stock exchange, recently marked its 29th anniversary on December 18. Established in 1996, the BRVM operates as a unified capital market for the eight member states of the West African Economic and Monetary Union (WAEMU), offering a single marketplace for both government and corporate financing across the bloc.

Over nearly three decades, the BRVM has consolidated its role as a critical funding channel for WAEMU economies. Governments across the region have relied heavily on the exchange to issue sovereign bonds to finance public expenditures, while private companies have used equity and debt listings to fund expansion, strengthen corporate governance, and enhance regional visibility. This distinctive regional model has played a vital role in pooling savings, harmonizing financial regulations, and deepening financial integration among economies with varying structures and levels of development.

The BRVM has also demonstrated a strong commitment to continuous modernization, aligning its market practices with international standards on transparency, disclosure, and investor protection. These sustained efforts have encouraged greater participation from both domestic and foreign investors, while simultaneously strengthening confidence in the regional financial system.

As it enters its thirtieth year of operation, the BRVM is focused on implementing further reforms aimed at expanding access to capital markets, enhancing support for small and medium-sized enterprises, and reinforcing its position as a strategic instrument for economic integration and long-term development in West Africa. The exchange’s regional structure is particularly significant as WAEMU countries confront rising financing needs for infrastructure development, industrialization, and the energy transition.

By maintaining a single, integrated market, the BRVM effectively reduces market fragmentation, allowing issuers to tap into a much broader pool of regional savings than individual national markets could provide. The exchange is increasingly positioning itself around key future growth themes, including the digitalization of market processes, expanded investor participation, and the development of sustainable finance instruments. These initiatives are intended to attract more private capital, especially long-term institutional investors, while supporting responsible financing aligned with social and environmental priorities. In a context where bank lending is often constrained, capital markets and the BRVM in particular, are expected to play a growing role in financing regional development.

Looking ahead, the central challenge for the BRVM will be converting its institutional stability and broad regional reach into higher liquidity, increased listings, and deeper secondary market activity. Achieving this transition will be critical in determining whether a regional exchange can evolve from a dependable funding platform into a dynamic engine for private-sector growth and shared prosperity across the WAEMU region.

Recommended Articles

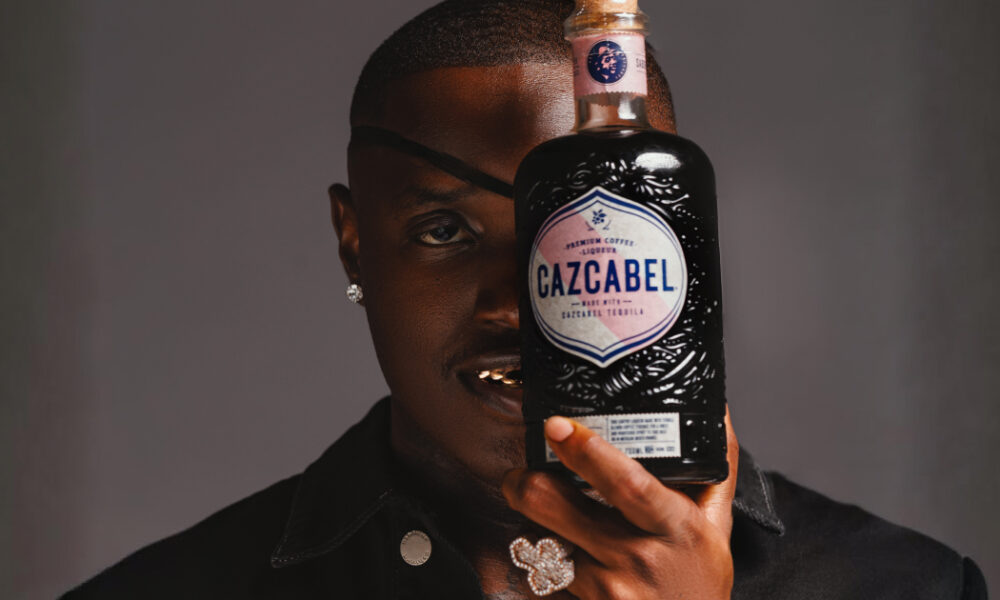

Ruger Becomes Face of Cazcabel Tequila as Brand Launches in Nigeria!

Premium tequila brand Cazcabel has launched in Nigeria, partnering with Afrobeats star Ruger as its brand ambassador to ...

Aviation Comeback: Iconic Boeing 747 Returns to Skies with Nigerian Carrier

In a unique reversal of global aviation trends, a Boeing 747-400, registered 5N-HMM, has returned to service for Nigeria...

Air Tanzania Soars: New Dar es Salaam–Lagos–Accra Route Ignites East-West Africa Connectivity!

Air Tanzania has launched a new Dar es Salaam–Lagos–Accra flight, significantly enhancing air connectivity between East ...

West Africa on High Alert: Leaders Call for Unified Strategy Amid Surging Terror Threats

West African leaders and experts convened in Accra to address escalating security threats, including terrorism and viole...

Breakthrough! Lassa Fever Vaccine Begins Human Trials in Nigeria

An experimental Lassa fever vaccine developed by the University of Oxford and CEPI has entered its first human trials in...

You may also like...

When Sacred Calendars Align: What a Rare Religious Overlap Can Teach Us

As Lent, Ramadan, and the Lunar calendar converge in February 2026, this short piece explores religious tolerance, commu...

Arsenal Under Fire: Arteta Defiantly Rejects 'Bottlers' Label Amid Title Race Nerves!

Mikel Arteta vehemently denies accusations of Arsenal being "bottlers" following a stumble against Wolves, which handed ...

Sensational Transfer Buzz: Casemiro Linked with Messi or Ronaldo Reunion Post-Man Utd Exit!

The latest transfer window sees major shifts as Manchester United's Casemiro draws interest from Inter Miami and Al Nass...

WBD Deal Heats Up: Netflix Co-CEO Fights for Takeover Amid DOJ Approval Claims!

Netflix co-CEO Ted Sarandos is vigorously advocating for the company's $83 billion acquisition of Warner Bros. Discovery...

KPop Demon Hunters' Stars and Songwriters Celebrate Lunar New Year Success!

Brooks Brothers and Gold House celebrated Lunar New Year with a celebrity-filled dinner in Beverly Hills, featuring rema...

Life-Saving Breakthrough: New US-Backed HIV Injection to Reach Thousands in Zimbabwe

The United States is backing a new twice-yearly HIV prevention injection, lenacapavir (LEN), for 271,000 people in Zimba...

OpenAI's Moral Crossroads: Nearly Tipped Off Police About School Shooter Threat Months Ago

ChatGPT-maker OpenAI disclosed it had identified Jesse Van Rootselaar's account for violent activities last year, prior ...

MTN Nigeria's Market Soars: Stock Hits Record High Post $6.2B Deal

MTN Nigeria's shares surged to a record high following MTN Group's $6.2 billion acquisition of IHS Towers. This strategi...