Paramount vs. Warner Bros: $82.7 Billion Netflix Deal Ignites Epic Legal Showdown

Paramount Skydance Corp., under the leadership of David Ellison, has significantly escalated its months-long campaign to acquire Warner Bros. Discovery Inc. (WBD), filing a lawsuit against the studio over its existing $82.7 billion merger agreement with Netflix Inc. This legal action marks a critical turn in one of Hollywood’s most prominent corporate struggles.

The lawsuit, lodged in the Delaware Court of Chancery, seeks the disclosure of the financial analysis utilized by the Warner Bros. board to justify its proposed deal with Netflix. Paramount's objective is to provide shareholders with essential information required to properly evaluate Paramount’s own substantial $108.7 billion all-cash bid before the tender offer concludes on January 21.

Beyond legal action, Paramount is also planning to nominate directors to Warner Bros.’ board, aiming to challenge the Netflix merger and influence shareholder decisions. Furthermore, the company has proposed an amendment to Warner Bros.’ bylaws that would mandate shareholder approval for any spinoff of its cable TV business, a key component of the Netflix deal. Paramount contends that this cable TV component, specifically the Discovery cable TV spinoff, holds little actual value.

Comparing the competing offers, Paramount’s proposal stands at $30 per share, an all-cash bid totaling $108.7 billion, backed by $40 billion in equity guaranteed by Larry Ellison and $54 billion in debt. In contrast, Netflix’s offer is valued at $27.75 per share, consisting of a mix of cash and stock, amounting to $82.7 billion. Paramount strongly argues that its all-cash bid is not only financially superior but also easier to value and more likely to successfully clear regulatory scrutiny.

The Warner Bros. board, however, has rejected Paramount’s latest offer. The board labeled Paramount’s arguments as “meritless” and noted that Paramount has neither increased its bid nor addressed previously identified deficiencies. Warner Bros. also issued a warning about the financial repercussions of abandoning the Netflix deal, which would trigger a $2.8 billion termination fee, adding to an estimated $4.7 billion in additional costs.

Paramount asserts that Warner Bros. has never claimed the Netflix deal is financially superior. Consequently, the dispute is expected to ultimately hinge on a shareholder vote. The outcome of this high-stakes battle will determine the control over Warner Bros.’ highly coveted content library, which includes iconic franchises such as Harry Potter, DC Comics, and HBO assets, thereby significantly reshaping Hollywood's content and streaming power dynamics.

You may also like...

Music Awards Politics: Merit or Marketing?

Music awards often spark debate: do they celebrate true artistic talent, or are they driven by marketing and industry in...

AfDB and AU push for visa-free Africa to accelerate economic integration

Africa’s push for visa-free travel reflects more than economic policy. It represents a shift toward integration, mobilit...

Splitting Bills at Birthday Parties Should Be Outlawed

Birthday dinners are meant to celebrate love and friendship, so why do they end with calculators and awkward money trans...

Smarter AI, Weaker Grid: The Energy Crisis Behind the Data Center Boom

The race to build smarter AI is colliding with a harsh reality: data centers are consuming electricity faster than power...

"Intelligence Tools Have Changed What It Means to Run a Company" — Dorsey Is Right, and That Should Terrify Us

After Jack Dorsey laid off 4,000 employees at Block Inc., his blunt admission about AI replacing roles exposes a deeper ...

Jazz Star Markkanen Sidelined with Hip Injury, Out for Weeks!

Utah Jazz forward Lauri Markkanen is set for a two-week reevaluation after an MRI confirmed hip impingement, inflammatio...

Thunder's SGA Cleared for Return, Playoff Hopes Surge!

Reigning NBA MVP Shai Gilgeous-Alexander is cleared to return for the Oklahoma City Thunder after missing nine games due...

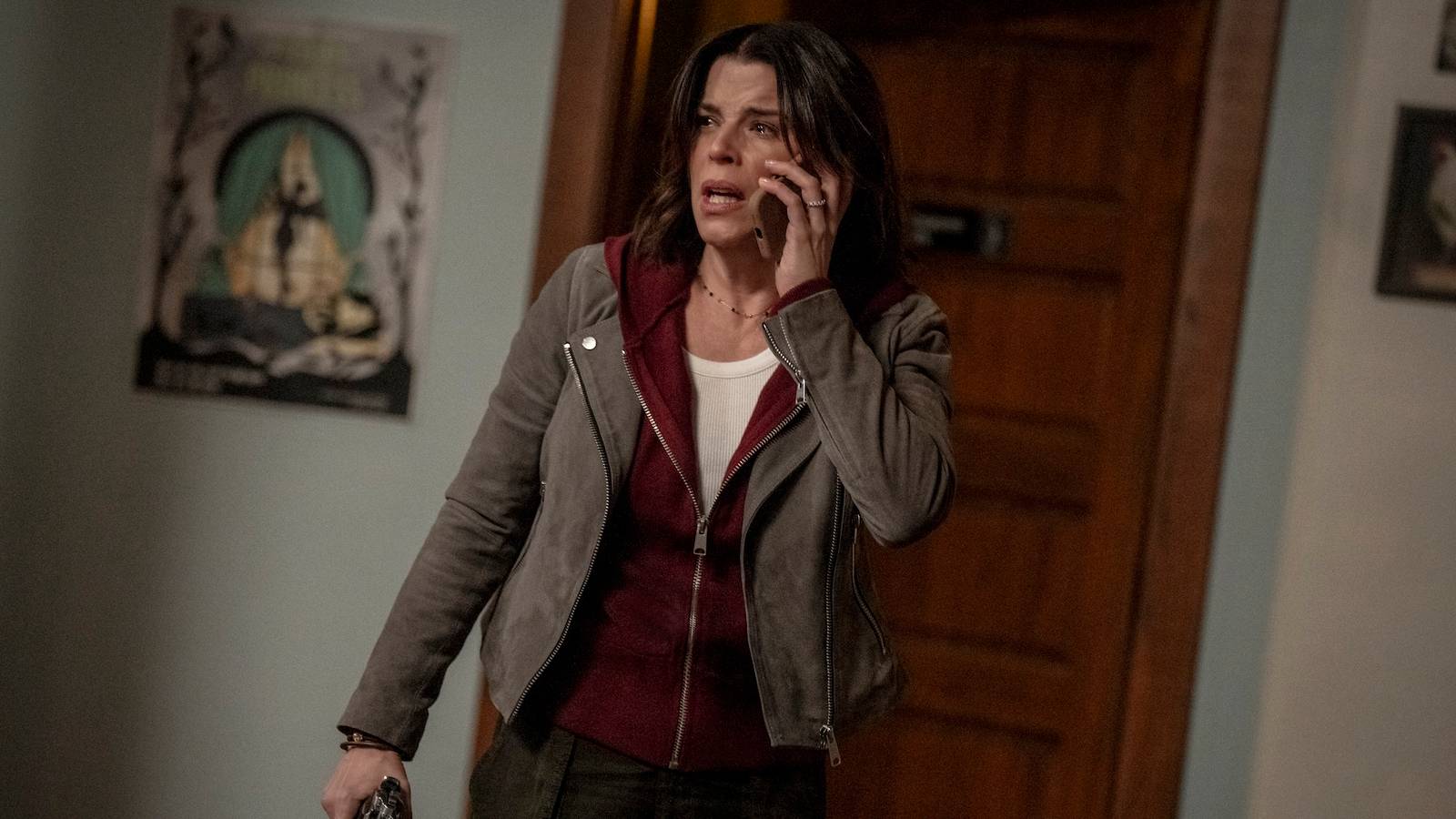

Horror Franchise in Peril: 'Scream 7' Reviews Slammed Despite Neve Campbell's Return to Basics

After a tumultuous production and cast exits, "Scream 7" arrives with Kevin Williamson directing and Neve Campbell retur...