From Oxford to Owning Airports: The Adebayo Ogunlesi Blueprint for Generational Wealth

The internet has somehow convinced an entire generation that if you are not a millionaire by 25, you have fumbled the bag. But while everyone has been chasing get-rich-quick schemes, a Nigerian man quietly built a $2.5 billion fortune doing something most people would scroll past — buying airports.

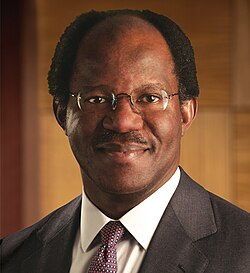

His name is Adebayo Ogunlesi, and his story is the ultimate counterargument to hustle culture. No viral moments, no controversial tweets, no leaked course selling the secret to passive income.

Just decades of strategic moves in industries so "boring" that your eyes probably glazed over reading the word "infrastructure." But one thing that has been consistent is that boring pays. Really, really pays.

The Long Game Starts Early

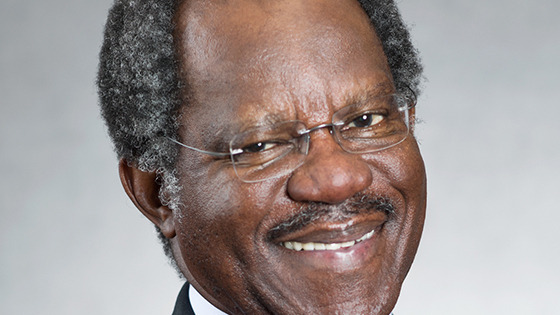

Ogunlesi's blueprint did not begin with a lucky break or a trust fund. He was born on 20 December, 1953 to the first Nigerian Professor of Medicine in University of Ibadan, Dr. Theophilus O. Ogunlesi, and Susan Olorunfemi Peters, with roots in Sagamu, Ogun State, Nigeria.

Ogunlesi took the traditional route, he actually stayed in school. He studied Philosophy, Politics, and Economics at Oxford, then stacked an MBA and law degree from Harvard.

But this was not just about collecting degrees like Pokémon cards. This was strategic positioning. He placed himself at the exact intersection where money meets power and power meets policy.

While his classmates were probably debating theory, Ogunlesi was learning the language spoken in rooms where billion-dollar decisions get made. And one lesson you should take from this is that education is not just about the piece of paper, it is about access.

Learning to See Money in Motion

After Harvard, Ogunlesi joinedCredit Suisse First Boston, eventually becoming co-head of Global Investment Banking. He learned how massive amounts of money actually move around the world.

Investment banking sounds about as exciting as watching paint dry. But here is what he understood that most people miss: the unentertaining stuff is where real wealth lives. While everyone's fighting for attention in oversaturated markets, the smart money is in places people overlook.

For years, he mastered deal structures, learned regulatory frameworks, built relationships with the people who actually have billions to deploy. No Instagram stories about the grind, no LinkedIn posts about waking up at 4am. Just competence compounding quietly in the background.

The Airport Era: Betting on "Boring"

In 2006, Ogunlesi made his power move. He foundedGlobal Infrastructure Partners and started buying things that sound incredibly boring but that you literally cannot live without — airports, energy facilities, water systems, ports.

He first acquired London Gatwick Airport, then Edinburgh Airport. Then more airports, more energy infrastructure, more essential services that governments needed private capital to maintain.

The strategy was almost offensively simple: buy things people will always need, hold them for the long term, collect steady cash flows, reinvest.

Think about it. Recessions happen, tech bubbles burst, crypto crashes, startups fail at a 90% rate. But people still need to fly. Energy still needs to flow. Water still needs to run.

Infrastructure is recession-proof. It is the ultimate "set it and forget it" wealth builder, except at a billion-dollar scale.

By 2024, his patience paid off in a way that would make any crypto trader weep.BlackRock acquired Global Infrastructure Partners, and Ogunlesi's net worth jumped $800 million practically overnight, hitting $2.5 billion total. That is generational wealth and not from one viral app, but from two decades of owning the literal foundations of modern society.

The Plot Twist: Hello, AI

Here is where it gets interesting. Just when you think you have figured out Ogunlesi's playbook, stick to physical infrastructure, repeat the same process, he pivots. In January 2025, he joined OpenAI's board of directors. Yes, that OpenAI, the ChatGPT people.

But this is not a random career switch. It is the same framework applied to a new frontier. He looked at AI the same way he looked at airports in 2006, essential infrastructure that the world is going to need, that most people are still figuring out, that requires patient capital and long-term thinking.

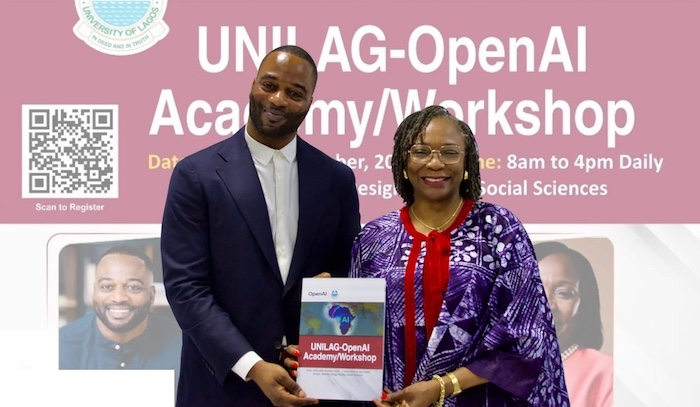

And his first move on the board was pushing OpenAI to establish Africa's first AI academyat the University of Lagos. The man who made billions building physical bridges is now building digital ones, making sure the next generation of Africans has access to the tools that will define the future economy.

It is the infrastructure mindset again: what will people need in 20 years, and how do I position myself there now?

Coming Home

In 2025, Ogunlesi did something else that hits home for young Africans watching the brain drain in real-time. He declared that Nigeria is "investable for the first time in years" and announced plans to invest in Nigerian ports and aviation infrastructure.

This is the full-circle moment. He did not just extract wealth from the developing world and park it in Western markets. He built credibility and capital globally, then brought it home. That is the diaspora playbook executed at the highest level and it is a framework young Africans are desperately trying to figure out right now.

Lessons To Learn

The greatest lesson Ogunlesi’s story teaches that social media never wants you to hear is that real, lasting, generational wealth usually takes decades, not days. It requires patience that feels almost impossible in the dopamine-hit economy we live in.

It means mastering things that won't get you likes or followers. It means being okay with people not knowing your name while you are building.

The blueprint is simple: get educated strategically, master how money actually works, find essential but undervalued sectors, execute with patience, adapt your framework to new opportunities, and play the long game while everyone else is chasing quick wins.

It is not as exciting as turning $100 into $1 million overnight. It won't make a good 60-second video. But when you are walking through an airport somewhere in the world, there is a decent chance the infrastructure beneath your feet is owned by someone who understood something most people miss.

And yeah, that might take longer than a TikTok trend cycle. But $2.5 billion later, Ogunlesi's probably okay with that.

You may also like...

When Sacred Calendars Align: What a Rare Religious Overlap Can Teach Us

As Lent, Ramadan, and the Lunar calendar converge in February 2026, this short piece explores religious tolerance, commu...

Arsenal Under Fire: Arteta Defiantly Rejects 'Bottlers' Label Amid Title Race Nerves!

Mikel Arteta vehemently denies accusations of Arsenal being "bottlers" following a stumble against Wolves, which handed ...

Sensational Transfer Buzz: Casemiro Linked with Messi or Ronaldo Reunion Post-Man Utd Exit!

The latest transfer window sees major shifts as Manchester United's Casemiro draws interest from Inter Miami and Al Nass...

WBD Deal Heats Up: Netflix Co-CEO Fights for Takeover Amid DOJ Approval Claims!

Netflix co-CEO Ted Sarandos is vigorously advocating for the company's $83 billion acquisition of Warner Bros. Discovery...

KPop Demon Hunters' Stars and Songwriters Celebrate Lunar New Year Success!

Brooks Brothers and Gold House celebrated Lunar New Year with a celebrity-filled dinner in Beverly Hills, featuring rema...

Life-Saving Breakthrough: New US-Backed HIV Injection to Reach Thousands in Zimbabwe

The United States is backing a new twice-yearly HIV prevention injection, lenacapavir (LEN), for 271,000 people in Zimba...

OpenAI's Moral Crossroads: Nearly Tipped Off Police About School Shooter Threat Months Ago

ChatGPT-maker OpenAI disclosed it had identified Jesse Van Rootselaar's account for violent activities last year, prior ...

MTN Nigeria's Market Soars: Stock Hits Record High Post $6.2B Deal

MTN Nigeria's shares surged to a record high following MTN Group's $6.2 billion acquisition of IHS Towers. This strategi...