Crypto Chaos: Bitcoin Crumbles as Trump Slams China with 100% Tariffs

The global cryptocurrency market recently experienced a significant downturn, with its total capitalization plummeting below the critical $120k support level within 24 hours. This sharp decline followed an announcement by United States President Donald Trump, who threatened to impose 100% tariffs on Chinese imports, effective November 1. In a post on Truth Social, President Trump accused Beijing of hostile actions, claiming it was attempting to hold the world 'captive' and sending letters to various countries detailing plans to implement Export Controls on every aspect of production.

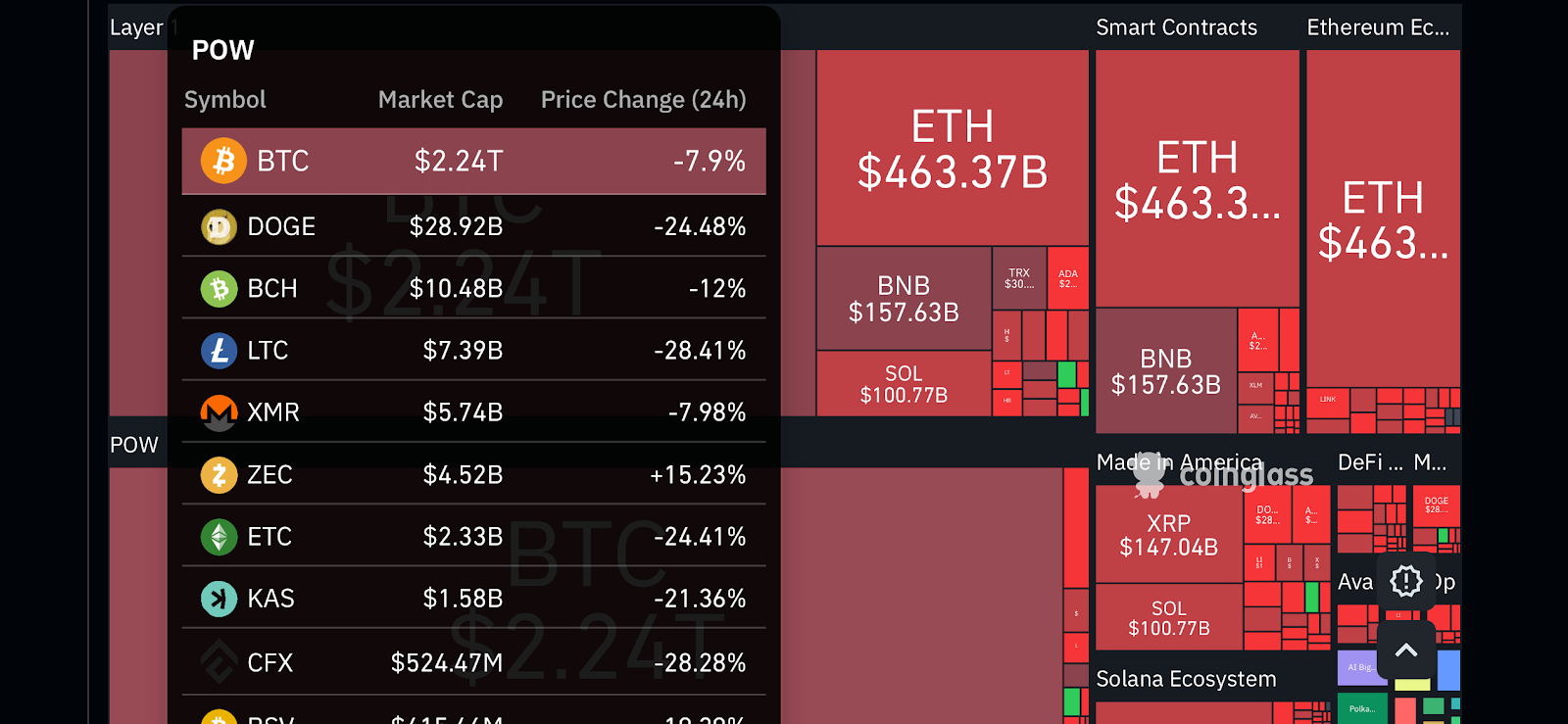

Before President Trump's tariff threat, Bitcoin (BTC) had recently achieved a new all-time high, trading at $121,300. However, in the wake of the announcement, BTC crashed below the $120k mark, reaching a new low of $109k on platforms like Binance. The impact was widespread, with Ethereum (ETH) dipping below $3,500 and Solana (SOL) falling below $150. Bitcoin's rapid drop resulted in a loss of over $10,000 in less than an hour, further declining under $114k before the situation worsened. This market instability wiped over $250 billion from the total crypto market capitalization, making it one of the largest single-day declines of 2025. As of press time, Bitcoin was trading at $112,296, reflecting a 7.91% decline, while Ethereum stood at $3,816, down 12.52% in value.

The ripple effect of the U.S. President's announcement led to massive liquidations across the crypto market. Over $7.5 billion in positions were liquidated within just one hour. Data from Coinglass on Saturday, October 1, revealed extensive liquidations over a 24-hour period, with Bitcoin leading at $5.39 billion, followed by Ethereum at $4.45 billion, Solana at $2.02 billion, and XRP at $710.35 million. In total, 1,673,146 traders were liquidated within the 24-hour window, amounting to a staggering $19.38 billion in total liquidations. The single largest liquidation event occurred on Hyperliquid, involving an ETH-USDT pair valued at $203.36 million.

Despite the widespread panic and market volatility, institutional demand for Bitcoin demonstrated surprising resilience. Glassnode observed that 'Bitcoin ETF inflows have continued despite the recent pullback, showing that institutional demand remains steady even as derivatives traders get chopped.' This indicates that a strong undercurrent of structural buying is still supporting the market, helping to absorb volatility and stabilize price movements. Key takeaways from this event include Bitcoin dropping significantly below $120k, reaching lows of $109k; over $1 billion in positions being liquidated in under 24 hours; steep declines for Ethereum, Solana, and other major altcoins; and sustained institutional inflows into Bitcoin ETFs suggesting confidence in a long-term recovery, even as Trump's tariff threat rekindled trade war fears and impacted global risk assets.

Recommended Articles

UAE's Secret Stash: Nation Amasses Jaw-Dropping $453M Bitcoin Fortune

Arkham Intelligence reports that UAE Royal Group-linked Bitcoin mining operations hold approximately $344 million in unr...

Armstrong Moves to Reassure Investors Amid Bitcoin ETF Backing Concerns

Coinbase executives recently defended the company's leading role in U.S. Bitcoin ETF custody, asserting over 80% market ...

MicroStrategy Surges 9% as Bitcoin Makes Strong Comeback

Bitcoin and MicroStrategy's stock saw a rebound by week's end, spurred by inflation data, yet concerns persist over Bitc...

Mega-Bet Unveiled: Goldman Sachs Reveals $1.1 Billion Bitcoin ETF Holdings!

Goldman Sachs has significantly increased its crypto exposure to $2.36 billion, with $1.1 billion invested in Bitcoin ET...

Bitcoin ETF Shockwave: New Capital Intake Suspended After Wild Ride!

Bitcoin ETFs have experienced four consecutive days of outflows totaling over $509 million, driven largely by BlackRock'...

Nasdaq Unleashes Bitcoin ETF Options: Position Limits Vanish!

Nasdaq has filed a rule change with the SEC to remove position and exercise limits on options tied to spot Bitcoin and E...

You may also like...

Bundesliga's New Nigerian Star Shines: Ogundu's Explosive Augsburg Debut!

Nigerian players experienced a weekend of mixed results in the German Bundesliga's 23rd match day. Uchenna Ogundu enjoye...

Capello Unleashes Juventus' Secret Weapon Against Osimhen in UCL Showdown!

Juventus faces an uphill battle against Galatasaray in the UEFA Champions League Round of 16 second leg, needing to over...

Berlinale Shocker: 'Yellow Letters' Takes Golden Bear, 'AnyMart' Director Debuts!

The Berlin Film Festival honored

Shocking Trend: Sudan's 'Lion Cubs' – Child Soldiers Going Viral on TikTok

A joint investigation reveals that child soldiers, dubbed 'lion cubs,' have become viral sensations on TikTok and other ...

Gregory Maqoma's 'Genesis': A Powerful Artistic Call for Healing in South Africa

Gregory Maqoma's new dance-opera, "Genesis: The Beginning and End of Time," has premiered in Cape Town, offering a capti...

Massive Rivian 2026.03 Update Boosts R1 Performance and Utility!

Rivian's latest software update, 2026.03, brings substantial enhancements to its R1S SUV and R1T pickup, broadening perf...

Bitcoin's Dire 29% Drop: VanEck Signals Seller Exhaustion Amid Market Carnage!

Bitcoin has suffered a sharp 29% price drop, but a VanEck report suggests seller exhaustion and a potential market botto...

Crypto Titans Shake-Up: Ripple & Deutsche Bank Partner, XRP Dips, CZ's UAE Bitcoin Mining Role Revealed!

Deutsche Bank is set to adopt Ripple's technology for faster, cheaper cross-border payments, marking a significant insti...