Bitcoin ETF Shockwave: New Capital Intake Suspended After Wild Ride!

The cryptocurrency market is currently experiencing a significant downturn, leading to a sustained decline in the value of major cryptocurrencies, most notably Bitcoin. This prolonged period of market volatility has specifically impacted Bitcoin Exchange-Traded Funds (ETFs), which have recorded steady capital outflows for four consecutive days, according to data provided by SoSoValue.

As of January 30, the U.S. spot Bitcoin ETFs have collectively witnessed a total net outflow of $509.70 million. This marks a critical period of sustained capital withdrawal from these funds. The outflows observed during their most recent trading session coincided with a broader market sell-off, which saw Bitcoin's price drop to approximately $83,910 at the time. Despite these recent withdrawals, the cumulative net inflows across all Bitcoin ETFs remain substantial, totaling $55.01 billion. This enduring figure suggests that while short-term sentiment has been negatively affected, long-term institutional participation has not entirely exited the market.

The steady withdrawals over these recent days have resulted in a notable decrease in the total net assets held across the U.S. Bitcoin spot ETFs. These assets have fallen by a notable 6.38%, bringing the total value down to $106.96 billion.

A closer examination reveals that BlackRock's IBIT fund was the primary driver behind the substantial capital withdrawals on the particular day in question. IBIT alone recorded outflows equivalent to approximately 6,310 BTC, valued at $528.30 million. While BlackRock's fund was the sole significant contributor to the day's negative flow, other Bitcoin funds reported minimal to no net inflows during the same period. For instance, Fidelity's FBTC managed to attract around $7.30 million in inflows, and ARK & 21Shares’ ARKB saw an injection of $8.34 million. However, the capital infused by these funds was insufficient to counteract the massive withdrawals initiated by BlackRock, underscoring the significant impact of individual large institutional movements on the overall market sentiment and fund flows.

You may also like...

Kroupi's Wolves Wonder Goal Softens Semenyo's Bournemouth Exit to Man City

Eli Junior Kroupi is emerging as a significant talent for Bournemouth, helping to soften the blow of Antoine Semenyo's d...

Gordon Silences Anfield with Defiant Ear Point

Hugo Ekitike's quick-fire brace turned the tide for Liverpool at Anfield, securing a decisive 4-1 victory against Newcas...

Hollywood Remembers Catherine O'Hara: Apple TV Panel Withdrawn, Stars Deliver Heartfelt Tributes

Comedy icon Catherine O’Hara has passed away at 71, prompting an outpouring of tributes from Hollywood. Stars like Steve...

Urgent Plea: Bravo Le Roux's Family Launches Campaign to Bring Him Home

The family of rapper and producer Bravo Le Roux, who passed away in Switzerland at age 30, has initiated a GoFundMe camp...

Ayra Starr's Second Grammy Nod: A Feeling of Reassurance

Ayra Starr shares her joy and gratitude over multiple GRAMMY nominations, viewing them as reassurance for her career pat...

Chilean Community Pioneers Human-Powered Chatbot: The Anti-AI Trend?

A Chilean community launched Quili.AI, a human-operated chatbot, to draw attention to the significant environmental impa...

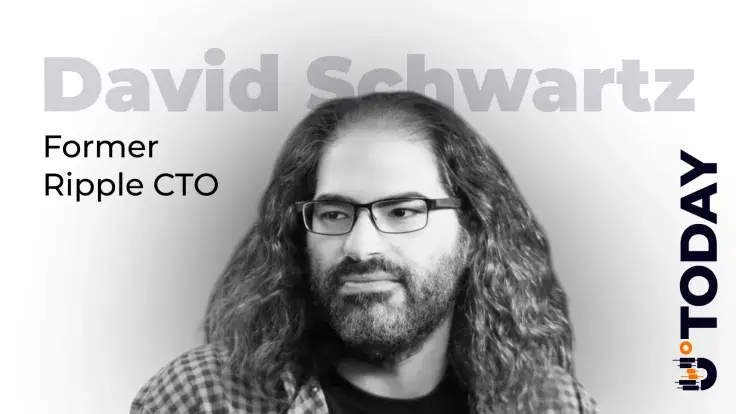

Epstein Files Bombshell: Ripple CTO Emeritus Links XRP, XLM to Infamous Scandal!

Ripple's CTO Emeritus, David Schwartz, publicly addressed claims linking Ripple and Stellar to Jeffrey Epstein, denying ...

Bitcoin ETF Shockwave: New Capital Intake Suspended After Wild Ride!

Bitcoin ETFs have experienced four consecutive days of outflows totaling over $509 million, driven largely by BlackRock'...