Michael Saylor's MicroStrategy Soars 9% as Bitcoin Rebounds!

The cryptocurrency market witnessed significant volatility around Valentine's Day, culminating in a rebound for Bitcoin (BTC) and shares of Strategy (MSTR), formerly MicroStrategy, by the end of the week. MSTR stock surged 8.85% on Friday, closing at $133.88 after a volatile trading session. High volume characterized the day, with approximately 24.6 million shares exchanged. Bitcoin itself saw a nearly 5% increase late on Friday, driven by January U.S. inflation figures that came in slightly below forecasts, fostering optimism among traders regarding potential future interest rate cuts.

Despite the recent rebound, the broader market sentiment remains cautious. Bitcoin’s price has experienced a significant downturn, dropping almost 50% since its peak on October 6. Additionally, U.S. spot bitcoin ETFs have registered substantial outflows, totaling around $12 billion since November 2025. At press time, Bitcoin was trading at $69,701, according to data from CoinMarketCap.

MicroStrategy, known as a prominent Bitcoin HODLer, reaffirmed its long-term strategy. CEO Michael Saylor firmly rejected the notion of capitulating and selling the company's Bitcoin holdings when questioned. Saylor emphasized the company's robust financial health, stating, "That's an unfounded concern. The truth is our net leverage ratio is half that of the typical investment-grade company. We've got 50 years' worth of dividends in Bitcoin. We've got two and a half years' worth of dividends just in cash on our balance sheet. So we're not going to be selling; we're going to be buying Bitcoin. I expect we'll be buying Bitcoin every quarter forever."

In addition to its Bitcoin strategy, MicroStrategy also issued a free writing prospectus on Friday for its "STRC" preferred stock. This offering outlines an 11.25% annualized dividend for February, alongside a monthly cash distribution. According to the SEC filing, the preferred stock is designed to maintain a price near $100 per share, with monthly adjustments to the dividend rate to achieve this stability. Investors on record as of February 15 are slated to receive their payout on February 28.

However, veteran trader Peter Brandt has issued a stern warning to Strategy shareholders, casting doubt on the resilience of investors in Michael Saylor’s Bitcoin-leveraged company. Brandt recently took to X (formerly Twitter) to question, "When on this journey will investors want to start jumping from the Sayl_boat? $BTC... MS will do just great, but what about his investors?"

Brandt's cautionary "journey" is graphically represented in a technical chart he shared, which indicates that Bitcoin is currently breaking down from a corrective "bear flag" channel. The chart illustrates BTC decisively losing support from the rising channel that characterized its early 2026 consolidation phase. Alarmingly, Brandt's chart projects a further decline, pointing to a potential target of $54,059.60. Should this projection materialize, it would represent an additional 28% drop from current levels, and critically, it would place MicroStrategy’s extensive Bitcoin holdings billions of dollars underwater.

You may also like...

GOAT Debate Settled? NBA Superstar Giannis Antetokounmpo Picks Between Messi and Ronaldo!

NBA star Giannis Antetokounmpo has weighed in on football's enduring 'greatest player' debate, surprisingly choosing Cri...

LeBron James' Shocking Confession: Future in NBA for 24th Season Uncertain!

LeBron James remains undecided on his NBA future beyond his 23rd season, emphasizing his immediate priority is the Los A...

Train Dreams Dominates Independent Spirit Awards: Full Winners Revealed!

The 41st Independent Spirit Awards celebrated excellence in indie film and television, with "Train Dreams" securing Best...

Cardi B's Electrifying Las Vegas Performance Takes Unexpected Turn with Mid-Show Tumble

Cardi B encountered a minor stage mishap during her "Little Miss Drama" tour in Las Vegas, falling from a chair but reco...

J. Cole Secures Seventh No. 1 Album on Billboard 200 with 'The Fall-Off'

J. Cole's "The Fall-Off" debuts at No. 1 on the Billboard 200, marking his seventh chart-topper and the largest R&B/hip-...

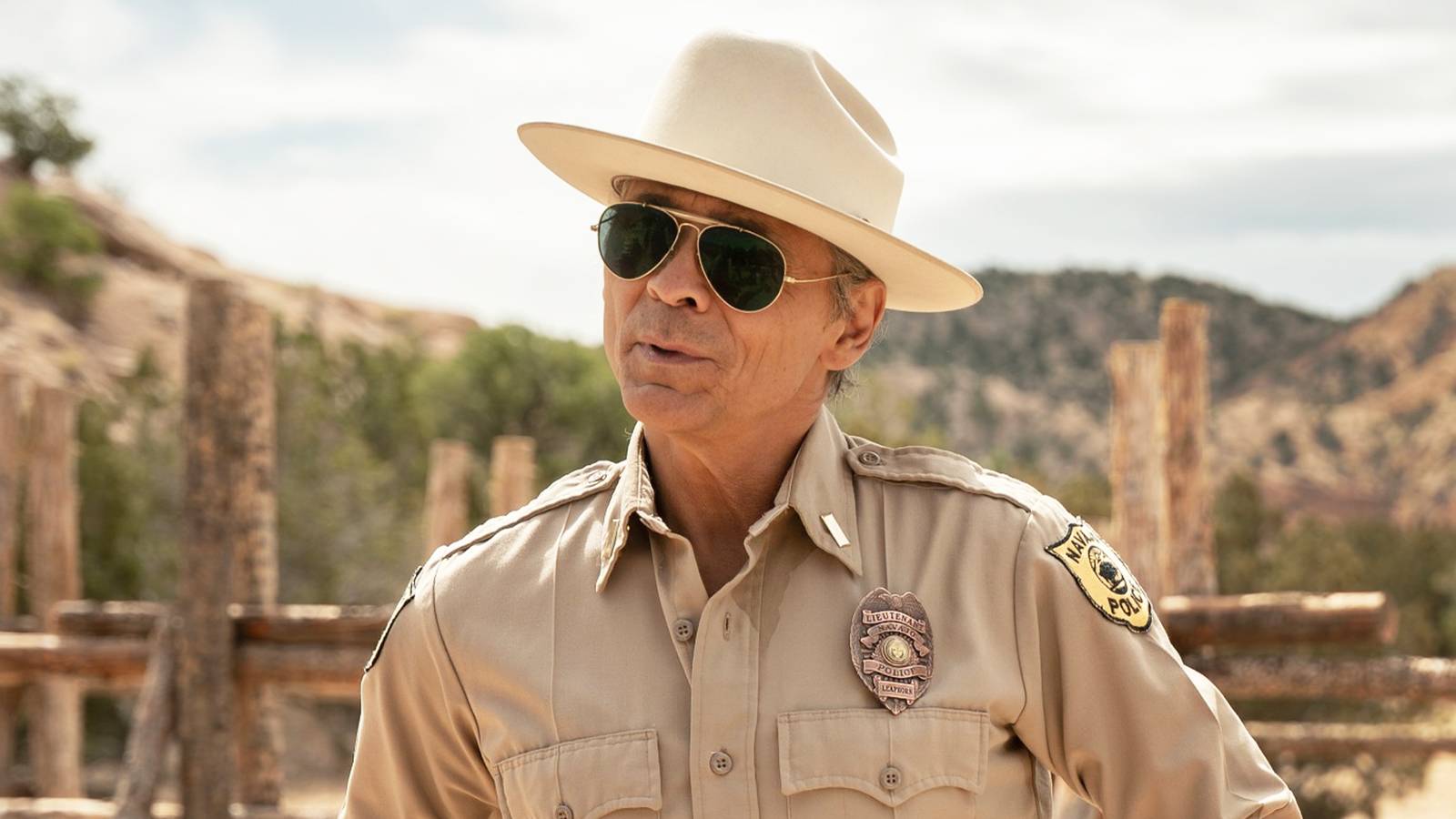

Dark Winds Unleashes 'Demented' Season 4 Villain: Showrunner Spills Chilling Details!

Dark Winds has been renewed for a fifth season, with showrunner John Wirth discussing the dramatic changes ahead for Sea...

Simpsons Shocker: EP Teases Cataclysmic Character Death After 800 Episodes!

The 800th episode of The Simpsons, "Irrational Treasure," unexpectedly became a milestone by prioritizing storytelling. ...

Billion-Dollar AI Boom: Blackstone Unleashes $1.2B into India's Infrastructure Via Neysa

Indian AI infrastructure startup Neysa has secured up to $600 million in primary equity from Blackstone and co-investors...