Nasdaq Unleashes Bitcoin ETF Options: Position Limits Vanish!

Nasdaq has formally filed a rule change with the U.S. Securities and Exchange Commission (SEC) to eliminate position and exercise limits on options linked to spot Bitcoin exchange-traded funds (ETFs). This strategic move, originally proposed on January 7 and made effective on January 21, aims to further integrate crypto-linked financial products into the traditional derivatives markets. The core of the proposal removes the existing 25,000-contract cap on options tied to both Bitcoin and Ethereum ETFs currently listed on Nasdaq. This change impacts a range of prominent products from major financial players including BlackRock, Fidelity, Grayscale, Bitwise, ARK/21Shares, and VanEck, as detailed in the filing.

The SEC demonstrated its willingness to expedite this integration by waiving the standard 30-day waiting period, allowing the rule change to take immediate effect. However, the Commission reserves the right to suspend the rule within 60 days should further review be deemed necessary. A public comment period is now open, with a final determination from the SEC anticipated by late February, barring any pauses in the process. Nasdaq's rationale for this significant adjustment centers on achieving equitable treatment; the exchange argues that lifting these limits would allow crypto ETF options to be regulated "in the same manner as all other options that qualify for listing," thereby addressing what it views as unequal treatment without compromising investor protections. Nasdaq further asserted that this change would bolster market efficiency while steadfastly maintaining safeguards against market manipulation and excessive risk.

Options are defined as derivative contracts that grant traders the right, but not the obligation, to either buy or sell an underlying asset at a predetermined price before a specified expiration date. Historically, position and exercise limits have been a regulatory tool, typically imposed to prevent concentrated positions that could potentially amplify market volatility or lead to destabilization. This latest filing from Nasdaq builds upon a previous approval in late 2025, which permitted the listing of options on single-asset crypto ETFs categorized as commodity-based trusts. While that earlier decision enabled Bitcoin and Ethereum ETF options to trade on the exchange, it did not remove the existing position limits.

Nasdaq's ongoing efforts to expand its footprint in crypto markets have been evident in recent years. In November, for instance, the exchange submitted a separate proposal to significantly raise position limits on options specifically tied to BlackRock’s iShares Bitcoin Trust (IBIT) to as much as one million contracts. This earlier proposal cited increasing institutional demand and a growing reliance on options for sophisticated hedging strategies as key justifications. Beyond derivatives, Nasdaq has also actively ventured into crypto indexing and tokenization initiatives. A notable collaboration occurred in January, when Nasdaq and CME Group announced their intentions to unify their respective crypto benchmarks under the new Nasdaq-CME Crypto Index, designed to track a diverse portfolio of major digital assets, including Bitcoin, Ether, XRP, Solana, Cardano, and Avalanche.

If granted permanent approval, this most recent rule change would represent another pivotal step in the ongoing normalization of Bitcoin derivatives within the U.S. regulated markets. Such a development would further blur the distinctions between traditional financial instruments and the burgeoning realm of crypto-native assets, signaling a deepening integration of digital currencies into the mainstream financial landscape.

You may also like...

Kroupi's Wolves Wonder Goal Softens Semenyo's Bournemouth Exit to Man City

Eli Junior Kroupi is emerging as a significant talent for Bournemouth, helping to soften the blow of Antoine Semenyo's d...

Gordon Silences Anfield with Defiant Ear Point

Hugo Ekitike's quick-fire brace turned the tide for Liverpool at Anfield, securing a decisive 4-1 victory against Newcas...

Hollywood Remembers Catherine O'Hara: Apple TV Panel Withdrawn, Stars Deliver Heartfelt Tributes

Comedy icon Catherine O’Hara has passed away at 71, prompting an outpouring of tributes from Hollywood. Stars like Steve...

Urgent Plea: Bravo Le Roux's Family Launches Campaign to Bring Him Home

The family of rapper and producer Bravo Le Roux, who passed away in Switzerland at age 30, has initiated a GoFundMe camp...

Ayra Starr's Second Grammy Nod: A Feeling of Reassurance

Ayra Starr shares her joy and gratitude over multiple GRAMMY nominations, viewing them as reassurance for her career pat...

Chilean Community Pioneers Human-Powered Chatbot: The Anti-AI Trend?

A Chilean community launched Quili.AI, a human-operated chatbot, to draw attention to the significant environmental impa...

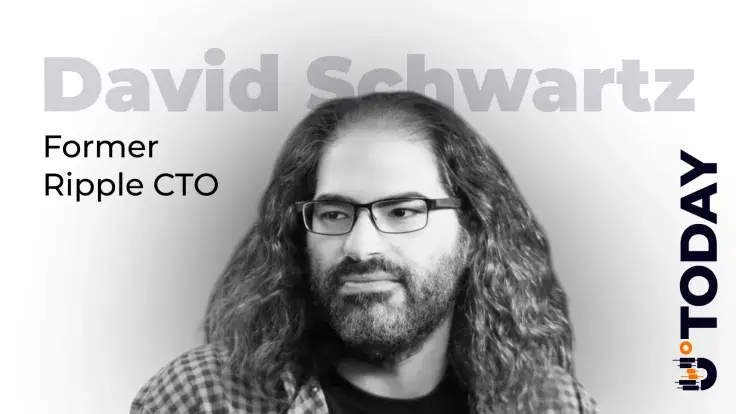

Epstein Files Bombshell: Ripple CTO Emeritus Links XRP, XLM to Infamous Scandal!

Ripple's CTO Emeritus, David Schwartz, publicly addressed claims linking Ripple and Stellar to Jeffrey Epstein, denying ...

Bitcoin ETF Shockwave: New Capital Intake Suspended After Wild Ride!

Bitcoin ETFs have experienced four consecutive days of outflows totaling over $509 million, driven largely by BlackRock'...