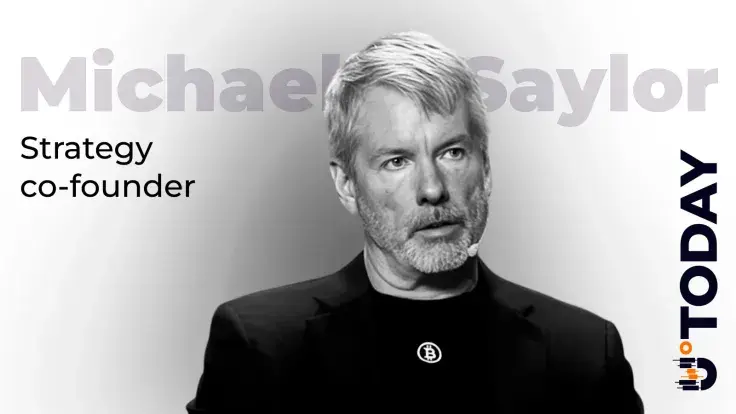

Breaking: Saylor's Mammoth Bitcoin Haul Shakes Crypto Markets

Strategy, formerly known as MicroStrategy, has made a massive Bitcoin acquisition, purchasing 8,178 BTC at an average price of $102,171 per coin, totaling approximately $835.6 million. This transaction represents a marked shift from the company's recent smaller Bitcoin buys, which had failed to make a significant market impact.

With this addition, the Virginia-based business intelligence firm now holds 649,870 BTC in its treasury. The total cost of these holdings amounts to $48.37 billion, yielding an average acquisition price of $74,433 per BTC. Despite the scale of the purchase, Bitcoin’s price dipped slightly to $94,321.43, a 1.1% decrease, following the announcement, according to CoinGecko. Similarly, Strategy’s stock (MSTR) fell 2.23% in pre-market trading, down to $195.29.

Co-founder Michael Saylor had previously hinted at the move via a social media post featuring an orange-dot chart and had teased a “pleasantly” surprising purchase during a CNBC interview on Friday.

Despite holding the title of the largest corporate Bitcoin owner, Strategy faces financial headwinds. Its stock has plummeted 56% from its July peak of $457, largely due to the erosion of its premium to net asset value (NAV). The company continues to contend with high leverage, ongoing debt issuance, and aggressive profit-taking by investors. After a high-profile 2025, the stock has experienced a 35% year-to-date decline, highlighting persistent challenges even amid bullish Bitcoin acquisitions.

You may also like...

Super Eagles Fury! Coach Eric Chelle Slammed Over Shocking $130K Salary Demand!

)

Super Eagles head coach Eric Chelle's demands for a $130,000 monthly salary and extensive benefits have ignited a major ...

Premier League Immortal! James Milner Shatters Appearance Record, Klopp Hails Legend!

Football icon James Milner has surpassed Gareth Barry's Premier League appearance record, making his 654th outing at age...

Starfleet Shockwave: Fans Missed Key Detail in 'Deep Space Nine' Icon's 'Starfleet Academy' Return!

Starfleet Academy's latest episode features the long-awaited return of Jake Sisko, honoring his legendary father, Captai...

Rhaenyra's Destiny: 'House of the Dragon' Hints at Shocking Game of Thrones Finale Twist!

The 'House of the Dragon' Season 3 teaser hints at a dark path for Rhaenyra, suggesting she may descend into madness. He...

Amidah Lateef Unveils Shocking Truth About Nigerian University Hostel Crisis!

Many university students are forced to live off-campus due to limited hostel spaces, facing daily commutes, financial bu...

African Development Soars: Eswatini Hails Ethiopia's Ambitious Mega Projects

The Kingdom of Eswatini has lauded Ethiopia's significant strides in large-scale development projects, particularly high...

West African Tensions Mount: Ghana Drags Togo to Arbitration Over Maritime Borders

Ghana has initiated international arbitration under UNCLOS to settle its long-standing maritime boundary dispute with To...

Indian AI Arena Ignites: Sarvam Unleashes Indus AI Chat App in Fierce Market Battle

Sarvam, an Indian AI startup, has launched its Indus chat app, powered by its 105-billion-parameter large language model...