Bitwise Declares Bitcoin's Four-Year Cycle Dead, Forecasts 2026 Highs

Asset manager Bitwise has released a significant new report predicting that Bitcoin (BTC) is poised to deviate from its established four-year market cycle. The firm forecasts that Bitcoin will achieve new all-time highs in 2026, accompanied by reduced volatility and a decreased correlation with traditional equities. Bitwise's Chief Investment Officer, Matt Hougan, highlighted three key forecasts for crypto investors: the impending end of the four-year cycle, a continuation of volatility compression, and a declining correlation between Bitcoin and conventional stock markets.

Historically, Bitcoin has followed a four-year pattern, intrinsically linked to its halving events, which typically involved three years of gains followed by a sharp market pullback. Under this traditional framework, 2026 would conventionally be anticipated as a down year for the cryptocurrency. However, Bitwise emphatically disputes this expectation. Hougan stated that the forces previously responsible for driving these four-year cycles—including the Bitcoin halving itself, interest rate cycles, and the leverage-fueled booms and busts within the crypto market—are now "significantly weaker" than in prior cycles.

Several factors contribute to this shift. Hougan pointed to the diminishing impact of successive halvings, suggesting their influence on price dynamics is waning. Furthermore, expectations of falling interest rates in 2026 are cited as a macroeconomic tailwind. Crucially, the crypto market has seen reduced systemic leverage following record liquidations in October 2025, which is expected to mitigate the risk of major market disruptions. Improving regulatory clarity is also anticipated to play a vital role in stabilizing the market environment. More significantly, Bitwise foresees an acceleration of institutional capital flows. With the approval of spot Bitcoin ETFs in 2024, the firm expects substantial participation from major wealth platforms such as Morgan Stanley, Wells Fargo, and Merrill Lynch. Increased adoption from Wall Street and fintech firms is also projected, fueled by a more favorable regulatory landscape expected after the 2024 U.S. election. Bitwise believes these combined factors will propel Bitcoin to unprecedented all-time highs, effectively rendering the traditional four-year cycle obsolete.

The report also addresses the long-standing criticism regarding Bitcoin's volatility, often cited as a barrier for mainstream investors. Bitwise contends that Bitcoin's volatility is continually decreasing, demonstrating its maturation as an asset. For instance, throughout 2025, BTC was observed to be less volatile than Nvidia stock, a comparison Hougan used to underscore Bitcoin’s ongoing evolution. Data presented in the report indicates a consistent decline in Bitcoin’s volatility over the past decade, a trend attributed to its diversifying investor base and the expansion of traditional investment vehicles like ETFs, which have broadened access to the asset. Bitwise anticipates this trend of volatility compression will persist into 2026, drawing a parallel to gold's market evolution following the introduction of gold ETFs in the early 2000s.

Finally, Bitwise forecasts a further decline in Bitcoin’s correlation with traditional stock markets in 2026. While critics frequently assert that Bitcoin trades in lockstep with equities, Hougan highlighted that rolling 90-day correlations with the S&P 500 have rarely exceeded 0.50. Moving forward, Bitwise expects crypto-specific catalysts—such as sustained regulatory progress and deepening institutional adoption—to increasingly drive Bitcoin’s price independently. This divergence is anticipated even as equity markets potentially contend with valuation concerns and decelerating economic growth. In summation, Bitwise views 2026 as a highly favorable year for Bitcoin investors, characterized by robust returns, diminished volatility, and a reduced correlation with traditional assets. Hougan described this outlook as "the trifecta for investors," predicting these dynamics could attract tens of billions of dollars in new institutional inflows.

You may also like...

Future Unclear: Is Pep Guardiola Set to Depart Man City?

Intense speculation surrounds Pep Guardiola's future at Manchester City, with rumors suggesting he might leave earlier t...

Saudi League Slams Ronaldo: 'You Are Not Bigger Than The League' Amid Al-Nassr Strike

)

Cristiano Ronaldo protested the Saudi Pro League's transfer dealings, citing perceived financial bias against Al-Nassr, ...

Set Secrets Unveiled: Rebecca Ferguson Details On-Set Abuse, Keeps 'Idiot' Actor Anonymous

Rebecca Ferguson opened up about a past incident where a co-star screamed at her on set, emphasizing that her story high...

Hollywood Shockwave: Timothy Busfield Indicted on Child Sex Abuse Charges

Timothy Busfield, director of "The Cleaning Lady," has been indicted on four counts of child sexual abuse in New Mexico,...

Must-Read: Yejide Kilanko's 'In Our Own Ways' Offers Exclusive Sneak Peek

Fadaka's spiritual quest, guided by Aunty Kike, leads her through a deceptive journey to a secluded ministry for a 'spec...

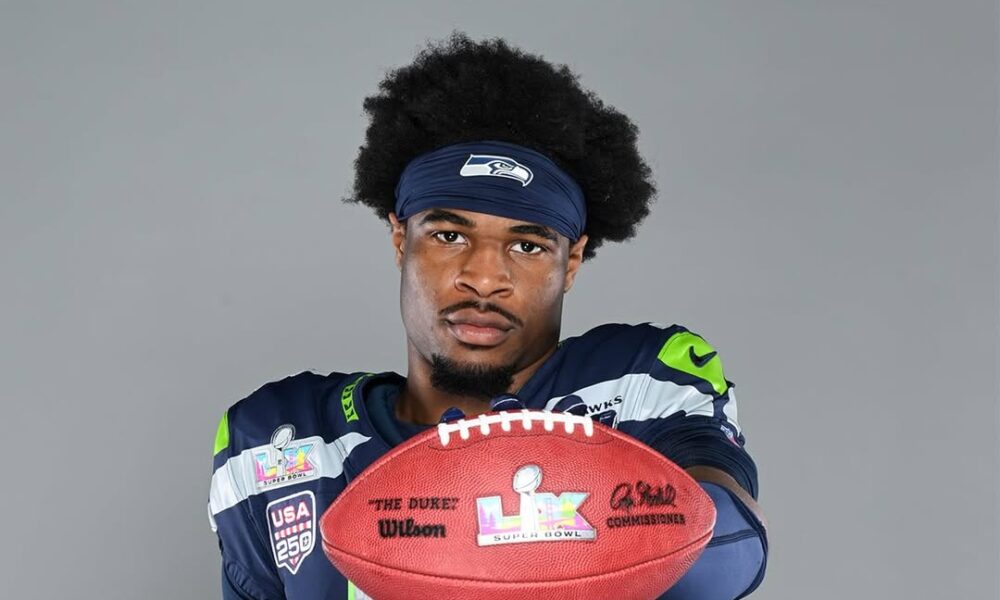

Super Bowl LX 2026: Anticipation Builds for Halftime Spectacle

Super Bowl LX is set to electrify Levi’s Stadium on February 8, 2026, featuring a star-studded halftime show by Bad Bunn...

Probiotic Powerhouse: Yogurt's Reign Challenged by 7 Surprising Dairy Rivals!

:max_bytes(150000):strip_icc()/Health-GettyImages-DairyWithMoreProbioticsThanYogurt-61aceb114e8542caae52b4e4a6067ac6.jpg)

While yogurt is a popular source of probiotics, many other fermented foods surprisingly offer significantly higher conce...

Miracle Spice? Turmeric's 10 Shocking Health Benefits Uncovered

:max_bytes(150000):strip_icc()/Health-GettyImages-ConditionsTurmericCanHelpWith-73e93e547c534162b3a55d2dc5b121d6.jpg)

Discover the extensive health benefits of turmeric and its active compound, curcumin, a potent anti-inflammatory and ant...