General Motors Unfazed by Major EV Losses, Remains Confident Despite Financial Setback

General Motors is forecasting a stronger financial performance in 2026, despite experiencing significant financial setbacks related to electric vehicles (EVs) in 2025.

The company reported a full-year net income of $2.7 billion for 2025, representing a 55 percent decline, while adjusted Earnings Before Interest and Taxes (EBIT) came in at $12.7 billion, in line with expectations.

The fourth quarter of 2025 proved particularly challenging, with GM recording a net loss of $3.3 billion. This was largely driven by $7 billion in special charges tied to major restructuring initiatives.

Strategic Shift Back to ICE and Hybrids

The bulk of the special charges were linked to restructuring operations in China and reconfiguring manufacturing capacity in North America.

GM redirected resources away from electric vehicle production toward Internal Combustion Engine (ICE) models, including hybrid vehicles, reflecting a strategic recalibration in response to slower-than-expected EV demand and cost pressures.

This pivot underscores the automaker’s near-term focus on profitability and operational flexibility, prioritizing vehicle segments that continue to deliver stronger margins.

Optimistic 2026 Outlook and Worker Profit Sharing

Buoyed by the anticipated returns from its revised strategy, GM has significantly raised its financial outlook for 2026.

The company now forecasts net income between $10.3 billion and $11.7 billion, with adjusted earnings projected to range from $13 billion to $15 billion.

The improved outlook also translated into strong profit-sharing results, with more than 47,000 hourly workers receiving payments of $10,500 each.

CEO Mary Barra praised the company’s performance, highlighting GM’s ability to adapt its strategy while continuing to reward employees and position the business for sustained profitability.

Recommended Articles

Bitwise Declares Bitcoin's Four-Year Cycle Dead, Forecasts 2026 Highs

Asset manager Bitwise predicts Bitcoin will break its historical four-year market cycle in 2026, setting new all-time hi...

Cadillac's Bold Return? The Vistiq SUV Debuts with One Controversial Flaw!

The 2026 Cadillac Vistiq emerges as a strong contender in the luxury SUV market, recognized as a finalist for the 2026 S...

EV Battle Heats Up: Lucid Gravity, Cadillac, Volvo Vie for SUV Crown!

MotorTrend compares three luxury electric SUVs: the Lucid Gravity, Volvo EX90, and Cadillac Vistiq. While the Gravity bo...

Trump's $5 Billion Lawsuit Haunts JPMorgan Amid CEO Dimon's Shocking 10.3% Pay Hike

JPMorgan Chase has increased CEO Jamie Dimon's compensation to $43 million for 2025, citing strong performance and leade...

Tech Giant Shake-Up: Microsoft Unleashes Massive Layoffs, Global Workforce Impacted!

Microsoft is implementing substantial global layoffs, affecting thousands of employees across all divisions in a strateg...

You may also like...

Future Unclear: Is Pep Guardiola Set to Depart Man City?

Intense speculation surrounds Pep Guardiola's future at Manchester City, with rumors suggesting he might leave earlier t...

Saudi League Slams Ronaldo: 'You Are Not Bigger Than The League' Amid Al-Nassr Strike

)

Cristiano Ronaldo protested the Saudi Pro League's transfer dealings, citing perceived financial bias against Al-Nassr, ...

Set Secrets Unveiled: Rebecca Ferguson Details On-Set Abuse, Keeps 'Idiot' Actor Anonymous

Rebecca Ferguson opened up about a past incident where a co-star screamed at her on set, emphasizing that her story high...

Hollywood Shockwave: Timothy Busfield Indicted on Child Sex Abuse Charges

Timothy Busfield, director of "The Cleaning Lady," has been indicted on four counts of child sexual abuse in New Mexico,...

Must-Read: Yejide Kilanko's 'In Our Own Ways' Offers Exclusive Sneak Peek

Fadaka's spiritual quest, guided by Aunty Kike, leads her through a deceptive journey to a secluded ministry for a 'spec...

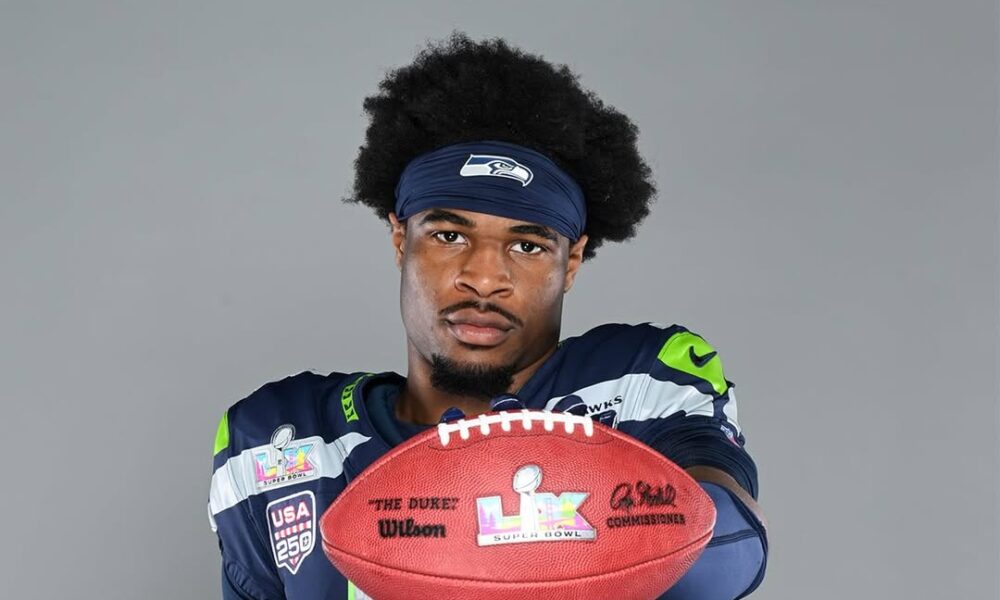

Super Bowl LX 2026: Anticipation Builds for Halftime Spectacle

Super Bowl LX is set to electrify Levi’s Stadium on February 8, 2026, featuring a star-studded halftime show by Bad Bunn...

Probiotic Powerhouse: Yogurt's Reign Challenged by 7 Surprising Dairy Rivals!

:max_bytes(150000):strip_icc()/Health-GettyImages-DairyWithMoreProbioticsThanYogurt-61aceb114e8542caae52b4e4a6067ac6.jpg)

While yogurt is a popular source of probiotics, many other fermented foods surprisingly offer significantly higher conce...

Miracle Spice? Turmeric's 10 Shocking Health Benefits Uncovered

:max_bytes(150000):strip_icc()/Health-GettyImages-ConditionsTurmericCanHelpWith-73e93e547c534162b3a55d2dc5b121d6.jpg)

Discover the extensive health benefits of turmeric and its active compound, curcumin, a potent anti-inflammatory and ant...