White House Summit: Crypto & Banking Titans Clash Over Stalled US Bill's Future!

The White House is set to host a crucial summit on Monday, February 2, bringing together key executives from both the banking and burgeoning crypto sectors. The primary agenda for this high-level meeting, convened by the administration’s crypto council, is to chart a viable path forward for stalled U.S. crypto legislation. Discussions are anticipated to home in on particularly contentious provisions within proposed laws, specifically how interest and other rewards paid by crypto firms on customer holdings of dollar-pegged stablecoins would be regulated.

This convening underscores the Trump administration’s apparent keenness to foster a compromise and advance comprehensive legislation, especially after previous negotiations faced significant obstacles due to competing priorities and strong industry pushback. While the White House has not yet provided official comment, Reuters reported on January 28, 2026, citing anonymous sources familiar with the deliberations, that the meeting is a critical step towards resolving the legislative deadlock.

The current state of U.S. federal crypto policy reflects months of legislative activity that initially raised expectations for robust regulation, only to see progress grind to a halt. The House of Representatives successfully passed a significant market-structure bill, known as the CLARITY Act, in July 2025. This bill was intended to establish clear regulatory rules for digital assets and delineate the jurisdictional boundaries between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), thus offering much-needed clarity to the industry.

However, the momentum stalled dramatically in the Senate. In early January, the Senate Banking Committee made the decision to postpone its planned markup of the CLARITY Act. This setback was largely attributed to influential industry voices, including major players like Coinbase, retracting their support for the bill. Critics argued vehemently that late-stage amendments introduced into the legislation posed a significant threat to crypto innovation. Concerns specifically revolved around tighter restrictions on stablecoin rewards, proposed alterations to decentralized finance (DeFi) oversight, and a perceived shift of regulatory power towards traditional financial regulators.

Brian Armstrong, the CEO of Coinbase, explicitly stated at the time that, “After reviewing the Senate Banking draft over the last 48 hours, Coinbase unfortunately can’t support this bill as written.” He further accused major banks of actively lobbying to modify the bill’s stablecoin provisions in ways that could potentially undermine the entire crypto industry and suppress yield-earning products. This public accusation served to deepen the existing rift between traditional banking interests and the burgeoning crypto advocacy movement.

Consequently, this legislative delay has left the issue of regulatory clarity largely unresolved, with the Senate debate now ensnared in broader political negotiations and repeated procedural postponements. Amidst this backdrop, the Senate Agriculture Committee is scheduled to cast its vote on a separate crypto market structure bill the day after the Reuters report, aiming to clarify regulatory jurisdiction over digital asset markets. This markup is expected to incorporate several amendments pertinent to crypto, with lawmakers ultimately deciding whether to advance the bill to the Senate floor.

Despite lingering uncertainty regarding Democratic support for this particular legislation, the absence of unrelated amendments that are often considered 'deal-breakers' has cautiously raised expectations that this bill might actually move forward. The ongoing efforts signify a persistent, albeit challenging, quest by U.S. policymakers to establish a clear and stable regulatory framework for the rapidly evolving digital asset landscape.

You may also like...

Tottenham's Champions League Success Contrasts With Troubled Premier League Form Under Thomas Frank

Tottenham's Premier League form poses problems for boss Thomas Frank despite their Champions League success. BBC Sport e...

The Pitt Unleashed: Exclusive Sneak Peeks, Star Secrets, and a Shocking 'Simpsons' Crossover!

The Indian SUV market sees compact SUVs leading sales in FY2025, with Tata Punch topping the charts. Maruti Brezza </div...

Neil Young Unleashes Fury: Slams Apple, Verizon, T-Mobile Over Trump Regime Support!

Neil Young has intensified his political activism, publicly condemning the Trump administration and companies like Veriz...

Grammy Gala Shakes Up 2026: Chappell Roan, Teyana Taylor, Karol G Join Presenter Ranks!

The 68th annual Grammy Awards are slated for February 1, 2026, with Trevor Noah hosting his final consecutive show. Chap...

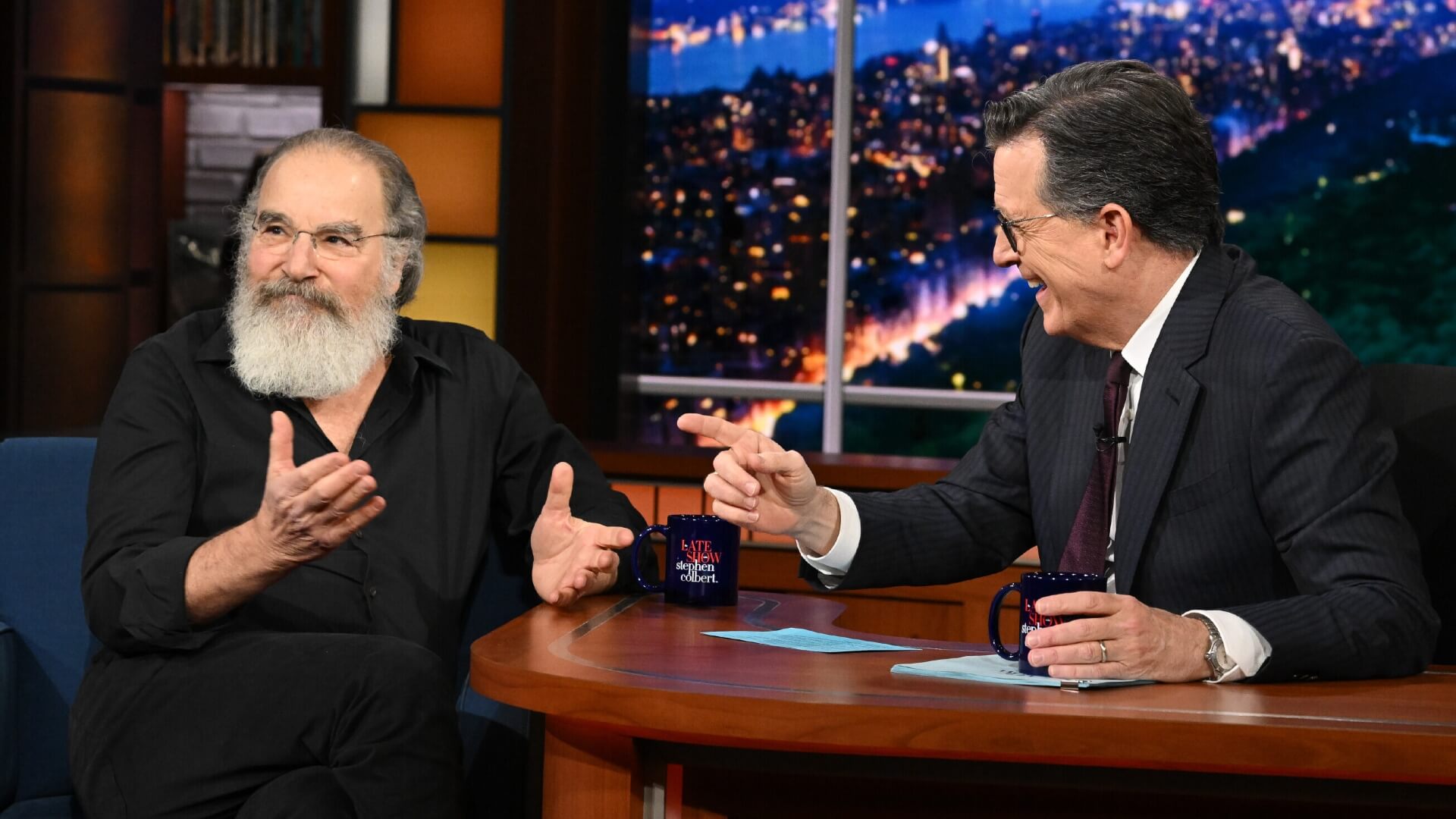

Divine Casting Revelation: Mandy Patinkin Ascends as Odin in Amazon's God Of War Series!

Mandy Patinkin has officially joined Amazon's live-action 'God of War' series, taking on the role of Odin, the Allfather...

Gaming Glory: Beth Mead, Cunha Dominate EA FC 26 Team of the Week 20!

Arsenal's Beth Mead earned a spot in the Team of the Week after a stellar performance against Chelsea, scoring and assis...

Crypto Bloodbath: Bitcoin Plummets to $84K, Triggering MicroStrategy Stock's 52-Week Low

Bitcoin's price plummeted sharply this morning, falling to the $84,000 range due to macro uncertainty and Federal Reserv...

Billion-Dollar Scandal: First Brands Founder Faces Charges for Massive Fraud

The founder and a former executive of First Brands Group, Patrick and Edward James, have been indicted in New York on ch...