Wall Street Breakthrough: Delaware Life Unveils First-Ever Bitcoin-Linked Annuity

Delaware Life Insurance Company has made a significant leap in the retirement planning landscape by becoming the first U.S. insurance carrier to introduce a fixed index annuity (FIA) that incorporates exposure to a cryptocurrency-focused index. This innovative product is linked to the BlackRock U.S. Equity Bitcoin Balanced Risk 12% Index, marking a pivotal moment for retirement investors seeking a measured approach to digital assets.

This pioneering offering enables policyholders to gain indirect exposure to Bitcoin, a leading cryptocurrency, while simultaneously benefiting from the principal protection inherent in traditional annuity products.

The BlackRock index is strategically designed to balance growth and risk, allocating 74% of its exposure to the iShares Core S&P 500 ETF, 25% to the iShares Bitcoin Trust ETF (IBIT), and maintaining a 1% cash allocation. Its architecture includes a 12% target volatility and utilizes dynamic cash adjustments to effectively moderate the inherent price swings of Bitcoin.

Robert Mitchnick, Global Head of Digital Assets at BlackRock, underscored the rationale behind this development, stating, "This launch builds around the tremendous success and client demand we have seen for IBIT, enabling insurance clients to now add Bitcoin exposure as part of a broader indexed annuity strategy."

He further emphasized the balanced nature of the index, allowing policyholders to engage with digital assets while retaining the expected downside protection of annuity products. Colin Lake, CEO of Marketing at Delaware Life, echoed this sentiment, highlighting the company's commitment to innovation and meeting the evolving needs of financial professionals and their clients. Lake affirmed, "Our fixed index annuities deliver what today’s investors want and need: opportunity for growth with protection."

The index’s mixed allocation strategy is specifically crafted to harmonize the growth potential of traditional equities with Bitcoin's typically high returns, all while actively managing overall volatility. As of December 31, 2024, the index had delivered a six-month return of 1.88%. However, it also experienced a 3.16% drop over the three-month period ending on the same date, primarily influenced by Bitcoin’s recent decline.

This innovative BlackRock U.S. Equity Bitcoin Balanced Risk 12% Index is currently available across three of Delaware Life’s prominent FIA products: Momentum Growth™, Momentum Growth Plus™, and DualTrack Income™. This provides clients with diverse avenues to integrate Bitcoin exposure into their broader retirement portfolios.

The inclusion of IBIT, recognized as the largest and most liquid Bitcoin exchange-traded product, ensures professional management of the underlying asset without necessitating direct cryptocurrency ownership by the policyholder. This marks the first instance where a life insurance company has enabled policyholders to select a product that incorporates Bitcoin exposure.

In related market context, the price of BTC today stands at $87,774, reflecting a 2% decrease over the last 24 hours, with a reported 24-hour trading volume of $64 billion.

You may also like...

NBA All-Star Weekend Delivers Blockbuster Headlines from Los Angeles

The recent NBA All-Star Weekend in Los Angeles saw a resurgence of competitive spirit, with Anthony Edwards winning MVP ...

Sensational Transfer Saga: Atletico Madrid Enters Race for Super Eagle Victor Osimhen

Atletico Madrid is reportedly pursuing Nigerian striker Victor Osimhen, with Galatasaray demanding a €100 million fee. S...

Lagos Dazzles as AFNAN’s 9PM Night Out Perfume Unveils in Global Spectacle

AFNAN officially unveiled its 9PM Night Out fragrance in Lagos, Nigeria, on February 11, 2026, marking a significant ste...

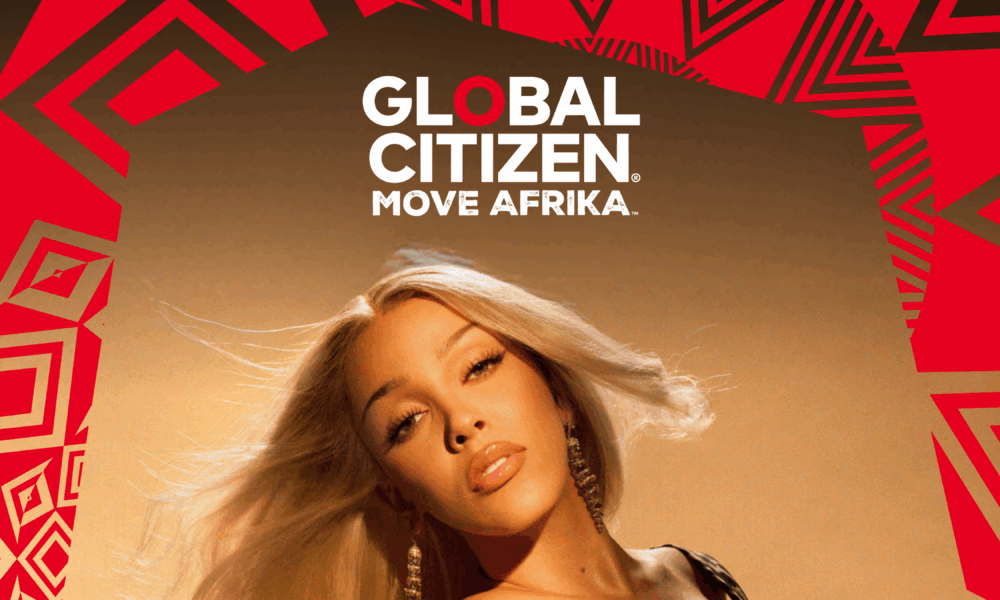

Doja Cat to Electrify Africa: Mega Headlining Role for Global Citizen ‘MOVE AFRIKA’ 2026

Global Citizen announces Doja Cat will headline Move Afrika 2026, expanding the music touring circuit to Rwanda and Sout...

Ethiopia Crowned Among World's Fastest-Growing Tourism Destinations with Staggering 15% Surge

Ethiopia emerged as one of the fastest-growing global tourism destinations in 2025, recording a 15% increase in internat...

Kenya's Aviation Authority Scrambles to Clear Backlog Amid Worker Strike Chaos

The Kenya Civil Aviation Authority (KCAA) is actively working to restore normal flight operations at Jomo Kenyatta Inter...

Measles Outbreak Grips London: Schools Hit, Vaccine Fears Rise!

London is facing a significant measles outbreak, with health officials urging parents to vaccinate their children amid a...

California Braces for Monster Winter Storm

California is bracing for a potent winter storm bringing heavy snow, high winds, and severe thunderstorms, prompting wid...