Crypto Catastrophe! Metaplanet Rocked by Staggering $619 Million Loss as Bitcoin Takes a Nosedive!

Metaplanet, a Tokyo-based Bitcoin treasury firm, reported a substantial net loss of 95 billion yen ($619 million) for fiscal year 2025. This significant loss was primarily driven by a 102.2 billion yen ($665.8 million) valuation decline on its extensive Bitcoin holdings. This disclosure highlights the challenges faced by corporate Bitcoin buyers as the cryptocurrency's price experienced a slide from its record highs established in October.

By the close of the fiscal year, Metaplanet held 35,102 BTC, with an approximate valuation of $2.4 billion. This considerable holding positions Metaplanet as the fourth-largest public corporate Bitcoin holder globally. Since it commenced accumulating Bitcoin 21 months ago, the company has invested nearly $3.8 billion, acquiring its Bitcoin at an average price of $107,000 per coin. As of December 31, the company's holdings were down approximately 37% on paper, translating into an unrealized loss of about $1.4 billion, with the fourth quarter alone accounting for a 102 billion yen ($664 million) decrease in value.

Despite the substantial valuation loss, Metaplanet showcased a strong operational performance with significant improvements. The firm's revenue saw a remarkable increase of 738%, reaching 8.91 billion yen ($58 million) from 1.06 billion yen ($6.9 million) in the prior year. Operating profit surged an even more impressive 1,695% to 6.29 billion yen ($41 million). This growth was predominantly fueled by premiums derived from Bitcoin option transactions, which constituted approximately 95% of the total revenue.

Metaplanet's largest Bitcoin acquisitions occurred when the cryptocurrency was trading above $100,000. Notable purchases included a 25% growth of its Bitcoin holdings through a $630 million acquisition in September at roughly $106,000 per coin, followed by another $615 million acquisition in October near $108,000. To fund these purchases, the firm largely relied on common stock issuances and also adopted preferred shares to secure additional capital. It introduced MERCURY and MARS, its inaugural preferred share offerings in Japan, specifically to bolster its balance sheet and establish a buffer against the inherent volatility of the crypto market.

Looking ahead to fiscal year 2026, Metaplanet projects revenue of 16 billion yen ($104 million) and an operating profit of 11.4 billion yen ($74.3 million), indicating an approximate 80% growth in both metrics. The company opted not to provide net income guidance due to the ongoing volatility in Bitcoin's price but reiterated its long-term objective of accumulating 210,000 BTC by 2027, which would represent about 1% of the total Bitcoin supply. Metaplanet's stock experienced a slight increase to 326 yen on Monday, according to Yahoo Finance, following a six-month period where it declined by over 62%. At the time of writing, Bitcoin was trading near $68,000.

You may also like...

NBA All-Star Weekend Delivers Blockbuster Headlines from Los Angeles

The recent NBA All-Star Weekend in Los Angeles saw a resurgence of competitive spirit, with Anthony Edwards winning MVP ...

Sensational Transfer Saga: Atletico Madrid Enters Race for Super Eagle Victor Osimhen

Atletico Madrid is reportedly pursuing Nigerian striker Victor Osimhen, with Galatasaray demanding a €100 million fee. S...

Lagos Dazzles as AFNAN’s 9PM Night Out Perfume Unveils in Global Spectacle

AFNAN officially unveiled its 9PM Night Out fragrance in Lagos, Nigeria, on February 11, 2026, marking a significant ste...

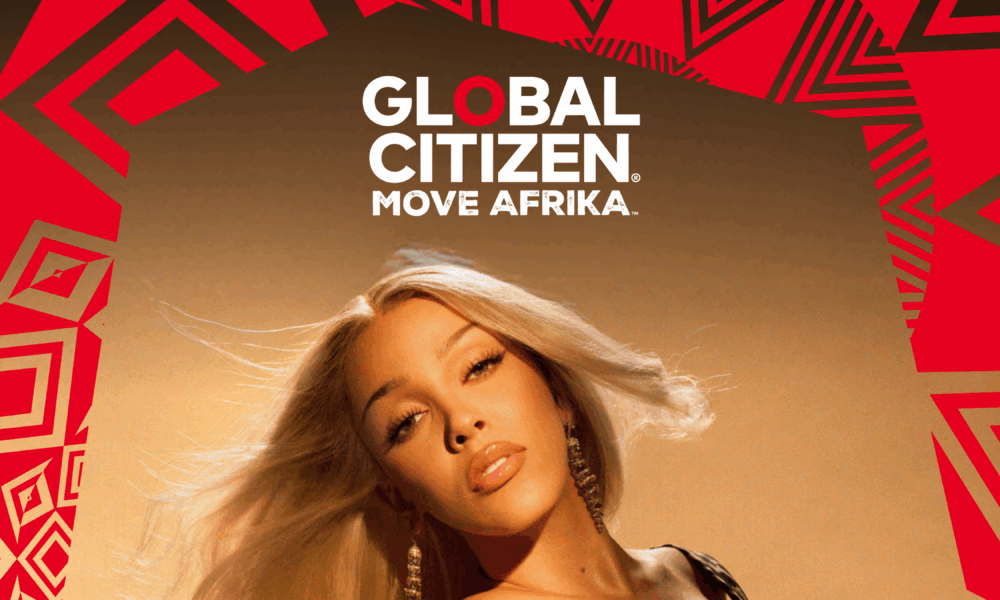

Doja Cat to Electrify Africa: Mega Headlining Role for Global Citizen ‘MOVE AFRIKA’ 2026

Global Citizen announces Doja Cat will headline Move Afrika 2026, expanding the music touring circuit to Rwanda and Sout...

Ethiopia Crowned Among World's Fastest-Growing Tourism Destinations with Staggering 15% Surge

Ethiopia emerged as one of the fastest-growing global tourism destinations in 2025, recording a 15% increase in internat...

Kenya's Aviation Authority Scrambles to Clear Backlog Amid Worker Strike Chaos

The Kenya Civil Aviation Authority (KCAA) is actively working to restore normal flight operations at Jomo Kenyatta Inter...

Measles Outbreak Grips London: Schools Hit, Vaccine Fears Rise!

London is facing a significant measles outbreak, with health officials urging parents to vaccinate their children amid a...

California Braces for Monster Winter Storm

California is bracing for a potent winter storm bringing heavy snow, high winds, and severe thunderstorms, prompting wid...