Trump's Steel Tariffs Spark Uncertainty and Canadian Reassessment

President Trump announced a significant escalation in trade policy on Friday, declaring a doubling of tariffs on foreign imports of steel and aluminum from 25% to 50%. This move has sparked concerns about potential price increases for a wide range of goods, including cars, appliances, and construction supplies, with Taurean Small providing details on the implications.

In response to these developments, Canada is carefully pondering its actions. The threat of these tariffs has already had a mixed impact on the Canadian economy, as tariff fears reportedly boosted Canada’s Q1 exports but hurt consumer spending. The uncertainty surrounding tariffs is a major concern, with luxury parka retailer Canada Goose withholding its annual forecast due to the unpredictable trade environment. Businesses located at the U.S.-Canada border are also reportedly being hammered by President Trump's tariffs and rhetoric.

Adding another layer to the situation, a U.S. trade court blocked President Trump's sweeping tariffs, a decision the White House criticized as a 'brazen abuse' of judicial powers. Separately, President Trump also delayed a proposed 50% tariff on the European Union, a development that one trader described as part of a 'to and fro' that 'drives markets mad'. Despite these ongoing trade tensions, G7 finance ministers managed to agree on a joint statement, though it notably made no mention of tariffs.

The Canadian government, led by Prime Minister Carney, is navigating a complex economic landscape. The Carney government recently tabled a $486 billion spending plan. Prime Minister Carney has publicly stated that 'weak productivity' is making life less affordable for Canadians and has stressed Canada’s need for new relations with the U.S., a point he likely discussed when he met with a bi-partisan delegation of U.S. senators in Ottawa. On the energy front, Conservatives have criticized Carney’s oil production cap, arguing it makes Canada more dependent on foreign oil.

Domestically, Canada has seen its inflation rate drop to 1.7% in April, primarily due to lower energy costs; however, grocery prices have remained high. The economic climate is further shadowed by issues such as thousands of laid-off Hudson’s Bay employees facing uncertainty, an increasing number of Canadians (1 in 3, according to Royal LePage) expecting to carry mortgage payments into retirement, missed debt payments reaching their highest level since 2009 according to Equifax, and general concerns about a looming recession. The Canadian housing market also shows signs of being on hold, as per CREA data. Amidst these economic pressures, President Trump has been urging Republicans to support his 'one, big beautiful' budget bill, which is reportedly one step closer to becoming law in the U.S.

You may also like...

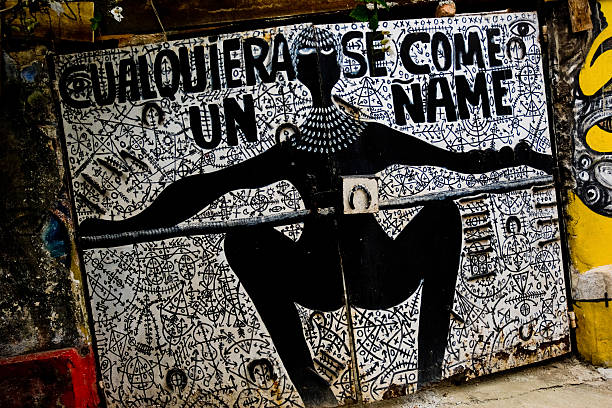

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

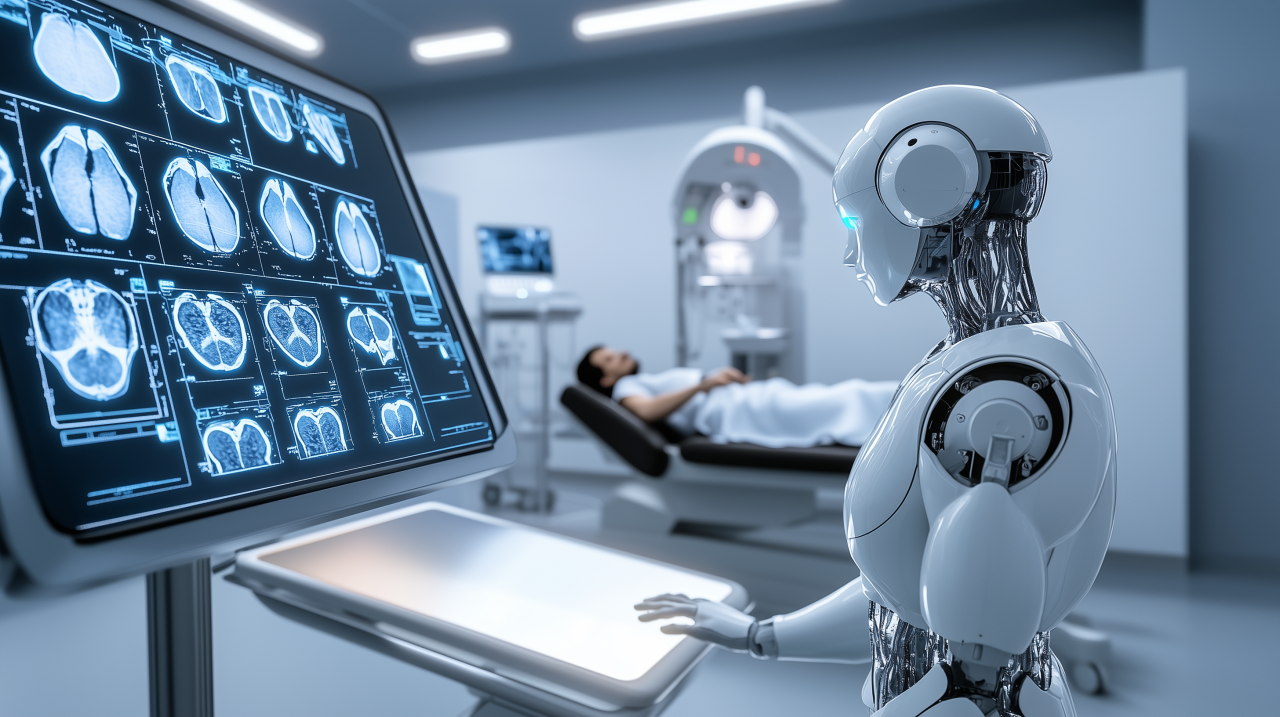

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

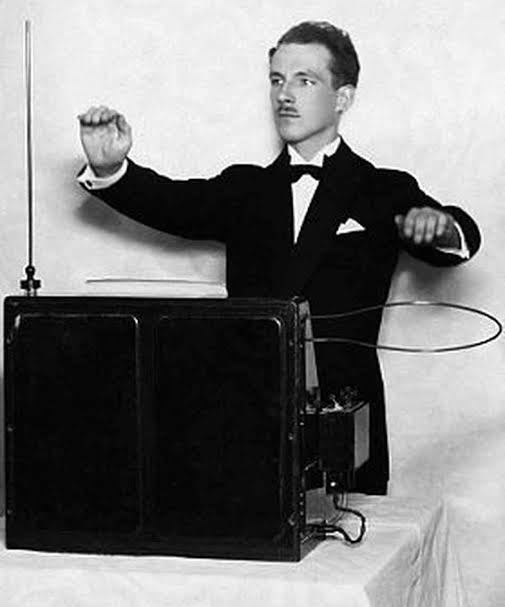

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

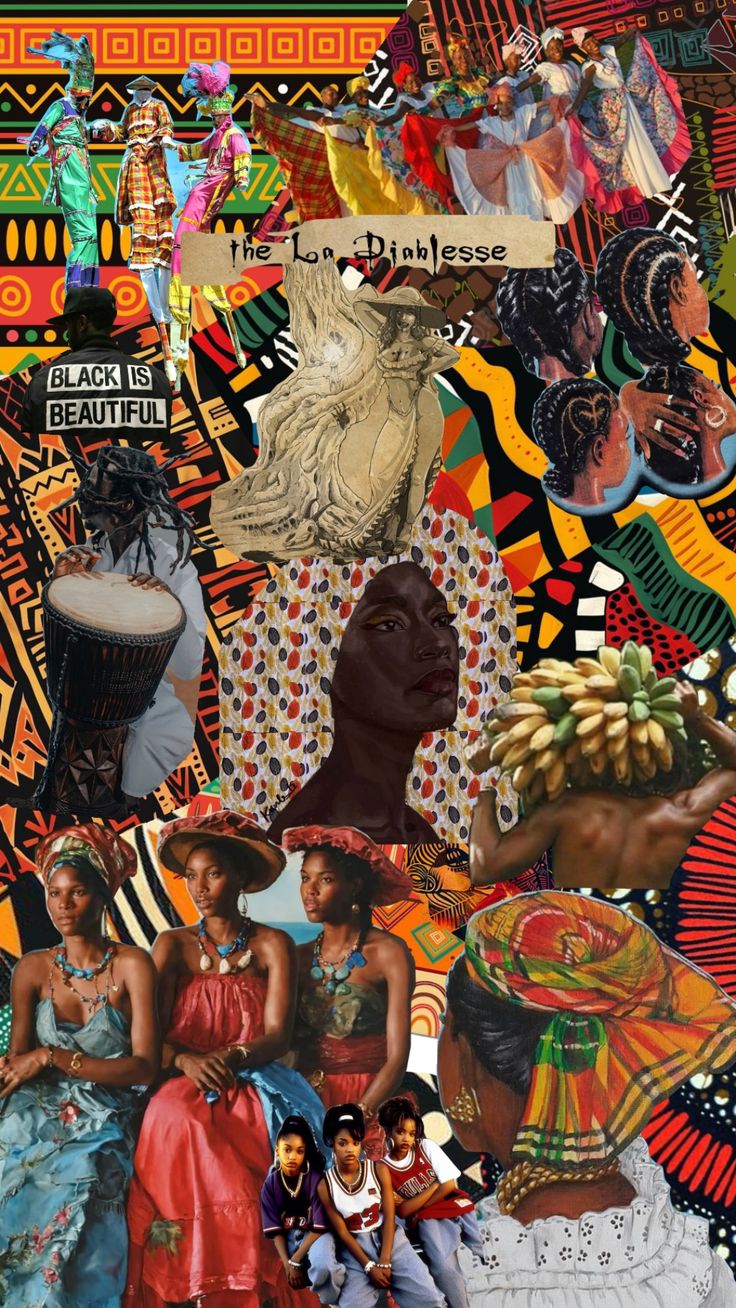

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...