Analysis of Donald Trump's Tariffs and US Fiscal Deficit

Professor Alan Auerbach, a distinguished expert in economics and law at the University of California, Berkeley, provides critical insights into the American economy, its inherent strengths, and the significant fiscal challenges it currently faces. His extensive research encompasses the effects of business and capital income taxation, the macroeconomic impacts of fiscal policy and government spending, and the long-term sustainability of fiscal policies in the face of demographic changes.

Auerbach identifies innovation, entrepreneurship, and economic flexibility as the primary drivers of American economic strength, setting the U.S. apart from other leading economies over the past two decades. This robust spirit has fueled the rise of numerous successful businesses, leading to superior productivity and economic growth. He points to the adaptability of the U.S. labor market, particularly highlighted during the Covid-19 pandemic, where the emphasis on cushioning individuals rather than preserving existing jobs allowed for a more flexible and effective response compared to Europe's approach. However, he expresses apprehension regarding the disruptive policies implemented by the Donald Trump administration, despite their seemingly limited immediate impact, fearing long-term adverse effects on the economy.

A central point of concern for Auerbach is the "One Big Beautiful Bill," which he describes as having remarkably unbalanced distributional consequences. This legislative effort significantly cuts spending, particularly in healthcare, thereby disproportionately impacting lower-to-middle-income populations. Simultaneously, while reducing taxes for most, the largest benefits accrue to high-income earners. Such a policy stance, according to Auerbach, not only exacerbates social inequalities but also exerts an enormous strain on government deficits, ultimately driving up interest rates on the national debt and setting the nation on an unsustainable fiscal trajectory.

Tracing the evolution of the overwhelming American national debt, Auerbach recalls the late 1990s under the Clinton administration, when the U.S. successfully ran budget surpluses, a testament to responsible fiscal policies dating back to the first George Bush and even the later part of Ronald Reagan's tenure. This period of sustainability, however, began to unravel with subsequent tax cuts, notably the Bush cuts in 2001 and Trump's in 2017. Compounding this, there have been substantial expenditure increases, including the expansion of healthcare spending under the Bush and Obama administrations and growing defense outlays. An underlying and persistent driver of this debt growth is demographic change, with an aging population naturally leading to increased spending on healthcare and pensions. Auerbach laments that instead of proactively addressing these foundational demographic shifts, successive governments have opted for additional tax cuts and unrelated spending increases, further worsening the fiscal outlook.

Regarding the Trump administration's tariffs, Auerbach notes a dual impact on U.S. debt. In the short term, the tariffs are generating considerable revenue, which aids in mitigating the otherwise massive deficit accumulation. However, this short-term benefit is overshadowed by the long-term prognosis: tariffs will ultimately weaken the broader economy. Measures companies initially take to cushion the impact, such as accumulating large inventories, are temporary and will eventually be exhausted. As these effects ripple through the economy, a weakened economic environment will inevitably lead to reduced overall tax revenues, thereby undermining the very purpose of the tariffs in deficit reduction. He highlights that a strong economy, as seen during the 1990s Clinton years, is far more effective in debt management than relying on tariff revenues from a struggling economy.

To address the burgeoning national debt, Auerbach posits that a critical reckoning with old-age entitlement programs, including public pensions, social security, and Medicare, is indispensable. Furthermore, adjustments to the existing tax system, whether through new taxes or improved collection methods, are necessary. He asserts that the challenge is not economic but fundamentally political. Given the highly polarized political landscape, major fiscal reforms demand bipartisan cooperation. Auerbach pessimistically suggests that a significant event, possibly a crisis or at least a mini-crisis in capital markets concerning U.S. debt, may be required to compel political factions to collaborate and implement the necessary changes for fiscal sustainability.

You may also like...

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

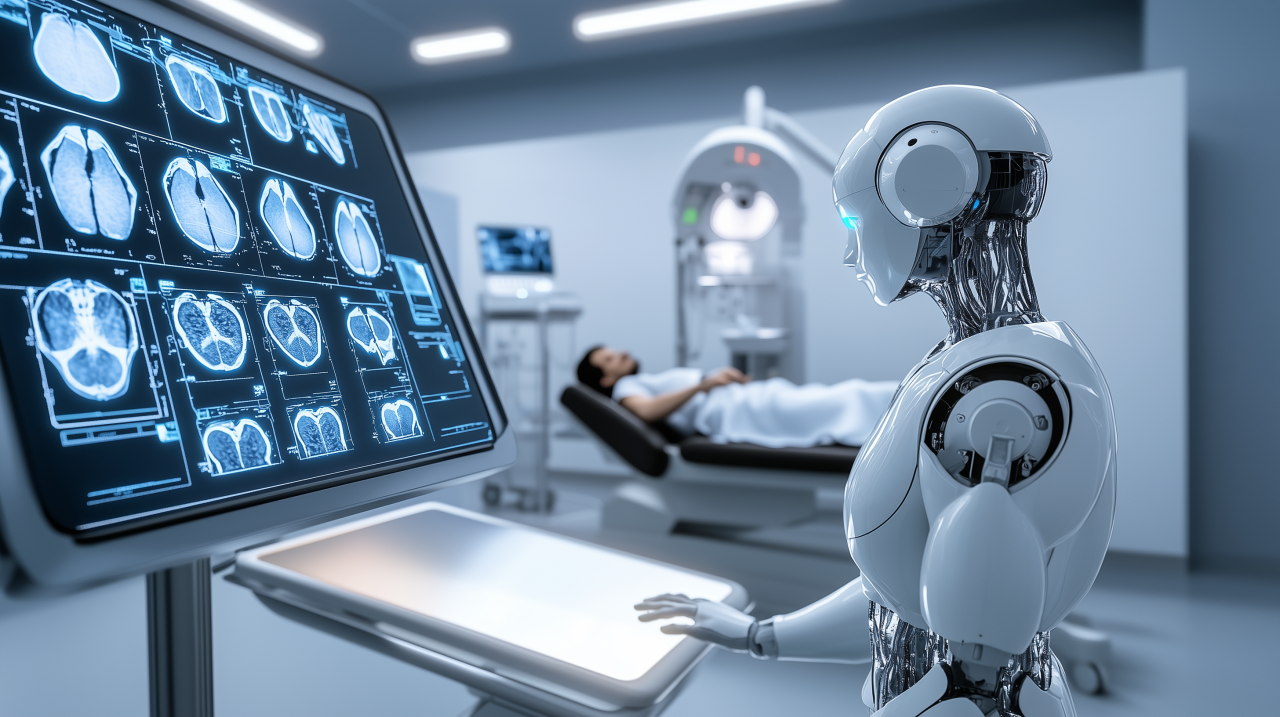

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

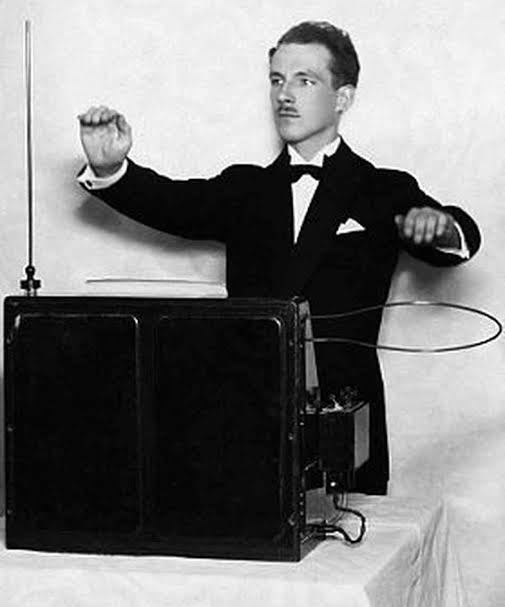

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...