Trump's Megabill Passes House Amidst GOP Support

New York congressional Republicans, many of whom previously voiced strong criticism of debt growth during the Democratic presidential administration, have demonstrated a significant shift in their fiscal stance by largely supporting President Donald Trump’s recent budget bill. This controversial legislation is projected to add an estimated $3 trillion to the national debt, a figure that could escalate to $3.3 trillion between 2025 and 2034 according to the nonpartisan Congressional Budget Office (CBO) – approximately $1 trillion more than the House’s initial version of the bill. The House of Representatives narrowly passed its version, 215-214, before ultimately approving the Senate's version following intense White House pressure and further haggling.

This apparent pivot by Republicans is not an isolated incident in U.S. politics. Syracuse University political scientist Grant Reeher highlighted to Newsday that such shifts have been consistent over the past two decades. He noted that both parties exhibit "hypocrisy" regarding the national debt, with their concern often depending on who occupies the White House. The party out of power typically expresses greater alarm over increasing debt. For instance, Democrats have shown willingness to expand debt for initiatives like green energy and college loan forgiveness, while Republicans prioritize tax cuts and military spending.

The budget bill, a sprawling 940-page document, is poised to impact nearly every domestic policy area. While it extends tax cuts that offer some benefits to lower-income households, the Urban-Brookings Tax Policy Center indicates that these cuts primarily favor higher-income earners. Concurrently, the bill allocates increased spending for the military and immigration enforcement, balanced against reductions in critical areas such as Medicaid, food benefits, and green energy programs.

Economists and policy experts have raised alarms about the long-term implications of this debt increase. Shai Akabas, vice president of economic policy for the Bipartisan Policy Center, warned that adding to the current national debt, which stands at over $36 trillion, will "exacerbate trends we already have from our current unsustainable trajectory." Akabas further explained that a surge in government debt typically leads to rising interest rates and a general slowdown in the economy. While the tax cuts embedded in the bill might initially stimulate consumer spending or investment, he cautioned that the associated debt increase would ultimately "negate those positive economic impacts over time."

Several New York Republican representatives exemplified this evolving political dynamic. Congresswoman Elise Stefanik (R-Schuylerville), who in 2023 decried increasing debt under President Joe Biden and called it one of the greatest threats to America, now praises the current Trump budget bill for its tax cuts, border security measures, and "wasteful spending" cuts, notably omitting any mention of the deficit. Similarly, Representative Michael Lawler (R-Pearl River), representing a swing district, supported the new bill, arguing that tax cuts would spur the economy and potentially offset debt growth. He stressed the importance of passing the tax bill to avoid the largest tax increase in American history, which he believes would negatively impact the economy and job market.

Other New York Republicans, like Nick LaLota (R-Amityville) and Andrew Garbarino (R-Bayport), also weighed their support. LaLota backed the House bill partly due to its provision to raise the cap on the state and local tax (SALT) deduction, a significant benefit for many high-tax, high-income Long Islanders, calling it a "yearslong battle." Garbarino, while acknowledging the bill raises the debt ceiling, contended that it is offset by tax savings and other benefits, describing it as having "real wins for Long Island and for the American people." Both LaLota and Garbarino had faced pressure from Democrats to oppose the bill. This intricate interplay of national fiscal policy, local economic impacts, and political expediency underscores the complex considerations faced by New York's congressional Republicans in navigating a highly partisan political landscape.

You may also like...

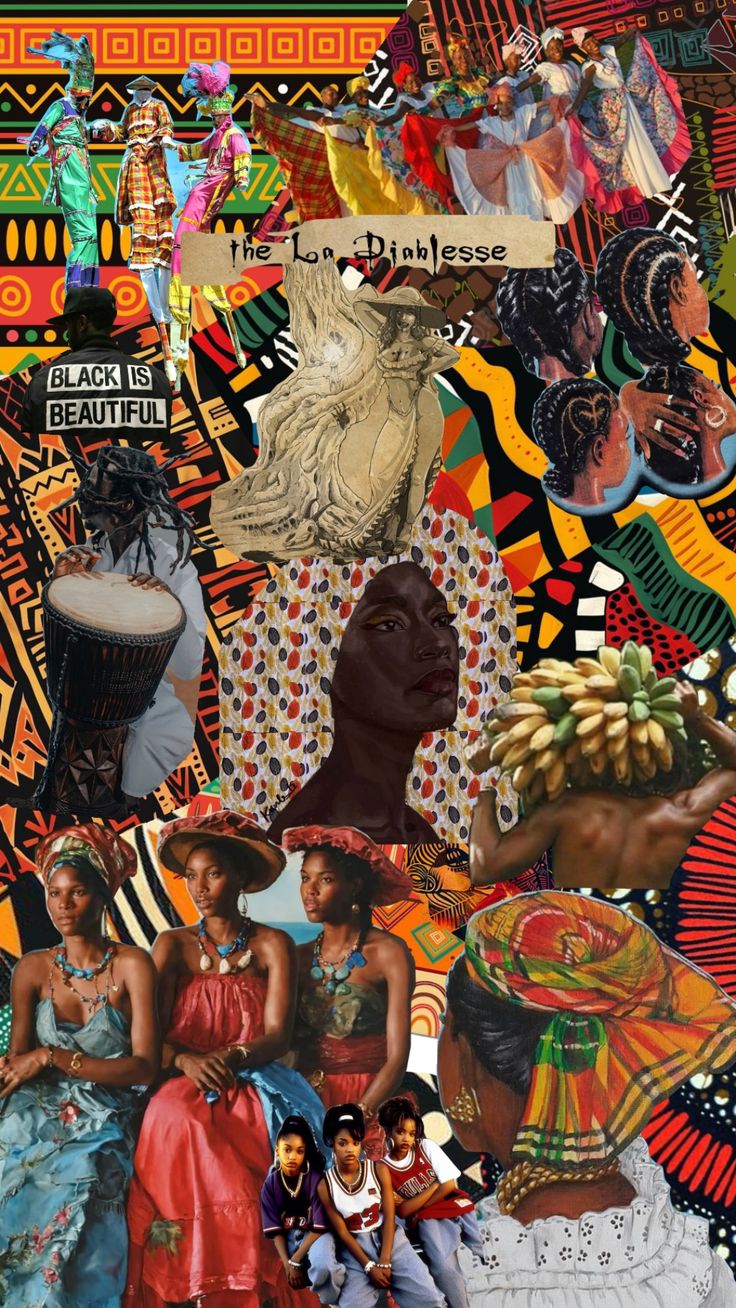

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

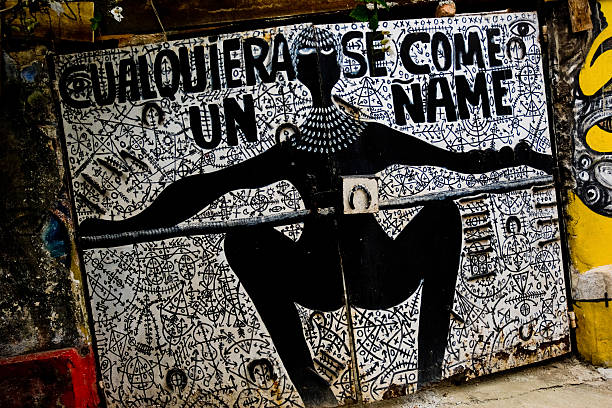

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

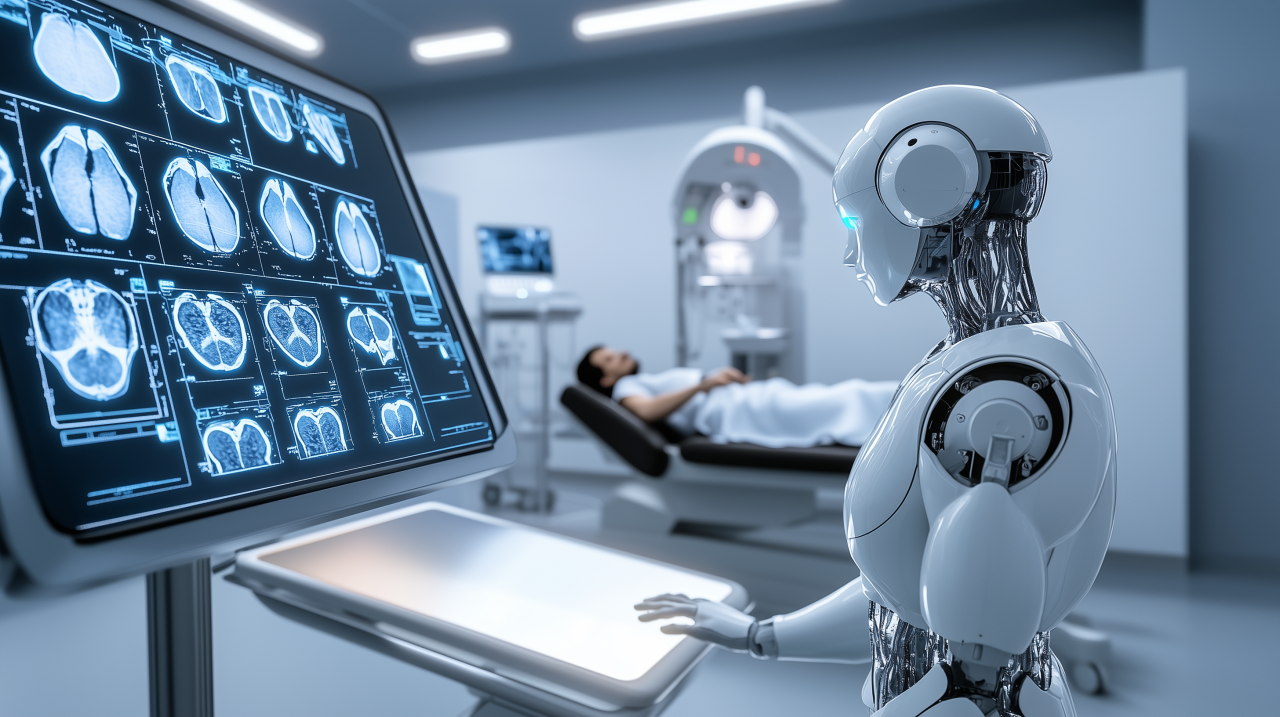

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

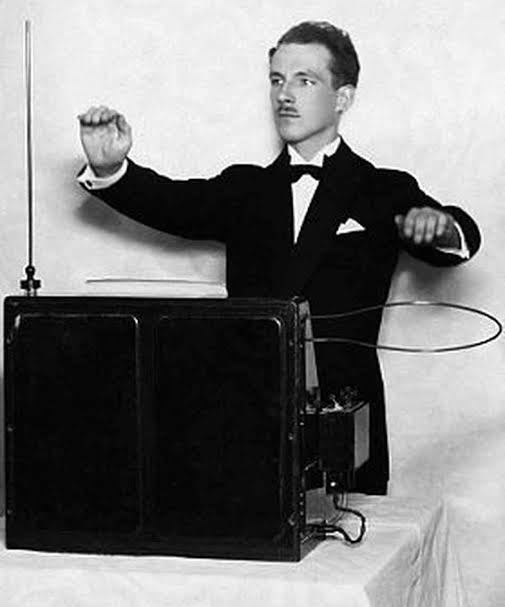

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...