Bank of Canada May Cut Interest Rates, Affecting Mortgages

The Bank of Canada is poised for a significant announcement on June 5, 2025, regarding its key interest rate, with widespread anticipation of a potential cut. This decision comes as Canadians grapple with the effects of two years of rising interest rates aimed at curbing inflation, leading to increased financial pressure on households and small businesses.

As inflation shows signs of cooling and borrowing costs remain elevated, many are hopeful for relief. The sustained period of high interest rates has resulted in surging mortgage payments, costlier loans, and strained credit access. With inflation now moving closer to the Bank of Canada’s target, the prospect of a rate cut has become a tangible possibility, offering potential respite.

Market watchers and economists widely expect the Bank of Canada to reduce its key interest rate by 0.25%, bringing it down from the current 5%. Factors supporting this potential move include a discernible slowdown in inflation, moderated wage growth, and economic activity that has been weaker than initially anticipated. These are all key indicators that the central bank meticulously reviews when formulating its monetary policy decisions.

A rate cut by Canada’s Central Bank could bring several benefits to the populace. These include potentially lower mortgage payments for individuals renewing their mortgages or those with variable-rate mortgages. Furthermore, it could lead to easier access to credit for both individuals and small businesses, and provide much-needed financial relief for households currently burdened by debt. A rate cut could also make borrowing more affordable for first-time homebuyers and those contemplating significant loans. However, financial advisors offer a note of caution, warning that any rate cuts are likely to be gradual, implying that substantial changes to borrowing costs might not be immediate.

Economists offer varied but generally optimistic outlooks on the timing and extent of these potential cuts. Desjardins economists point to what they describe as “clear signs of slowing” in the Canadian economy, particularly evident in consumer spending patterns and the housing market. They believe the Bank of Canada might take a leading role by implementing an early rate cut, possibly even preceding similar actions by the US Federal Reserve. Capital Economics concurs with this sentiment, forecasting up to three rate cuts by the end of 2025, with the first potentially occurring as early as June. In contrast, economists at the Royal Bank of Canada adopt a more cautious stance. While acknowledging the possibility of a June cut, they suggest the Bank might prefer to wait until July to gather more comprehensive data on inflation and wage growth before making a decision.

Changes in interest rates have far-reaching effects, influencing a wide spectrum of economic variables, from credit card rates and investment returns to housing prices and overall consumer confidence. This is why the Bank of Canada's decisions are closely monitored not just by financial experts and economists, but also by everyday Canadians whose financial well-being can be directly impacted. As the June 5 announcement approaches, all attention is focused on the central bank. A rate cut, if implemented, could signal the beginning of a new economic phase aimed at providing Canadians with greater financial breathing room and fostering a more stable economic environment.

You may also like...

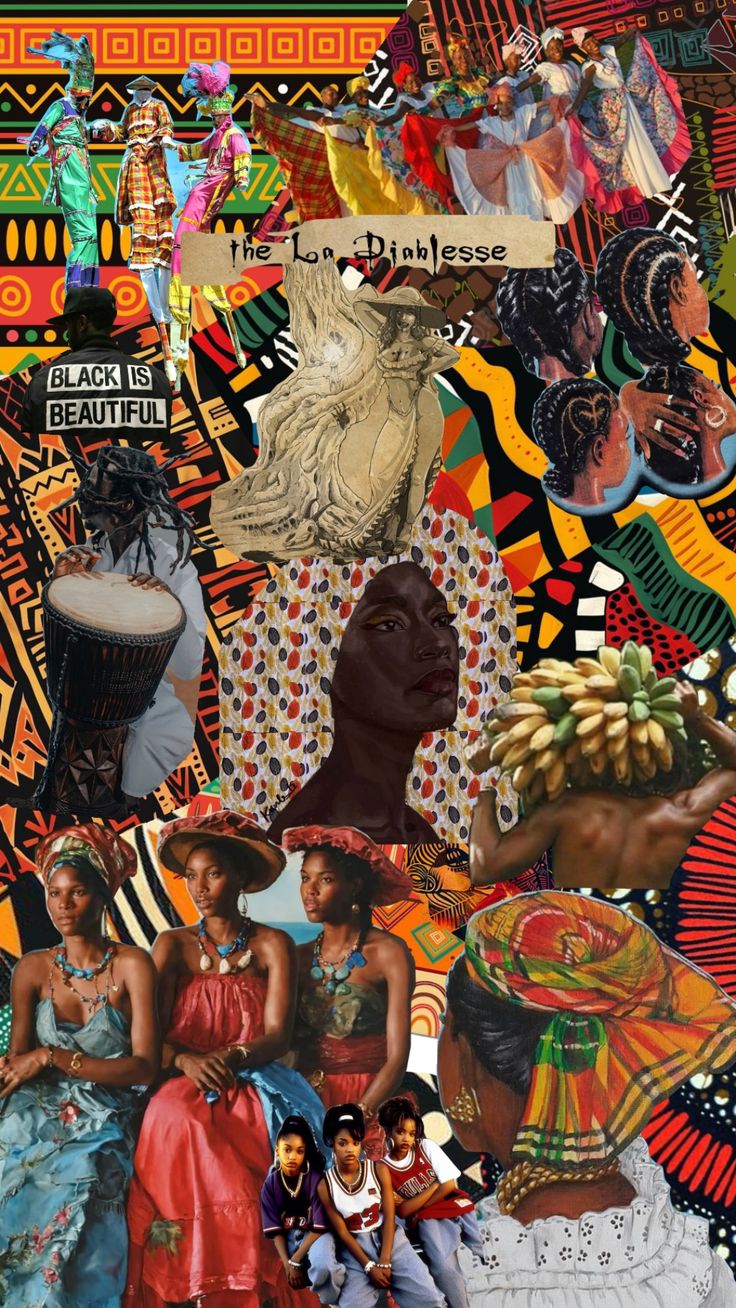

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

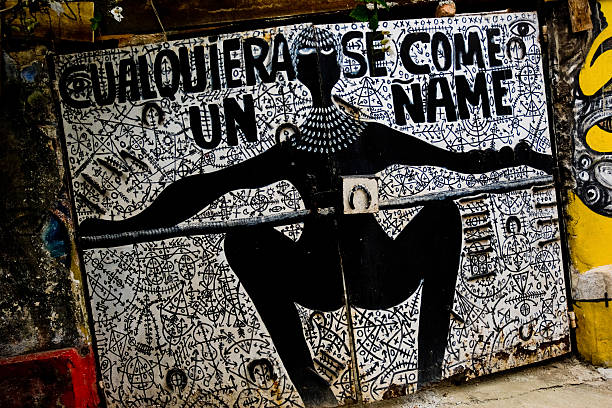

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

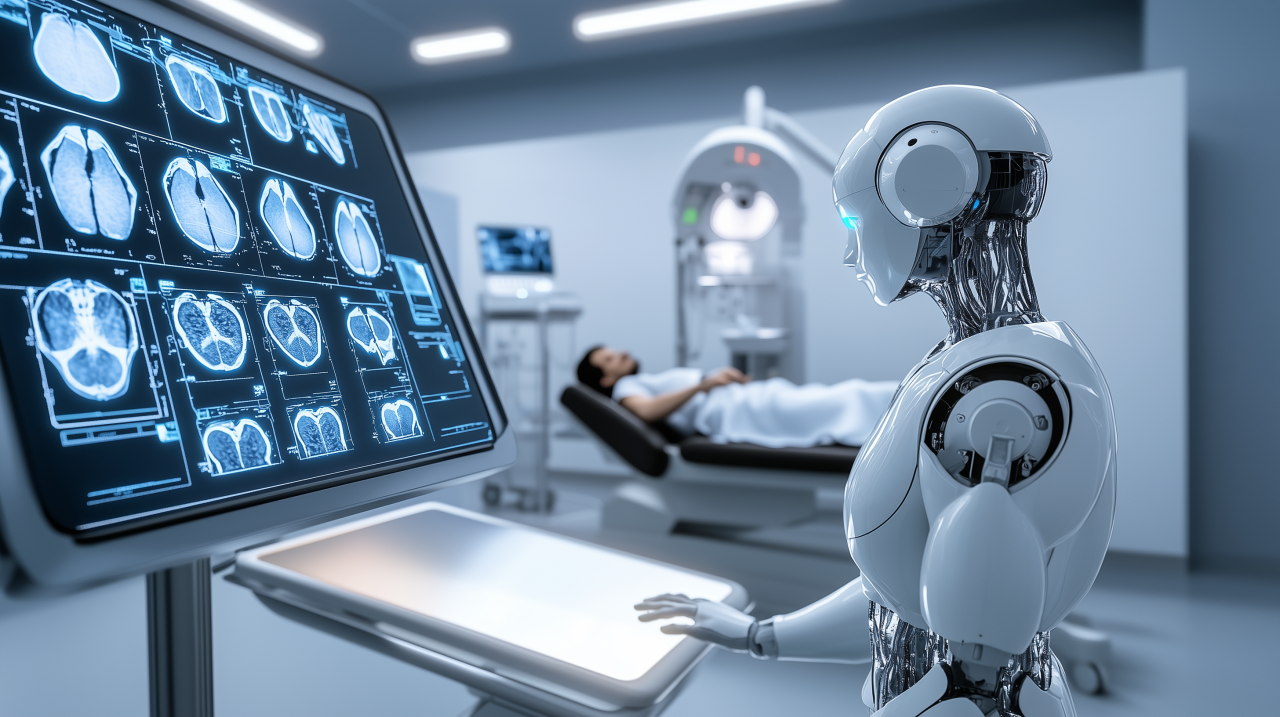

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

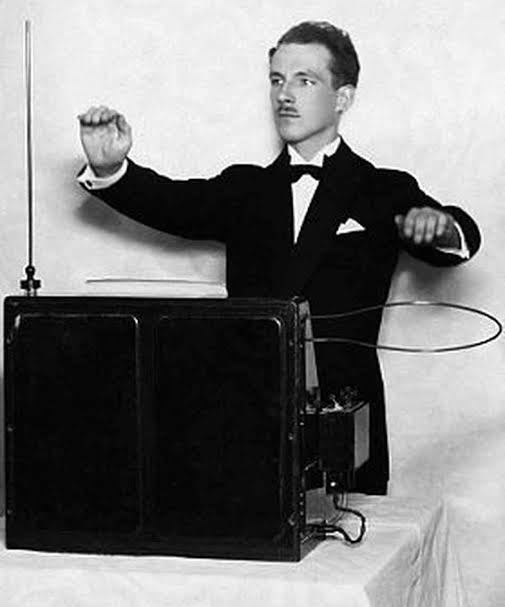

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...