Trade Tensions and Retail Retreat: Navigating Canada's Sector-Specific Risks Ahead of Q3 Slowdowns

Clyde MorganSaturday, Jun 21, 2025 8:08 pm ET

![]() 54min read

54min read

The Canadian retail sector is grappling with its most significant challenge in years. A sharp 1.1% decline in May 2025 retail sales—marking the largest drop since records began—highlights the fragility of an industry already strained by U.S. tariffs, supply chain bottlenecks, and shifting consumer behavior. With analysts warning of a Q2 economic slowdown and the Bank of Canada's policy path in flux, investors must reassess exposures to tariff-sensitive sectors while seeking shelter in resilient alternatives.

The latest Statistics Canada data paints a bleak picture. After April's modest 0.3% rise (driven by a temporary spike in auto sales), May's broad-based decline—spanning all nine subsectors—signals deeper structural issues. Core retail sales (excluding autos and gasoline), which grew just 0.1% in April, now face renewed pressure as consumer confidence wanes. The March 2025 data further underscores regional disparities: while Quebec and Nova Scotia saw gains, Manitoba's 1.6% drop and a 2.1% decline in e-commerce sales hint at uneven recovery.

1. 36% of Canadian retailers report operational disruptions due to U.S. tariffs, including higher input costs, reduced demand, and supply chain delays. Auto parts dealers, for instance, face a double whammy: tariffs on aluminum and steel inflate production costs, while retaliatory measures curb exports.

2. Falling crude prices in early 2025 cut gasoline sales by 6.5% in March, a trend likely exacerbated by fears of an economic slowdown.

3. Sluggish wage growth and rising interest rates have dampened discretionary spending, with CIBC Economics noting “sluggish non-auto sales” as a harbinger of broader weakness.

The May data underscores vulnerabilities in Canadian equities tied to U.S.-exposed sectors. Auto retailers, in particular, face headwinds:

Investors must pivot toward sectors insulated from trade friction and interest rate risks. Here's how to navigate the slowdown:

- Companies like Shoppers Drug Mart (WCG) and Hydro One (HUN.TO) offer stable cash flows and inelastic demand.

- Firms tied to local consumption, such as Tim Hortons (THI) or Maple Leaf Foods (MFI.TO), face fewer cross-border disruptions.

- Look for retailers with diversified supply chains or tariff mitigation strategies. For example, Home Depot Canada (HD.TO) has invested in Canadian manufacturing hubs to reduce reliance on U.S. imports.

-

- Consider ETFs like the iShares Canadian Utilities ETF (XUU.TO) or the Vanguard Canadian Dividend ETF (VDIV.TO), which prioritize dividend stability.

4. Monitor Policy Responses:

- The Bank of Canada's upcoming rate decisions will influence consumer spending. With CIBC predicting two more cuts by year-end, rate-sensitive sectors like real estate (e.g., CMHC-backed REITs) could rebound.

The data is clear: Canada's retail sector is in a precarious state, with U.S. tariffs and global economic headwinds compounding existing weaknesses. Investors holding positions in autos, discretionary retail, or U.S.-exposed supply chains must reassess their exposures. By pivoting to tariff-resistant industries, companies with contingency plans, or defensive equities, portfolios can weather the Q3 slowdown and position for recovery.

As the June 20 release of April's revised retail data approaches, stay vigilant—this could be the final signal to reallocate before markets adjust.

JR Research

June 19, 2025

You may also like...

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

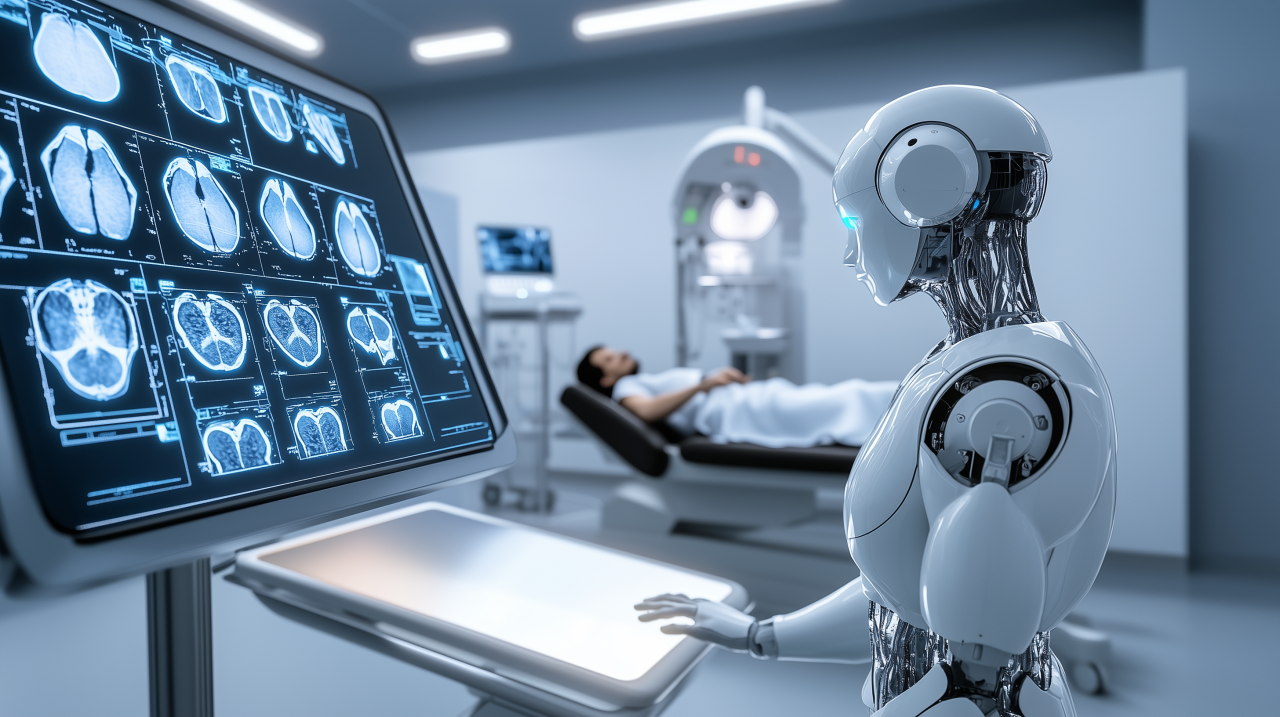

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

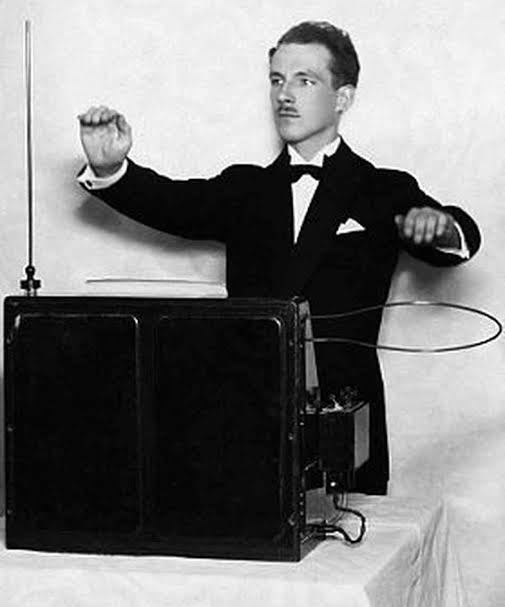

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...