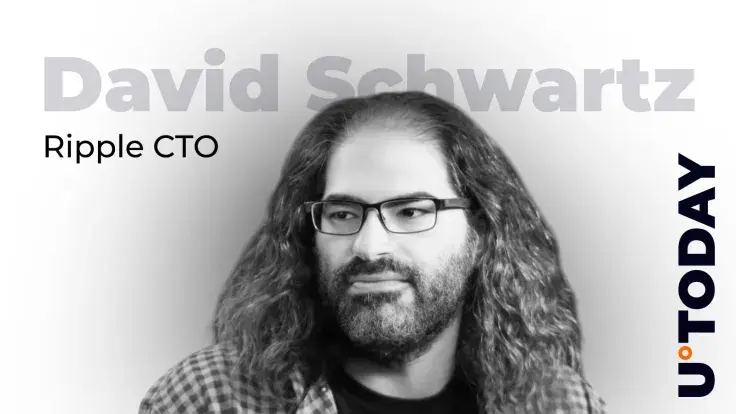

Ripple CTO Emeritus Declares Bitcoin a “Technological Dead End,” Raising Industry Debate

David Schwartz, co-creator of the XRP Ledger and newly named CTO Emeritus of Ripple, has ignited discussion across the cryptocurrency space by calling Bitcoin a “technological dead end.”

He argues that the world’s leading cryptocurrency prioritizes stability and adoption over innovation and revealed that he sold nearly all of his Bitcoin holdings when the price was around $7,500.

The remarks came during a question from the XRP community about whether Schwartz would return to Bitcoin development. He firmly dismissed the notion, stating, “Not really.

I think bitcoin is largely a technological dead end for the same reason the dollar is,” adding that “the technology just doesn't seem to matter all that much to its success, at least not at the blockchain layer.” In his view, Bitcoin has solidified into a monetary standard where its established status outweighs base-layer upgrades.

Schwartz has also criticized Bitcoin’s decentralization narrative. In December, he emphasized, “In more than a decade, no XRP transaction has ever been censored or treated unfairly while bitcoin miners routinely delay transactions they disfavor for any reason at all.”

He noted that Bitcoin has faced incidents showing higher centralization than the XRP Ledger, despite XRP’s early genesis glitch.

Moreover, Schwartz highlights that all blockchains require human oversight during crises. Referring to Bitcoin’s 2013 intervention, he stated, “Any problem with XRP can be fixed by XRPL's governance, as Bitcoin had to do in 2013.

And it will be because every chain's governance cares.” This underscores that no blockchain is fully autonomous, contrary to popular belief.

A critical concern for Schwartz is Bitcoin’s proof-of-work (PoW) consensus mechanism. He warned of a potential “death spiral” scenario, where high prices combined with low transaction volumes could create network vulnerabilities, potentially undermining Bitcoin’s long-term security and resilience.

You may also like...

Iwobi's Fulham FA Cup Heroics: Midfielder Hits Major Milestone in Thrilling Escape

)

Alex Iwobi celebrated his 100th appearance for Fulham by playing a pivotal role in their dramatic 2-1 FA Cup comeback vi...

Wuthering Heights Box Office Bonanza: Dominates Global Charts with $82 Million Haul

Emerald Fennell's 'Wuthering Heights' dominated the global box office with an $82 million debut, offsetting mixed domest...

New Video Game 'Relooted' Lets Players Reclaim Stolen African Artifacts

"Relooted," a new video game from South African studio Nyamakop, tackles the timely political topic of artifact restitut...

Ethiopia's Bold Maritime Strategy Rocks Regional Power Balance

The political economy of the Horn of Africa is undergoing a profound structural transition, marked by Ethiopia's strateg...

Behind the Scenes: The 'Outrageous' Making of 'Good Luck, Have Fun, Don't Die'

Director Gore Verbinski opens up about the challenging, low-budget production of his original sci-fi comedy 'Good Luck, ...

Aviation Comeback: Iconic Boeing 747 Returns to Skies with Nigerian Carrier!

In a unique reversal of global aviation trends, a Boeing 747-400, registered 5N-HMM, has returned to service for Nigeria...

Luxury Boom: Southern Europe's Travel Sector Soars with High-Yield Charters!

Africa's inbound tourism is strategically pivoting towards Southern European markets, identifying Portugal, France, and ...

Massive Growth: Sam Altman Reports 100 Million Weekly ChatGPT Users in India

India has become OpenAI's second-largest global market, boasting 100 million weekly active ChatGPT users, as CEO Sam Alt...