Samsung Q2 Profit Drop Due to Weak AI Chip Sales

Samsung Electronics is projected to announce a significant 39 percent decline in its second-quarter operating profit, expected to be 6.3 trillion won (US$4.62 billion). This marks the lowest income for the company in six quarters and its fourth consecutive quarterly decrease, according to LSEG SmartEStimate. This prolonged financial weakness has intensified concerns among investors regarding the South Korean tech giant's capacity to compete with its smaller rivals in the crucial area of high-bandwidth memory (HBM) chips, which are essential for artificial intelligence (AI) data centers.

The primary reason for Samsung's subdued performance is attributed to delays in supplying its advanced memory chips, particularly HBM chips, to Nvidia, a leading company in the AI chip market. While key competitors like SK Hynix and Micron Technology have benefited substantially from the robust demand for AI-driven memory chips, Samsung's gains have been limited. This is partly due to its significant reliance on the China market, where sales of advanced chips have been constrained by U.S. restrictions.

Analysts indicate that Samsung's efforts to get the latest version of its HBM chips, specifically the HBM3E 12-high chips, certified by Nvidia have been proceeding slowly. Ryu Young-ho, a senior analyst at NH Investment & Securities, noted that HBM revenue likely remained flat in the second quarter, largely due to persistent sales restrictions in China and Samsung's unconfirmed supply of HBM3E 12-high chips to Nvidia. He further suggested that significant shipments of these new chips to Nvidia are unlikely this year. Despite Samsung's earlier expectation in March for meaningful HBM chip progress as early as June, the company has declined to comment on whether its HBM3E 12-layer chips have successfully passed Nvidia's qualification process. However, it was confirmed in June that Samsung has begun supplying these chips to AMD.

Beyond the memory chip segment, Samsung's diverse business portfolio, encompassing chips, smartphones, and home appliances, faces ongoing uncertainty due to various U.S. trade policies. Analyst predictions suggest that Samsung's smartphone sales are likely to remain robust, buoyed by demand for stock in anticipation of potential U.S. tariffs on imported smartphones. Specific policies, such as President Donald Trump's proposal for a 25 percent tariff on non-U.S.-made smartphones and the July 9 deadline for 'reciprocal' tariffs against numerous trading partners, pose significant challenges. Additionally, the U.S. government is considering revoking authorizations granted to global chipmakers, including Samsung, which would make it more difficult for them to acquire U.S. technology for their plants located in China.

In terms of stock performance, Samsung shares have climbed approximately 19 percent this year, yet they have underperformed the benchmark KOSPI's 27.3 percent rise, making Samsung the worst-performing stock among major memory chipmakers. As of early Monday trading, Samsung Electronics shares were down 1.9 percent, contrasting with a 0.3 percent rise in the KOSPI.

You may also like...

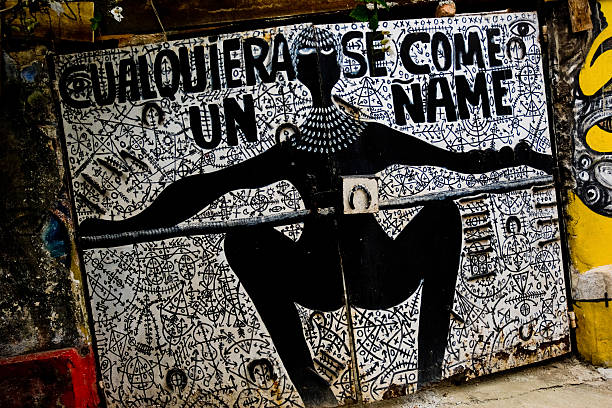

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

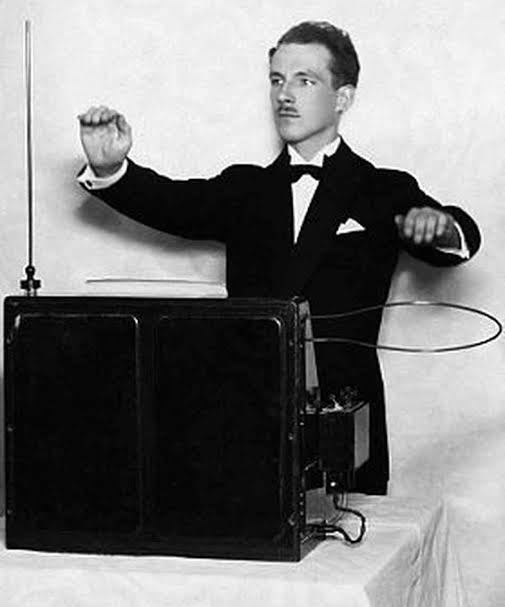

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

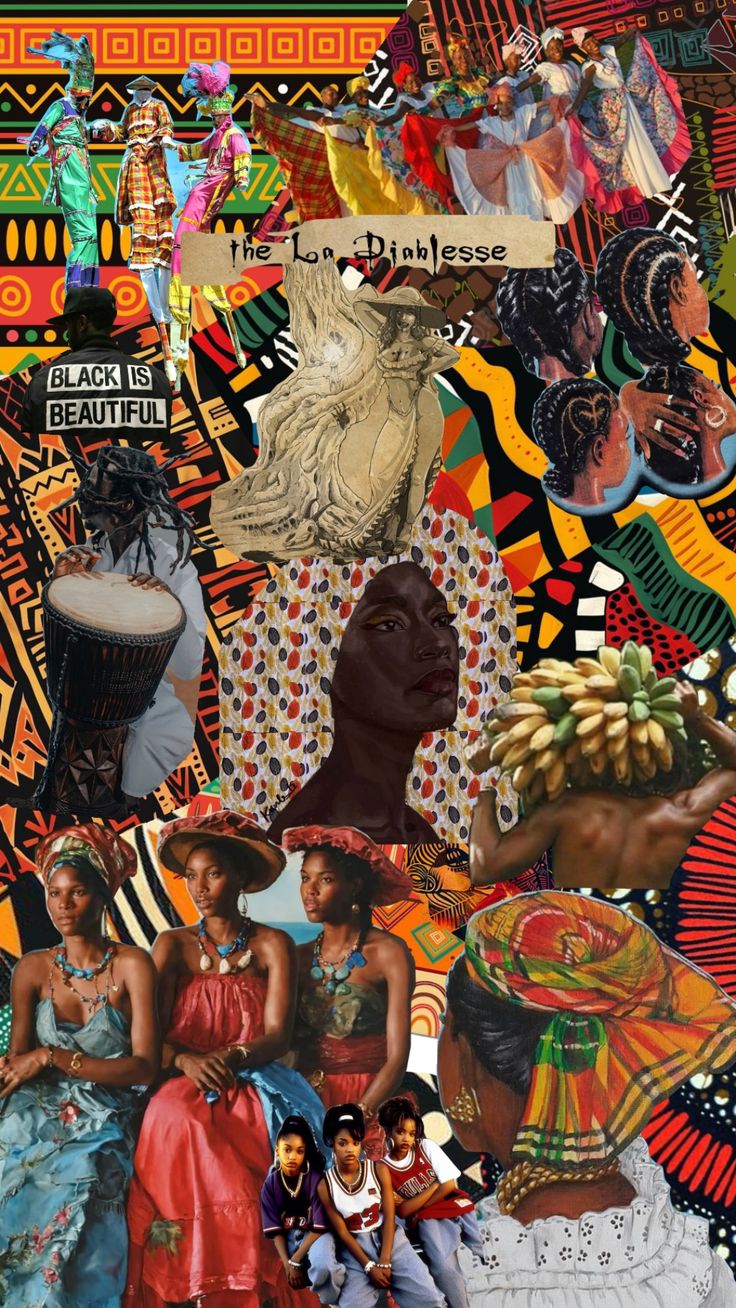

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...