Pakistan's Bold Crypto Mining Gambit

Pakistan's recent announcement to allocate 2,000 megawatts (MW) of its surplus electricity to Bitcoin mining and AI data centres represents a significant and ambitious step towards engaging with the global digital economy. This initiative, unveiled by the Finance Ministry, has the potential to position Pakistan on the international crypto map. However, it concurrently brings to the forefront critical questions regarding the nation's energy policy, its economic priorities, and the long-term sustainability of such a venture, especially given the volatile nature of cryptocurrency markets and energy prices. While the proposal offers prospects for digital innovation and new revenue streams, its success hinges on careful planning and implementation to avoid entrenching risky economic dependencies or compromising more stable development pathways.

The 2,000MW allocation is a substantial portion of Pakistan's estimated 10,000 to 15,000MW surplus electricity generation capacity. This surplus largely stems from expensive power purchase agreements (PPAs), which impose significant capacity charges on the government, amounting to approximately $5.3 billion annually and potentially rising to $9 billion if the energy remains unused. This situation presents a paradox: despite having underutilised generation capacity, the country grapples with frequent load shedding, soaring electricity bills for consumers, and a fragile transmission network that loses about 16% of generated power due to theft and inefficiencies. While monetising idle electricity through crypto mining seems a pragmatic approach, dedicating such a large amount of power to an energy-intensive and speculative sector could exacerbate existing structural energy challenges.

Establishing Bitcoin mining operations at the proposed 2,000MW scale involves considerable financial investment. Current market estimates suggest that ASIC mining hardware (specialised machines for Bitcoin mining) could cost between $400 million and $500 million. Further investments would be necessary for cooling systems, grid infrastructure upgrades, security measures, and the construction of data centres, potentially requiring an additional $300 million to $400 million. The operational profitability of such a venture is heavily reliant on the price of Bitcoin, which has demonstrated significant volatility, fluctuating between $15,000 and $70,000 over the past five years. Under ideal conditions, a fully optimised 2,000MW facility could potentially generate around $1 billion in annual revenue, but these figures are subject to the extreme volatility of cryptocurrency markets, hardware depreciation, increasing mining difficulty, and rising global competition in the sector.

Beyond direct revenue, the initiative carries several strategic benefits. It has reportedly attracted interest from international investors looking to partner with Pakistani authorities, which could lead to foreign direct investment (FDI) and the infusion of technological expertise. Monetising surplus power could also alleviate some of the fiscal pressure currently exerted by idle capacity payments. Furthermore, the infrastructure developed for crypto mining could serve as a foundational gateway for broader development within the digital economy, including nurturing data centres, AI laboratories, and various blockchain platforms. However, it is important to note that job creation in crypto mining itself is relatively limited, with a typical mining facility employing only 1 to 3 workers per MW, significantly fewer than the 10 to 20 workers per MW seen in manufacturing or IT sectors.

The venture is not without significant risks. The primary concern is the inherent volatility and potential obsolescence associated with Bitcoin and the broader crypto market. Bitcoin's value is notoriously unstable, and past crypto crashes, such as the one in 2022–2023, led to massive value losses and the closure of several mining firms. Committing public infrastructure to such a volatile asset class introduces a high degree of fiscal risk. Another major concern pertains to Pakistan’s already strained electricity grid; introducing a constant demand of 2,000MW could cause further instability unless substantial upgrades are implemented. Future outages or demand shocks could cripple mining operations or disrupt electricity supply to other critical sectors. Additionally, the global regulatory landscape for cryptocurrencies is still evolving and uncertain. Despite Pakistan's progress in establishing the Pakistan Digital Assets Authority (PDAA) and engaging with the Financial Action Task Force (FATF), policy reversals in other countries, like China and Kazakhstan, serve as cautionary examples.

If Pakistan is serious about leveraging its surplus power, several alternative investment scenarios in more stable, job-rich industries could offer greater long-term dividends. For instance, manufacturing and heavy industries such as aluminium smelting, steel production, and petrochemicals require significant power inputs but create extensive employment opportunities and sustainable long-term exports. Investing in general manufacturing or defence industries could also yield more reliable economic growth, stimulate domestic supply chains, reduce import dependency, and are less volatile than crypto markets.

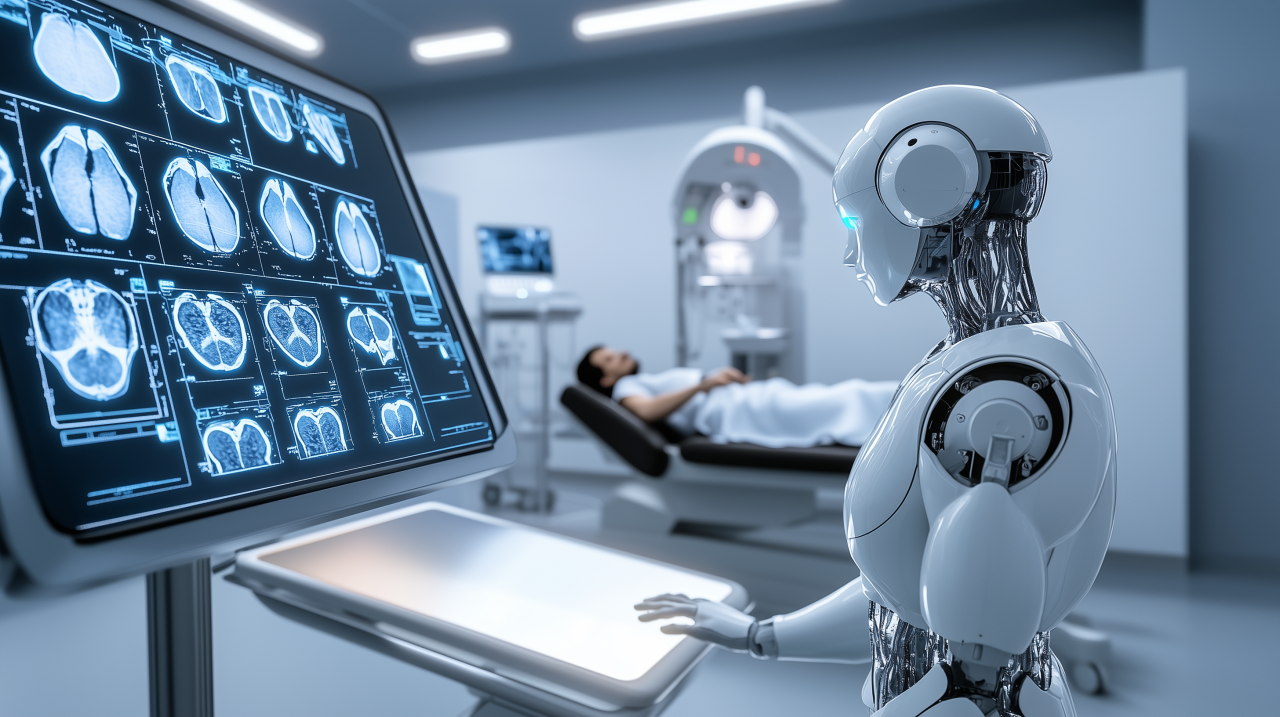

Another promising alternative lies in bolstering Pakistan's IT and cloud infrastructure. The nation's IT sector already generates over $2 billion in annual exports and is experiencing a robust growth rate of 15–20% per year. Channeling investment into data centres, cloud computing facilities, and software parks could significantly multiply export earnings, build valuable human capital, and support the growth of business process outsourcing (BPO) and artificial intelligence startups. Furthermore, with its abundant sunlight and wind resources, Pakistan has the potential to become a regional hub for the green hydrogen economy. Using surplus electricity for electrolysis to produce green hydrogen could open up future-ready export markets in Europe, the Gulf, and East Asia, aligning with global climate commitments and potentially unlocking strategic geopolitical leverage.

Pakistan's crypto mining initiative, while visionary, should ideally be approached as a pilot project rather than a complete policy shift. Its success will critically depend on establishing transparent public-private partnerships that incorporate risk-sharing mechanisms, implementing robust regulatory oversight, and developing clear energy allocation strategies. Crucially, this initiative should be pursued in parallel with investments in more sustainable industries that can also utilize the surplus power.

A multisector approach that includes cryptocurrency mining but also prioritizes manufacturing, information technology, and clean energy development is essential for maximizing economic diversification and safeguarding the nation against speculative risks. Pakistan's 2,000MW crypto mining gambit holds genuine potential but must be implemented with meticulous care, transparency, and a clear understanding of the associated challenges. The most prudent path may not involve betting solely on Bitcoin, but rather using this opportunity to strategically leverage energy assets across multiple high-impact sectors. Ultimately, crypto mining should be viewed as one component within a broader, more comprehensive economic puzzle—one that strives to balance digital innovation with economic stability and long-term national interests. Sustainable development requires visionary ideas to be coupled with measured, evidence-based execution, ensuring Pakistan’s future is powered not just by hash rates, but by smart, inclusive, and diversified growth.

You may also like...

The Names We Carry: Why Africa’s Many-Name Tradition Shouldn’t Be Left Behind

"In many African communities, a child's birth is marked with a cascade of names that serve as fingerprints of identity, ...

WHY CULTURAL APPROPRIATION ISN’T ALWAYS OFFENSIVE

In a world of global fusion, is every act of cultural borrowing theft—or can it be respect? This thought-provoking essay...

Africa’s Health Revolution: How a New Generation is Redefining Global Wellness from the Ground Up

Move beyond the headlines of health challenges. Discover how African youth and innovators are using technology, traditio...

Kwame Nkrumah: The Visionary Who Dreamed of a United Africa

(13).jpeg)

Discover the powerful legacy of Kwame Nkrumah, Ghana’s first president and a pioneer of Pan-Africanism, whose vision for...

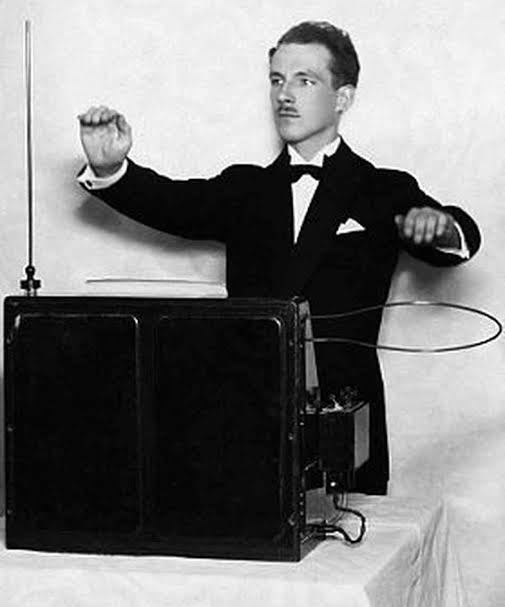

Meet the Theremin: The Weirdest Instrument You’ve Never Heard Of

From sci-fi movies to African studios? Meet the theremin—a touchless, ghostly instrument that’s making its way into Afri...

Who Told You Afro Hair Isn’t Formal?

Afro hair is still widely seen as unprofessional or “unfinished” in African society. But who decided that coils, kinks, ...

1986 Cameroonian Disaster : The Deadly Cloud that Killed Thousands Overnight

Like a thief in the night, a silent cloud rose from Lake Nyos in Cameroon, and stole nearly two thousand souls without a...

How a New Generation is Redefining Global Wellness from the Ground Up

Forget fast fashion. Discover how African designers are leading a global revolution, using traditional textiles & innov...