NFTs After the Crash: What Fueled the Craze, What Survived, and What Didn’t

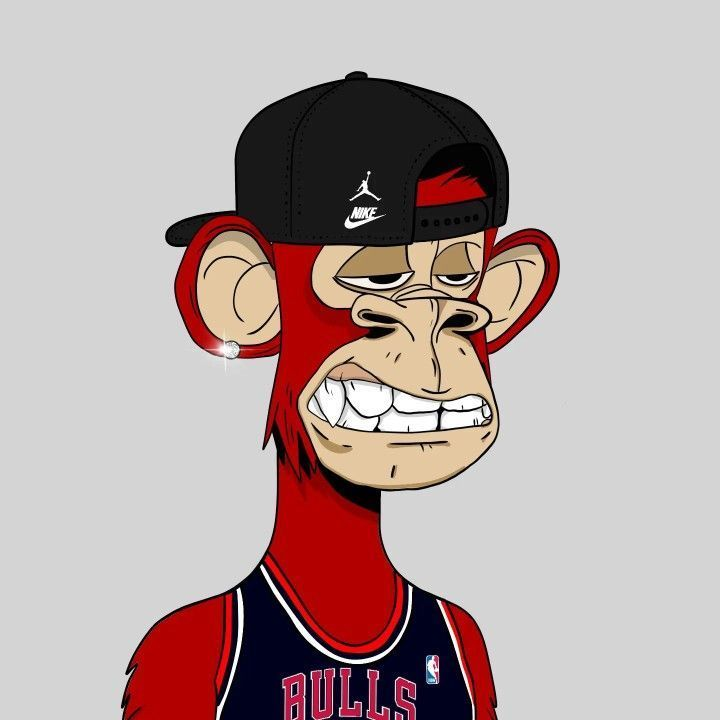

Remember when everyone was talking about NFTs? When your timeline was flooded with digital apes drawings, and that one crypto bro wouldn't shut up about his "investment" in a JPEG? Yeah, those days are over. But what actually happened, and is anything left standing?

The Perfect Storm

The NFT craze was a perfect collision of post-pandemic weirdness, crypto money, and Fear Of Missing Out (FOMO).

It is 2021, you are probably still half-stuck at home and people who bought Ethereum years ago are suddenly rich. Now, they are looking for the next thing that mines like gold, and NFTs seemed like it.

At that time, it might look like Bored Ape Yacht Club were just selling monkey drawings but what they were actually selling was status. Owning one meant you were in an exclusive digital country club with a six-figure entry fee.

Then celebrities jumped in. Paris Hilton showed off her NFTs on The Tonight Show. Snoop Dogg revealed he had been anonymously buying them. Suddenly, NFTs felt legitimized.

If you were not minting, trading, or at least talking about NFTs, you felt like you were missing out on generational wealth.

The narrative was intoxicating and it felt like the future was here. The future of art where artists finally getting paid without the gallery gatekeepers.

The Crash

By late 2022, the party was over that it almost felt like the whole trade was, in itself, a dream. The broader crypto market crashed, dragging NFTs down with it. Trading volumes collapsed by over 95%. Those Bored Apes that sold for hundreds of thousands of dollars were now worth less than a used car.

The problems became impossible to ignore. Most projects had zero actual utility — just promises and Discord servers that went completely silent after the mint. The market was flooded with copycat collections. Rug pulls happened constantly. Rumours, in fact, started to go round that the whole trade was just a front for money laundering.

Turns out, when your entire value proposition is "someone else will pay more for this later," you are just playing with a hot yam.

What Died

One major casualty that can be pointed to is the vast majority of those 10,000-piece profile picture collections. They are now worthless. Check OpenSea; it is a graveyard of abandoned projects with zero trading volume.

Virtual land in metaverses that never materialized is now worth less than actual Monopoly properties. Celebrity NFT projects that dropped with massive hype are now case studies. Gaming companies that went all in on NFT integration faced player revolts and had to backtrack.

The infrastructure around the hype mostly evaporated. Even the language feels dated now. When was the last time someone unironically told you "WAGMI" (we're all gonna make it)?

What Actually Survived

However, NFTs did not completely die. They just got way less annoying about it. Good news, I guess.

Legitimate digital artists who were creating before the hype are still selling work to actual collectors. The difference is that these purchases are not speculative rather genuine art purchases.

Music NFTs are letting artists sell directly to fans without Spotify taking 70%. Some musicians are making more from a small NFT drop than they would see in years of streaming.

Brands figured out NFTs work better as loyalty programs than investment vehicles. Nike is using them for sneaker authentication. Starbucks experimented with NFT-based rewards.

Ticketing is probably NFTs' best use case. Blockchain verification can prevent scalping and prove authenticity without the speculative craze. Some events and communities still use NFTs as proof of attendance or membership, not as status symbols of the past, but as actual functional tools.

The Lesson

The NFT crash taught us something important. It lets us understand clearly the difference between technology hype and actual utility. Just because something uses blockchain does not make it automatically valuable.

What remains of the NFT world is quieter, less flashy, and genuinely more functional. The people still involved are not promising you will get rich. They are building actual tools for digital ownership, creator compensation, and authentication.

NFTs are not dead yet but that version that promised to make everyone instant millionaires absolutely is. And maybe that is for the best.

The real question now is not whether NFTs will make a comeback. It is whether the quiet, more practical applications can actually deliver on the promises the hype never could.

Probably not quite as exciting. But at least your timeline is bearable again.

You may also like...

Do You Know a Few Extra Days Abroad Can Become a Problem? The Truth About Visa Overstays

Visa overstays carry serious consequences many travelers don’t understand. Here’s how overstaying affects visas, bans, j...

Introvert Parents Raising Extrovert Kids (and Vice Versa)

Introvert parents and extrovert kids and vice versa can clash, but it doesn’t have to be hard! Learn tips, strategies, a...

NFTs After the Crash: What Fueled the Craze, What Survived, and What Didn’t

NFTs once promised digital ownership, quick wealth, and internet clout. After the crash, this piece breaks down what fue...

Cristiano Ronaldo Returns to Al-Nassr After Strike Amid Toni Kroos’ Criticism of Saudi League

)

Cristiano Ronaldo ends strike at Al-Nassr following disputes over transfers, executive authority, and staff wages. Toni ...

Premier League Thriller: Haaland’s Late Penalty Sparks Manchester City Title Charge Against Arsenal

)

Erling Haaland’s stoppage-time penalty secures Manchester City a 2-1 win over Liverpool, reigniting the Premier League t...

Steven Spielberg Returns to Dinosaur Magic with Netflix Docuseries “The Dinosaurs”

Steven Spielberg executive produces Netflix’s “The Dinosaurs,” a visually stunning docuseries narrated by Morgan Freem...

James Cameron Continues Box Office Reign, Crushes Another Marvel Record

James Cameron's Avatar: Fire and Ash concludes its theatrical run with mixed box office results, falling short of its pr...

Mind Over Machine: AI Psychosis Looms Over Hospitality Industry

The rise of "AI psychosis," where intense interactions with AI trigger delusional thinking, poses new challenges for men...