Morgan Stanley Weighs In as Top Miners Get Nod and Marathon Rated Underweight!

Morgan Stanley has initiated coverage on three publicly traded bitcoin miners this Monday, assigning Overweight ratings to Cipher Mining (CIFR) and TeraWulf (WULF) while giving Marathon Digital (MARA) an Underweight designation.

Analysts Stephen Byrd and his team set price targets of $38 for Cipher and $37 for TeraWulf. Shares of CIFR surged roughly 134% to $16.50, WULF climbed 13% to $16.20, and MARA edged higher to $8.28, below its $8 target.

Morgan Stanley’s thesis focuses on the transformation of bitcoin mining sites into valuable data center assets. Byrd explained that miners with established data centers and long-term leases with creditworthy counterparties should be valued for predictable cash flow rather than exposure to bitcoin prices.

He likened these assets to data center REITs such as Equinix (EQIX) and Digital Realty (DLR), which trade at high multiples due to their scale and stable revenue.

Cipher Mining exemplifies this model. Byrd described its facilities as suitable for a “REIT endgame,” with leased data centers functioning like toll roads, producing steady cash flow with minimal dependence on bitcoin volatility.

TeraWulf similarly fits this infrastructure-centric strategy, boasting a strong record of securing data center agreements and managing power infrastructure.

The company aims to expand data center capacity by 250 megawatts annually through 2032, with Morgan Stanley modeling a 50% base-case success rate and 75% in an optimistic scenario.

In contrast, Marathon Digital received a cautious assessment. Its hybrid model, combining bitcoin mining with nascent data center ambitions—limits upside potential.

The firm’s reliance on bitcoin accumulation and funding through convertible notes exposes it to the cryptocurrency’s volatility. Limited history in hosting data centers and low historical returns on mining investments further influenced the Underweight rating.

The coverage arrives amid a broader industry shift, as many miners pivot from pure proof-of-work operations to AI and high-performance computing (HPC) data centers.

Shrinking mining margins, revenue pressures from halving events, and operational volatility are driving this transition. Publicly traded miners are signaling full or partial exits from legacy mining to host AI workloads and secure long-term cloud or hyperscaler contracts, reinforcing the move toward infrastructure-focused business models.

You may also like...

Seven African Fashion Brands Dominating Global Style

Seven rising African fashion brands are reshaping global style through culture, sustainability, and bold design, proving...

How to Write a Resume That Passes AI Screening Tools

Think you’re qualified but still getting rejected? Learn how to write a resume that passes AI screening tools (ATS) usin...

Nigeria’s First Nationalists and the Fight for Self-Rule

A look at Nigeria’s first nationalists and how they led a peaceful struggle for self-rule, challenged British colonial a...

Do You Know That A Flight of Stairs Could Be a Mini Workout for Your Brain and Body?

Climbing the stairs isn’t just about fitness, it boosts heart health, strengthens muscles, and sharpens brain function. ...

Lagbaja Didn't Need a Face to Become a Voice

From Abacha-era Nigeria to today’s Afrobeats boom, Lagbaja built a cultural legacy without ever revealing his face—provi...

Crisis Brews: Thomas Frank Fights for Spurs Job Amidst Relegation Threat

Tottenham Hotspur head coach Thomas Frank is under severe pressure after a 2-1 defeat to Newcastle United, with fans cal...

Catastrophic Failure: 2026's Major Horror Release Implodes by Week 3

The film adaptation 'Return to Silent Hill' has faced severe criticism and a dismal performance at the U.S. box office s...

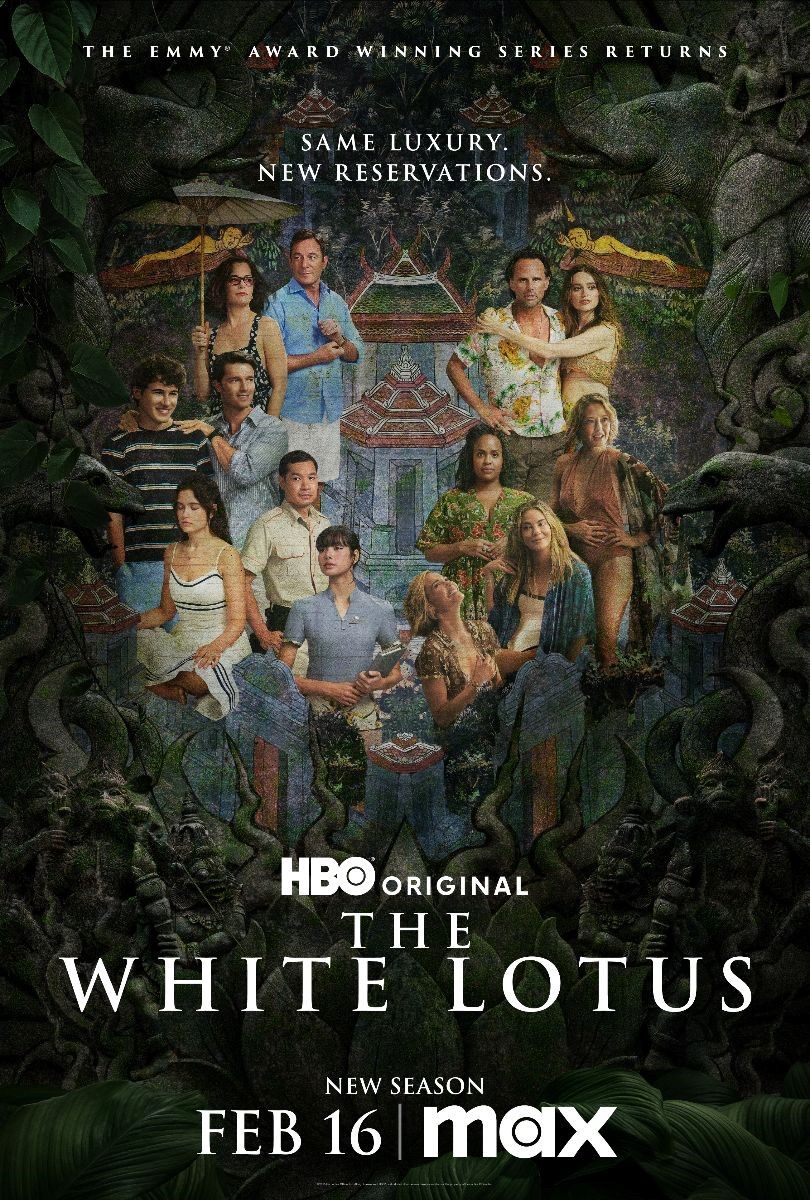

White Lotus Season 4 Lands A-List Talent, Adding 'Severance' Star

The White Lotus Season 4 is set to welcome actor and comedian Sandra Bernhard to its cast, joining other notable names f...