Ghana's Economy Gets a Shot in the Arm: BoG Slashes Key Policy Rate!

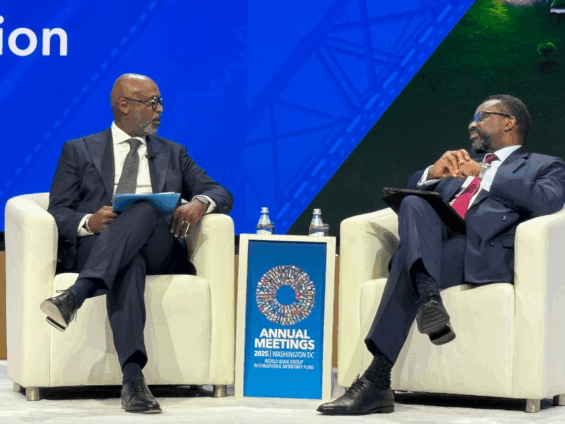

The Monetary Policy Committee (MPC) of the Bank of Ghana (BoG) has announced a significant reduction in its policy rate, lowering it by 350 basis points from 25% to 21.5%. This pivotal decision was made following the committee's 126th meeting on September 17, 2025, and was officially communicated by the Governor of the Bank of Ghana, Dr. Johnson Asiama.

Dr. Asiama elaborated that the reduction was primarily driven by the committee's positive outlook on inflation. The MPC forecasts that headline inflation will continue to ease in the near term and is expected to fall within the medium-term target of 8% ± 2% by the close of the fourth quarter. This anticipated disinflation process heavily influenced the majority decision to decrease the policy rate.

Highlighting the robustness of the Ghanaian economy, Dr. Asiama also underscored the strength of the Cedi. He stated that the currency remains among the strongest globally year-to-date, reflecting a cumulative appreciation of 21.0% against the US dollar through September 12, 2025. This strong performance is attributed to prudent monetary policy measures, effective liquidity management, ongoing fiscal consolidation efforts, and increased foreign exchange inflows. The Bank of Ghana affirmed its commitment to keenly monitoring the Cedi's performance and implementing regulatory measures to ensure its continued stability.

Despite the optimistic macroeconomic environment, the Governor issued a cautionary note regarding potential price pressures stemming from possible upward reviews of utility tariffs. He specifically mentioned a request by the Electricity Company of Ghana (ECG) for a substantial 225% increase in its Distribution Service Charge. Such adjustments, if implemented, could exert some pressure on prices in the medium term, potentially impacting the inflation rate.

Looking ahead, the MPC reiterated its commitment to continuously monitor macroeconomic developments and stands ready to take appropriate policy decisions as and when necessary to reinforce the disinflation process. The reduction in the policy rate is widely anticipated to have a positive impact on the economy by making credit more affordable and accessible for businesses. Lower interest rates are expected to ease the cost of borrowing, facilitating corporate expansion, investment in new projects, and strengthening working capital.

Recommended Articles

Ghana Central Bank's Crypto Clampdown: New Laws to Control Digital Remittances

Ghana's diaspora remittances are increasingly flowing through cryptocurrency channels, bypassing traditional banks, as c...

Ghana's Groundbreaking Crypto Legalization Set to Reshape African Digital Economy by 2025!

Ghana is set to legalize and regulate cryptocurrencies by December 2025, marking a significant policy reversal driven by...

Ghana Central Bank Fires Back: Governor Defends FX Market, Assures IMF Exit

Ghana's foreign exchange market is experiencing significant pressure due to a combination of large energy sector payment...

African Lending Revolution: AGI Boss Predicts Interest Rate Plunge as Banks Brace for Change

The Association of Ghana Industries is optimistic that recent policy rate cuts by the Bank of Ghana, reducing the rate t...

Fintech Freeze: Regulators Suspend Major Remittance Players Over Breaches!

The Bank of Ghana has suspended eight companies and UBA Ghana Limited for violating remittance guidelines, effective Sep...

You may also like...

Digital Portfolios Are the New Business Cards; Here’s How to Build One That Gets Seen

In today’s digital-first economy, your online portfolio is your handshake, résumé, and elevator pitch rolled into one. H...

Career Pivoting: Why Changing Paths Might Be the Smartest Move You Make

In a world where stability often overshadows fulfillment, career pivoting may be the smartest move for professionals se...

Why Your First Failure Might Be the Best Thing That Ever Happened to Your Business

Failure isn’t the end of entrepreneurship, it’s the education success never gives. Here’s why your first business collap...

Consumerism vs Culture: Is Africa Trading Values for Trendy Lifestyles?

Is Africa trading its cultural values for trendy lifestyles? Explore how consumerism, foreign brands, and social media p...

The War on Boys: Are African Male Being Left Behind in Gender Conversations

Why are African boys and men often left out of gender empowerment programs? Explore how emotional suppression, lack of m...

Pay Slip, Motivation Slips: The Silent Crisis Among the Working Class

Across Nigeria, millions of workers are trapped in jobs that pay just enough to survive but too little to live. Beneath ...

Premier League's Unsung Heroes: Bournemouth, Sunderland, and Tottenham Shockingly Exceed Expectations

This Premier League season sees teams like Bournemouth, Sunderland, and Tottenham exceeding expectations. Under Thomas F...

El Clasico Fury: Yamal Controversy and Refereeing Blunders Ignite Post-Match Debates

)

Real Madrid secured a 2-1 El Clasico victory over Barcelona amidst significant controversy surrounding a late penalty de...